[ad_1]

praetorianphoto/E+ through Getty Photos

Over the previous 4 years, important occasions such because the pandemic and ongoing conflicts have made investing appear daunting in a broader context. Lengthy-term investing requires accepting volatility (Properly demonstrated through the occasions of final week) as a part of the method and sticking to systematic approaches (Ex: Greenback Value Averaging)

Nevertheless, downturns can considerably have an effect on long-term funding returns, and it is well-known that the first risk to compounding capital is a drawdown on one’s portfolio.

Beginning Internet Price % Loss Ending Internet Price % Achieve Wanted to revive beginning internet value $100,000 1% $99,000 1.01% $100,000 5% $95,000 5.26% $100,000 10% $90,000 11.11% $100,000 15% $85,000 17.65% $100,000 20% $80,500 24.22% $100,000 25% $75,000 33.33% $100,000 30% $70,250 42.35% $100,000 40% $60,000 66.67% $100,000 50% $50,000 100.00% $100,000 60% $40,000 150.00% $100,000 70% $30,000 233.33% $100,000 80% $20,000 400.00% Click on to enlarge

Whereas huge drawdowns appear unattainable if you’re simply holding the index, it needs to be harassed that the index has turn out to be extraordinarily “top-heavy” and there’s skepticism about how lengthy it could proceed (particularly with the valuations of those mega caps working a lot forward of their earnings). Many indices are nonetheless down from their 2021-2022 highs, and a potential rollover of the mega-caps makes the present market fairly fragile. There are a number of approaches to counter broad market-based dangers.

1. With the risk-free charge at this stage, traders can select to remain in money for a portion of their portfolio. This has the extra good thing about offering dry powder or capital to get again at an opportune time out there.

2. Publicity to Gold usually encounters a decrease drawdown than the general market.

3. Publicity to high quality uncorrelated property.

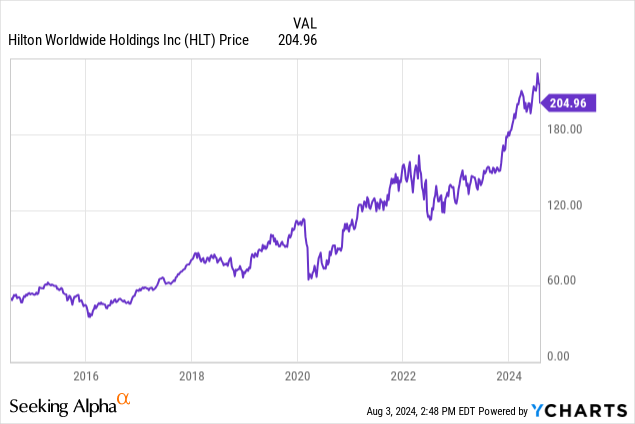

The above approaches are undoubtedly not complete and whereas I make use of the entire above methods in my portfolio, it doesn’t cowl my favourite – Publicity by out-of-the-money put choices which give asymmetrical returns within the occasion of market drawdowns and function an efficient hedge to my lengthy publicity. I imagine Hilton Worldwide Holdings (NYSE:HLT) is one such identify that has introduced itself each as a strategic and a tactical alternative to offer this sort of publicity.

Bearish on Hilton and elements that assist my view

Hilton’s enterprise is extremely uncovered to the economic system

As a distinguished international hospitality firm that operates a various portfolio of lodges and resorts in a number of nations, Hilton has an enormous presence in the USA. It generates income primarily by owned, leased, or managed lodges and charges from franchised properties. As such, the corporate’s efficiency is influenced by shopper discretionary spending, which may be beneath risk by two potential situations.

1. Geopolitical instability that’s current now and has been exhibiting steady indicators of escalation that may have an effect on journey developments.

2. Attainable financial downturn that may considerably cut back each leisure and enterprise journey, resulting in decreased resort bookings and decrease revenues.

So you probably have a bearish view of the economic system going ahead however need to keep invested, its previous efficiency throughout market downturns may make a superb case that it may probably function a hedge.

Quantitatively, after we have a look at its beta (Measure of its volatility or sensitivity to market actions. It quantifies the connection between the inventory’s returns and the returns of the general market. A beta of 1 signifies that the inventory strikes in step with the market, whereas a beta higher than 1 means that the inventory is extra unstable than the market) we see that the 5Y Beta is roughly 1.3 which signifies the inventory is extra prone than the index to market actions. Subsequently, if you’re working a portfolio extremely correlated to the index however have a bearish outlook general, what I’m going to dive into additional on this write-up could be relevant for you.

Hilton’s financials don’t encourage confidence

Hilton Worldwide Holdings has proven robust annual income development lately, significantly in 2021 and 2022, with development charges of 51.72% and 53.65%, respectively. This was, after all, coming off the pandemic, which set a really low bar by way of future development. However the income development in 2023 additionally continued to be sturdy at 16% and up to date quarters have additionally proven power in prime line (Q1 YoY at 12%). Internet revenue has fluctuated in latest quarters, however the general path has been constructive and rising. EPS seems robust, and it is across the highest it is ever been for the inventory, which can also be aided by the truth that the corporate has been aggressively shopping for again its personal inventory. Within the first quarter of 2024 alone, they repurchased 3.4M shares and spent roughly $700M returning capital to shareholders. All of this seems nice on the outset.

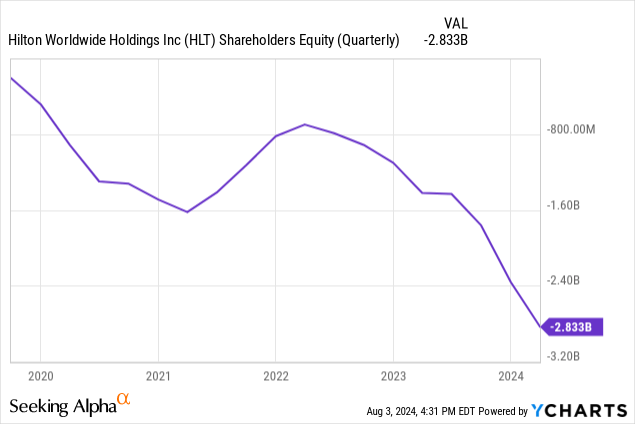

However trying on the stability sheet is a special story. The corporate’s shareholders’ fairness has been detrimental since 2019, and the detrimental fairness has worsened considerably lately.

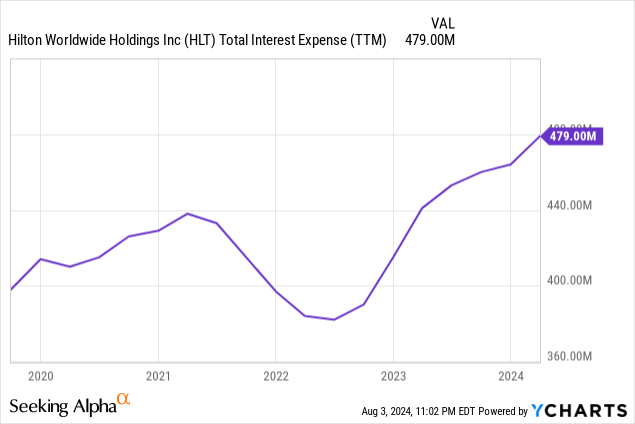

Mainly, what it tells me is that the expansion exhibited by the corporate is coming at the price of its stability sheet, which doesn’t encourage confidence. Curiosity expense has been steadily climbing, and the corporate at present has detrimental working capital, which has resulted in a detrimental working capital turnover ratio.

In its most up-to-date quarter, the corporate issued one other billion {dollars} in debt, with rates of interest starting from 5.8 – 6.1%. I’m not the largest fan of this sort of allocation of capital the place debt is raised to pay dividends and buyback inventory (which props up EPS) however shareholders fairness is repeatedly declining and detrimental! I imagine this solely supplies a sugar excessive and is a traditional case of short-term acquire over long-term sustainability. What would occur if financial situations worsen and revenues and/or earnings do not look nearly as good anymore?

Solely when the tide goes out do you uncover who’s been swimming bare

– Warren Buffett

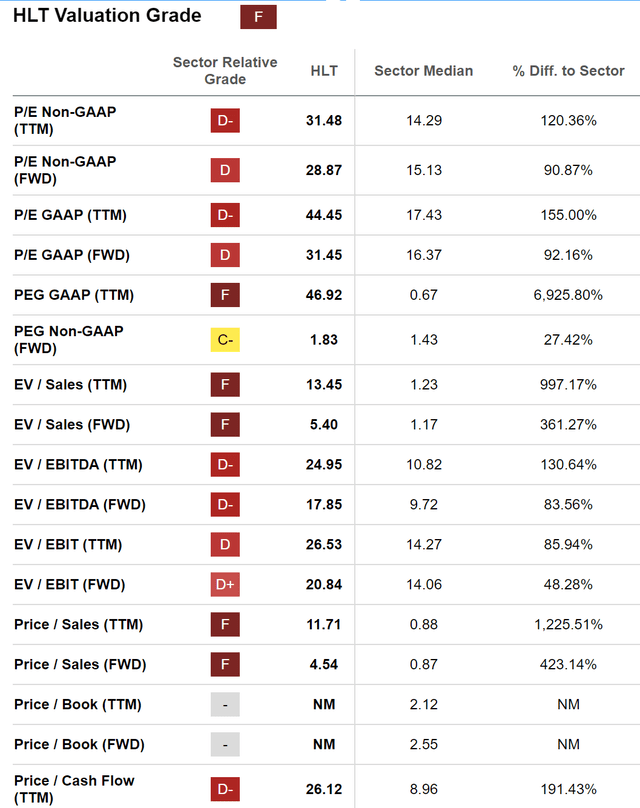

Hilton is overvalued and valuation is overly optimistic for the longer term

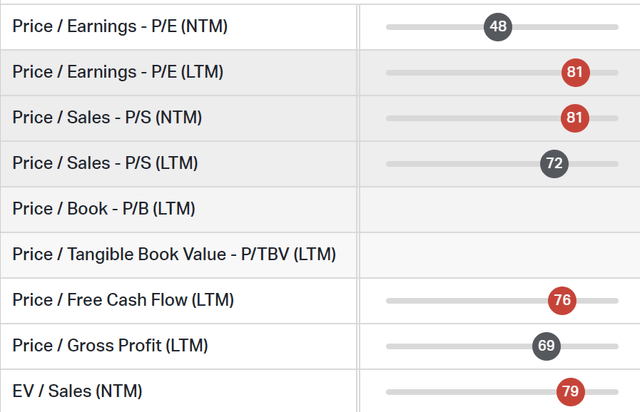

Hilton at present scores a valuation grade F on Searching for Alpha, and its Value to Earnings trades at 44x, greater than double the sector median. The excessive valuation reveals that traders are extremely optimistic concerning the firm’s earnings and development prospects.

Searching for Alpha

Valuation can also be excessive compared traditionally. Percentile rank reveals that PE was decrease than its present ranges greater than 80% of the time (That is, after all, after you account for its excessive valuation through the Covid period. For those who account just for the time when its operations have been extra normalized, percentile rank would shoot even larger)

Valuation Percentile Rank in opposition to 10Y historical past (Koyfin)

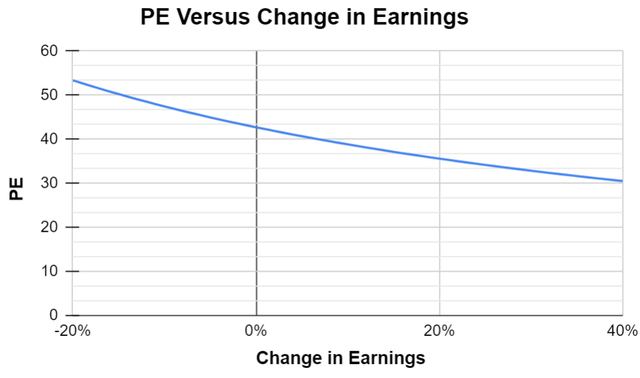

One good rationalization for its valuation could be we’re trailing metrics. Ahead PE drops considerably to round 30 instances earnings, which displays its outlook for the yr. However this doesn’t account for dangers and through unsure environments I all the time attempt to calculate valuation in a spread of situations.

Valuation beneath a spread of earnings (Writer generated)

The bump in earnings certainly makes our Value to Earnings a number of look higher, however any drop in earnings from right here additional inflates our a number of. Within the unlikely however potential situation (worst case) that earnings drop by 20% we see the a number of capturing past 50x. What now we have usually seen within the markets is shares proceed to get priced larger primarily based on ahead a number of or optimism concerning the future and even primarily based on a perceived model, however anytime this isn’t realized the correction is swift and violent. In such a situation, a correction of as much as 50% from present ranges can’t be dominated out.

Hilton’s upcoming Q2 Earnings and earnings season up to now

Administration had laid out nice expectations for 2024 and the subsequent quarter in its Q1 earnings name. Internet revenue is projected to be round $450M million for the quarter and for the total yr, round $1.6B. This interprets near 10% development for the comparable quarter and a 40% development for the yr!

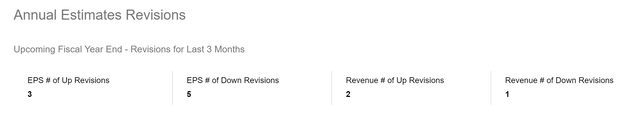

Hilton’s earnings estimates from analysts are exhibiting consensus EPS of $7.1 and revenues of $11.28B. However revisions from the final three months are telling a barely completely different story. The variety of EPS down revisions for the upcoming FY finish is greater than up revisions and there’s additionally a down revision for revenues.

Searching for Alpha

May this counsel that analysts expect an financial downturn to have an effect on a shopper discretionary inventory like Hilton? Latest considerations from Wells Fargo lends some credence to this query.

2Q24 SPX earnings are coming in forward of consensus, however the charge of gross sales beats is disappointing and shopper commentary has been largely detrimental. When large-caps 44% of the S&P 500 names have beat gross sales consensus estimates, which is properly under the standard 60% charge. On the similar time, small-caps, much like large-caps are additionally beating much less often on the highest line.

– Wells Fargo’s Christopher Harvey

Dangers to this Thesis

I’m bearish general and suggest a Promote on the inventory. Moreover, I might be taking a brief place on the inventory by using put choices. So, by nature, it comes with all of the dangers of holding and shopping for an choice (You’ll be able to lose your total funding if it doesn’t pan out inside the time length of the choice). I’m going lengthy on places and with the earnings popping out this week, if efficiency is in line or exceeds expectations, mixed with the inventory reacting positively (and even not reacting a lot in any respect) can severely convey down the worth of the funding. Even with a nasty earnings report, we may see the inventory transfer larger for a number of causes –

Administration commits to an even bigger buyback The economic system could not have a lot affect on Hilton because it caters extra in direction of a better finish shopper and high-end customers are much less affected by recessions. Dangerous quarter however constructive outlook could impress the market.

Nevertheless, since we might be shopping for long-duration, there may nonetheless be a slim probability of this understanding as this inventory has a Beta of 1.3, and important market volatility may gain advantage us (I plan to carry or roll the places relying on market response). If volatility picks up loads earlier than earnings, I could even resolve to trim my place to get my capital again and let the remainder of the place trip for “free”.

Hilton Put Choice Play and Closing ideas

That is considered one of my many different tail danger performs. Whereas this doesn’t present all of the safety I would like for my portfolio, it undoubtedly types part of my general tail danger or drawdown safety technique. My final such protection on Searching for Alpha supplied at the least 10x payoff, and I proceed to have publicity right here. Intel was one other such publicity I had earlier than going into earnings, though I couldn’t cowl it right here on Searching for Alpha.

Whereas shopping for this, just a few issues of be aware –

1. Deep OTM put choices with at the least 3 months to expiry have asymmetry however depend on excessive volatility or important worth correction to offer any actual profit (Payoff is important in case my thesis works out and the worth strikes in my favor or implied volatility resets to a considerably larger worth). I’ve publicity to contracts expiring on Oct 18 and Jan 17 at numerous strike costs ($160, $145, $135). Payoffs fluctuate relying on the premiums paid and the transfer of the inventory. Far OTM places can probably generate 10x – 50x the funding.

2. Adequate Liquidity and quantity to make sure the unfold between bid and ask is affordable

3. This technique or modifications of this technique (Ex: Shorter-dated places resembling Aug 16 or Sep 20 expiry and nearer strike worth) may additionally work for people with important lengthy publicity to Hilton or shopper discretionary sector typically and who need to shield themselves from any short-term draw back.

It needs to be harassed, that the implied volatility is larger than regular as earnings are imminent (Aug 7) and market individuals expect a transfer within the inventory (as much as 10% strikes might be priced-in for earnings). So if the inventory strikes up because of a positive response to earnings, doesn’t react, and even strikes down, the premiums paid to the choices may lose their total worth.

It is a guess on the inventory gapping down considerably put up the earnings announcement OR the inventory transferring down under the strike worth earlier than expiry as a response to the market additionally transferring decrease OR volatility out there cascading to particular person names resembling Hilton within the shopper discretionary sector.

[ad_2]

Source link