[ad_1]

Shutthiphong Chandaeng/iStock by way of Getty Photos

Key takeaways

The fund carried out according to its benchmarkStock choice within the info know-how (‘IT’) sector added essentially the most to relative return. Twin concentrate on free money flows and wholesome stability sheetsThe fund is balanced throughout sectors and industries, with a concentrate on long-term progress areas and firms with sustainable free money circulation and wholesome stability sheets, which ends up in an total high quality bias and defensive traits. Renewed curiosity in dividend- paying stocksIn an surroundings characterised by excessive uncertainty and the potential for extra muted and even unfavorable returns, we consider traders will place larger emphasis on corporations with steady dividends.

Supervisor perspective and outlook

Fairness market efficiency diverged within the second quarter. Whereas shares associated to Synthetic Intelligence (‘AI’) drove a number of fairness indexes to all-time highs, different market segments declined.

Stubbornly excessive inflation despatched shares broadly decrease in April amid worries the US Federal Reserve (Fed) is likely to be pressured to maintain rates of interest larger for longer. Nonetheless, in Could and June, shares rallied in response to indicators of cooling inflation.

Company earnings have been usually optimistic with most S&P 500 constituents beating expectations. As anticipated, the Fed’s June assembly produced no change to the federal funds charge, and assembly minutes instructed the committee anticipates only one charge reduce in 2024. Although the market seems to be at a crossroads as traders seemingly attempt to decide when the Fed will start to scale back rates of interest, the driving rules of our funding course of stay rooted in a complete return strategy that seeks to ship appreciation, revenue and preservation over a full market cycle. Irrespective of the backdrop, we concentrate on corporations producing engaging free money circulation and we analyze their drivers and talent to assist future dividend progress, in addition to stability sheet power and suppleness. We proceed to emphasise the expansion and sustainability of an organization’s dividend as a result of historical past leads us to consider corporations with these traits can outperform over a full market cycle.

Portfolio positioning

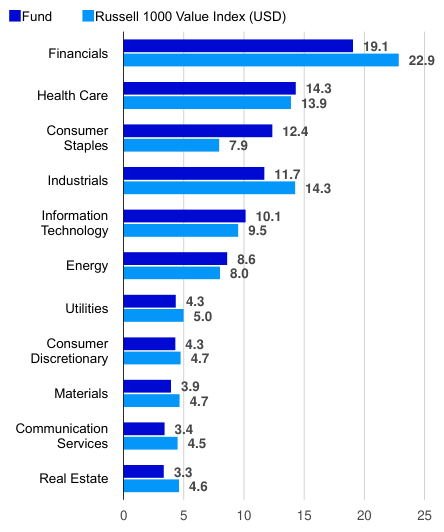

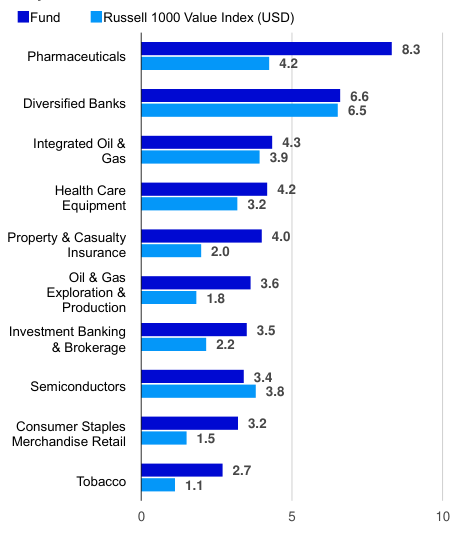

In comparison with the Russell 1000 Worth Index, the fund’s positioning is mostly balanced throughout sectors and industries, with publicity to areas benefiting from long-term secular progress tailwinds, together with ecommerce, electrical autos, cloud computing, industrial automation, medical know-how and broadband. Importantly, our twin concentrate on corporations producing sustainable ranges of free money circulation and having wholesome stability sheets additionally provides the fund a top quality bias and gives defensive traits that we consider ought to show priceless if market volatility persists in 2024.

Notable Additions to the fund

PepsiCo (PEP) is in our view effectively positioned in rising beverage and snack classes with low non-public label penetration and has substantial model recognition that’s anticipated to assist continued pricing energy and powerful worldwide outcomes.

Suncor Power (SU) is a Canada-based vitality firm that we added to the fund as a result of we consider its new administration group is executing at a excessive stage and constructing on operational consistency and value reductions at a faster-than-expected tempo.

Microchip Know-how (MCHP) has been seeing indicators of restoration regardless of persevering with stock corrections by some prospects. Stock on the corporate’s books has remained excessive however administration has some capability to scale back stock ranges over time. We anticipate alternative for outperformance as inventories backside as a result of a cyclical restoration in semiconductors is predicted to develop quickly.

Notable Gross sales

Accenture (ACN) is an IT providers and consulting firm that we faraway from the fund on account of deteriorating fundamentals; the corporate decreased annual income steering, pointing to weak point in shorter time period discretionary tasks, elongated gross sales cycles and re-prioritization of IT budgets.

WEC Power (WEC) was bought in the course of the quarter as a result of we’ve decrease conviction within the inventory and consider there’s much less upside to our value goal on account of modifications within the Illinois regulatory surroundings. On the time of buy, Illinois was considered as an accommodative jurisdiction, however current unfavorable regulatory selections towards three totally different utilities, together with WEC Power, elevated the danger of working within the state.

Starbucks (SBUX) has skilled deterioration in US retailer site visitors as customers rein in spending amid larger prices and rates of interest. Geopolitical controversies have additionally continued to weigh on ends in an already difficult restaurant surroundings. We eliminated the inventory from the fund in the course of the quarter.

High issuers (% of complete internet property)

Fund

Index

JPMorgan Chase & Co (JPM)

3.52

2.75

Merck & Co Inc (MRK)

3.38

1.21

Walmart Inc (WMT)

3.21

1.36

Chevron Corp (CVX)

2.99

1.27

Philip Morris Worldwide Inc (PM)

2.70

0.74

Morgan Stanley (MS)

2.47

0.53

Johnson & Johnson (JNJ)

2.47

1.66

Public Service Enterprise Group Inc (PEG)

2.30

0.17

American Worldwide Group Inc (AIG)

2.20

0.25

Chubb Ltd (CB)

2.17

0.49

As of 06/30/24. Holdings are topic to alter and will not be purchase/promote suggestions.

Click on to enlarge

Sector breakdown (% of complete internet property)

High industries (% of complete internet property)

Efficiency highlights

Market efficiency was combined in the course of the quarter, with IT, communication providers and utilities delivering beneficial properties whereas most different sectors have been flat or unfavorable. Supplies, industrials and vitality had the bottom returns for the quarter. Led by AI, progress shares outperformed worth shares because the Russell 1000 Development Index returned 8.33% and the Russell 1000 Worth Index declined, returning -2.17%. On this surroundings, the fund’s return was much like the Russell 1000 Worth Index. The fund’s inventory choice within the IT, client staples and financials sectors added essentially the most to relative return. An obese within the client staples sector and an ancillary money place helped to offset unfavorable outcomes. Conversely, inventory choice in the true property, client discretionary and industrials sectors detracted essentially the most from relative return.

Contributors to efficiency

Walmart’s share beneficial properties have been pushed by the retailer’s mixture of worth choices and comfort, which resonated throughout quite a lot of revenue demographics and supported year-to-date gross sales progress of roughly 15%.

Philip Morris delivered one other sturdy quarter of earnings outcomes and raised its forward-looking steering. Favorable outcomes have been pushed by surging demand for its tobacco-less Zyn nicotine pouches, which had quantity develop of 80% year-over-year.

Analog Units has continued to learn from sturdy and rising demand for semiconductor chips, pushed by synthetic intelligence and machine studying capabilities.

Detractors from efficiency

Walt Disney (DIS) reported underwhelming monetary outcomes. Administration offered cautious commentary concerning site visitors at its amusement parks and its cruise ship investments, which collectively in our view might be a near-term headwind to progress of working revenue within the section.

CVS Well being (CVS) was bought in the course of the quarter following underwhelming monetary outcomes and administration’s discount of forward-looking steering on account of macroeconomic headwinds and better prices, which may result in a dividend reduce.

Prologis (PLD) shares have been weak after reporting earnings from the California market that fell in need of expectations. Prologis’ properties in different states have been working at or above expectations, offering good visibility into future earnings. We proceed to consider the shares supply materials upside.

High contributors (%)

Issuer

Return

Contrib. to return

Walmart Inc.

12.92

0.35

Philip Morris Worldwide Inc.

12.04

0.30

Dell Applied sciences Inc. (DELL)

21.32

0.26

Analog Units, Inc. (ADI)

15.87

0.25

Public Service Enterprise Group Integrated

11.27

0.23

Click on to enlarge

High detractors (%)

Issuer

Return

Contrib. to return

Walt Disney Firm

-18.85

-0.37

CVS Well being Company

-24.06

-0.28

Prologis, Inc.

-13.01

-0.25

Lowe’s Corporations, Inc. (LOW)

-13.05

-0.25

Weyerhaeuser Firm (WY)

-20.41

-0.25

Click on to enlarge

Standardized efficiency (%) as of June 30, 2024

Quarter

YTD

1 Yr

3 Years

5 Years

10 Years

Since inception

Investor shares (MUTF:FSTUX) inception: 06/02/86

NAV

-2.38

4.78

9.82

6.19

7.42

7.36

8.29

Class A shares (MUTF:IAUTX) inception: 03/28/02

NAV

-2.41

4.79

9.80

6.19

7.42

7.36

8.11

Max. Load 5.5%

-7.77

-0.96

3.77

4.20

6.22

6.76

7.84

Class R6 shares (MUTF:IFUTX) inception: 09/24/12

NAV

-2.33

4.92

10.15

6.53

7.81

7.75

9.06

Class Y shares (MUTF:IAUYX) inception: 10/03/08

NAV

-2.31

4.91

10.05

6.44

7.68

7.63

8.75

Russell 1000 Worth Index (‘USD’)

-2.17

6.62

13.06

5.52

9.01

8.23

–

Whole return rating vs. Morningstar Giant Worth class (Class Investor shares at NAV)

–

–

87%

(1011 of 1182)

56%

(647 of 1103)

87%

(916 of 1039)

81%

(637 of 813)

–

Click on to enlarge

Expense ratios per the present prospectus: Class Investor: Web: 0.94%, Whole: 0.94%; Class A: Web: 0.93%, Whole: 0.93%; Class R6: Web: 0.59%, Whole: 0.59%; Class Y: Web: 0.69%, Whole: 0.69%.

Efficiency quoted is previous efficiency and can’t assure comparable future outcomes; present efficiency could also be decrease or larger. Go to Nation Splash for the newest month-end efficiency. Efficiency figures replicate reinvested distributions and modifications in internet asset worth (NAV). Funding return and principal worth will fluctuate so that you simply

could have a achieve or a loss once you promote shares. Returns lower than one yr are cumulative; all others are annualized. On Feb. 6, 2013, the fund’s funding technique eradicated a requirement to pay attention its investments primarily within the securities of issuers in utilities-related industries. Outcomes previous to Feb. 6, 2013, replicate the efficiency of the fund’s earlier technique. Index supply: FactSet Analysis Techniques Inc. Had charges not been waived and/or bills reimbursed previously, returns would have been decrease. Efficiency proven at NAV doesn’t embrace the relevant front-end gross sales cost, which might have decreased the efficiency.

Class Investor, Y and R6 shares don’t have any gross sales cost; subsequently, efficiency is at NAV. Class Y shares can be found solely to sure traders. Class Investor and R6 shares are closed to most traders. Please see the prospectus for extra particulars.

For extra info, together with prospectus and factsheet, please go to Invesco.com/FSTUX

Not a Deposit Not FDIC Insured Not Assured by the Financial institution Could Lose Worth Not Insured by any Federal Authorities Company

Click on to enlarge

[ad_2]

Source link