[ad_1]

Revealed on June seventeenth, 2024 by Josh Arnold

Excessive-yield shares pay out dividends which might be considerably greater than market common dividends. For instance, the S&P 500’s present yield is barely ~1.2%, which is sort of low on an absolute foundation, but additionally on a historic foundation.

Excessive-yield shares may be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

First Interstate Financial institution (FIBK) is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

We have now created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra to assist buyers discover these high-yield shares simply.

You’ll be able to obtain your free full listing of all securities with 5%+ yields (together with necessary monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our listing of excessive dividend shares to evaluation is First Interstate Financial institution (FIBK).

First Interstate Financial institution has a 10-year dividend enhance streak, which actually isn’t among the many longest available in the market. Nevertheless, the inventory is yielding north of seven% as we speak, and barring a giant decline in earnings, we imagine the payout is secure for the foreseeable future.

Enterprise Overview

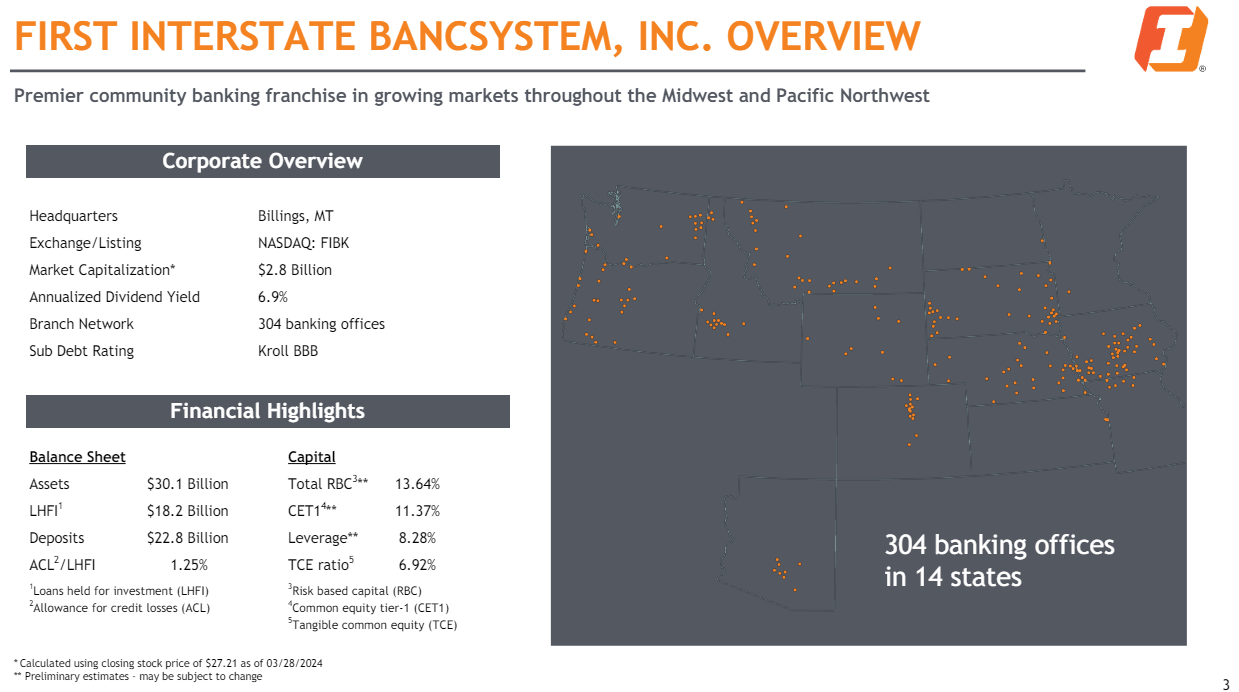

First Interstate BancSystem is a Montana-based financial institution holding firm for First Interstate Financial institution, offering a spread of conventional banking services within the US.

The corporate supplies checking, financial savings, time deposits, actual property loans, shopper loans, bank cards, in addition to an array of business-focused merchandise.

Supply: Investor presentation

The financial institution was based in 1971, and has grown within the 53 years since then to a couple of billion {dollars} in income and a market cap of $2.6 billion.

The corporate reported first quarter earnings which confirmed some weak spot. Income fell almost 6% year-over-year to $242 million, however that was fractionally forward of estimates. Earnings-per-share got here to 57 cents, which was off from 72 cents a yr in the past, however was seven cents higher than estimated.

Credit score high quality improved considerably, as criticized loans declined greater than $58 million from the year-ago interval. Allowances for credit score losses had been 1.25% of common loans excellent, or $228 million. These totals had been nearly flat from a yr in the past.

Deposits ended the quarter at $22.8 billion, down 5.4% from a yr in the past. Internet curiosity margin was 2.91%, down eight foundation factors sequentially and off 42 foundation factors from a yr in the past. We count on the financial institution to earn $2.29 per share this yr after Q1 outcomes.

Progress Prospects

First Interstate has pursued a twin technique of development over time. That is much like how most banks try and take market share and develop over time, with the 2 elements being natural and purchased development.

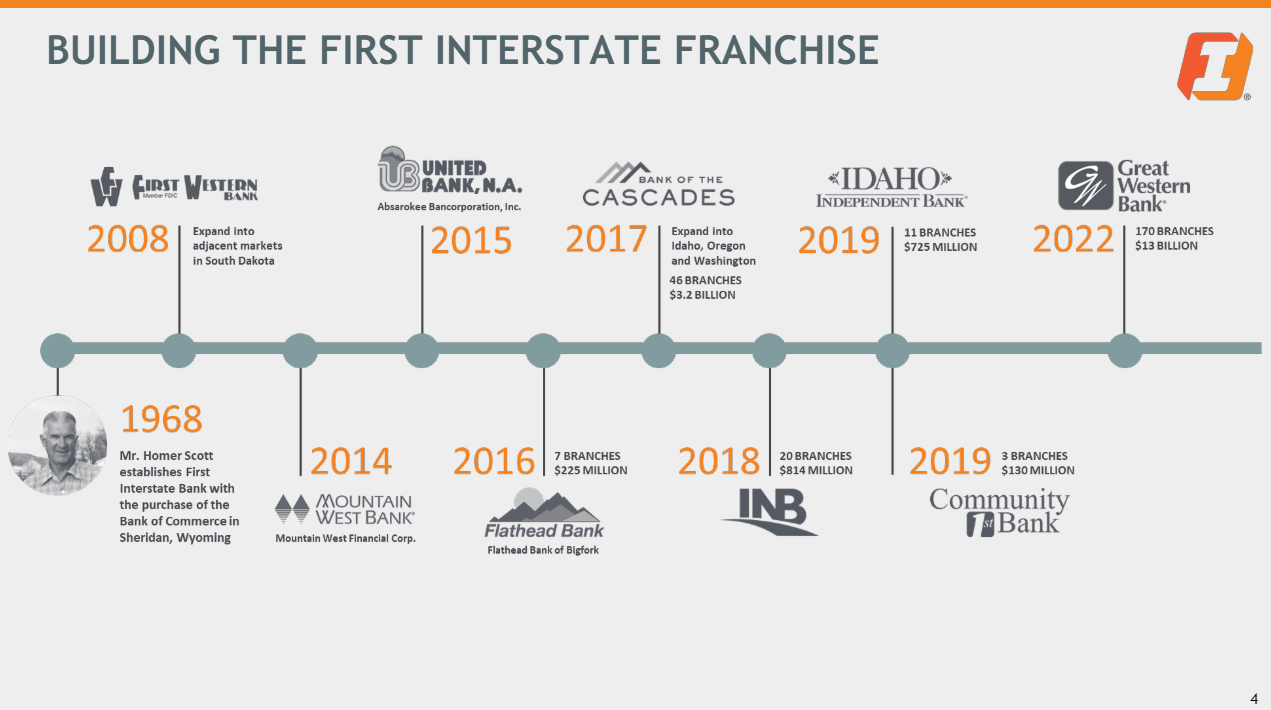

First Interstate has undertaken numerous sizable acquisitions over time, as we will see under.

Supply: Investor presentation

Previously 16 years, First Interstate has pretty aggressively pursued market share positive aspects through buying all or a part of numerous opponents.

That has helped it broaden from Montana into 13 further states and greater than 300 places of work. The financial institution has used acquisitions to enrich its natural development fairly successfully.

Going ahead, we see 2% annual earnings-per-share development, pushed by a mixture of comparatively struggling credit score high quality, web curiosity margin weak spot, and better charges of lending.

We see the trail ahead from 2024 earnings as murky, and are subsequently cautious on the financial institution’s means to develop rapidly.

Aggressive Benefits & Recession Efficiency

Like some other financial institution, aggressive benefits are onerous to return by for First Interstate. Primarily all banks provide the identical lineup of services, which means pricing energy is extraordinarily restricted.

Smaller regional banks like First Interstate subsequently attempt to acquire scale benefits by making acquisitions. Nevertheless, we be aware this doesn’t represent a market benefit when it comes to competitiveness.

One other attribute of banks is that they are typically fairly vulnerable to recessions, and First Interstate’s efficiency in the course of the Nice Recession exhibits it’s no exception.

The corporate noticed a giant earnings draw-down in the course of the earlier main financial downturn, the Nice Recession of 2008-2009:

2008 earnings-per-share: $1.77

2009 earnings-per-share: $1.44

2010 earnings-per-share: $0.84

With this in thoughts, we warning buyers to observe the financial institution’s efficiency ought to a downturn come up, as a result of it’s fairly possible we’d see earnings decline, and doubtlessly fairly meaningfully.

Dividend Evaluation

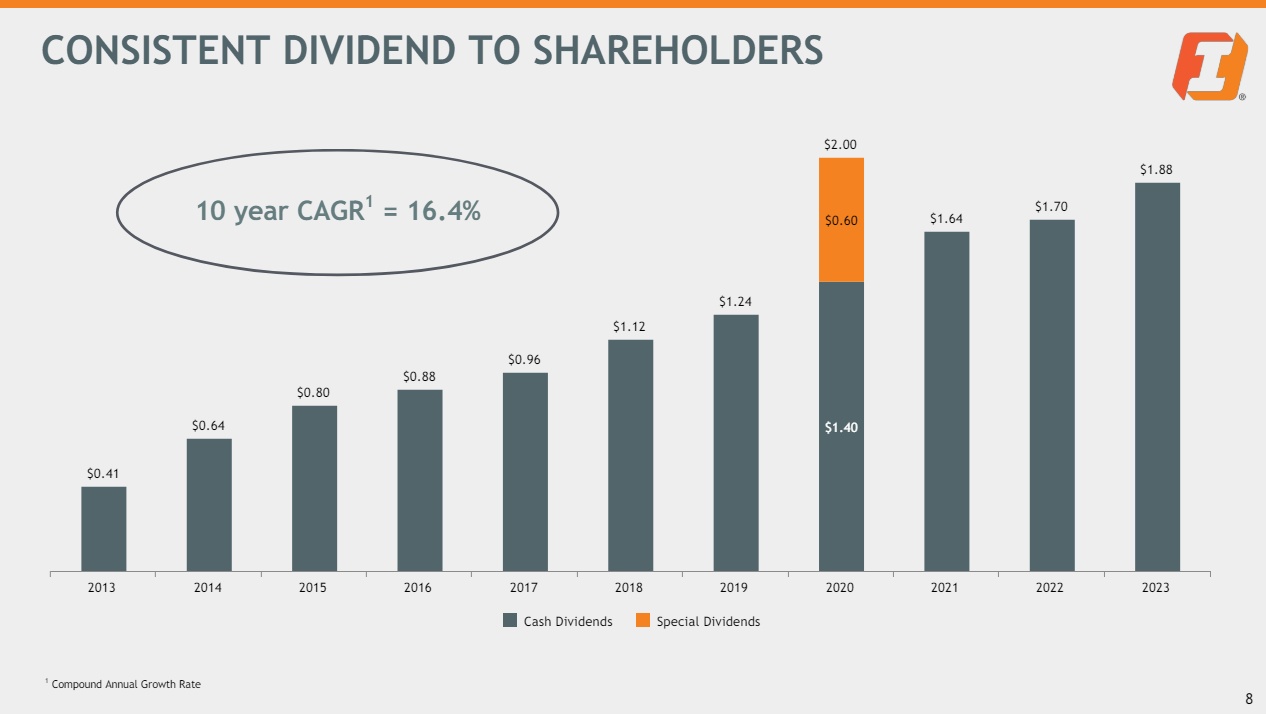

First Interstate’s present annual dividend is $1.88, which is similar dividend that’s been paid for the previous seven quarters. First Interstate’s dividend enhance historical past has been considerably spotty given its lumpy earnings, and recession susceptibility.

We imagine that’s more likely to proceed give the payout ratio for this yr is 82% of earnings. That top degree means there may be not solely little room for will increase, however little room for earnings declines earlier than the payout could be at potential threat.

On the plus facet, the yield is an eye-popping 7.5%, greater than six instances that of the S&P 500. On that measure, it’s an excellent earnings inventory.

Supply: Investor presentation

Administration touts a 10-year compound common development charge of greater than 16% for the dividend, however we see nothing of the type going ahead. We’re estimating no dividend development for the foreseeable future, given the earnings scenario.

Total, the yield is extraordinarily enticing, however we see it as a possible warning signal from the market {that a} lower could also be vital.

Last Ideas

We see First Interstate as a inventory with a particularly enticing yield, but additionally one that’s seeing a good quantity of basic weak spot.

The truth that the yield is so excessive is the results of a low share value, which itself is derived from a comparatively weak earnings outlook.

With the sky-high yield, we expect the market could also be warning buyers that the present dividend of $1.88 per share could also be robust to keep up.

For now, so long as the dividend stays intact, it’s a terrific earnings inventory, however we do warning buyers that latest earnings studies have actually present some weak spot.

In case you are taken with discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link