[ad_1]

On the peak of the American battle machine’s realization that China controls almost all of its uncooked supplies, two new developments in Europe now recommend that the West has a preventing probability to safe vital metals for the longer term: A serious discovery in Norway, and a doubtlessly game-changing acquisition in Greenland.

In mid-June, Norwegian mining firm Uncommon Earths Norway unveiled one of many largest deposits of uncommon earth components in Europe within the Fen Carbonatite Advanced within the nation’s south. That discovery adopted a vote in Norwegian parliament that paved the way in which for offshore, deep-sea mining of uncommon minerals within the nation’s distant northern waters, Fortune journal reported, making this the primary nation in Europe to permit such seabed mining actions.

On the identical time, Vital Metals Corp (NASDAQ:CRML) introduced an acquisition deal for what it believes is the most important vital metals deposit on the planet, in Greenland.

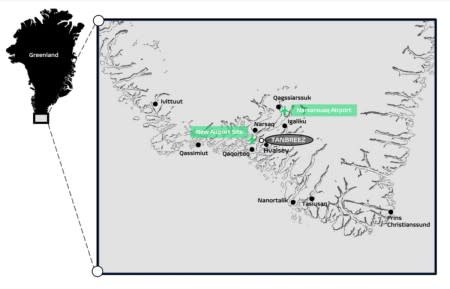

On June 10, Vital Metals Corp signed an settlement to accumulate a controlling curiosity in Greenland’s Tanbreez venture, which it says is the most important uncommon earth deposit on the planet. As soon as operational, CRML expects it to provide Europe and North America. And on June 18 the corporate introduced it had accomplished its preliminary funding for the Tanbreez acquisition, lending extra confidence to the deal and additional de-risking the transaction, based on an organization press launch.

Tanbreez is alleged to have over 28 million tonnes of whole uncommon earth oxides, the corporate estimates internally, and almost 30% of that’s the most coveted “heavy” uncommon earth components (HREE).

Given the success of MP Supplies (NYSE:MP), a $2.2 billion market cap issuer that has a identified useful resource of just below 3 million tonnes that’s virtually completely gentle uncommon earth components (LREE), CRML might be set for a big valuation re-rate.

“Tanbreez is a game-changing uncommon earth mine for the West and a key step in positioning Vital Metals Corp because the main provider of vital minerals, CEO Tony Sage mentioned in a press launch.Uncommon earths metals are utilized in our on a regular basis electronics, however with out them, there might be no clear power transition, and the U.S. will discover itself at a weapons drawback—a fearful thought at a time of geopolitical upheaval spreading throughout Europe and the Center East.

With Russia and NATO continuously dipping their toes over their respective “purple traces” on Ukraine, Russia making flanking actions in northern Africa and the Israel-Hamas battle inflicting shifting world alliances and calculations, uncommon earths metals draw a line within the sand within the subsequent world battle.

Story continues

That makes European discoveries all of the extra pressing, and Vital Metals is eyeing its potential to turn into one of the vital miners of the last decade. And whereas heavy vital metals is golden goose in mining at present, Vital Metals can be gearing as much as develop the Wolfsberg Lithium Undertaking in Austria, Europe’s first fully-permitted lithium mine.

China Is Wielding the Final Weapon, Tanbreez May very well be Frontline Protection

The 2-pronged commerce battle has been nicely below manner for a while now, and it’s all in regards to the nexus of microchips and uncommon earth’s components (REEs).

In August 2022, the Biden administration signed the CHIPS and Science Act into regulation to spice up home manufacturing of semiconductors and cut back reliance on China. That transfer was in response to Beijing’s transfer to tighten exports of uncommon earths components gallium, germanium and graphite. In late 2023, Beijing tightened controls on exports of uncommon earths after which banned the export of uncommon earths extraction expertise. The commerce battle pits semiconductors in opposition to REEs in actions and reactions by Beijing and Washington.

The whole lot going ahead is about microchips. Synthetic intelligence (AI), army protection, and completely every part in between. It’s all powered by chips, which don’t exist with out the REEs essential to make them.

That’s why the Tanbreez acquisition is so vital. The mine is positioned to turn into a significant REE provide chain for the western hemisphere within the face of a Chinese language authorities that has the flexibility to severely disrupt the provision of almost all vital metals.

The Chinese language might virtually immediately take 50% of uncommon earth oxide provide off the market, which might devastatingly have an effect on U.S. protection methods, that are already stretched skinny over Ukraine.

Tanbreez is a 4.7-billion-tonne Kakortokite outcropping ore physique about which over 2,000 tutorial papers have been written. It incorporates economically engaging quantities of Zirconium, Tantalum, Niobium, Hafnium and REEs. Practically 30% of the minerals, all of that are mentioned to happen in vital measurement and high quality, are probably the most priceless of heavy uncommon earths.

Supply: Tanbreez.com

The venture was awarded an exploitation license on August 13, 2020, and is now engaged on the ultimate environmental allow earlier than commencing mining operations in Greenland. Practically 400,000 assays have already been taken from over 400 drill holes. And an SK-1300 is now underway on this 4.7-billion-tonne multi-element asset, which hosts 28.2 million tonnes of whole uncommon earth oxides (TREO).

Tanbreez might unlock REE provide for the Western world.

And the Western world is rising determined. The concern is that Beijing has all of the leverage on this race. China has already halted exports of some REEs, and since China additionally processes its personal REE uncooked supplies, there may be palpable concern that they might minimize off the West completely. That’s what makes this a sport of chips and uncommon earths.

In truth, it was this concern, aired very publicly, that reportedly prompted Donald Trump in 2019 to drift the concept amongst his aides of shopping for Greenland, an autonomous Danish territory, outright. Now, it’s in American fingers, via the conventional channels of company acquisitions.

Tanbreez might maintain the important thing not solely due to its sheer measurement and scale, but in addition as a result of an estimated 27.1% of the asset is believed to be comprised of the rarer and extra priceless “heavy” uncommon earths components (HREE). By comparability, different Western miners of REEs have belongings with 0.03%-16% of HREE, and a bigger proportion of LREEs, gentle uncommon earths components.

LREEs are primarily used within the manufacturing of magnets, that are vital elements of electrical automobile motors, medical gear, wind generators and knowledge storage methods. HREEs, then again, are vital for nationwide protection and important for heavy weaponry, however are additionally utilized in fiber optics, medical gear and hybrid automobiles.

A single DDG-51 Aegis Destroyer, as an example, requires an outstanding 5,200 lbs. of REEs, whereas an F-35 fighter jet requires almost 600 lbs.

Time is now operating out, and Tanbreez might be the very best shot at securing this provide chain for nationwide protection.

Vital Metals Corp (NASDAQ:CRML) has what might form as much as be the most important deposit of HREEs on the planet, and it already has an exploitation allow, with a whole bunch of 1000’s of assays already present process testing. From an infrastructure perspective, Tanbreez can be extremely advantageous, with year-round direct transport entry via deep-water fjords that feed into the North Atlantic ocean.

“The whole lot in your cell phone, every part in automobiles comes from these Uncommon Earth components. Supercomputers sooner or later, quantum computing … The windmills which are up, all of the magnets in there. It is all Uncommon Earths,” Sage informed Oilprice.com in a current interview.

“And one factor we do not like to speak about is all of the missiles which are getting used on the Ukraine battle theater and the Israel-Hamas battle theater in the intervening time. All of them should be replenished by some means, and once more, that is all Uncommon Earths. That is why the West is so involved that China might merely pull the plug,” Sage added.

The Lithium Icing on the Uncommon Earths Cake

CRML’s new operation is Tanbreez, however Lithium was its first success. In truth, the corporate can have the primary totally licensed lithium spodumene mine in Europe.

In Austria, Vital Steel’s (NASDAQ:CRML) Wolfsberg Undertaking is positioned in shut proximity to giant lithium import markets in Europe, akin to Germany, Belgium, France, Italy and Spain, and deliberate battery tasks in Hungary, Germany, Sweden and the UK, CRML’s CEO Tony Sage informed Autofutures earlier in June.

The mine is totally permitted in perpetuity and is positioned to be the subsequent producing lithium mine within the European Union, and the primary to supply battery-grade lithium.

“Substantial exploration and growth work has already been performed by the earlier house owners together with approx. 17,000m of drilling / 1,400m of underground decline, drives and crosscuts. We glance ahead constructing upon this basis and advancing our growth plans for this strategic and key asset for Europe’s EV provide chain,” he added.

The S-Ok 1300 was up to date simply final 12 months, indicating a useful resource of 12.88 million tonnes at 1% Li2O in Zone 1. Vital Metals signed a binding, long-term lithium offtake settlement with BMW Group in December 2022. Wolfsberg is anticipated to be accomplished by 2026, with Vital Metals to provide BMW by 2027. Then, in June this 12 months, BMW made a $15-million pre-payment to CMC, which might be repaid via equal setoffs in opposition to lithium delivered. European Lithium (ASX: EUR) has additionally entered right into a binding settlement to construct the primary regional Lithium Hydroxide Refinery in Saudi Arabia, via a JV with Obeikan Funding Group. CMRL expects to learn from this JV.

The corporate’s first goal–to turn into the primary native, battery-grade lithium provider into an built-in European battery provide chain—was sufficiently big.

Its new aim is to safe one of many largest uncommon earth’s deposits on the planet for nationwide protection, and the outcomes of checks on a whole bunch of 1000’s of assays might become a big response to China within the coming weeks, months, and years.

The markets don’t appear to have realized the total extent of the acquisition and what it means for the West and the corporate itself. That may in all probability change over the approaching months because the story is simply simply making its manner into the mainstream media.

Listed below are another firms within the vital sources house price following:

BHP Group (NYSE:BHP), a worldwide sources large, showcases a diversified portfolio encompassing iron ore, copper, coal, nickel, and power operations. With a considerable presence in Australia and the Americas, BHP’s operational scale is spectacular. The corporate’s dedication to sustainable practices, together with environmental influence discount and neighborhood engagement, additional solidifies its place as a accountable and forward-thinking chief within the world sources sector.

FMC Company (NYSE: FMC) Based mostly in Philadelphia, FMC Company is a worldwide agricultural sciences firm delivering modern expertise to growers worldwide and has a big stake in lithium for rechargeable batteries and different high-tech purposes. The corporate’s agricultural merchandise contribute to elevated crop yield and high quality, addressing world meals safety points. FMC’s dedication to innovation and sustainability has pushed sturdy demand for its crop safety merchandise, supported by greater commodity costs and powerful agricultural market fundamentals.

Lithium Americas (NYSE:LAC) has emerged as a big participant within the lithium market, pushed by the rising demand for lithium-ion batteries in electrical automobiles and renewable power. The corporate’s Thacker Move venture in Nevada holds the potential to be one of many world’s largest lithium sources, positioning Lithium Americas as a significant contributor to the worldwide lithium provide chain. Strategic investments and partnerships with established trade gamers additional improve the corporate’s prospects for development and growth.

Albemarle Company (NYSE:ALB) stands as a worldwide specialty chemical substances chief, distinguished by its place because the world’s largest lithium producer. This prominence within the lithium market aligns with the surging demand for electrical automobile batteries, a key development driver for the corporate. Albemarle’s diversified portfolio, encompassing bromine, catalysts, and prescription drugs, showcases its adaptability and dedication to innovation throughout varied sectors.

Piedmont Lithium Restricted (NASDAQ:PLL) is an Australian mining firm centered on growing lithium sources in the US. Its flagship Piedmont Lithium Undertaking in North Carolina is projected to supply a considerable quantity of lithium hydroxide yearly, catering to the rising demand for lithium-based merchandise. Piedmont Lithium’s strategic partnerships with trade leaders like LG Chem spotlight its dedication to constructing a sturdy provide chain for the burgeoning electrical automobile market.

MP Supplies Corp. (NYSE:MP) holds a singular place as the only real operator of a totally built-in uncommon earth mining and processing facility in the US. The corporate’s deal with producing uncommon earth oxides and metals, vital elements in varied applied sciences, is especially vital given the rising demand for these supplies in rising sectors like renewable power and electronics. MP Supplies’ vertical integration mannequin ensures high quality and consistency in its merchandise, additional strengthening its market place.

Uncommon Component Sources Ltd. (TSX:RES) is devoted to the exploration and growth of uncommon earth components (REEs), essential elements in clear power applied sciences. The corporate’s flagship Bear Lodge venture in Wyoming, acknowledged as one of many world’s largest undeveloped REE deposits, holds immense potential to contribute to the worldwide provide of REEs. REE’s dedication to sustainable and accountable mining practices underscores its dedication to moral useful resource extraction and environmental stewardship.

Avalon Superior Supplies Inc. (TSX:AVL) is a Canadian firm specializing in growing and manufacturing specialty supplies for various industries. With experience in high-purity metals and alloys utilized in electronics, aerospace, and biomedical purposes, Avalon performs a significant function in advancing varied technological fields. The corporate’s deal with growing supplies for power storage options, notably lithium-ion and solid-state batteries, demonstrates its dedication to innovation and addressing the evolving wants of the market.

First Quantum Minerals Ltd. (TSX:FM) is a Canadian mining and metals firm with a various world portfolio. The corporate’s operations span a number of international locations and embody the manufacturing of copper, nickel, gold, and zinc. First Quantum’s dedication to accountable mining practices and neighborhood engagement is clear in its efforts to create financial alternatives and decrease environmental influence within the areas the place it operates.

Allkem Restricted (TSX:AKE), an Australian mining firm, is a big participant within the lithium market. Its various portfolio of lithium tasks in Australia, Argentina, and Canada, together with a considerable presence within the lithium-rich Salar de Atacama, positions it as a significant contributor to the worldwide lithium provide chain. Allkem’s built-in strategy to lithium manufacturing, spanning exploration, manufacturing, and refining, solidifies its function in assembly the rising demand for lithium within the electrical automobile and renewable power sectors.

Teck Sources Restricted (TSX:TECK), a Canadian mining powerhouse, is a number one producer of zinc and copper. Its intensive operations in Canada, the US, Chile, and Peru contribute considerably to the worldwide provide of those important metals. Teck’s zinc manufacturing is especially noteworthy because of its vital function in varied battery applied sciences, aligning with the rising demand for power storage options throughout a number of industries.

By. Tom Kool

Learn this text on OilPrice.com

[ad_2]

Source link