[ad_1]

An equities dealer’s place is taken into account “flat” once they have zero publicity to the market – no internet lengthy nor internet quick the market.

In some platforms, there’s a “flatten” button {that a} dealer can press in a market crash.

This function will attempt to exit their positions for equities merchants till all their positions are closed.

It is a little more difficult for the choices dealer, and there may be possible no flatten button in your specific platform.

So right this moment, we’ll present you the right way to purchase a lengthy put (or a protracted name) to flatten your portfolio delta briefly.

Contents

By getting your portfolio delta to as near zero as doable, we take away the directional publicity. We’re not eliminating the vega (or volatility) publicity.

Nevertheless, directional publicity is a very powerful concern in preserving capital if the market strikes quick in a single path.

For the reason that market strikes sooner happening than up, we’ll begin with an instance portfolio with a optimistic delta and faux that the market is shifting down towards us.

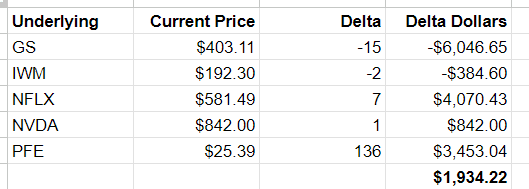

Suppose we’ve got choices positions on these shares:

It doesn’t matter if the place is an iron condor, butterfly, calendar, or diagonal as a result of the Greeks give us all the required data.

To remove directional publicity, we’re solely involved with the positional delta of every place.

Crucial quantity to calculate is the portfolio Delta {Dollars}.

To calculate this quantity, we multiply the place delta by the inventory’s present value.

Combination this for all shares within the portfolio.

Within the above spreadsheet, we calculated the portfolio Delta {Dollars} to be optimistic $1934.

That is equal to an equities dealer being lengthy $1934 price of inventory.

Attempting to get the $1934 Delta Greenback all the way down to zero by promoting or adjusting choice positions is simply too time-consuming when the market is shifting quick.

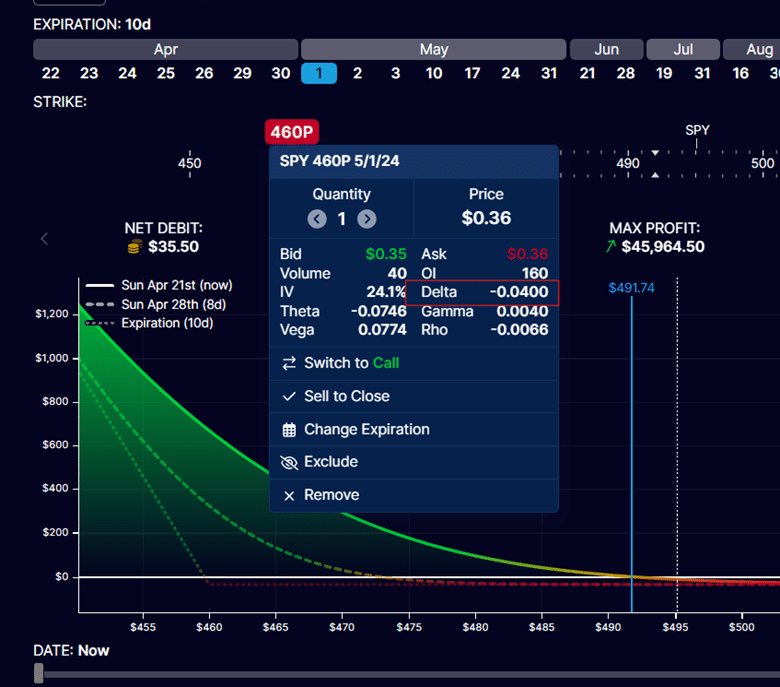

As an alternative, we’ll purchase a put choice in SPY (the S&P 500 ETF).

Suppose that the dimensions of SPY is $495 on the time.

$1934 / $495 = 3.9

We’d like a SPY put choice that has a -4 delta.

Wanting across the choice chain, we discover {that a} put choice with the 435-strike value expiring in 26 days has a couple of -4 delta.

This put choice prices about $60.

Or we are able to purchase a put choice with the 460-strike value, expiring in 10 days, with an identical -4 delta. This selection will price much less at $35.

However it is going to lose its worth sooner.

In any case, this can be a momentary measure whereas the market is dropping.

It provides you time to correctly alter or exit your positions.

Because the market strikes, the delta {dollars} will certainly change, and the put choice could should be exchanged with one other one with totally different deltas.

Obtain the Wheel Technique eBook

If the portfolio Delta {Dollars} is adverse and the market goes up towards us, we have to purchase a name choice.

As a result of the market goes up, we want a bullish name choice.

We’d like one with the correct amount of delta to offset the adverse Delta {Dollars} by performing an identical calculation.

Why can’t we simply have a look at the place delta of every place?

Merely trying on the place delta shouldn’t be adequate. Within the above, we see that PFE has a delta of 136.

One may suppose that that is the place that has probably the most directional publicity.

However that may be incorrect.

The scale of the underlying value is necessary. NFLX, with a delta of seven, has a bigger Delta Greenback than PFE as a result of one share of NFLX is many instances bigger than one share of PFE.

Therefore, we have to have a look at the Delta {Dollars} for the calculation.

Does the variety of contacts matter?

The variety of contracts does matter.

Nevertheless, it’s already accounted for within the place delta.

The place delta of the place already considers the variety of contracts.

A place with double the variety of contracts would present a positional delta twice as giant.

What if we’ve got adverse Delta {Dollars}, and the market is crashing?

If the market goes down whilst you have adverse Delta {Dollars}, the portfolio ought to theoretically acquire worth because the market goes in the identical path because the delta.

Nevertheless, the consequences of vega haven’t been accounted for and could also be affecting the P&L of the place.

In both case, the adverse Delta {Dollars} could change shortly, and you’ll want to recalculate this quantity shortly (in case your platform doesn’t already do it for you).

In some unspecified time in the future, the adverse Delta {Dollars} could even change into optimistic Delta {Dollars}.

Can we use one other underlying to hedge?

It is usually doable to make use of one other underlying, equivalent to IWM, SPX, or RUT, to carry out this delta hedge.

If you happen to discover that you simply want a 100-delta put, don’t purchase an choice that’s so far-off from the cash.

As an alternative, purchase two 50-delta put choices.

If you happen to discover that you simply want 10 SPY put choices, you should buy one SPX put choice as an alternative – roughly talking, you’ll want to do the precise calculations.

How come I don’t discover a 4-delta put choice within the choice chain?

The platform could present the delta on a “per share” foundation.

The deltas we’re utilizing on this article are on a “per contract” foundation, that means they’ve already been multiplied by 100.

What we name a 4-delta put is proven in some platforms as “-0.04.”

Can we use this hedging approach for inventory portfolios?

Sure, one share of inventory is one delta, so when you’ve got 5 shares of NVDA at $842 per share.

Then your Delta {Dollars} is $4210 for that place.

To flatten our portfolio delta, we have to know the Delta {Dollars} of our portfolio.

Take this quantity and divide it by the worth of SPY to find out what delta put or name you’ll want to purchase.

Purchase a put if the market goes down towards our place.

Purchase a name if the market goes up towards our place.

We hope you loved this text on the right way to shortly flatten delta.

When you have any questions, please ship an e-mail or go away a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who aren’t acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link