[ad_1]

Tero Vesalainen/iStock by way of Getty Photos

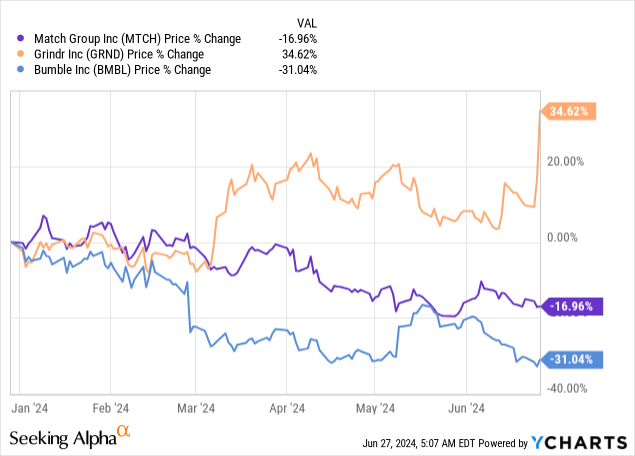

Relationship app shares have been in a world of ache this yr. The highest two publicly traded relationship app firms: Match (NASDAQ:MTCH), by far the biggest firm within the group and operator of Tinder and Hinge; Bumble (BMBL), the app finest recognized for having ladies make the primary connection, have each seen double-digit declines. In the meantime Grindr (GRND), the LGBTQ relationship app, has seen surprisingly sturdy efficiency pushed by double-digit person and income progress.

Amid this volatility, Match stands out with weak fundamentals. Income progress is slower than every of its opponents, which is comprehensible as Match is considerably bigger. However the place we needs to be cautious is the truth that Match is shedding paid customers, whereas its rivals are gaining.

I final coated Match in mid-2022, when the inventory was nonetheless buying and selling within the $80s. Within the final two years as progress has fizzled out and enthusiasm over progress prospects for Hinge have dwindled, the inventory has misplaced ~60% of its worth. Whereas Match would possibly make for a tempting rebound purchase, I do not just like the decline in its person base – and I stay bearish on the corporate.

Let’s now dig into the the explanation why.

Shedding customers, and slowing progress in rising product strains

The core drawback for Match.com: its largest utility, Tinder, which is liable for over half of its income, is seeing a decline in its customers’ willingness to pay. The corporate has lengthy operated a “freemium” enterprise mannequin (customary throughout the business), and amid a extra aware client setting, increasingly customers have opted to remain free customers.

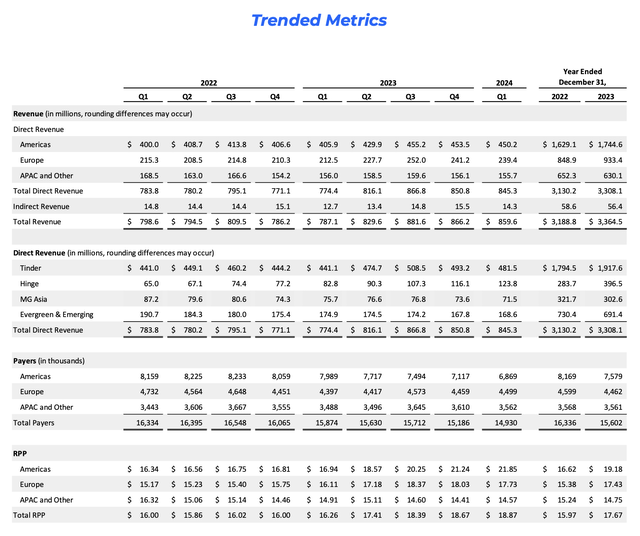

Match trended person metrics (Match Q1 earnings launch)

Check out the trended metrics within the desk above. In the newest quarter (Q1), Match ended with 14.93 million paid customers, which represents a sequential decline of ~250k customers and can also be down -6% y/y.

The corporate blamed the poor efficiency on weaker Tinder outcomes, which had been in flip pushed by customers’ decrease propensity to pay. Per CEO Bernard Kin’s remarks on the Q1 earnings name:

Tinder is working tirelessly to execute in opposition to their technique, and I am extremely assured within the staff’s capability to fulfill these evolving expectations that customers have. By the top of the yr, we anticipate to have a considerably improved product. Equally, pressures on discretionary client spending, particularly amongst Tinder’s youthful person base, have negatively impacted Tinder’s a la carte income. The staff is doubling down on its efforts to enhance the efficacy of its present ALC options and introduce new choices at inexpensive worth factors. We anticipate to see enhancements in ALC developments by the again half of the yr. We all know we’ve work to do to fulfill each new technology of daters. The Tinder staff is working to enhance the relationship journey at each level of the expertise. By way of innovation, particularly with AI, we imagine we are able to enhance the standard of profiles, matching outcomes, security options, and the post-match expertise to make the complete Tinder platform extra fashionable and ship on their model promise.”

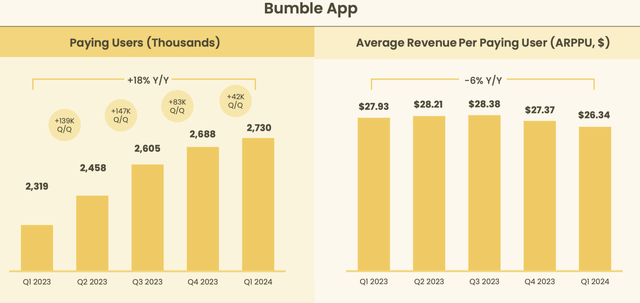

And but: we won’t merely chalk this as much as weaker macro client discretionary spending if Tinder’s rivals are seeing totally different outcomes. Bumble noticed sequential paid person progress of 42k in its most up-to-date quarter, and whole paid customers had been additionally up 18% y/y:

Bumble person metrics (Bumble Q1 earnings launch)

Even Badoo, a Bumble subsidiary that is a a lot much less well-known relationship app, noticed 13k sequential progress in customers and 13% y/y progress in the newest quarter.

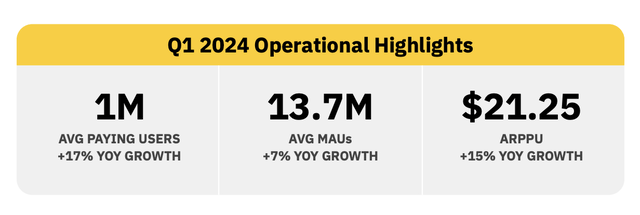

Equally, even at a smaller scale, Grindr can also be seeing super progress, with 17% y/y progress in paid customers. Alongside substantial progress in ARPPU, we additionally be aware that Grindr achieved 35% y/y income progress in Q1, which far outpaces Match’s 9% income progress in Q1 (or Bumble at 10% progress):

Grindr person metrics (Grindr Q1 earnings launch)

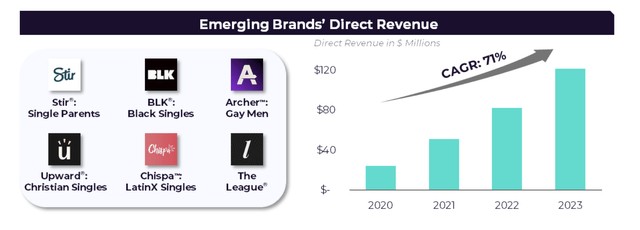

A part of the issue as properly is that Match’s different manufacturers (excluding Hinge and Tinder) are not as substantial of a progress automobile for the corporate. Match has lengthy been very acquisitive, and it has constructed up a diversified portfolio of extra focused-category relationship apps to complement its general-interest merchandise. Archer is the corporate’s reply to Grindr, whereas the corporate additionally has relationship apps for single dad and mom, black and latino people, and Christian singles. The League is one other one among Match’s subsidiaries, which focuses on academic {and professional} {qualifications} to make matches.

Match rising product CAGR (Match Q1 earnings launch)

Over the previous three years, these “rising manufacturers” have generated a income CAGR of 71%. And but, in Q1, rising and evergreen manufacturers (the grey bar within the lower-right chart under) noticed a -4% y/y decline in income.

Match income segmentation (Match Q1 earnings launch)

The one vivid spot for Match is Hinge, which remains to be rising paid customers and is reaching 50% y/y income progress. And but, with Tinder nonetheless representing a a lot bigger portion of Match’s total income base, the corporate’s medium-term objective of getting Hinge to a $1 billion annual income scale is probably not sufficient to offset these slowdowns.

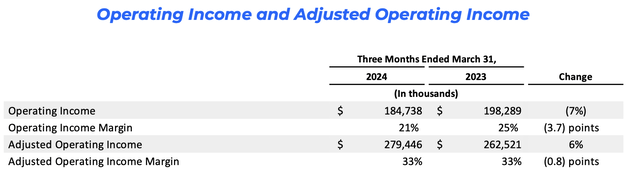

Weakening margins

Amid slower progress, we would usually anticipate firms to concentrate on boosting profitability. And but that is additionally not the case for the Match Group, the place in Q1, the corporate’s working earnings margins fell by -370bps y/y, and adjusted working margins (adjusted for inventory comp and different non-cash and one-time objects) fell -80bps y/y.

Match margins (Match income segmentation)

The corporate laid off 8% of its headcount final February, however since then it hasn’t introduced another main restructuring plans. The corporate’s main value motion within the works now’s integrating its backend platforms. However the advantages right here could also be each too minuscule and arrive too late: the corporate is anticipating $60 million of totally phased-in value reductions by 2026, however even that is lower than 2% of income.

Key takeaways

In my opinion, Match stays a poor funding as its progress charges stall and its core money cow, Tinder, continues to wrestle in attracting and retaining paid customers – even whereas different rival apps achieve. Proceed to steer clear right here.

[ad_2]

Source link