[ad_1]

Up to date on Could thirty first, 2024 by Bob Ciura

Excessive-yield shares pay out dividends which are considerably greater than market common dividends. For instance, the S&P 500’s present yield is just ~1.4%.

Excessive-yield shares will be very useful to shore up earnings after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Altria is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

We now have created a spreadsheet of shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with essential monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our checklist of excessive dividend shares to assessment is Altria Group (MO).

Altria has a 54-year dividend improve streak, which qualifies it as a Dividend King. A big a part of why Altria has been in a position to elevate the dividend for therefore lengthy is due to its a number of aggressive benefits.

Enterprise Overview

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra underneath quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

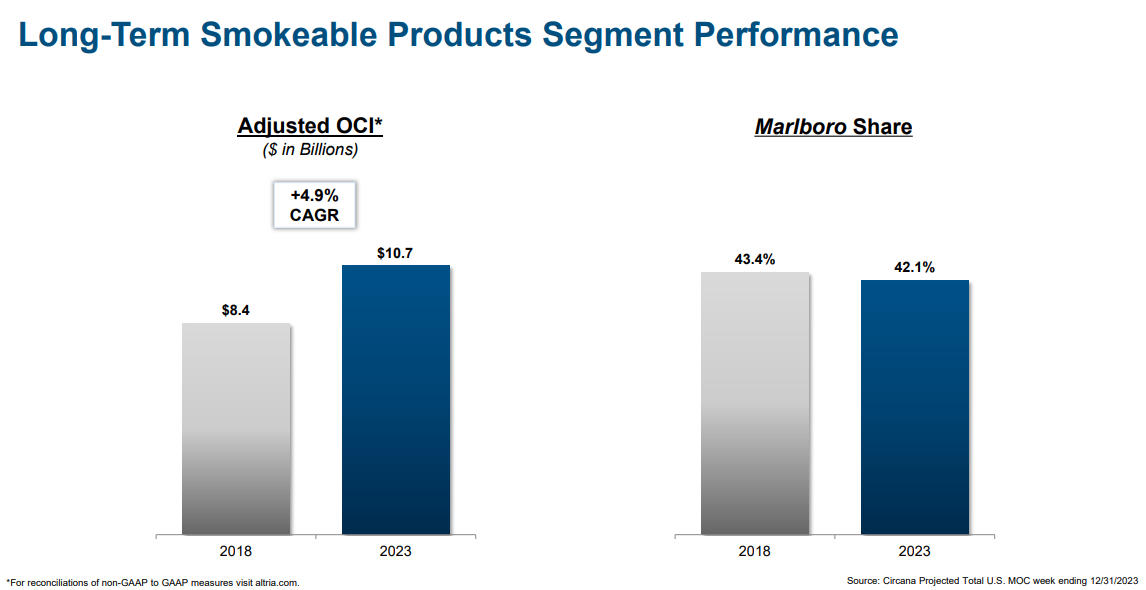

The vast majority of Altria’s income and revenue remains to be made up of smokeable tobacco merchandise. The Marlboro model nonetheless enjoys the main market share within the U.S. market.

Supply: Investor Presentation

Over many many years, this has served the corporate (and its shareholders) very properly. Whereas excessive dividend yields are frequent with tobacco shares, no different firm within the {industry} has a dividend improve streak so long as Altria’s.

Within the 2024 first quarter, Altria’s internet income of $5.576 billion declined 2.5% from the primary quarter of 2023, with income internet of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a lower of two.5% in comparison with the identical interval final yr.

Progress Prospects

Altria’s future development faces an unsure future as a result of altering client habits.

As a serious tobacco firm, Altria has to face the fact of declining smoking charges in the US. Annually, there are fewer cigarette people who smoke within the U.S. Because of this, there are fewer prospects for tobacco corporations like Altria.

The whole {industry} decline was estimated at 8% in 2023. Altria’s declines mirror the industry-wide challenges.

Historically, tobacco producers have compensated for falling smoking volumes with value will increase. Up to now, this has labored to offset misplaced income. Altria will proceed to boost costs within the years to return.

However nonetheless, tobacco corporations should adapt to the brand new setting, and Altria is making ready for a post-cigarette world by investing within the improvement of smoke-free merchandise.

Supply: Investor Presentation

Altria has invested closely in non-combustible merchandise, comparable to its $13 billion funding in e-cigarette chief JUUL and its $1.8 billion funding in Cronos. E-vapor and hashish could possibly be two main long-term development catalysts going ahead.

Altria has additionally acquired Swiss firm Burger Söhne Group, to commercialize it’s on! oral nicotine pouches. Oral tobacco is a development space for Altria, as customers who’ve give up smoking more and more shift to oral tobacco merchandise.

The corporate may even be capable of generate earnings-per-share development by way of value reductions and share repurchases. Altria utilized $1 billion for share repurchases in 2023, and $1.8 billion in 2022.

In all, we count on ~2.4% compound annual development for Altria’s earnings-per-share over the following 5 years.

Aggressive Benefits & Recession Efficiency

Altria advantages from a large number of aggressive benefits, which have allowed the corporate to generate regular development over many years. First off, Altria has large model loyalty.

Retail market share for the flagship Marlboro cigarette model has remained at over 40% for a few years. This permits the corporate to boost costs yearly and nonetheless hold its buyer base intact.

Additionally, tobacco producers function an advantageous enterprise mannequin which doesn’t require intensive capital expenditures. Tobacco isn’t a capital-intensive enterprise, due to economies of scale in manufacturing and distribution. That is why Altria generates robust free money circulation annually, whilst income has stagnated from falling smoking charges.

Such robust free money circulation leaves a substantial amount of money accessible for shareholder returns, debt compensation, and funding in future development initiatives.

One other good thing about Altria’s enterprise mannequin is that it’s extremely proof against recessions. Cigarettes and alcohol gross sales maintain up very properly throughout recessions, which retains Altria’s profitability and dividend development intact.

The corporate carried out strongly throughout the earlier main financial downturn, the Nice Recession of 2008-2009:

2008 earnings-per-share: $1.66

2009 earnings-per-share: $1.76

2010 earnings-per-share: $1.87

Altria grew its adjusted earnings-per-share in annually of the Nice Recession. This demonstrates the corporate’s capacity to supply regular earnings development, even when the broader financial setting turns into more difficult.

Earnings-per-share additionally grew throughout the pandemic, which is simply one other instance showcasing the resilience of Altria’s enterprise underneath numerous robust financial environments and unsure buying and selling circumstances.

Given Altria’s publicity to recession-resistant merchandise, it ought to maintain up very properly throughout the subsequent downturn.

Dividend Evaluation

Altria’s present annual dividend is $3.92 per share. With the corporate shares at the moment priced at $46, Altria has a excessive yield of 8.5%.

Given Altria’s outlook for 2024, diluted EPS is predicted to be $5.06. Because of this, the corporate is predicted to pay out roughly 78% of its EPS to shareholders within the type of dividends.

Because the firm has robust adjusted working corporations earnings (OCI) margins, low CAPEX, little competitors, and a really vast moat, it will probably afford to pay out a big portion of earnings safely. For its half, Altria has a goal payout ratio of about 80%.

Altria is a Dividend King, which is an elite group of shares which have every raised their dividend for 50 consecutive years or extra. This exhibits Altria’s dependability as a dividend development inventory.

The dividend seems to be sustainable, and we estimate the corporate will proceed to develop the dividend at an annual development charge of about 2% over the medium time period.

The 8.5% dividend yield could be very enticing for buyers who focus totally on earnings.

Remaining Ideas

Altria has elevated its dividend annually for over 5 many years, a extremely spectacular observe file. It now faces uncertainty because of the continued decline in smoking charges, nevertheless it has made investments to cope with the altering client panorama by increasing into new merchandise comparable to heated tobacco, e-vapor, and hashish.

The corporate will probably be counting on these segments to gasoline continued development within the years to return. Subsequently, the inventory appears very enticing for earnings buyers.

In case you are excited by discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.

[ad_2]

Source link