[ad_1]

Foryou13

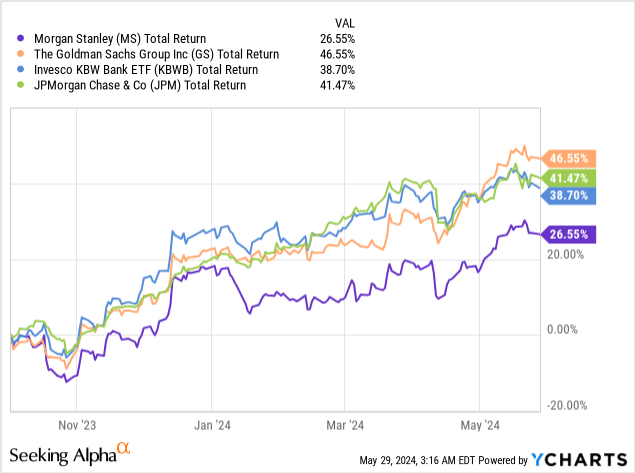

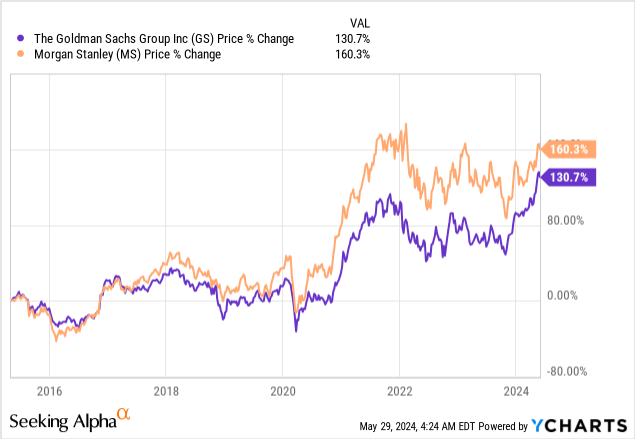

For the reason that October lows, Morgan Stanley (NYSE:MS) has underperformed its friends Goldman Sachs (GS), JPMorgan (JPM), and the overall financial institution ETF. Regardless of these comparatively poor outcomes, I contemplate Morgan Stanley a cautious purchase to meet up with the opposite banks within the brief time period and for good diversification and first rate returns over the long run.

Why Morgan Stanley is perhaps underperforming?

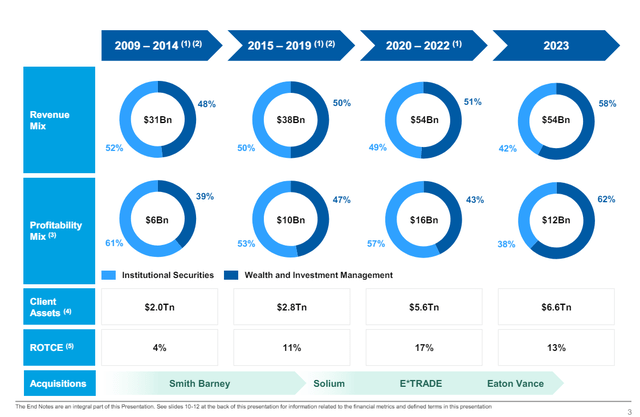

For my part, there’s one large purpose that may clarify Morgan Stanley’s underperformance. First, following Morgan Stanley’s newest strategic presentation, the corporate is significantly much less uncovered to heavy cyclicality than its friends. From the doc, the corporate explains that its revenues fluctuate between 50% conventional funding banking and 50% wealth administration within the buoyant components of the cycle (2020 to 2022) to 42% conventional funding banking and 58% wealth administration in the latest funding banking slowdown.

Morgan Stanley Income Distribution (Morgan Stanley Technique Replace 2024)

In distinction, its friends, Goldman Sachs and JPMorgan are far more uncovered to cyclicality. For instance, Goldman noticed revenues exterior of Asset Administration of about 70% in its earnings report for the complete yr 2023, whereas JPM solely noticed revenues from its asset administration division of round 12.5% of whole revenues in its 4Q 2023 earnings report.

This discrepancy happens as a result of, since 2015, administration has determined to step down its efforts to maximise cyclical returns and refocus on the extra steady, larger margins, considerably much less thrilling asset and wealth administration business.

Therefore, Morgan Stanley’s income volatility has been capped. For instance, Goldman Sachs’s funding banking revenues in its Q1 2024 earnings launch jumped 53% quarter over quarter and 15% yr over yr, whereas Morgan Stanley’s revenues simply grew 4% yr over yr and 17% quarter over quarter. For my part, it is no shock that in a inventory market restoration, like since October, a extra strong and steady firm like MS could be underperforming its extra unstable cyclical friends.

If the corporate is underperforming, then why is it a purchase?

Morgan Stanley’s enterprise mannequin is sort of totally different from that of conventional funding banks. In its newest 10K, MS clarifies its enterprise mannequin into three main classes. The primary is named Institutional Securities, which covers conventional funding banking actions, advisory, M&A, fairness, and debt underwriting, and monetary market making in bonds and shares. This class accounted for almost 43% of revenues.

The second and third segments are Wealth Administration and Asset Administration. Each are in control of managing property, after all, however the distinction is that shoppers in Wealth Administration are typically people and their advisors, whereas Asset Administration is in control of offering companies as intermediaries for establishments like sovereign funds, foundations, and insurance coverage firms, amongst many others.

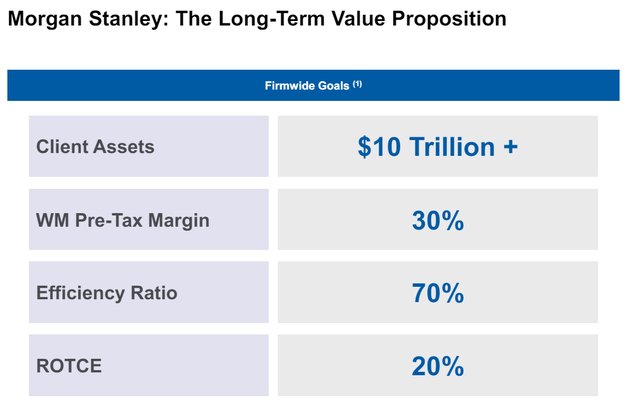

Following this concept, Morgan Stanley’s present targets are to succeed in $10 trillion in consumer property whereas preserving its effectivity ratio over 70%.

Morgan Stanley Lengthy Time period Worth Proposition (Morgan Stanley Technique Replace 2024)

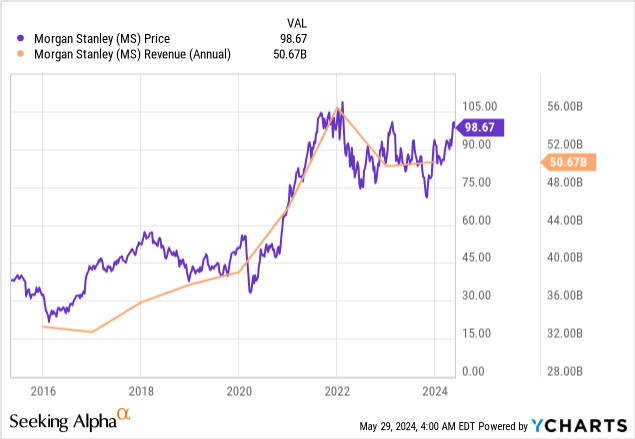

Though that aim is bold, it’s potential within the mid-term future for Morgan Stanley. Some good achievements have been made; for instance, the corporate has gotten $282 billion in web new property in 2023 and near $600 billion during the last two years. At that tempo, and with out main acquisitions, the corporate might attain that aim in shut to eight years. Moreover, MS has made some large acquisitions which were very helpful for the corporate’s development, like buying Solium in 2019, E*Commerce in 2020, or Eaton Vance in 2021.

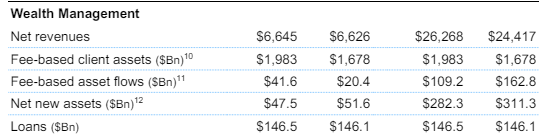

Morgan Stanley Wealth Administration Metrics 2023 (Morgan Stanley This fall Earnings Launch)

That technique from MS has allowed them to outperform, for instance, Goldman since Could 2015, improve its revenues, and develop considerably without having to be that uncovered to market cyclicality.

However there’s nonetheless one query to be answered, and I discovered it in Morgan Stanley’s Q1 2024 earnings name, and that’s if the corporate is buying all these new property underneath administration, the place is the monetization of that development? Luckily, the CFO, Sharon Yeshaya, responded that the enterprise mannequin concept for each new cash that enters that section is to monetize it by way of some form of advisory or extra service within the close to future. Which means, for my part, that ultimately, as time goes on, the corporate ought to be capable of develop in a secular method as an alternative of simply booms and busts like the standard funding bankers.

What’s subsequent for Morgan Stanley?

Within the close to future, if macroeconomic situations allow, MS ought to be capable of rebound revenues as demand for funding banking and monetary market-making recovers. In the identical earnings name, the present CEO expressed that the corporate expects some stabilization within the subsequent 3 to five years, which is sort of optimistic, for my part. If that assumption is right, the corporate ought to see a brighter future comparatively quickly and, with that, a greater inventory value. Nonetheless, I nonetheless contemplate this inventory a cautious purchase as a result of valuation is perhaps costly within the brief time period.

Valuation

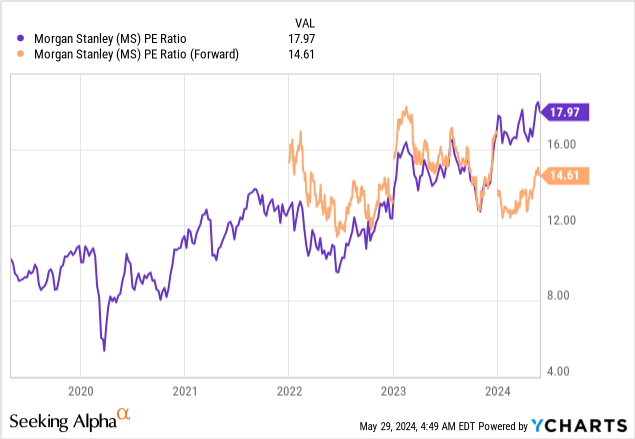

At the moment, Morgan Stanley has been comparatively costly to itself up to now, with a PE ratio of near 18. Luckily, the Ahead PE ratio remains to be at first rate ranges, though it isn’t correctly low-cost. The most important discrepancy between these two metrics is that the corporate is anticipated to develop earnings this yr in vogue, which might result in a decrease PE ratio within the close to future.

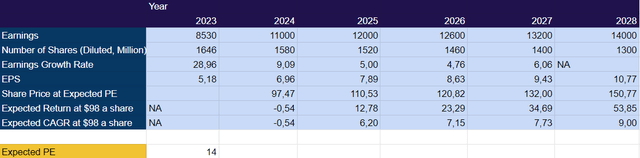

For this valuation mannequin, I take advantage of an earnings development price of shut to five% after the normalization yr 2024. Moreover, I contemplate Morgan Stanley to purchase again round 60 million shares a yr, which is what it purchased in 2023, though it’s removed from the 100 million shares buyback finished in 2022. That projection provides an EPS of round $10.8, which, multiplied by the present PE of 14, would imply a CAGR of 9% to 2028, with out dividends that may come at 2% after taxes, outpacing by little the SP500 often anticipated CAGR of 9%. That is the explanation why, for my part, the corporate is barely a purchase. For buyers who can watch for higher costs in money, it is perhaps higher to attend a bit of for entry factors.

Picture created by the creator primarily based on 10K projections (Writer)

Dangers

There are some dangers that MS might face between now and 2028. The primary is sort of at all times a giant downside for a monetary establishment: the macroeconomic setting. If the economic system considerably deteriorates, most of the firm’s potential revenues from cyclical sources may be compromised. Moreover, if the deterioration is robust sufficient, it might probably even hit the wealth and asset administration companies.

Secondly, and as a particular case for the primary group of dangers, a major deterioration in geopolitics might trigger disruption within the economic system and, subsequently, additionally find yourself hitting Morgan Stanley.

The third danger I see would possibly come from the brand new administration, as James Gorman, MS CEO for a few years, has left the cost, though he’s nonetheless govt chairman, he’ll ultimately be leaving the corporate. Luckily, the brand new CEO, Ted Choose, appears to be aligned with the $10 trillion in property goal, however the future is unsure.

Conclusion

Morgan Stanley is a wonderful firm with a demonstrated observe document and transformation to a hybrid between asset supervisor and funding banking. At the moment, the corporate appears not low-cost, but additionally probably not that costly, which implies that if execution for the following years is ample, shareholders might see some first rate capital appreciation plus some good dividends. Nonetheless, the corporate is just not a screaming purchase.

[ad_2]

Source link