[ad_1]

hapabapa

Prelude

I initiated protection of Micron Expertise, Inc. (NASDAQ:MU) following Q2 earnings, calling it a blowout report. At the moment, I am following up and reiterating my Purchase score on sturdy pricing dynamics within the reminiscence {industry}. The market closely rewarded Micron after fiscal Q2, given the surprisingly sturdy HBM efficiency and early return to profitability. Following the Q2 report, I wrote

I’m now way more bullish on Micron’s medium-term outlook. The expansion story right here is compelling so long as you consider demand for AI accelerators might be sturdy. I do consider this demand is strong at the very least by 2024, and subsequently am initiating protection of Micron with a Purchase score. Micron is a pacesetter within the reminiscence {industry} and might be a essential participant within the ongoing construct of accelerated computing infrastructure.

This thesis has held water. The inventory has returned 23% since my preliminary protection, and the basics of the reminiscence {industry} proceed to enhance. In March, Chosun reported that NAND flash inventories are stabilizing whereas costs and manufacturing are growing. In the meantime, Tom’s {Hardware} reported in Could that “costs of HBM reminiscence are anticipated to extend by 5% to 10% subsequent yr… Moreover, costs of different forms of DRAM will seemingly enhance as properly, with DDR5 predicted to extend by 15% to twenty% on account of reminiscence producers shifting priorities to HBM manufacturing.”

A lot of that is pushed by the surging demand from knowledge facilities, which can also be supporting SSD demand. Sturdy demand, NAND provide/demand re-balancing, and re-allocation of manufacturing capability to HBM has led to increased than beforehand anticipated value hikes throughout the {industry}.

This results in my thesis for this text: a powerful Q3 beat and really upbeat This fall steerage. The market would not re-price shares based mostly on {industry} reviews suggesting sturdy value hikes, it re-prices based mostly on actual outcomes from firms. Micron’s upcoming report will present the influence of the stronger than anticipated value restoration, and it is going to be re-priced accordingly.

Valuation

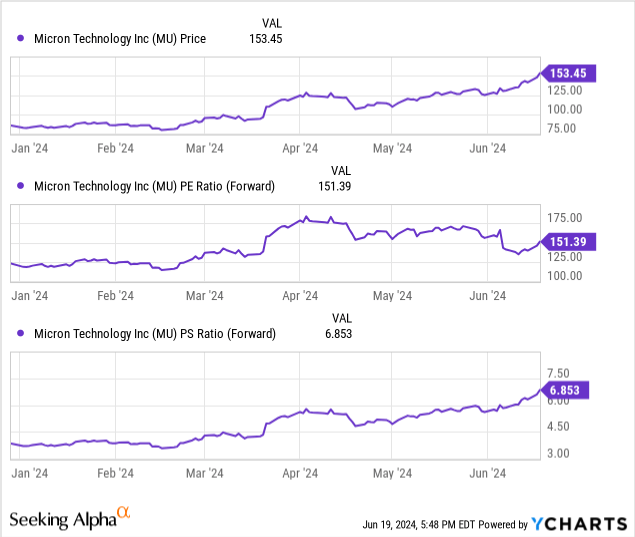

Whereas Micron’s present costs recommend all upside is priced in, I consider the inventory has additional room to run. I might not sometimes advocate shopping for a inventory with such excessive present valuation multiples, however the market has proven its willingness to pay such costs just lately. Look no additional than Broadcom’s (AVGO) current 20% post-earnings pop regardless of a strikingly excessive gross sales a number of.

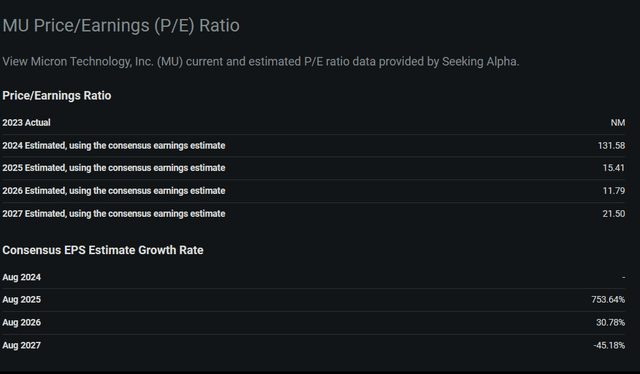

The present non-GAAP FWD P/E ratio sits above 130, which is clearly a steep value to pay. This can be a short-term phenomenon although, as sturdy gross sales development, gross margin explosion, and file ranges of demand throughout quite a few end-markets is anticipated to drive the earnings a number of down materially within the subsequent few years. Paying 15x ’25 earnings for a pacesetter in an explosive development, albeit commoditized and extremely cyclical, {industry} that is experiencing quite a few elementary tailwinds is a really cheap value to pay. The reminiscence {industry}’s cyclicality is benefitting Micron proper now, and it is unwise to wager towards a cyclical upswing.

Searching for Alpha Micron Valuation Tab

I discover it extremely seemingly Micron will submit a powerful beat on estimates in Q3 and supply even stronger steerage given a broader {industry} restoration and powerful share positive aspects in HBM. HBM continues to dominate the narrative, however provide/demand dynamics in non-HBM segments may present stunning uplifts in income. Herein lies the important thing danger core to this thesis: assembly expectations.

Dangers: Excessive Expectations, Tough Execution

Micron has set the audacious aim of capturing roughly 25% of the HBM market by 2025. But, the one public design win presently is the H200, whereas SK Hynix touts the best quantity AI chip, the H100, and Samsung is in validation for the B200. In the meantime, Samsung is supplying HBM3e for the MI325x.

This danger was mitigated just lately by a report from Enterprise Korea, stating that Micron’s HBM3E might be utilized in Nvidia’s GB200 chip. But in the identical article, Enterprise Korea reiterates the unbelievable rise and significant danger:

The semiconductor {industry} has taken be aware of Micron’s fast developments. Choi Jung-dong, an {industry} knowledgeable, remarked, “When the U.S. lab researches the first and third technology processes, the Japanese lab handles the 2nd and 4th technology processes. Over the previous 5 years, they’ve almost halved the event time in comparison with rivals.” This ‘zigzag’ technique has allowed Micron to remain forward within the technological race. Nevertheless, the competitors isn’t with out its challenges. An {industry} insider famous, “Though there are nonetheless many points with manufacturing quantity and yield, when it comes to efficiency alone, many evaluations recommend Micron is essentially the most superior.” This sentiment is echoed by one other insider who acknowledged, “Latecomers like Micron are taking aggressive, nearly gambling-like methods to compete.”

Additional, Micron’s continued dependence on the NCF strategy to HBM manufacturing, whereas SK Hynix makes use of MUF and Samsung is rumored to be exploring it as properly, may sign they’re liable to being left behind if MUF is certainly the superior strategy.

Whereas I do consider it is seemingly Micron will beat and lift within the upcoming quarter, the inventory may nonetheless be harm if the corporate would not acquire as a lot market share as anticipated. Any feedback on market share or manufacturing challenges might be met with a really unfavourable market response.

With that, let’s dive into the core of the article. From right here, I am going to present a short overview of the reminiscence {industry}, a glance into the present state of the HBM market, and eventually will reiterate why I consider Micron stays a very good possibility regardless of excessive valuation and powerful YTD efficiency.

The Reminiscence Market

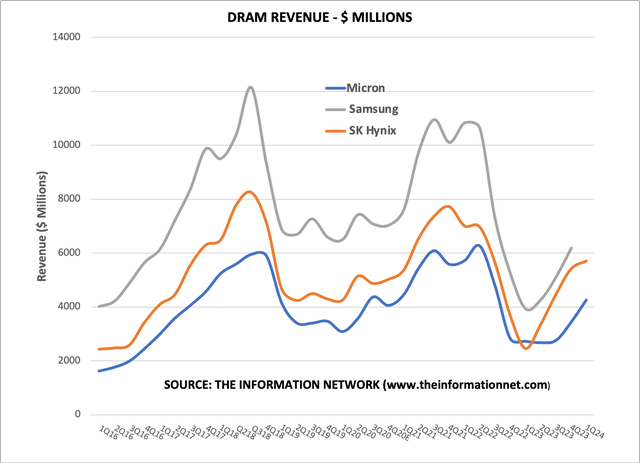

The reminiscence market is dominated by provide/demand dynamics. When enterprise is booming and demand outpaces provide (or some exogenous shock reduces provide), value will increase trigger sturdy gross sales development and margin enlargement. As finish markets cool off and costs fall amidst a requirement scarcity or provide glut, reminiscence costs reconcile with the sudden imbalance. Decrease costs trigger a major drag on earnings. This graphic from Robert Castellano’s current article “I’m Upgrading Micron To A Purchase As It Wins The HBM Yield Race With SK Hynix” illustrates this cyclicality fairly properly.

The Data Community

Reminiscence makers loved sturdy demand by 2016-2018, and costs remained persistently excessive. On the finish of 2018, unseasonably low smartphone demand brought about a provide glut and a subsequent erosion of pricing energy. This remained the case till COVID brought about a extreme provide scarcity and despatched costs rocketing again upwards. As soon as world provide chains recovered and inflation started to erode demand for shopper electronics globally, the market confronted one other provide glut and value downturn. The underside got here for Samsung (OTCPK:SSNLF) and SK Hynix within the first quarter of 2023 whereas Micron remained flat till later within the yr earlier than only in the near past experiencing a powerful DRAM gross sales restoration.

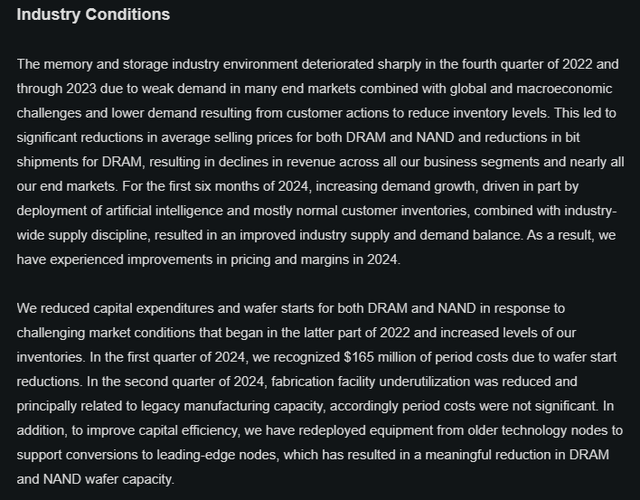

Micron described this identical sentiment within the current 10-Q whereas additionally making an necessary remark about manufacturing capability. Amidst file demand for HBM, a subsegment of DRAM (dynamic random entry reminiscence), Micron has “redeployed gear from older know-how nodes to help conversions to modern nodes, which has resulted in a significant discount in DRAM and NAND wafer capability”.

This may trigger provide constraints on older know-how and suggests value development on non-HBM merchandise. Samsung and SK Hynix are additionally reportedly slowing the speed of capability expansions for non-HBM DRAM and NAND merchandise, inflicting costs to climb.

Micron Q2 Earnings 10-Q

Regardless of the sensational efficiency of AI chips in 2023, the broader semiconductor {industry} did not truly develop. 2024 has seen a extra broad-based restoration, with 2025 anticipated to be a full restoration, based on ASML in its current earnings report.

The reminiscence story for this yr, nevertheless, stays solely targeted on HBM, so let’s drill down additional.

HBM Market Dynamics and Roadmap

Micron was late to the HBM sport, as illustrated by the DRAM gross sales plateau all through the primary half of 2023. On the time, Micron bought the measly leftovers from Samsung and SK Hynix, capturing round 10% of the market. SK Hynix took the early lead in HBM with its MR-MUF (Mass Reflow Molded Underfill) stacking methodology, which reportedly provides superior warmth dissipation in comparison with Micron and Samsung’s NCF (non-conductive movie) methodology.

eetimes.com

This lead started to erode as early as March of this yr as yield points brought about elevated scrutiny from NVIDIA (NVDA). That is additionally mirrored within the graphic above exhibiting DRAM income traits. I extremely advocate Robert’s article linked above for extra perception into this.

Whereas SK Hynix loved the explosive development from its H100 design win, Micron and Samsung rapidly introduced their respective next-gen HBM3e merchandise. Dealsite believes Micron can also be more likely to grapple with yield points regardless of the announcement of mass-production and inclusion in Nvidia’s H200 chip. There’s a broader debate ongoing about whether or not Micron’s HBM3e announcement means the product has handed Nvidia’s qualification check or if that check is ongoing and nonetheless inconclusive, based on the identical Dealsite article.

Samsung unveiled an HBM3e 12H product, with the ’12H’ representing the variety of DRAM stacks at 12. Micron and SK Hynix are presently in manufacturing with 8 excessive stacks. Business reviews rapidly claimed that Samsung could be the only real HBM3e 12H provider for Nvidia beginning in September 2024. It was later reported that Samsung was struggling to cross Nvidia’s qualification check and that this timeline is in danger. There may be some rumor that the qualification check was fitted for SK Hynix’s MR-MUF design and subsequently not match for objective with Samsung’s NCF design. This might additionally influence Micron because it’s constructed on NCF know-how, however that is unconfirmed.

It is equally seemingly that Samsung is grappling with yield points. HBM yield is inversely associated to the variety of die stacks. If every particular person DRAM die has a yield of 95%, then an 8-stack HBM die can have a yield of about 66% (.95 occasions itself 8 occasions). A 12-stack die can have a yield of about 54%. As of early June, Nvidia and Samsung are nonetheless working to certify this product for top quantity use.

Nonetheless, Samsung is more likely to win some HBM enterprise from Nvidia. Regardless of TSMC’s (TSM) finest efforts, the CoWoS superior packaging bottleneck is persistent. This bottleneck is compounded by a scarcity of silicon interposers, which is pushing Nvidia towards Samsung. In accordance with THE ELEC:

…this scarcity in interposers is probably going why Nvidia will inevitably place some orders to the South Korean tech big. Samsung is among the few chipmakers that may design and produce its personal interposers. It additionally has HBM and a couple of.5D package deal manufacturing capability. Samsung burdened earlier this month in its Samsung Foundry Discussion board that it was the one firm that may supply reminiscence, interposer, and package deal in turn-key. More difficult for Samsung is to catch as much as SK Hynix’s HBM, which was designed with traits personalized for Nvidia’s GPU. This can be a place that Samsung, the world’s chief in reminiscence chips, has by no means discovered itself in earlier than. Will Samsung’s HBM cross Nvidia’s high quality check? It appears so. However it’s the how of it, not when, that can matter.

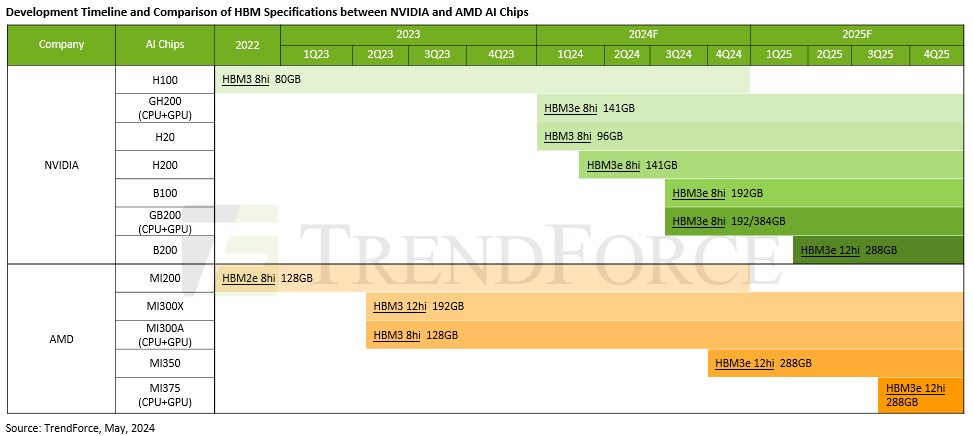

The present state of HBM is characterised by fiercely intense competitors. It is all-hands-on-deck to be first to market with new know-how. Profitable the HBM market is of utmost significance for these three firms. HBM3 costs have reportedly elevated 5x since 2023 and HBM3E carries a better price ticket. TrendForce expects that HBM costs will enhance one other 5-10% in 2025, with the shift to 12-stack HBM anticipated mid-2025.

TrendForce

Each Micron and SK Hynix have reportedly bought out of HBM capability for 2024 and most 2025 capability is spoken for. SK Hynix presently provides HBM for the H100 and Micron is within the H200 and has reportedly received the GB200 design. Samsung is working by verification for the B200.

In the meantime, SK Hynix has accelerated its timeline for future generations of HBM, based on this report citing unnamed sources. SK Hynix will mass produce HBM4 this yr and HBM4e in 2026, each a yr forward of plan, to maintain tempo with Nvidia who has additionally shortened the cadence of recent chip releases from 2 years to 1 yr.

Regardless of SK Hynix’s accelerated timeline, demand remains to be very a lot up for grabs. A launch plan is simply that, a plan, which remains to be rife with execution danger. Nvidia selected Micron for the H200 as a result of SK Hynix is grappling with yield points, which means that Micron has turn out to be a reliable contender within the HBM battle regardless of being late to the sport.

Including gas to this fireplace is a current Digitimes headline stating that Micron presently has the sting in Nvidia’s next-next-gen platform Rubin and its HBM4 reminiscence chips. To its credit score, Micron is aggressively increasing manufacturing capability, based on Nikkei Asia (emphasis added):

…Micron Expertise is constructing check manufacturing traces for superior high-bandwidth reminiscence chips within the U.S. and is contemplating manufacturing HBM in Malaysia for the primary time to seize extra demand from the AI increase, sources briefed on the matter mentioned.

Micron has mentioned it goals to greater than triple its market share for HBM, an important part in AI chips, to the “mid-20” proportion vary by 2025. That’s about the identical degree as its share available in the market for extra standard dynamic random entry reminiscence (DRAM) chips, which TrendForce knowledge places at about 23% to 25%… Micron’s largest HBM manufacturing web site is within the central Taiwanese metropolis of Taichung, the place additionally it is including capability.

Whereas Micron was late to HBM, they’ve turn out to be a powerful pressure within the {industry}. Micron has grown HBM market share amidst an enormous demand spike and continues to push ahead so as to add extra capability and seize extra share. In accordance with the identical Nikkei article, “Micron trails the opposite two by a big margin: SK Hynix controls greater than 50% of the worldwide marketplace for HBM, whereas Samsung has a 42.4% share, based on market analysis TrendForce.”

Whereas SK Hynix’s MR-MUF stacking methodology provides superior warmth dissipation and Samsung is the one vendor that may present reminiscence, package deal, and interposer collectively, Micron claims that its HBM consumes 30% much less power than its rivals. As server energy consumption has turn out to be top-of-mind within the TCO (whole price of possession) consideration, providing essentially the most energy-efficient product is a promising place to be in.

Q3 Expectations and Investor Takeaway

I discover it seemingly Micron will present very compelling outcomes and steerage this quarter. The gross sales development might be largely brought on by sequential will increase in common promoting costs, so gross margin will broaden. Manufacturing capability expansions help stronger than anticipated steerage as properly.

The corporate beat the excessive finish of gross sales steerage by $300m or 5.45% in Q2 and guided for gross sales of $6.4b-$6.6b in Q3. Contemplating CEO Sanjay Mehrotra commented that HBM capability was bought out by 2024, this implies gross sales development would be the results of sturdy value will increase. That is why current reviews of sturdy pricing energy in reminiscence make me extra bullish.

Robust knowledge middle tailwinds are additional supported by the beginnings of shopper electronics tailwinds as AI begins to proliferate the sting. As extra AI merchandise emerge, extra capability might be devoted to HBM. This may additional exacerbate the provision/demand imbalance for NAND and non-HBM DRAM merchandise, which is able to help additional value will increase. Moreover, Micron guided for OpEx to stay flat, so the gross margin enlargement will even translate to working and internet margin expansions.

In my eyes, all indicators level to a really sturdy quarter for Micron and one other sturdy information. The market has been closely rewarding firms this yr, and I count on Micron might be equally rewarded. Due to this fact, I reiterate my Purchase score on the corporate at the very least till the This fall earnings report. It appears unwise to wager towards an organization with a promising market place amidst drastic, industry-wide value will increase throughout one of many strongest bull markets in current historical past. That is clearly a momentum play, however it’s one which I really feel fairly conviction in.

[ad_2]

Source link