[ad_1]

mattjeacock/E+ by way of Getty Photographs

Life360 Funding thesis

On June 5, 2024, Life360, Inc. (NASDAQ:LIF) started buying and selling on the Nasdaq change. Nonetheless, it has operated for greater than a decade, and was listed on the Australian Securities Alternate 5 years in the past.

It isn’t but worthwhile, however traders have been bidding up its value since its Preliminary Public Providing [IPO], presumably as a result of they anticipate it to transition from a loss to a revenue within the close to future. It’s additionally half of a big and rising area of interest.

Given its progress towards profitability, the prospects inside its area of interest, and its capacity to allocate capital to development, I contemplate it a Purchase.

About Life360

The corporate was created within the wake of Hurricane Katrina in 2008, as households struggled to maintain monitor of one another’s whereabouts. The unique app offered households with real-time location updates, emergency alerts, and allowed them to speak with one another.

Since then, Life360 has made a collection of acquisitions that allowed it to increase into adjoining markets. It now calls itself a full-service, family-safety software. The providers inside its cellular phone app embrace:

Location sharing and notifications Security options that embrace crash detection (auto crashes), emergency SOS alerts, and driving stories. Communication by means of household discussion groups Driving insights Pet monitoring Location historical past Stolen cellphone safety.

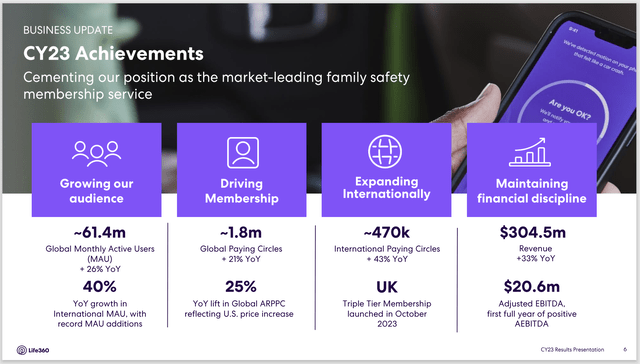

General, its providers are designed for households or different teams that need to know the whereabouts of different members and to offer security providers. As proven on this slide from its calendar yr 2023 outcomes presentation, it’s already well-established:

LIF Company Achievements (2023 investor presentation)

In 2022, Life360 acquired Tile, an organization that makes a speciality of discovering issues, or objects, utilizing a cloud-based discovering platform. In the identical interval, it acquired Jiobit, which is a supplier of hardware-enabled location monitoring options, together with wearables.

The agency started buying and selling on the Australian Securities Alternate (ASX:360) in Could 2019.

It launched on Nasdaq on June 5, 2024, at $27.00. On the shut of buying and selling on June 17, it was up 15.74%, to $31.25. At that value, it had a market cap of $2.25 billion.

Key information to contemplate: the corporate has been in enterprise for greater than a decade, has a robust ongoing enterprise, and is now a mid-cap inventory.

Competitors for Life360

Life360 famous in its 10-Ok for 2023 that it faces quite a few opponents, various from direct opponents to firms which have some overlapping choices. Direct opponents embrace:

FamiSafe: a parental management device that features monitoring a toddler’s exercise on their cellphone. It’s a product from Wondershare, which additionally owns FollowMee. FollowMee: Turns an iPhone or Android cellphone right into a GPS tracker, with which individuals and gadgets will be tracked. Map My Run: A product from Underneath Armour, Inc. (UA) that gives monitoring instruments and will be built-in with wearables.

Regardless of the competitors, Life360 is optimistic about its place within the private security and monitoring area of interest, in accordance with its 10-Ok:

Whereas our business is turning into more and more aggressive, we imagine that we are going to proceed to compete efficiently as a result of our main market place, superior worth proposition, model recognition, capacity to leverage our member base, our complete suite of choices and economies of scale. As well as, our data-driven insights on households’ habits, wants and preferences allow us to constantly improve our product choices and enhance the member expertise, reinforcing our aggressive differentiation.

That declare could also be backed up by its margins–in the long run. Whereas its gross margin was a wholesome 77% within the first quarter of 2024, its EBIT and web earnings margins had been adverse: minus 5.61% and minus 2.70% respectively.

Life360 margins

As famous, it has a robust gross margin, however adverse EBIT and web earnings margins. That’s commonplace amongst firms which have not too long ago gone public. Anticipate extra and better bills related to its IPO within the subsequent couple of quarters, after which a big discount.

The corporate forecast constructive EBITDA in 2025 and “in the end” robust EBITDA margins within the annual report delivered with the 10-Ok.

That’s logical for a software program firm as a result of income ought to develop extra rapidly than bills for a longtime firm. In first quarters, its web revenue/loss improved, from minus 21% in Q1-2023 to minus 12% in Q1-2024, in accordance with its Q1-2024 earnings launch. On the identical time, its adjusted EBITDA margin improved from 1% to five%.

Development

Life360’s Q1-2024 earnings report (its final earlier than it started buying and selling on Nasdaq), famous “continued robust subscription income development” in addition to improved leverage in its operations.

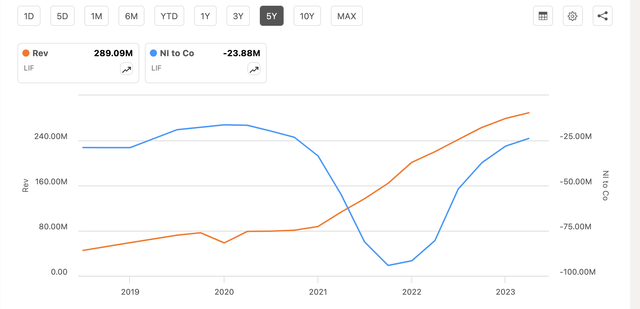

The next chart reveals how the corporate’s income and web earnings has fared since going public in Australia in 2019:

LIF Income and Internet Revenue chart (SeekingAlpha)

In its outlook for full-year 2024, Life360 is forecasting (with 2023 leads to brackets):

Consolidated income: $365-$375 million ($304.5 million) Adjusted EBITDA: $30-$35 million ($20.6 million) EBITDA: a loss between $8 million and $13 million (-$20.8 million) 12 months-end money: $80-$90 million ($69 million)

Extra broadly, Life360 has grown its income, and its web earnings has recovered from the dip of 2021 and 2022. It isn’t but worthwhile, however that ought to occur in 2025.

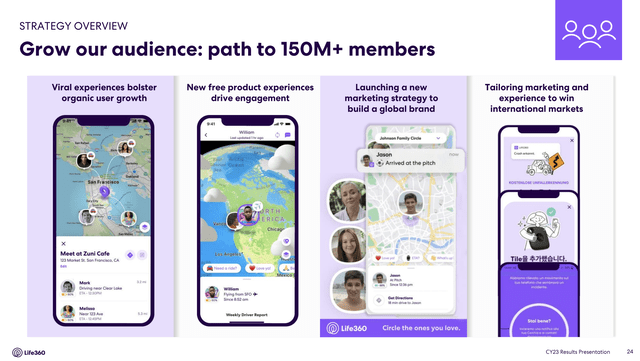

Listed here are the techniques it can make use of on its quest to achieve 150 million month-to-month lively customers and income of greater than $1billion:

LIF Development Path (2023 investor presentation)

It estimates the 2024 spend in its area of interest at $402 billion, which it describes as a “large market”.

Financials

The corporate reported its Q1-2024 outcomes on Could 9 and included the next highlights (with Q1-2023 leads to brackets):

Complete income: $78.227 million ($51.664 million) Complete price of income: $18.214 million ($18.313 million) Gross revenue: $60.013 million ($49.830 million) Complete working bills: $66.392 million ($64.722 million) Different earnings and bills: -$2.004 million ($.929 million) Provision for earnings taxes: $1.394 million ($.108 million) Internet loss: $9.777 million ($14.071 million) Weighted common shares: 68.536 million (65.592 million) Internet loss per share, primary and diluted: $0.14 ($0.21) Working money move: $10.7 million (-$9.2 million)

Complete income grew by 51.41% in the middle of a yr, whereas the price of income declined barely; that’s a severe enchancment. Because of this, it was in a position to trim its web loss by 43.91% and its web loss per share by 50%. It additionally improved its money place, with working money move shifting from adverse to constructive.

If it stays on this monitor, Life360 ought to meet its aim of turning into worthwhile in 2025.

Valuation

As famous above, the worth has risen sharply, by greater than 15%, from its IPO on June 5. With lower than two weeks of buying and selling, setting a valuation isn’t simple.

Nonetheless, it has traded on the Australian Inventory Alternate for about 5 years. In an evaluation of Australian shares revealed June 17, Merely Wall St estimated it’s buying and selling nicely under its truthful worth. Particularly, with the inventory buying and selling at A$15.44, it estimated truthful worth at A$23.97, that means it trades at a reduction of 35.6%.

The evaluation did notice there was “substantial” insider promoting and shareholder dilution, which ought to mood traders’ expectations.

General, I cannot put a lot weight on the Australian valuation, nevertheless it does make me lean towards believing the American inventory can be undervalued.

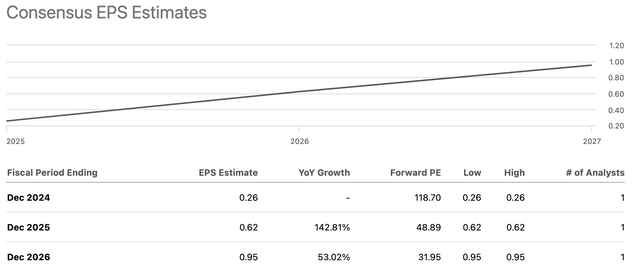

Just one analyst at the moment follows the American inventory, and is bullish on 2025 and 2026 earnings:

LIF EPS Estimates (SeekingAlpha )

Assuming Life360 delivers these or comparable earnings, the ahead P/E would drop considerably over the following three years.

Such a drop would assist align it with the present P/Es of a number of friends (software expertise within the Info Know-how sector):

Lightspeed Commerce Inc. (LSPD) : 42.55 Verint Methods Inc. (VRNT): 12.05 Sprinklr, Inc. (CXM): 21.68 PagerDuty, Inc. (PD): 31.09

That one Wall Avenue analyst has a mean one-year value goal of $36.25, which might be a rise of 16% within the subsequent yr. The low estimate is $32.00 and the excessive estimate is $40.00.

I imagine the excessive estimate is the most certainly. By the shut on June 17, the worth had already hit $31.25, which is simply $0.75 shy of the low estimate. I’m additionally bullish as a result of I believe it might be undervalued, that few traders know the title, it has strong development plans, and its merchandise remedy huge, well-known issues.

Subsequently, I estimate its share value might be close to $40 a yr from now, and price it a Purchase. The Wall Avenue analyst charges it a Maintain, in the one different score to this point.

Danger elements

The enterprise mannequin is dependent upon an ever rising base of recent and present members, any disruption in its advertising and gross sales might be an issue. Its mannequin additionally is dependent upon new prospects upgrading from free to paid providers.

Clients have excessive expectations, particularly that Life360 will defend their relations in crucial conditions. Any operational glitches that reduce that safety might metastasize and result in the lack of many shoppers.

Given the scale of the entire addressable market, we should always anticipate many extra opponents to enter this area of interest. They may power decrease costs, take away Life360’s prospects, and extra.

The corporate could promote extra shares to assist its development, leaving present shareholders with diluted holdings.

As a expertise firm, it wants subtle scientists and technicians for analysis and growth. Such folks could change into much more tough to seek out, recruit, and hold.

Conclusion

Life360 affords a collection of services and products which have confirmed fashionable amongst customers with an curiosity within the security and site of their households and belongings. It ought to be capable to develop together with its rapidly increasing business.

It has the sources to continue to grow, due to its enhancing money move and rising money and money equivalents. Notably, its first-quarter outcomes present income rising, whereas bills remained comparatively flat.

I anticipate the worth to proceed rising, to about $40 within the subsequent yr, and price it a Purchase.

[ad_2]

Source link