[ad_1]

Choices are a incredible device for buying and selling and investing.

They provide freedom and adaptability in timing, technique, danger, and profit-taking and have change into probably the most used buying and selling devices within the markets.

One misunderstood idea about choices is how typically they get exercised early.

The reply is much less typically than you’d suppose.

Under, we are going to go over what early train is, what choices it impacts, and the way it might have an effect on you as a dealer.

Contents

Earlier than leaping into the weeds about early expiration, let’s recap some fundamental choices, phrases, and ideas.

First are two sorts of choices contracts: Calls and Places.

Calls are the correct, however not the duty, to buy the underlying on the strike worth by the expiration date.

A put is the correct, however not the duty, to promote the underlying on the strike worth by the expiration.

It also needs to be famous that in case your possibility is $0.01 Within the Cash or extra within the US, it is going to be auto-exercised at expiration.

Subsequent are the 2 several types of choices contracts: American and European.

The variations between these two contract sorts will be difficult.

Nonetheless, for our functions, we will break it right down to American choices, which will be voluntarily exercised at any time as much as expiration, and European choices, which may solely be exercised at expiration.

One extra part of choices that we want to concentrate on is the distinction between when an possibility is exercised vs when it’s assigned.

Exercised – Solely an extended possibility will be exercised, and that is the voluntary alternate by the contract proprietor to pay for the underlying shares on the specified strike. As we examined above, early train is just potential in American-style choices.

Assigned – Solely a short-option contract can get assigned. The contract vendor has no say in whether or not their contract will get assigned to them; it’s strictly on the will of the choice purchaser (the opposite aspect of the commerce); that is the place the danger of early train sits with the choice vendor.

Given what we now find out about Exercised vs Assigned choices, it ought to make sense why Money Secured Places take the whole quantity of the underlying as collateral and why brief calls typically require you to have the 100 shares of inventory as collateral for the commerce (coated name).

Entry The Prime 5 Instruments For Possibility Merchants

Now that all the fundamentals are coated let’s have a look at some examples of choices trades and see if it might make sense to train them early.

Instance 1:

A dealer buys 5 AMD $100 name choices that expire in 90 days, and AMD is at the moment buying and selling at $97/share.

The dealer spends $5/contract on the commerce. Within the subsequent ten buying and selling days, AMD rallies as much as $105/share, making that dealer’s contracts value $11 every.

Would it not make sense for them to train the contracts and take management of the shares?

In the event you mentioned no, you’re appropriate.

If the dealer exercised the contracts, they’d pay $100/share for the inventory, instantly grossing the client a $5/share revenue however netting them $0 after the price of the choice is figured in.

Had been they to promote the choices as a substitute, they’d internet a $6/share revenue and wouldn’t be required to outlay all the capital to purchase the inventory.

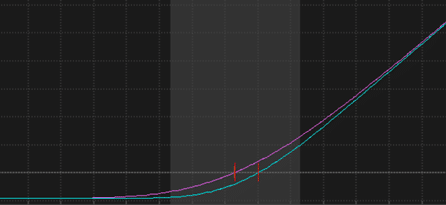

It is because, on high of the $5/share of intrinsic worth the choice has, there may be nonetheless a lot time left that it additionally has $6 of extrinsic worth.

Instance 2:

A dealer buys 1 AMZN $75 name contract that expires in 45 days whereas AMZN trades at $75/share (so they’re on the cash).

The dealer pays $4 for the decision.

Over the subsequent seven buying and selling days, the inventory trades as much as $85/share, and the decision is now at $11. Ought to the dealer train their name?

This time is a bit trickier on condition that it’s considerably extra within the cash, however the reply right here would in all probability not.

If the dealer sells the choice at a revenue, they’d internet $7/contract earlier than charges. In the event that they have been to train the contract after which instantly promote the shares, they’d get $6/share in revenue, $85 promoting worth – $75 price of the shares – $4 price of the choice = $6 internet revenue per share.

Moreover, the dealer must outlay $7,500 in margin or money to buy the share, dramatically decreasing the return on capital.

Obtain the Choices Buying and selling 101 eBook

Given that the majority merchants would slightly shut the choice and notice the bigger share achieve on the choice, what are a couple of causes that an possibility could be exercised early?

First, suppose there’s a particular announcement on the inventory.

In that case, If the corporate broadcasts a particular distribution or dividend with the ex-date earlier than your expiration date, exercising and taking possession of the shares might make sense.

That is very true if you happen to nonetheless preserve your principle that the inventory goes up (assuming it was a name possibility).

You wish to capitalize on each the dividend and the appreciation.

The second cause could be the announcement of a inventory break up that falls inside your holding interval.

Whereas technically, the choices regulate to the brand new share rely, if you’re holding by a break up, it’s typically simpler to train and promote the shares post-split in case your account can deal with that.

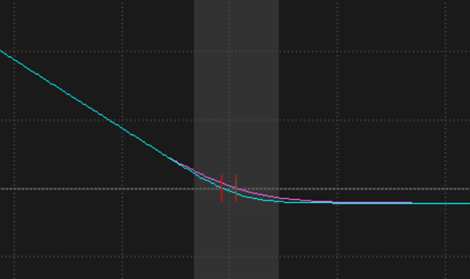

The third and last cause could be {that a} held name is deep in-the-money, and there may be little or no time left till expiration.

This is able to permit the exerciser to forfeit little or no extrinsic worth on the choice and take possession of the shares at a steep low cost.

This, nevertheless, can also be fairly uncommon except the choice holder is a long-term investor or sees plenty of potential upside left on the inventory and doesn’t wish to spend extra capital for an additional deep-in-the-money name.

One other factor to note is that all the above examples have lengthy calls and no places.

The explanation for that is in how the contracts function.

An extended name lets the dealer buy the inventory, whereas an extended put lets the dealer promote it.

That isn’t to say lengthy places can’t be exercised early; it’s simply a way more particular situation that it might occur.

There is just one frequent cause to train a put early: to guard an underlying place.

If you’re lengthy 100 shares of inventory and buy an at-the-money put for cover, typically closing the put for a revenue is sensible if the worth falls.

The exception to this rule is that if the corporate comes out and broadcasts information of both a chapter or another occasion that will materially change the corporate.

If this occurred and the inventory was to plunge with little quick likelihood of rebounding, exercising the put and promoting your shares would make sense.

This is able to will let you exit the place, and the one actual price related to it’s the buy worth of the put.

Many lengthy and brief choices merchants are involved with early expiration when they’re in a commerce, however after taking a look at why a dealer would possibly train early, it might seem like an exceedingly uncommon occasion.

Except a particular announcement is made that the dealer would profit from holding the precise shares or the contracts which might be held are deep within the cash with little time left, promoting to shut the choice typically makes essentially the most sense.

This isn’t to say it isn’t a danger. It’s simply not as massive a danger as many merchants suppose.

We hope you loved this text on choices early train.

You probably have any questions, please ship an e mail or go away a remark under.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who are usually not acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link