[ad_1]

Up to date on June twenty seventh, 2024 by Bob Ciura

Excessive-yield shares with dividend yields above 5% are interesting to revenue buyers. Nonetheless, not all high-dividend shares are created equally.

Some have safe dividend payouts, however others are in questionable monetary situation, leaving shareholders susceptible to a dividend minimize in a downturn.

With this in thoughts, we created an entire record of high-dividend shares.

Common is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

You possibly can obtain your free full record of all excessive dividend shares with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Common Company (UVV) is a Dividend King with a really excessive dividend yield. However the decline of the U.S. cigarette business poses long-term problem. General, Common is a high-risk dividend inventory.

Enterprise Overview

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to shopper product producers.

It was based in 1918 and at present operates in two segments: Tobacco Operations and Ingredient Operations.

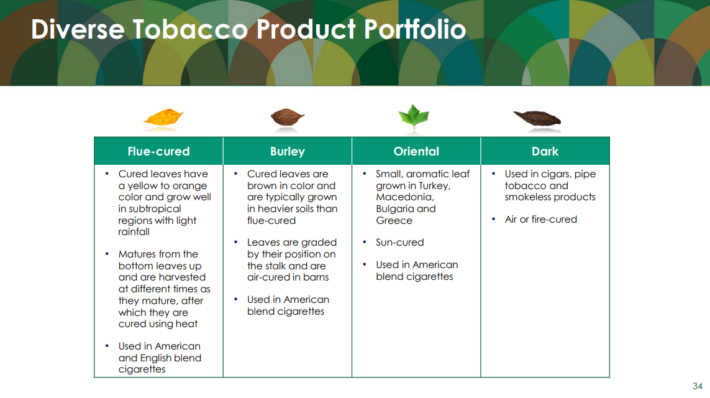

The Tobacco Operations phase buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations. Common has been rising this enterprise by way of acquisitions beginning in 2020.

Common Company reported its fourth-quarter earnings outcomes on the finish of Might. The corporate generated revenues of $770 million in the course of the quarter, which was 11% greater than the revenues that Common Company generated in the course of the earlier yr’s interval.

Revenues had been positively impacted by product combine modifications, and development was weaker than in the course of the earlier quarter. Common’s gross margin was up in comparison with the earlier yr’s interval. This tailwind helped the corporate in rising its earnings meaningfully in comparison with the earlier yr’s interval.

Common’s adjusted earnings-per-share totaled $1.79 in the course of the quarter. The corporate has not supplied steerage for the present fiscal yr, however feedback point out that demand is wholesome.

Progress Prospects

Common’s major enterprise has been declining as a waning business provider for years. Cigarette gross sales declined from a peak of $635.6 billion in 1981 to $270 billion in 2023.

The mix of regulation and well being considerations about most cancers means it’s unlikely the long-term decline will reverse, regardless that the worldwide tobacco market grew in 2023.

Tobacco business development is being pushed by underdeveloped markets, whereas the U.S. tobacco business faces a continued decline.

Moreover, e-cigarettes and smokeless merchandise present extra competitors and are growing gross sales. In flip, they’ve accelerated the long-term decline of cigarette gross sales.

To that finish, Common’s earnings per share had been decrease in 2020 than in 2010.

The corporate is rising by way of acquisitions of fruit and vegetable suppliers. Common acquired FruitSmart and Silva in 2020 and Shank’s Extracts in 2021.

The fruit and vegetable provide companies are just like the leaf tobacco enterprise, however with higher long-term prospects.

Aggressive Benefits

As one of many main gamers in a declining business, Common has little to fret about with new entrants. The corporate’s primary opponents are Pyxus Worldwide and the cigarette producers who can immediately supply leaf tobacco.

Nonetheless, Common has a protracted historical past of established relationships with farmers and cigarette producers, that are troublesome to copy and end in entry obstacles.

Moreover, Common provides worth by checking the standard, mixing, and testing the leaf tobacco earlier than promoting it to prospects. This value-added perform provides to the corporate’s aggressive benefit.

Subsequent, because the business is declining, important capital expenditures aren’t wanted. Because of this, tobacco corporations like Common sometimes generate sturdy free money circulate.

For instance, Common generated $186 million of free money circulate in 2023, and utilized $77 million for dividend funds.

The free money circulate might be even be used for acquisitions to develop the Ingredient Operations phase, and to pay down debt.

Dividend Evaluation

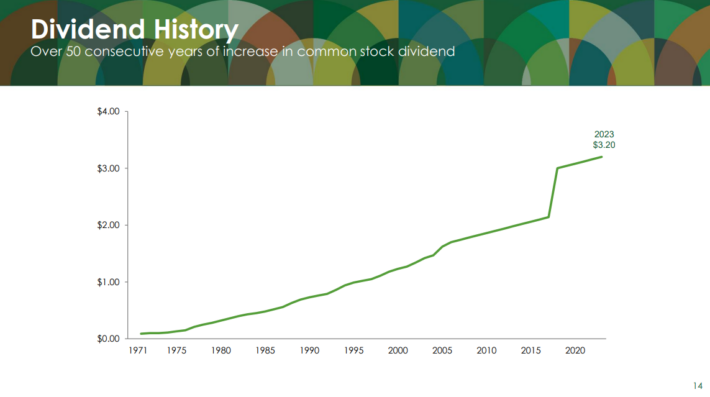

Common has paid an growing dividend for 53 years. This makes UVV one in all solely 53 Dividend Kings.

The ahead dividend fee is $3.24 per share, giving the inventory a excessive ahead dividend yield of ~6.7%. This worth is larger than the 5-year common yield.

Supply: Investor Presentation

The payout ratio is roughly 68% anticipated for 2024. The payout ratio was roughly 50% of internet earnings for the previous decade.

After finishing a strategic overview, Common raised the dividend by 36% in 2019. Since then, the corporate has principally authorized annual dividend will increase within the low single digit proportion vary.

Remaining Ideas

Excessive-dividend shares have prompt enchantment for revenue buyers. However buyers ought to rigorously analyze every firm earlier than shopping for particular person shares, as there could also be warning indicators of potential challenges.

Common’s main problem going ahead is that its business is in secular decline. It’s attempting to develop within the fruit and vegetable market by buying smaller corporations, however the tobacco operations nonetheless account for almost all of revenue.

That stated, the present dividend payout is roofed by earnings and free money circulate. And, Common has elevated its dividend for over 50 years.

Because of this, UVV inventory could possibly be enticing for revenue buyers.

In case you are all in favour of discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link