[ad_1]

Sundry Pictures

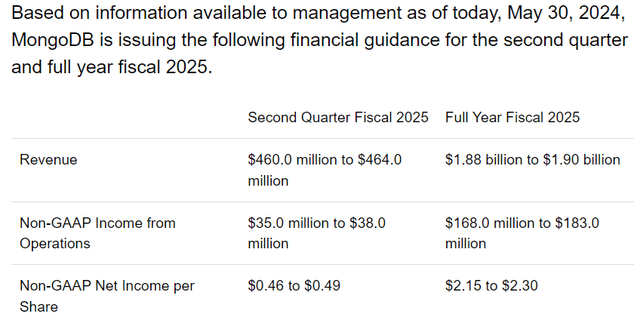

MongoDB’s (NASDAQ:MDB) inventory dropped by greater than 20% within the aftermath of the primary quarter of fiscal 12 months 2025 (FQ1) outcomes, regardless of revenues rising by 22% YoY and beating topline estimates. Nevertheless, it lowered gross sales steerage for the fiscal 12 months ending in January 2025 (FY-25), implying decreased development, from 14% to 12%.

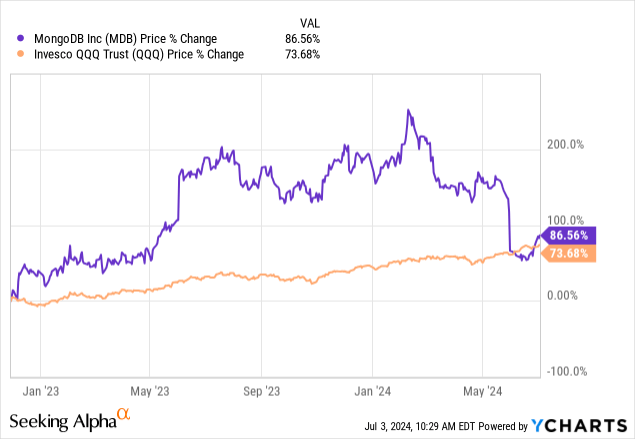

The value motion for the reason that finish of November 2022, which coincided with the launch of ChatGPT is illustrated within the chart beneath and reveals that the inventory has outperformed the tech-heavy Invesco QQQ Belief (QQQ). On this respect, some are extremely optimistic about MongoDB’s AI alternatives, that are anticipated to start out materializing throughout this half.

Nevertheless, this thesis goals to point out that such optimism is unjustified on condition that, along with alternatives, Gen AI additionally comes with challenges. Therefore, regardless of the inventory buying and selling round $265, it’s not a purchase as the value might fall additional.

I begin by investigating the explanations for demand weak point.

Faces Demand Weak spot

For individuals who are new to its expertise, MongoDB focuses on No SQL (or no sequel) or non-relational databases. On this context, there are principally two sorts of databases: relational databases, the usual database that shops data in tables and has been championed by the likes of Oracle (ORCL), Microsoft (MSFT), and others. Then there’s the MongoDB non-relational database, which is designed with the cloud in thoughts in addition to with the concept that the quantity of information can develop exponentially, which means that the info retailer needs to be very scalable.

This implies No SQL is an acceptable answer for patrons who have already got plenty of knowledge that’s going to develop over time. Furthermore, it differentiates itself by being document-based with the first product referred to as Atlas, a cloud usage-based enterprise. Revenue is earned each via subscriptions and product licensing for on-premises deployments.

Nevertheless, as talked about earlier, Atlas has been affected by slower-than-expected consumption which might have a downstream affect within the the rest of fiscal 2025 explaining the rationale for the decrease steerage. Coming again to FQ1, regardless of the double-digit development, non-GAAP gross margins declined to 75% from 76% YoY and as per the CFO, this was as a result of Atlas’ share of the general enterprise rising. Now, income rising at 22% YoY whereas margins lowering by 1% might be as a result of decrease product pricing to drive adoption in a extremely aggressive market, one the place newly acquired prospects are consuming lower than anticipated.

On this case, MongoDB competes with hyperscalers like Google (GOOG) and Amazon (AMZN) with out forgetting Oracle and plenty of others, and the issue when going through giants is the danger of shedding market share as a result of product bundling, particularly throughout a difficult macro atmosphere. For instance, it might be cheaper for a buyer who has an IaaS subscription to the clouds of those giants so as to add a No SQL service than to search for a separate SaaS supplier like MongoDB.

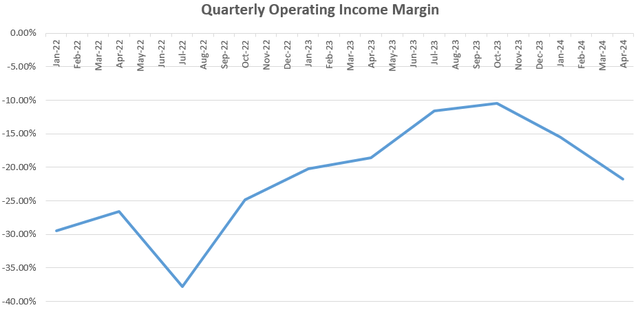

Now, I’m not ready to say what’s definitively occurring however the truth that non-GAAP working margins for FQ1 fell by 5% YoY might suggest having to spend further advertising {dollars} to “inspire” prospects to signal multi-year offers, particularly at a time when the pipeline for the remainder of the 12 months is coming lower than anticipated. Additionally, as charted beneath, a downtrend in working margins already began within the fourth quarter of fiscal 2024.

Chart constructed utilizing revenue assertion knowledge from (seekingalpha.com/)

Faces One other Problem along with Weak Macros

Now, the primary cause for this weak point is attributed to a “softer macro atmosphere”. Trying throughout the {industry}, different software program firms like UiPath (PATH) appear to be affected by elongated gross sales cycles, that are once more being blamed on prospects tightening their wallets and never keen to spend as a lot cash as they’d been beforehand. Nicely, this can be true due to the uncertainty attributable to excessive rates of interest (above 5%) and inflation persisting above 3%, however, that is solely a part of the reason for 2 causes.

First, the headwinds suffered by both MongoDB or UiPath should not aligned with Gartner, whose researchers anticipate that there needs to be extra IT spending this 12 months in comparison with 2023. Thus, development for software program and IT providers are anticipated to speed up by 13.9% and 9.7% respectively. The second cause appears associated to the disruptive nature of Generative AI, particularly the GPT (Generative Pre-Coaching Transformer) which allows textual content to be created out of huge datasets in response to queries in a pleasant method. Thus, by encapsulating this function in functions like ChatGPT, interactive instruments have emerged that immensely facilitate the duty of software program improvement, a function that may encourage extra in-house groups to take management of their IT, which might come on the expense of outsourcing to firms like MongoDB.

Nevertheless, trying into the rear mirror, MongoDB introduced AI-powered capabilities to assist builders turn into extra productive again in September 2023, however this appears to not have but proven up in MongoDB’s numbers. Trying additional, the innovation has to date been helpful to chip and infrastructure firms, the place the actual investments are occurring.

www.mongodb.com

Nevertheless, after spending billions of {dollars} on superior computing chips, prospects must see returns on investments, which ought to profit software program performs be it these specialised in databases or functions. For this objective, the corporate has additionally launched MAAP (MongoDB AI Utility Program) in collaboration with the three hyperscalers in Might. Additionally included are industry-leading consultancies like Accenture (ACN) and AI mannequin suppliers with the target is to establishing an ecosystem together with skilled providers to assist prospects begin. MAAP is considered as a development driver, over time. The corporate has additionally partnered with a financial institution to modernize its customer support functions.

Thus, MongoDB could also be at first of its journey to learn from AI, however, a couple of and a half years for the reason that popularization of Gen AI and within the absence of a dollar-based pipeline, it’s too early to be optimistic. To this finish, in keeping with Gartner, this 12 months needs to be about planning Gen AI which incorporates experimentation and prototyping to find out which side of the innovation will drive extra efficiencies of their enterprise or what’s finest for the shopper expertise. Gartner provides that this planning course of needs to be helpful extra to knowledge facilities in 2024.

Speaking disruption, in keeping with McKinsey with the power of Gen AI to decrease the bills related to knowledge migration and shifting away from legacy techniques, it’s possible for startups to emerge and take market share away from incumbents like for instance MongoDB and even Oracle. McKinsey additionally estimates that with extra firms wish to undertake software program improvement duties together with knowledge entry & synthesis in-house, churn for system integrators might improve by 1% to three%.

Due to this fact, the corporate not solely faces giant opponents however might face smaller startups which have been agile in leveraging Gen AI, and even the danger of seeing additional weak point in multi-year offers as prospects perform extra developments in-house, additionally pressured by weaker macros. On this case, MongoDB might have to offer reductions to lure prospects, which can affect profitability and push it additional away from breaking even (above chart). Therefore, there’s the likelihood that it might fall wanting attaining steerage for FY-25, or these could also be reviewed decrease. Alternatively, it might obtain the topline goal however on the expense of EPS because it spends extra advertising {dollars}.

FQ1 Earnings Press Launch (seekingalpha.com)

Has Potential However The Draw back is Prone to Proceed due to Excessive Expectations

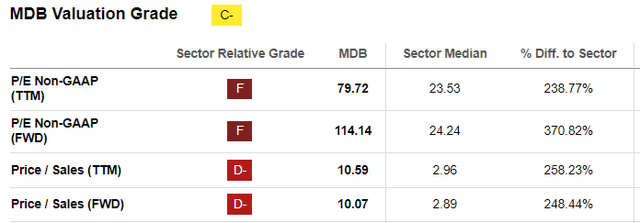

That is the rationale for my pessimistic outlook for a inventory that continues to be overpriced relative to the IT sector median by a big proportion each based mostly on gross sales and earnings metrics as illustrated beneath. Therefore, I estimate it might fall by 12.9% or the proportion by which it has outperformed QQQ as per the introductory chart. This leads to a share value of $231 (265 x 0.871).

seekingalpha.com

Due to this fact, in case there aren’t any AI-led breakthroughs to spice up monetary outcomes, the inventory might fall additional.

This mentioned, I might be flawed in my outlook given they do have $2 billion in money versus solely $1.2 billion of debt, and this retains on rising. This can be a cash-flow-positive enterprise that has been producing more cash from operations over the last three quarters. This implies it may well make an acquisition that would speed up development, however it is going to rely upon execution.

Moreover, it may gain advantage from synthetic intelligence like utilizing the expertise emigrate legacy and mission-critical workloads of huge companies whose builders are gone (have both retired or left). Such migrations are important for regulatory and technological evolution causes however are tough to carry out, entail excessive dangers, and are expensive. Nevertheless, it’s unlikely for patrons to recruit new builders or rent startups for the job, which places MongoDB in an acceptable place to safe such contracts as it may well dramatically cut back migration period and price whereas continuing systematically via pilot tasks. As per the CEO, many have proven curiosity in such modernization alternatives that fall below the enterprise channel which might see the strongest development, however he additionally mentions that is over the long run.

Furthermore, such use instances contain coping with the info, one among MongoDB’s robust factors. Tellingly, knowledge is a key ingredient for Gen AI fashions to be skilled earlier than they will ship clever AI apps and MongoDB is properly positioned, however its excessive valuations present that the market expects outcomes quickly, which seems unlikely. Furthermore, excessive gross sales development accompanied by decrease margins tends to point extra of a extremely aggressive atmosphere the place the corporate isn’t at the moment managing to distinguish itself via its expertise.

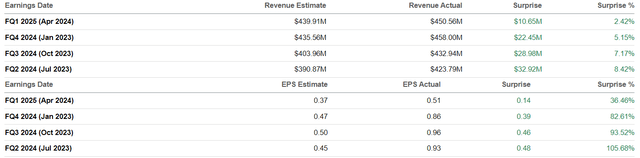

Due to this fact, I don’t imagine that AI alternatives will translate into gross sales this 12 months making it extra seemingly for the inventory to be risky, implying that it’s not time to purchase the dip. Lastly, to justify my bearish stance, the proportion shock or by which revenues and EPS have crushed estimates have each trended downward for the reason that final 4 quarters as illustrated beneath. This will likely present that it’s changing into more and more tough to shut bigger and extra worthwhile offers.

Income and Earnings surprises – Quarterly (seekingalpha.com)

[ad_2]

Source link