[ad_1]

Find out how to Enhance ETF Sector Momentum

On this article, we discover the historic efficiency of sector momentum methods and look at how their alpha has diminished over time. By analyzing the underlying causes behind this decline, we establish key components contributing to the underperformance. Most significantly, we introduce an enhanced method to sector momentum, demonstrating how this answer considerably improves the efficiency of an ETF sector momentum technique, making it as soon as once more an efficient instrument for systematic traders.

Introduction

Sector momentum is an funding technique that goals to capitalize on the continued efficiency of particular market sectors by specializing in these with latest robust returns, beneath the belief that this momentum will persist. On this article, we discover sector momentum particularly throughout the context of ETFs. We’ve beforehand examined comparable methods in Sector Momentum – Rotational System and Trade Momentum – Using Trade Bubbles, the place we targeting long-only methods. Whereas the alpha of the sector momentum methods was attention-grabbing prior to now, the excessive correlation between sectors and elevated market effectivity that got here with the introduction of ETFs as funding autos diminished the efficiency of the standard long-short sector momentum. We addressed an identical problem in Robustness Testing of Nation and Asset ETF Momentum Methods. Our aim on this examine is to enhance sector momentum methods, whether or not via long-short or long-only approaches, aiming to reinforce general efficiency regardless of these difficulties. We addressed an identical problem of enhancing momentum methods for commodities in Find out how to Enhance Commodity Momentum Utilizing Intra-Market Correlation article.

On this examine, we utilise a dataset comprising the 9 sectors of the S&P 500 index (ETFs) for all analyses. These sectors embody XLB (supplies), XLE (vitality), XLF (financials), XLI (industrials), XLK (know-how), XLP (client staples), XLU (utilities), XLV (well being care), XLY (client discretionary). All of those ETFs are adjusted for dividends and splits, that means that historic costs have been modified to mirror dividend payouts and inventory splits. This adjustment offers a extra correct illustration of the ETF’s efficiency over time by accounting for complete returns, together with reinvested dividends, and by correcting for worth modifications attributable to splits. Utilizing these adjusted costs is essential for exact historic efficiency evaluation and technique comparability. The information have been sourced from Yahoo Finance and signify the each day adjusted closing costs of the given ETF, masking the interval from December 22, 1998 to September 5, 2024.

Moreover, it’s vital to make clear that on this examine, the notation “S&P 500” refers back to the SPY ETF (SPDR S&P 500 ETF Belief), which can also be adjusted for dividends and splits. This exchange-traded fund replicates the efficiency of the S&P 500 index, whereas the changes account for dividends and shares splits. We use this knowledge as a benchmark for comparability.

In each desk perf stands for yearly efficiency (return), st dev represents yearly normal deviation, max dd means maximal drawdown, Sharpe ratio is calculated as a return to a volatility and Calmar ratio as a unfavorable return to a maximal drawdown.

On this analysis, we calculate the momentum of the ETFs primarily based on the adjusted month-to-month costs of every particular person ETF. For every month, we kind all 9 ETF momentum values from highest to lowest. We then choose an non-compulsory variety of ETFs to go quick (these with lowest momentum worth) and an non-compulsory quantity to go lengthy (these with the best momentum worth).

Step 1 – Benchmark

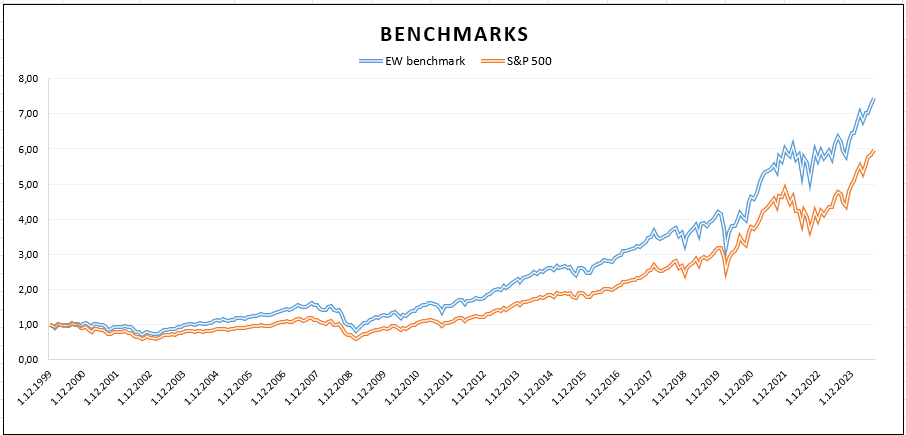

In step one we concentrate on two benchmarks for our analysis for comparability of effectiveness of the next examined methods. For this goal, we created an equally-weighted (EW) benchmark consisting of all 9 ETFs, month-to-month rebalanced, and than we in contrast it to the S&P 500 index.

The graph in Determine 1 clearly demonstrates that the equally weighted (EW) benchmark outperforms the S&P 500 index over the interval from 1999 to 2023. The effectiveness of the EW benchmark is additional supported by the Sharpe ratio and Calmar ratio introduced in Desk 1.

Step 2 – Lengthy/quick momentum technique

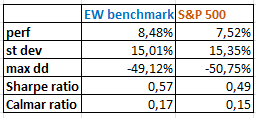

Secondly, we wished to evaluate how efficient lengthy/quick momentum methods may be on S&P 500 sectors. We chosen 3 worst ETFs to go quick and three finest to go lengthy, primarily based on their momentum. For this evaluation, we are going to contemplate a 12-month momentum rating interval and 1-month holding interval.

The three lengthy/3 quick momentum technique has proven poor efficiency, characterised by unfavorable returns and excessive drawdowns, leading to unfavorable ratios values. The curve of the graph reveals an unstable evolution with a declinig tendency, reflecting inefficiency. The one optimistic facet of this technique is the seen optimistic efficiency throughout market disaster, which point out some hedging properties.

Moreover, we steadily adjusted the rating interval, starting from 1 month to 12 months, and assorted the variety of property on lengthy/quick sides (4v4, 3v3, 2v2, 1v1). Sadly, these modifications didn’t yield any useful outcomes.

Step 3 – Separation of the lengthy/quick momentum legs

Subsequent, we determined to separate the lengthy/quick momentum right into a long-only momentum technique and a short-only momentum technique.

Lengthy-only momentum technique

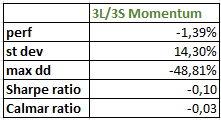

After we centered on long-only technique, we determined to set 12-month rating interval for momentum (and 1-month holding/rebalancing interval), as it’s a extensively used interval in most educational papers. We utilized this rating interval in each technique case, choosing 1 sector with the very best month-to-month momentum (1 Lengthy), 2 sectors with the very best momentum (2 Lengthy), and continued this course of till we chosen 6 sectors with the very best momentum (6 Lengthy).

Contemplating primarily the Sharpe ratio outcomes, long-only momentum technique reveals promising potential, particularly when choosing 4 or extra sectors to go lengthy.

Quick-only momentum technique

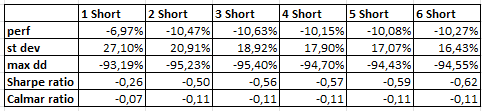

Just like the long-only technique, we additionally set 12-months rating interval and choose 1 (1 Quick), 2 (2 Quick), …, as much as 6 (6 Quick) sectors to go quick, primarily based on the worst month-to-month momentum, after which calculate their efficiency traits.

Primarily based on the efficiency outcomes of every technique, we are able to conclude that the technique involving the 1 worst momentum sector yields the very best outcomes, regardless that they’re nonetheless unfavorable. Nonetheless, the stunning reality is that short-only momentum technique that selects 1 ETF doesn’t have as unfavorable return as different variants, as a result of -7% efficiency is considerably higher than -10% efficiency.

Then, we had a spark of inspiration—what if we used an asymmetrical long-short momentum technique that picks totally different numbers of property within the lengthy leg than within the quick leg? And what if the short-leg (hedging leg) didn’t have the identical weight because the lengthy leg? We don’t must hedge 100% of the lengthy momentum leg by quick momentum leg—it could be sufficient to quick just a bit and improve the efficiency of the general long-short momentum by reducing the beta publicity of the lengthy leg by hedging with (comparatively) low-cost quick leg.

Due to this fact, the conclusion is that the long-only momentum technique is simpler when it consists of 4, 5, or 6 sectors, whereas the short-only momentum technique achieves probably the most appropriate outcomes by using only one sector. Plus, we are going to analyze methods that don’t quick the identical proportion of the portfolio as they go lengthy.

Step 4 – Mixture of the momentum and quick technique

Contemplating the outcomes of the long-only and short-only momentum methods (launched within the Step 3), we determined to mix the long-only technique with a selective hedge, the place the short-strategy just isn’t set with 100% weight, however solely 5% to 30%. Whereas working with this technique, it’s essential to hold the shorting prices in thoughts. We assume they’re roughly on the stage of the 3-month rate of interest.

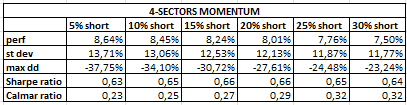

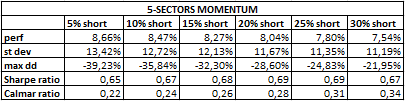

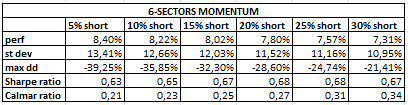

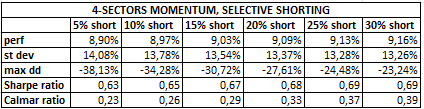

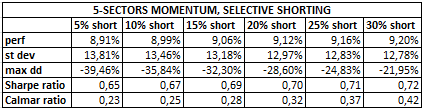

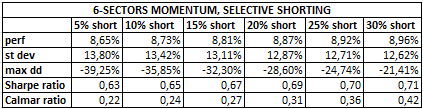

We determined to implement a momentum + quick technique, using 4, 5, or 6 sectors within the lengthy momentum technique whereas shorting 1 sector. For this asset, we initially set a weight of 5%, then elevated it to 10%, adopted by 15%, and continued till we reached 30%. All through this evaluation, we maintained a 12-month rating interval (and 1-month rebalancing interval).

By evaluating the outcomes from Tables 5, 6, and seven with these in Desk 1 introduced in Step 1, we are able to conclude that the momentum + quick methods are simpler than the S&P 500 or equally weighted benchmark. Due to this fact, their utility is useful for traders, particularly the 5-sectors momentum technique.

On this step, we adjusted the shorting facet of the technique, specializing in selective shorting. Sustaining a brief place all through all the funding interval just isn’t mandatory. As a substitute, we aimed to carry the quick place solely when the equally weighted (EW) benchmark (launched in Step 1) was in a unfavorable development – particularly, under the 12-month transferring common.

As within the earlier step, we chosen 4, 5, and 6 sectors with the very best month-to-month momentum for the long-momentum half. For the short-momentum half, we used 1 sector with the worst month-to-month momentum, making use of assorted weight settings from 5% to 30% in 5% increments, however solely when the EW benchmark confirmed a unfavorable development. The 12-month rating interval stays unchanged.

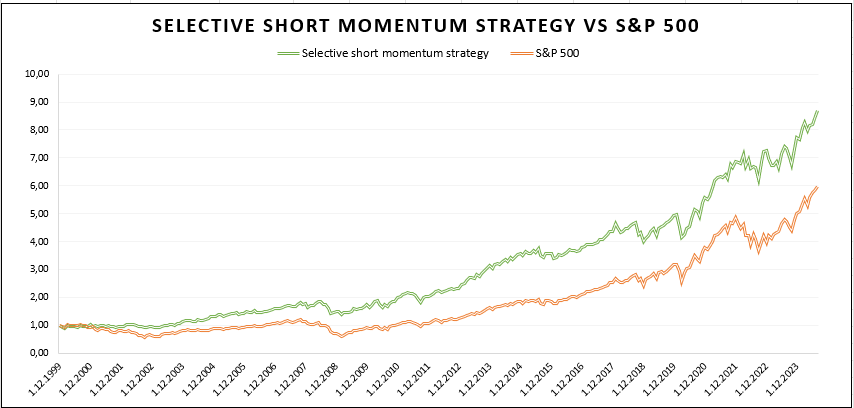

At first look, it’s evident that our long-short momentum technique and the S&P 500 index exhibit very comparable habits available in the market, albeit with totally different progress intensities. Our technique has yielded noticeably greater values, demonstrating an inclination to develop and outperform the benchmark from 2001 till the top of the noticed interval.

Conclusion

The long-short ETF sector momentum technique by itself doesn’t carry out nicely, making its utility unprofitable. Luckily, there are approaches that may improve this technique. Though the separation into lengthy and quick momentum just isn’t very useful independently, the right impartial settings of lengthy and quick legs can yield environment friendly outcomes. We discovered that combining 4, 5, or 6 sectors with the very best month-to-month momentum values for lengthy positions, together with 1 sector with the worst month-to-month momentum worth for brief positions (utilized with a weight not exceeding 30%), considerably will increase the technique’s efficiency. This method may be additional improved by going quick solely when the worth of the EW benchmark is under the 12-month transferring common. With this refined technique, the Sharpe ratio reaches wonderful values starting from 0.60 to 0.72, and it additionally outperforms the S&P 500 index over greater than 20 years, reflecting its effectiveness.

Creator: Sona Beluska, Junior Quant Analyst, Quantpedia

Are you searching for extra methods to examine? Go to our Weblog or Screener.

Do you wish to study extra about Quantpedia Professional service? Test its description, watch movies, assessment reporting capabilities and go to our pricing provide.

Do you wish to know extra about us? Test how Quantpedia works and our mission.

Are you searching for historic knowledge or backtesting platforms? Test our listing of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a pal

[ad_2]

Source link