[ad_1]

Merchants have numerous methods to select from relying on their threat profile and market situations.

One strategy is Larry Connors’ 2-period RSI technique, which focuses on imply reversion.

This technique exploits short-term value reversals, creating distinctive alternatives in bullish and bearish markets.

This information will discover the technique’s foundations, key parts, execution guidelines, related dangers, and sensible modifications to probably improve profitability.

Contents

Larry Connors developed the 2-period RSI technique as his tackle conventional momentum buying and selling.

Quite than concentrating on main market tops or bottoms, this strategy appears to be like to commerce short-term extremes.

The two-period Relative Power Index (RSI) permits merchants to establish native tops and bottoms which are usually influenced by short-term market sentiments somewhat than long-term tendencies.

On the coronary heart of the technique are three important indicators.

The two-period RSI is on the coronary heart of this technique.

The 200-period Transferring Common (MA) additionally supplies important context for the prevailing pattern.

An upward slope indicators a bullish setting, whereas a downward slope signifies bearish situations.

Lastly, the 5-period Transferring Common is used to find out exit factors.

Now that we now have the fundamentals down let’s take a look at how one can place each a protracted and a brief commerce and when to exit.

Lengthy trades:

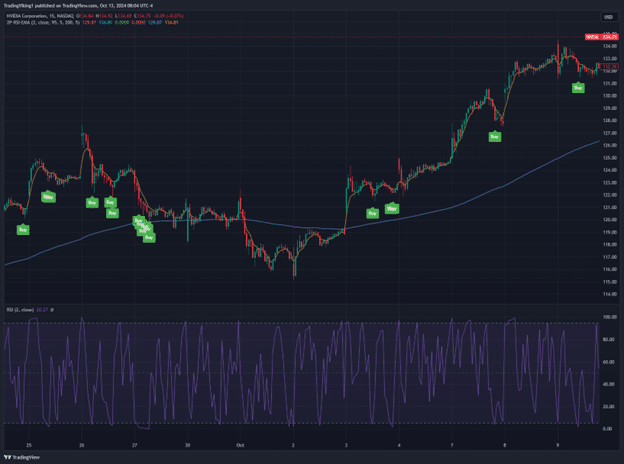

As mentioned above, lengthy trades are entered when the 2-period RSI drops under 5 whereas the worth is above the 200-period shifting common however under the 5-period shifting common.

Quick trades:

Quick trades are the alternative of the lengthy trades above when the RSI is above 95, and the worth is under the 200-period shifting common however above the 5-period shifting common.

Exit methods:

There are a couple of totally different exit methods that you should use.

Connors really useful closing the trades in revenue when the worth crosses by means of the 5-period shifting common.

So, on a protracted commerce, it’s when it crosses above, and on a brief commerce, it’s when it crosses under.

Connors has no cease losses on the unique commerce plan, resulting in massive potential drawdowns.

One other potential exit technique is utilizing your threat administration for a set cease loss and taking revenue on every commerce.

If that is the route you go, needless to say this can be a momentum commerce in a short while body.

Whereas the 2-period RSI technique is exclusive, it comes with challenges.

One notable concern is the absence of stop-loss mechanisms, which may result in vital losses in risky markets.

The short-term focus additionally provides the chance of being whipsawed on entry.

This may result in false indicators in uneven situations.

The technique’s dependence on historic efficiency is one other problem within the present market setting.

Whereas previous backtests have proven promise, latest market situations have produced blended outcomes utilizing the pure 2-period technique.

One other potential threat with the technique is the instrument that it’s used on.

Illiquid devices can produce false indicators and problem coming into and exiting at good costs.

That is a straightforward threat to mitigate; persist with liquid names and devices, and it turns into a non-issue.

There are a couple of methods to extend potential profitability and scale back a number of the dangers related to this technique.

First, the edge and interval on the RSI have to be altered.

The thresholds are already excessive, however shifting them from 5/95 to one thing like 2/98 will significantly scale back the variety of entries and improve the overextended transfer.

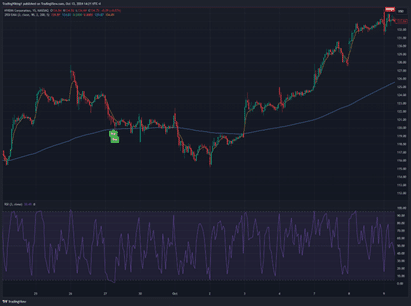

The chart to the appropriate is identical as above however makes use of a 3-period RSI and a 2/98 threshold.

As you possibly can see, the variety of trades has decreased considerably.

An alternative choice is incorporating superior trend-filtering methods to boost the technique’s reliability.

By including extra shifting averages, such because the 50-period or 100-period, merchants can strengthen pattern verification.

Using different indicators just like the Common Directional Index (ADX) or Momentum Indicator can additional affirm robust market tendencies earlier than coming into trades.

Diversification is one other manner to enhance the 2-period RSI.

Making use of the technique throughout a variety of uncorrelated devices or sectors can successfully unfold the momentum threat.

It’s potential that this could trigger you to be lengthy/quick concurrently, so relying on the timeframe, you might need to make the most of choices for that.

There’s extra on that under.

Maybe the easiest way to enhance on this technique is to incorporate some type of threat administration.

Implementing stops may help mitigate drawdowns, and utilizing trailing stops may help safe income as costs transfer in your route.

Multi-time body evaluation can even assist merchants achieve a broader market perspective, making it simpler to establish key help and resistance ranges to commerce off of or into.

Free Wheel Technique eBook

Utilizing choices with the 2-period RSi technique can even assist to extend profitability and reduce threat.

First, it must be famous that it will work finest with greater time frames however is theoretically relevant to any timeframe greater than quarter-hour.

The easiest way to make use of choices with this technique is to commerce them lengthy for the leverage.

As a sign fires you’d purchase an at-the-money or in-the-money name or put (relying on route).

The objective right here is to get as shut as potential to a delta of 1/-1 in order that value motion will increase the choice’s worth. A couple of methods to set a cease loss would work right here.

The primary is to have a set greenback worth, so if the choice loses $X, you’d shut the commerce. The second is predicated on the underlying.

If the underlying strikes towards you by X% or $X, you’d shut the choices no matter the place they’re.

The third could be letting the choice run till the underlying crosses the 5-period common or expires nugatory (not really useful).

The take revenue on this technique is identical; as the worth crosses the 5-period common, you’d exit the place.

As said firstly of the part, the upper the time-frame, the higher this is able to work.

Whereas it’s potential to day commerce the choices profitably, the 4-hour or greater time-frame would allow you to maintain in a single day and never waste day trades, and it will additionally give the underlying extra room to run.

For merchants searching for to seize short-term value extremes, the 2-period RSI technique provides an efficient, adaptable technique for varied market situations.

This technique can evolve past its preliminary setup by fastidiously combining historic insights with sensible modifications—corresponding to enhanced entry thresholds, extra pattern filters, and choices integration.

Whereas the absence of stop-loss is a big detractor of the technique, implementing threat administration is straightforward and will be executed on the fly.

The technique generally is a beneficial instrument in a dealer’s arsenal, permitting them to commerce momentum in a brand new manner.

We hope you loved this text on Larry Connors’ 2-period RSI technique.

When you’ve got any questions, ship an e-mail or go away a remark under.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who usually are not aware of trade traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link