[ad_1]

There’s apparently a “house price disaster,” and a brand new fintech firm referred to as Mesa is trying to resolve that.

It’s no secret that house costs are by means of the roof, and when coupled with a lot greater mortgage charges and issues like skyrocketing owners insurance coverage, it might probably put homeownership out of attain.

Or on the very least, make it a battle for the common American to maintain up. To ease this burden, the corporate has rolled out a collection of merchandise to make homeownership slightly extra inexpensive.

Maybe mockingly, this new firm operates out of Austin, Texas, one of many hardest hit housing markets nationwide.

The favored metro has suffered from a glut of housing provide as many distant tech employees packed their baggage and moved again to wherever they got here from.

What Is Mesa?

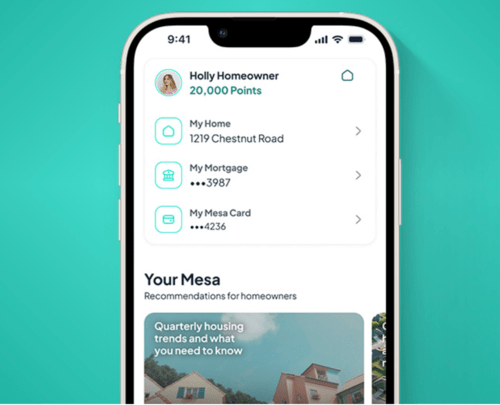

Known as the “first house owner membership platform,” Mesa is definitely a bunch of choices geared toward making homeownership cheaper and extra beneficial.

This implies placing higher mortgage offers in entrance of potential house patrons and giving them rewards once they make housing-related purchases.

Their first two merchandise are the Mesa Mortgage Market and the Mesa Householders Card.

{The marketplace} seems to function much like the Zillow Mortgage Market. Potential house patrons and present owners trying to refinance can evaluate lenders in a single place.

And apart from perhaps scoring a decrease price and/or lowered closing prices, they’ll earn a portion of the mortgage quantity again in rewards factors.

Those that take out a mortgage through the Market get 1% again within the type of rewards.

For instance, a $500,000 mortgage quantity would end in 500,000 rewards factors, which might be value $5,000.

These factors might then be redeemed for issues like closing prices on the mortgage, or for journey, and even reinvested again into the house through an additional mortgage fee.

It’s vital to notice that Mesa is just not a mortgage lender or a mortgage dealer, however relatively offers promoting for lenders and brokers through {the marketplace} and earns a charge.

The Mesa Householders Card

Their different fundamental product at launch is the “Mesa Householders Card,” which they consult with as the primary premium bank card designed particularly for owners.

We’ve seen different homeowner-centric bank cards up to now, however this one is outwardly premium for one motive or one other.

Like different playing cards earlier than it, cardmembers can get rewarded once they use the cardboard to make month-to-month mortgage funds.

However it goes a step additional by providing bonus factors on issues like HOA charges, utilities, house repairs, and different home-related providers like insurance coverage.

Per TechCrunch, you’ll earn 1X when utilizing the cardboard to make mortgage funds, 2X on gasoline and groceries, and 3X within the house providers class.

These factors might be eligible for reward card redemptions, mortgage fee redemptions, or transfers to airline & resort companions.

My understanding is you’ll be capable of use the Mesa Householders Card to make your mortgage funds, regardless of bank card issuers generally not permitting this.

Mesa has partnered with Visa on the deal and has a group that previously labored at corporations like American Categorical, Capital One, and Bilt, the latter of which needed to reward prospects for paying the mortgage with a bank card.

Bilt at the moment lets cardholders pay their hire and earn money again with out being topic to a transaction charge.

They’d deliberate to do the identical for mortgage funds, nevertheless it by no means got here to fruition. Will Mesa succeed the place others failed? It stays to be seen, nevertheless it has at all times been a problem.

Finally, mortgage lenders don’t love the concept of householders paying the mortgage with a bank card, and for good motive.

So it’s potential Mesa will minimize a test or ship an ACH if you happen to use their bank card to pay your mortgage servicer, to make sure fee is accepted.

The Mesa Householders Community

Lastly, Mesa has partnered with “manufacturers you’re keen on” to offer unique reductions and presents.

This would possibly embody reductions for memberships at Costco and at different companies that provide homeowner-centric providers.

As well as, the corporate plans to broaden their membership rewards to HELOC originations, house guarantee plans, insurance coverage, and different monetary merchandise for owners. And an app is coming quickly as effectively.

The aim is to make homeownership each extra inexpensive and rewarding by providing reductions and money again on all associated bills.

Figuring out at present’s price pressures transcend the principal and curiosity on the mortgage, this might present some aid to households who’re stretched.

For me, the query mark stays whether or not they’ll be capable of let customers pay the mortgage with the bank card.

In the event that they’re capable of pull that off, it may be worthwhile. If not, you possibly can argue that bank card factors earned with different issuers might hypothetically be cashed out and utilized towards the mortgage the identical manner.

For instance, I can at the moment money out by Chase Final Rewards at a penny apiece and apply further funds towards my mortgage. However I can’t use my Chase card to pay the mortgage.

So that they’ll want one thing to really differentiate and add worth versus present choices. I’d in all probability contemplate it in the event that they let me pay the mortgage every month.

Other than incomes 1% again every month, I’d get a grace interval to drift the mortgage fee earlier than the fee was due.

The product is at the moment waitlisted and you’ll enroll through their web site if .

Earlier than creating this website, I labored as an account govt for a wholesale mortgage lender in Los Angeles. My hands-on expertise within the early 2000s impressed me to start writing about mortgages 18 years in the past to assist potential (and present) house patrons higher navigate the house mortgage course of. Comply with me on Twitter for warm takes.

[ad_2]

Source link