[ad_1]

Wirestock

I’m at all times looking out for brand new funding alternatives within the aerospace and protection industries, as I imagine that there are vital alternatives to capitalize on favorable tendencies. The business airplane trade presently is going through aerospace provide chain challenges, however the long-term development for air journey demand is concentrated upwards with greater manufacturing charges in prospect whereas demand for protection tools stays elevated. Moreover, commercializing of area and extra space-based protection options present vital alternatives for development of area sectors. I’m excited to increase my aerospace and protection protection with LISI (OTCPK:LSIIF). Since that is the primary time I cowl the corporate, I will probably be offering a quick description of the corporate’s actions adopted by a dialogue of the latest earnings, a threat evaluation and a inventory worth goal and ranking.

LISI: Aerospace, Automotive And Medical

LISI, which stands for Hyperlink Options for Business, was established in 1899 and focuses on supplying merchandise to the aerospace, automotive and medical finish markets. The corporate has a market capitalization of $1.43 billion and posted revenues of $1.80 billion in 2023. The corporate derives 52% of its gross sales from aerospace, 37% from automotive and 11% from the medical market. The mix of automotive and aerospace is sensible, however the mixture of these finish markets with the medical end-market may appear considerably puzzling. Nonetheless, having studied Aerospace Engineering with a minor in MedTech Primarily based Entrepreneurship, I can say that there are a lot of similarities between the medical and automotive and aerospace markets when it comes to required competences.

The aerospace section supplies all kinds of components equivalent to fasteners and engine elements and has all of the trade’s important gamers equivalent to Boeing, Airbus, Embraer, Dassault, Spirit AeroSystems, MTU Aero Engines and Safran in its buyer portfolio. For the automotive trade the corporate supplies cable channels, sealing screws, information pins and digital parking brakes for firm equivalent to BMW, Mercedes, GM, Stellantis and Volkswagen whereas the Medical section supplies stablers and hip protheses and has corporations equivalent to Johnson & Johnson, Medtronic and Intuitive Surgical within the buyer portfolio.

LISI Posts Greater Gross sales And Earnings However Demand And Provide Challenges Present

LISI

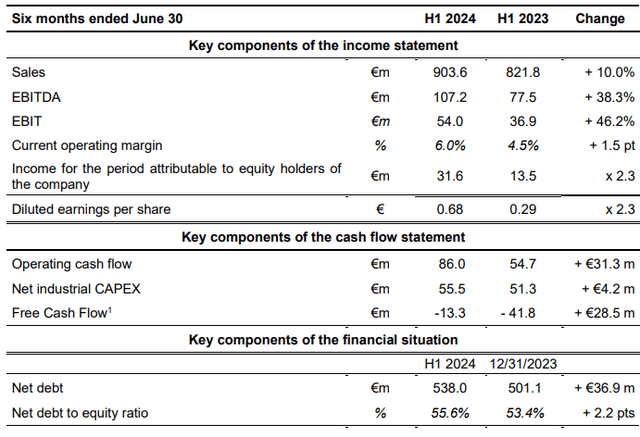

Whole gross sales grew 10% to €903.6 million in H1 2024 whereas EBITDA grew 38.3% to €107.2 million with EBIT rising 46.2% to €54 million, indicating a margin enhance of 1.5 factors to six%. We additionally noticed money flows enhancing, offering a sign that the aerospace provide chain, a minimum of for LISI, is enhancing considerably, requiring much less stock construct.

Aerospace gross sales grew by 22% on greater order ranges, primarily for single aisle airplanes and elevated upkeep actions. The corporate didn’t present an EBITDA margin for the section however famous that EBITDA margins had been up 4.7 factors as productiveness of newly employed employees is enhancing whereas quantity will increase permit for higher value absorption. Automotive gross sales declined 2.5%, however that also was higher than the general drop of 5.7% in manufacturing that LISI Automotive clients skilled. EBITDA elevated from €25.9 million to €26.7 million, pushed by value management. The medical section noticed gross sales being 0.8% decrease to €88.5 million. The primary drivers of the secure revenues are a powerful leap in gross sales within the comparable quarter final yr, in addition to difficulties sourcing uncooked supplies. EBITDA of €13.1 million with margins of 14.8% in contrast unfavorably to €14.5 million and 16.3% in the identical quarter final yr.

So, whereas the corporate is lively in key markets we do see aerospace provide points that proceed to be difficult, automotive demand is gentle with a weaker second half anticipated whereas the primary half of the yr was a difficult one for the medical section.

What Are The Dangers And Alternatives For LISI?

The demand tendencies in aerospace are favorable, and that may be a development I imagine to be favorable for the longer phrases. Presently, the danger is the stress within the aerospace provide chain. Within the automotive trade, there may be some stress on sure producers equivalent to Volkswagen, which is a buyer of LISI and that would impose a threat, whereas elevated labor and materials prices present a threat for a lot of corporations lively within the aerospace and automotive industries. Whereas these prices are higher below management, they continue to be a watch merchandise.

LISI Provides An Engaging Funding Alternative

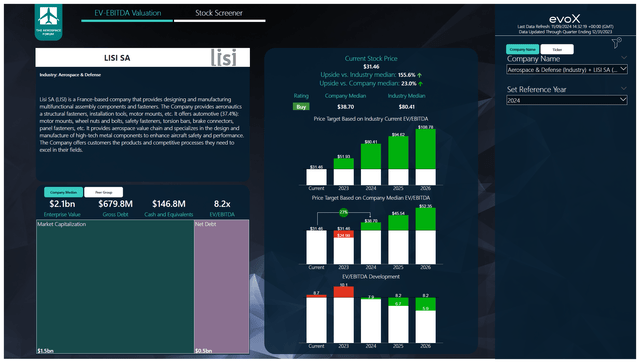

The Aerospace Discussion board

To find out multi-year worth targets The Aerospace Discussion board has developed a inventory screener which makes use of a mixture of analyst consensus on EBITDA, money flows and the latest steadiness sheet knowledge. Every quarter, we revisit these assumptions, and the inventory worth targets accordingly. In a separate weblog I’ve detailed our evaluation methodology.

If you’re excited about shopping for LISI inventory, I’ve to notice that the ticker LSIIF gives little quantity, which ends up in rare worth making. So, if you’re excited about buying the inventory of the corporate, I do imagine that the itemizing in Paris gives a greater alternative. Worth targets are additionally set with the Paris itemizing in thoughts. EBITDA is anticipated to develop by 13.3% yearly, whereas free money circulation development is ready to develop from $41.9 million in 2023 to $93.8 million in 2026. That makes fairly a compelling funding alternative as it could suggest that towards 2024 earnings there may be 23% upside with even stronger upside within the years forward, making LISI a gorgeous longer-term funding alternative.

Conclusion: LISI Faces Some Challenges, However There Is Upside

The primary half outcomes confirmed that there are some transient pressures confronted in a number of finish markets, both as a result of demand softening or as a result of challenges in procuring uncooked supplies. Nonetheless, the longer-term tendencies, particularly in aerospace, are sturdy, and the present valuation is interesting as there stays upside within the years forward whereas the inventory is considerably undervalued in comparison with sector friends which might additionally open up alternatives for the inventory costs to extend as a result of growth of the EV/EBITDA multiples consistent with the peer group.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link