[ad_1]

Mortgage cliff approaches quick | Australian Dealer Information

Information

Mortgage cliff approaches quick

Fastened-rate time period ending for a lot of debtors

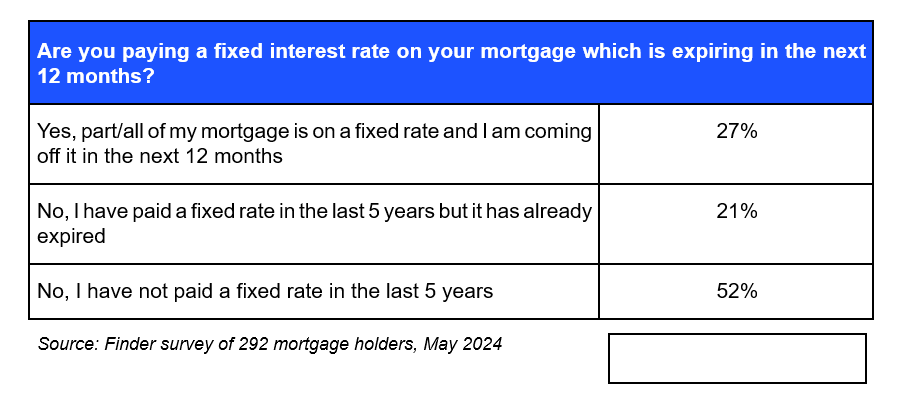

A major mortgage transition looms as 27% of debtors are set to shift from fixed-rate mortgages to probably greater variable charges throughout the subsequent 12 months, in accordance with latest analysis performed by comparability web site Finder.

This transformation includes roughly 891,000 mortgage holders who secured low fixed-rate loans throughout the pandemic and haven’t but transitioned to variable charges, that are at the moment almost thrice greater.

Previous and future challenges

The Finder survey, which included 1,012 individuals with 292 being mortgage holders, additionally highlighted that 21% (about 693,000 households) have already transitioned from low fastened charges up to now 5 years, with many now fighting significantly greater repayments.

“A large change is coming for these debtors who have been very lucky to place their price on ice after they did,” mentioned Sarah Megginson (pictured above), a private finance skilled at Finder.

Charge hikes and monetary pressure

With the Reserve Financial institution’s subsequent rate of interest choice scheduled for June 18, and following 13 price will increase since April 2022, the typical house owner now faces nearly $1,400 in extra month-to-month repayments.

The continual rise in charges over the previous two years has shielded some, however as fastened phrases finish, a brand new actuality units in.

“Charges have been rising persistently over the previous two years and are 4.25% greater than they have been – however this group has been insulated from the sting, as they locked of their mortgage simply earlier than charges began to climb,” Megginson mentioned.

Wanting forward and coping methods

Whereas specialists stay divided on whether or not the cycle of price will increase will proceed, inflation developments recommend potential declines within the RBA money price. Nonetheless, Megginson warned of the extreme influence of additional will increase.

“We anticipate that many mortgage holders can be unable to satisfy their month-to-month obligations if charges do improve, as it might be an enormous monetary shock,” she mentioned.

Megginson additionally suggested these dealing with mortgage stress to discover hardship preparations with lenders, similar to interest-only loans or mortgage holidays, and for these overcommitted, to think about renting out spare rooms or downsizing.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE every day publication.

Associated Tales

Sustain with the most recent information and occasions

Be part of our mailing record, it’s free!

[ad_2]

Source link