[ad_1]

Our purpose with The Each day Temporary is to simplify the largest tales within the Indian markets and provide help to perceive what they imply. We received’t simply inform you what occurred, however why and the way too. We do that present in each codecs: video and audio. This piece curates the tales that we discuss.

You’ll be able to take heed to the podcast on Spotify, Apple Podcasts or wherever you get your podcasts and video on YouTube.

Right now on The Each day Temporary:

No subsidy for EVs?

SEBI tells RBI to do the mathematics proper for family financial savings!

Metal market is chaotic!

Let’s speak in regards to the electrical car (EV) market in India as a result of there are some thrilling developments, but in addition a little bit of combined messaging from the federal government.

To offer you some background, India launched the Sooner Adoption and Manufacturing of Hybrid and Electrical Autos (FAME) scheme again in 2015, with a price range of Rs 895 crores. The purpose? To encourage the adoption and manufacturing of electrical automobiles within the nation.

Then got here FAME II in 2019, with a a lot larger price range of Rs 10,000 crores. It aimed to spice up gross sales of about 15 lakh electrical two-wheelers, three-wheelers, automobiles, and buses. Now that FAME II is nearing its finish, the federal government launched a brief scheme known as the Electrical Mobility Promotion Scheme (EMPS), which is about to run out on September thirtieth.

Let’s take a look at the numbers.

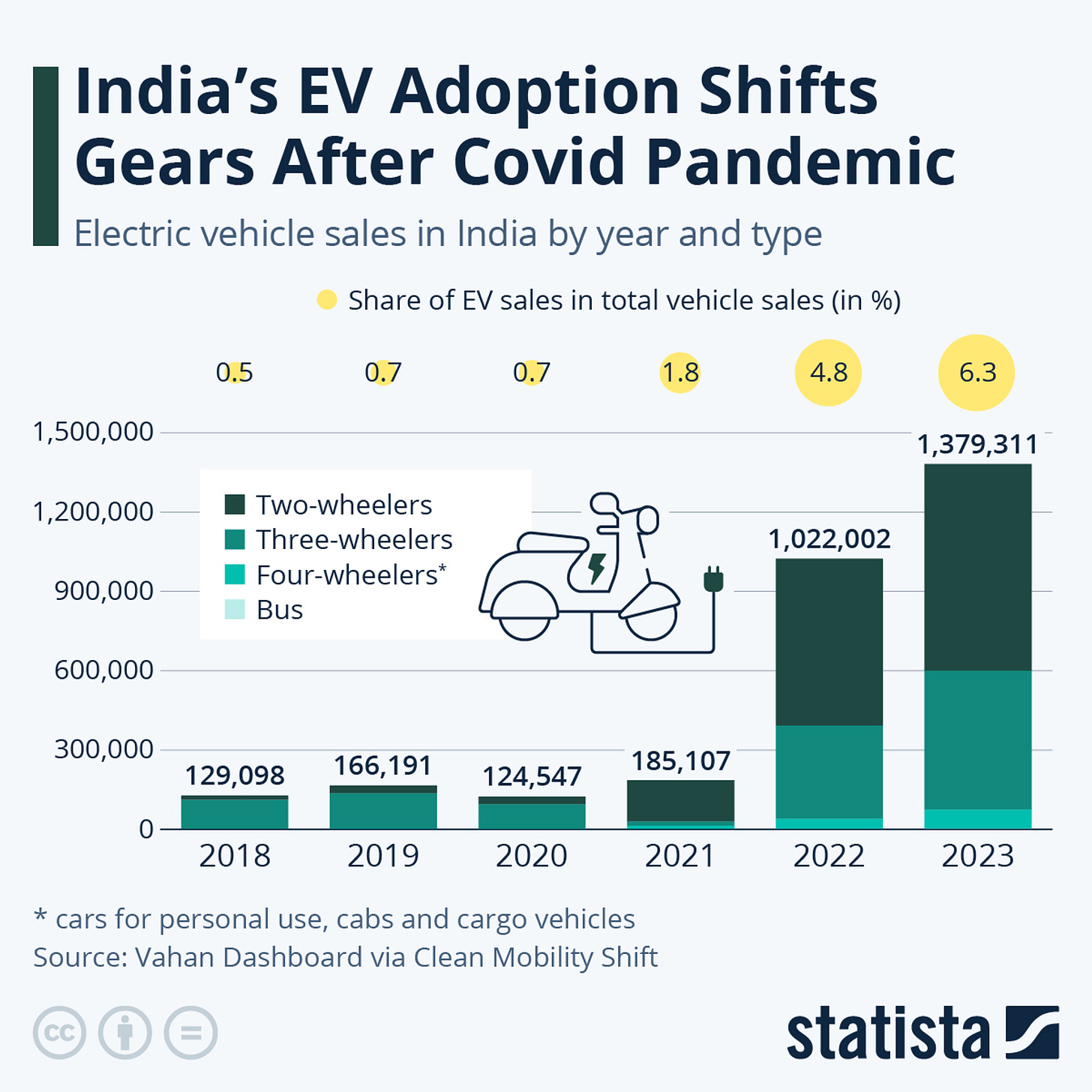

EV adoption in India is rising however nonetheless within the single digits, accounting for about 2% of whole car gross sales. It’s an honest begin, however there’s loads of room to develop.

In 2023, electrical automobile registrations jumped 70% in comparison with the earlier yr, whereas total automobile gross sales grew by lower than 10%. This exhibits that EV progress is selecting up because the market matures.

What’s additionally fascinating is how gasoline preferences are altering. Based on CareEdge Scores, the share of petrol automobiles in whole gross sales dropped from 86% in 2020 to 76% in 2023.

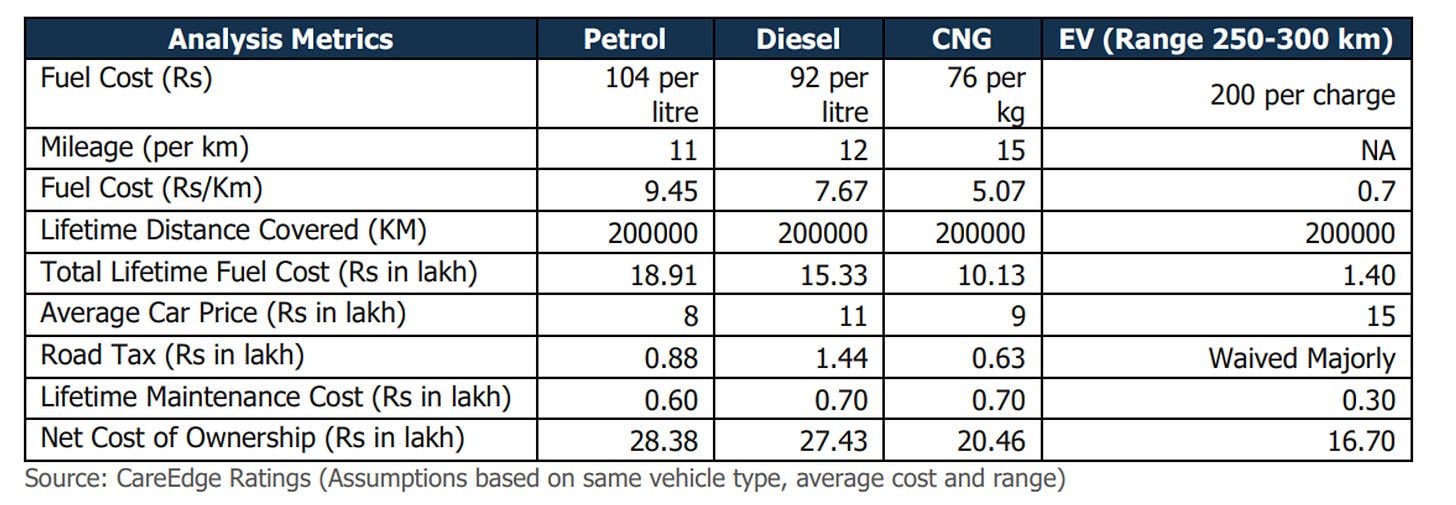

One of many greatest causes persons are switching to EVs is the general price financial savings. CareEdge’s evaluation exhibits that, over a car’s lifetime, EVs are the most affordable to personal, adopted by CNG automobiles. This consists of not simply the acquisition worth, but in addition gasoline, upkeep, and authorities incentives.

Supply: CareEdge

For instance, they estimate that proudly owning a petroleum automobile prices round Rs 28.38 lakh over its lifetime, whereas an equal EV would price simply Rs 16.70 lakh. That’s an enormous distinction!

However right here’s the place issues get a bit complicated. Two senior authorities officers appear to have totally different views about the way forward for EV subsidies.

On one facet, now we have Union Heavy Industries Minister H.D. Kumaraswamy saying that FAME III is on the way in which. He lately talked about that the federal government might finalize the third section of the FAME scheme within the subsequent month or two. An inter-ministerial group is outwardly engaged on it, addressing points from the sooner phases.

On the opposite facet, now we have Union Highway Transport Minister Nitin Gadkari, who means that EV subsidies is likely to be coming to an finish. He believes that with rising demand and manufacturing, prices are dropping, which might scale back the necessity for presidency help.

Gadkari additionally highlighted that the GST on electrical automobiles is simply 5%, in comparison with 48% for petrol and diesel automobiles, which he sees as a serious benefit for EVs.

So, what’s happening?

It looks like there’s an ongoing debate about the way forward for India’s EV coverage. Whereas Kumaraswamy’s feedback counsel that authorities help continues to be wanted, Gadkari believes the trade is able to stand by itself.

This uncertainty is inflicting some fear within the EV trade, particularly with the festive season across the nook. October is a big month for car gross sales in India, with Navratri and Diwali each happening. EV producers are involved that if EMPS ends and FAME III isn’t prepared, there is likely to be a niche in subsidies.

Some trade gamers are calling for both an extension of EMPS or a fast rollout of FAME III to maintain the momentum going. A sudden cease in incentives might decelerate gross sales, particularly throughout this key gross sales interval.

Nevertheless, Gadkari stays optimistic. He’s assured that India can develop into a world hub for EV manufacturing, with help from initiatives just like the Manufacturing Linked Incentive (PLI) scheme, which goals to spice up native manufacturing.

Briefly, the Indian EV market is at a crucial level. The federal government’s subsequent transfer can be essential in shaping the trade’s future. Will subsidies proceed with FAME III, or will Gadkari’s imaginative and prescient of a self-sufficient trade take over?

Gadkari additionally emphasised the potential of other fuels like CNG, LNG, ethanol, methanol, and inexperienced hydrogen. He careworn the necessity to reduce prices whereas sustaining high quality to make Indian EVs aggressive on the worldwide stage.

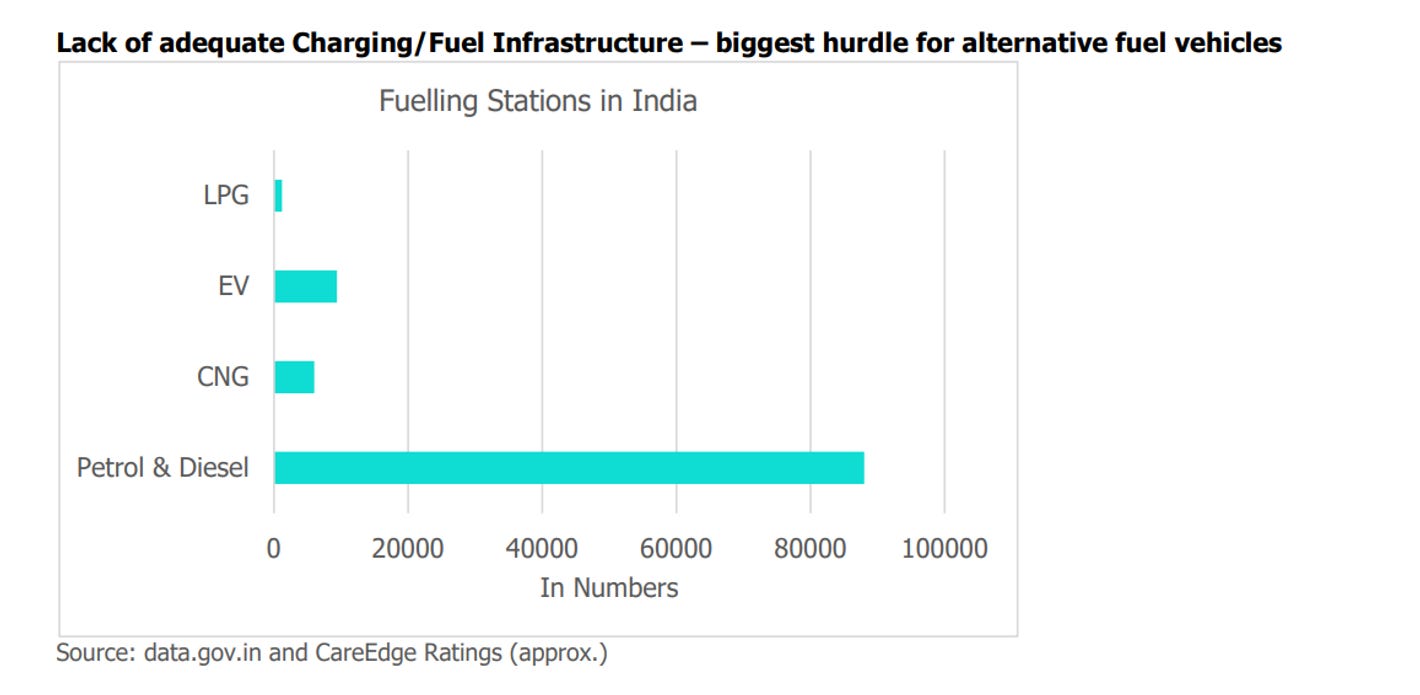

One other massive hurdle for EV adoption is the shortage of charging stations. Gadkari believes market forces will drive the event of charging infrastructure, saying there are many alternatives for individuals to make the most of.

Supply: CareEdge

One factor’s for certain: with the worldwide shift towards cleaner transportation and India’s bold local weather objectives, the EV sector will stay one to look at. The federal government’s choice on subsidies might have a huge impact on the complete auto trade. So, we’ll be maintaining a tally of what occurs subsequent!

A few days in the past, we talked about how Indians are spending much less. A lot of you requested how that is measured, and fortunate for you, SEBI simply printed a brand new analysis paper on the subject. So, we thought it will be an ideal concept to elucidate how Indian family financial savings are literally calculated.

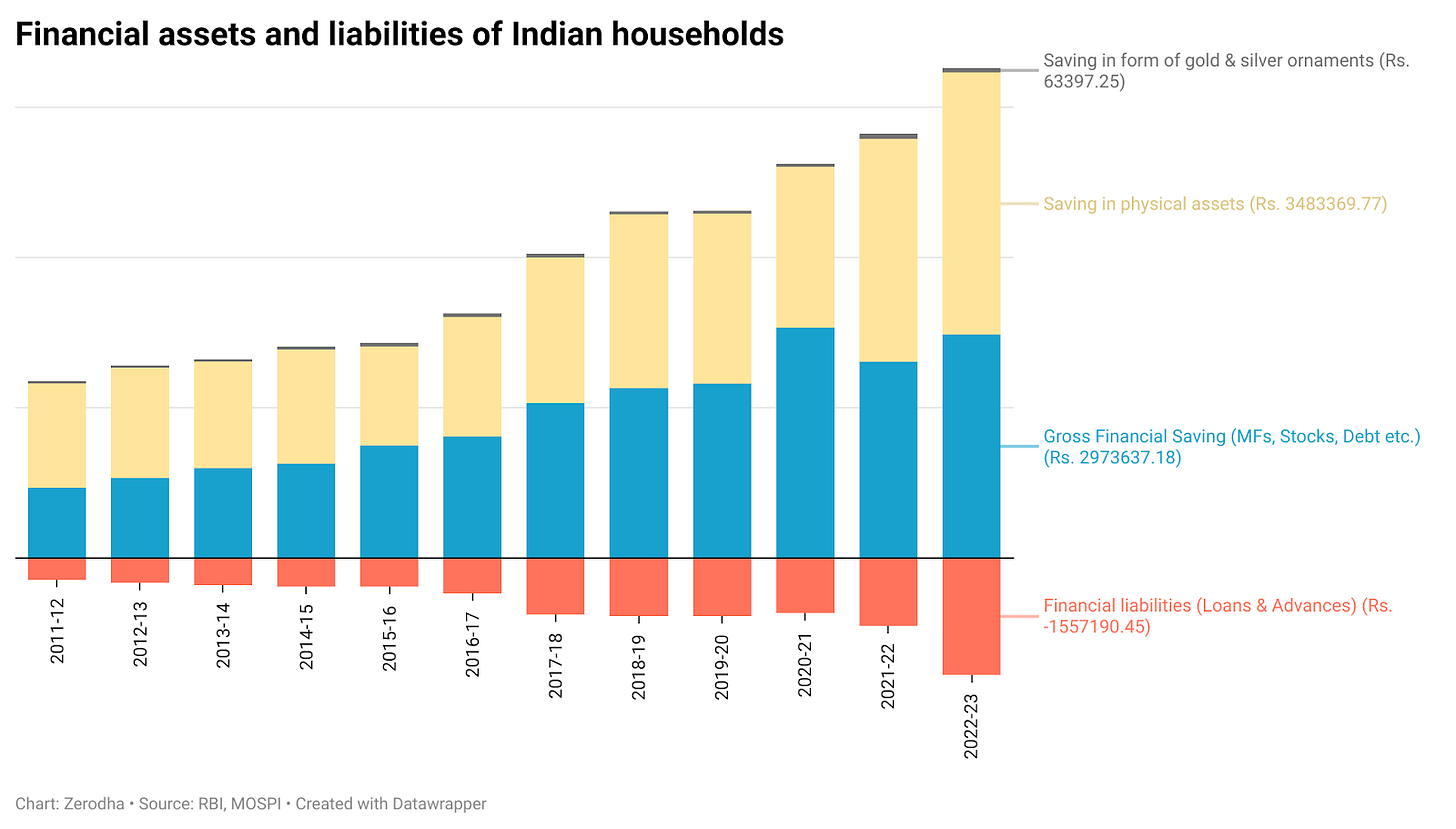

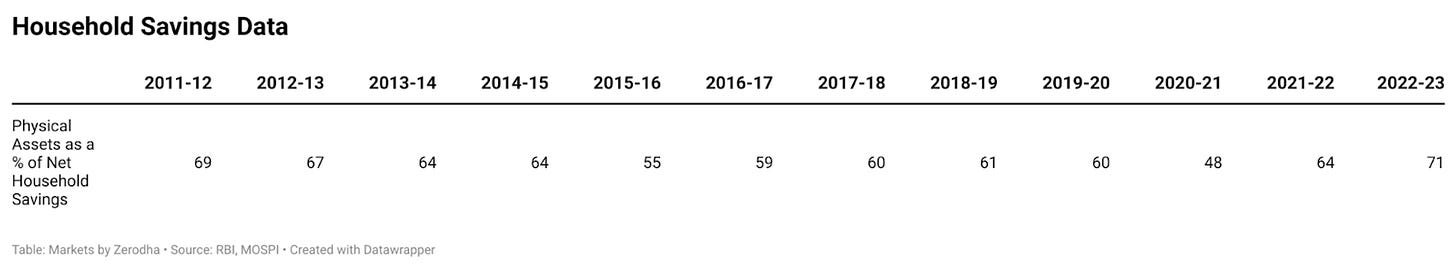

The formulation for Family Financial savings is fairly easy: Family Financial savings = Gross Monetary Financial savings – Monetary Liabilities + Bodily Financial savings.

Gross Monetary Financial savings consists of issues like deposits, investments in mutual funds, shares, bonds, and different monetary merchandise.

Bodily Financial savings refers to investments in bodily belongings like actual property or gold.

Monetary Liabilities are family debt, like loans or advances.

These numbers matter as a result of they inform us how a lot financial savings can be found within the nation. Companies can faucet into these financial savings to develop, and the federal government can borrow from this pool for improvement initiatives.

Each the RBI and the Ministry of Statistics and Programme Implementation (MoSPI) recurrently publish information on family financial savings and investments. Allow us to offer you an concept of what the numbers seemed like for India in FY23:

Gross Family Financial savings doubled from ₹23.55 lakh crore in FY12 to ₹65.2 lakh crore in FY23. That’s an annual progress charge of 9.72% over the past decade.

Bodily belongings, like actual property and gold, make up over 70% of whole family financial savings.

Web monetary financial savings (financial savings minus debt) dropped by 40% between FY21 and FY23.

One fascinating development is that increasingly more of those financial savings are being invested within the inventory market. That’s a great factor as a result of it means persons are shifting away from conventional choices like financial savings accounts, fastened deposits, and gold, and are selecting market-linked investments as a substitute.

However SEBI isn’t too pleased with how the RBI and MoSPI calculate whole family financial savings. Final week, they launched a working paper suggesting a brand new, extra detailed method to measure family financial savings. SEBI raised three predominant points with the present methodology:

The RBI’s present methodology solely seems to be at sure teams, like retail traders and high-net-worth people (HNIs). SEBI suggests together with all particular person traders, in addition to non-profits like NGOs, that are at present ignored.

The present methodology solely tracks a restricted vary of monetary merchandise, like equities and mutual funds, and sometimes focuses on simply the first market (IPOs of shares and bonds). SEBI desires to incorporate secondary market transactions and newer devices like REITs, InvITs, and ETFs for a extra correct image.

Vital financial savings information, like investments in different funding funds (AIFs), non-public placements, and different newer monetary merchandise, aren’t being captured. SEBI thinks these must be included to higher mirror family financial savings.

Due to these gaps, family investments within the inventory market have been undercounted, and SEBI desires to vary that. Based on SEBI’s calculations, Indians are saving greater than we beforehand thought.

Additionally, the present RBI information exhibits that bodily financial savings made up greater than 71% of family financial savings in FY23, the best it’s been since 1970. However primarily based on SEBI’s new calculations, Indian households would possibly truly be much less depending on bodily belongings and extra invested in monetary belongings than we realized. So yeah, that is excellent news.

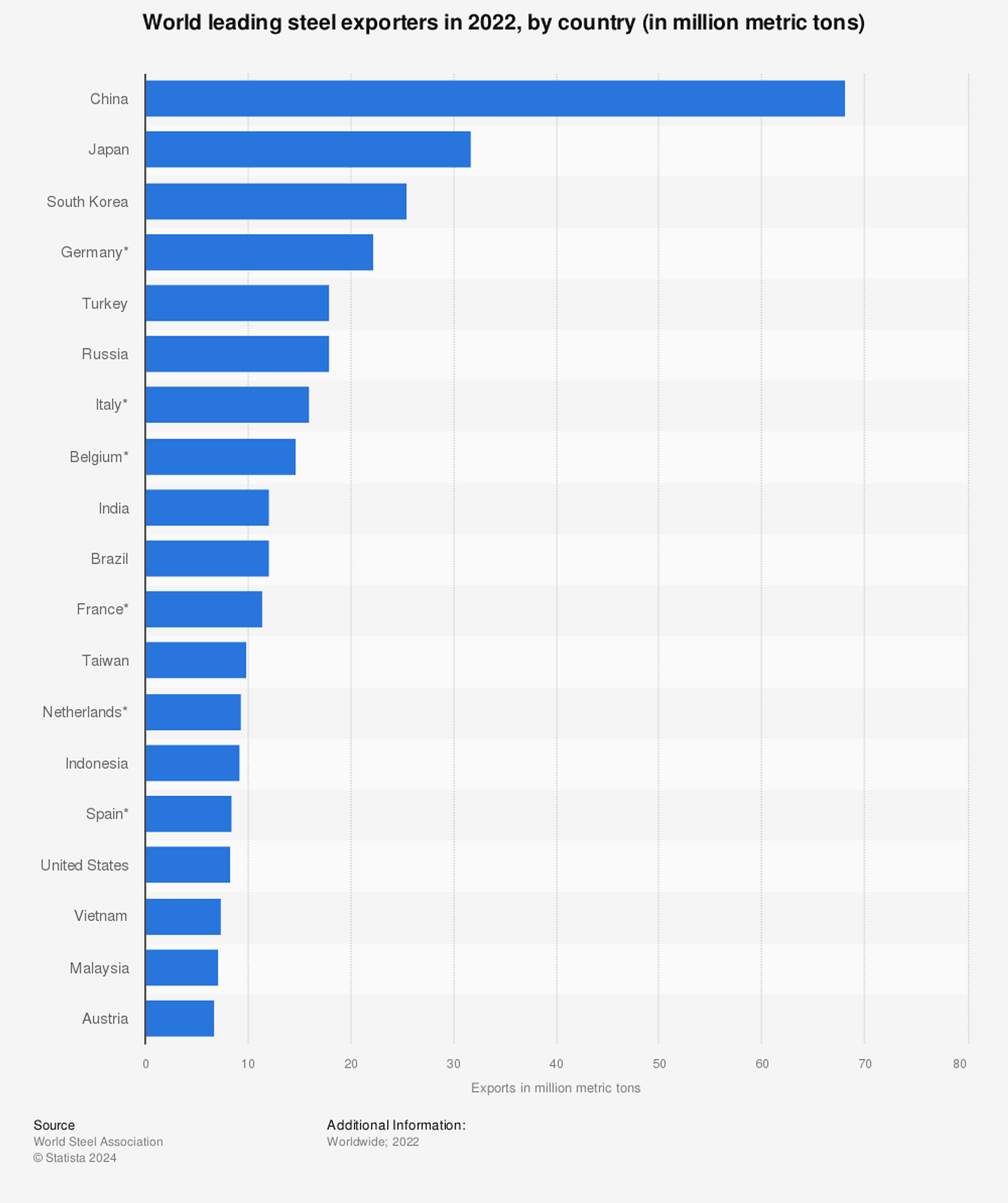

The world produces about 1.8 billion metric tons of metal yearly, which, only for enjoyable, is the load of roughly 180 million elephants!

China is by far the largest participant, with over 50% of the worldwide market share. India, compared, has a market share of round 6-7%. However currently, the metal trade has been dealing with some critical challenges, and it’s price diving into what’s happening.

One of many greatest issues proper now’s China dumping low-cost metal into markets like India, usually promoting it at costs under the price of manufacturing. That is taking place as a result of China constructed means too many metal factories within the final decade, because of large spending on infrastructure and manufacturing. However over the previous 5 years, China’s economic system has slowed down, largely as a result of collapse of its actual property and building sectors, which collectively account for over 30% of its GDP.

Due to the trillions of {dollars} China invested in constructing its bodily infrastructure and industrial base, its factories at the moment are making far more metal than they want. And since home demand has dropped considerably, they’re promoting this additional metal to different nations at rock-bottom costs.

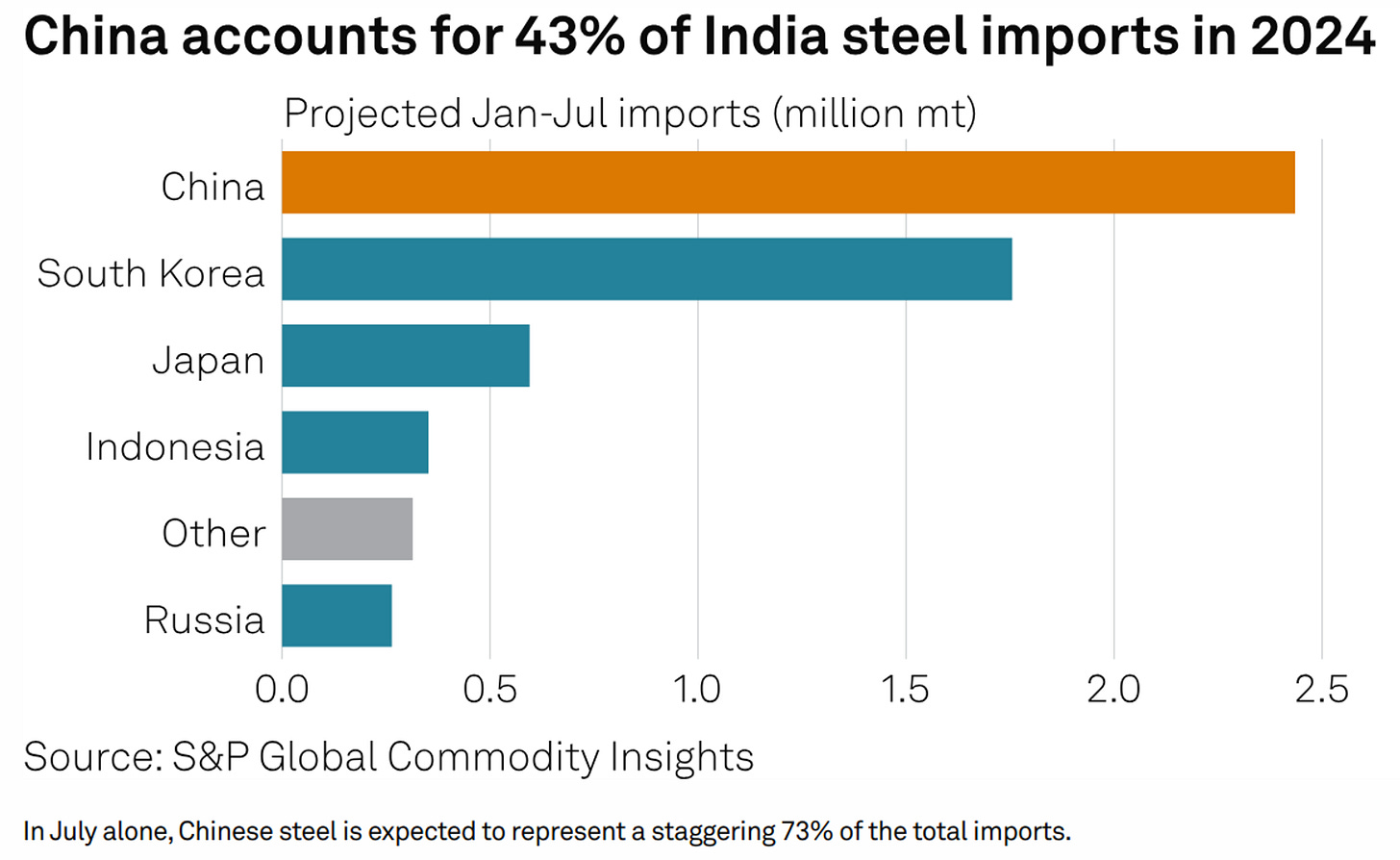

To place this in perspective, current costs for Chinese language metal had been about Rs 48,000 per metric ton, in comparison with India’s Rs 51,000 per metric ton. Whereas that distinction would possibly sound small, it’s large within the metal trade, the place margins are skinny and each rupee counts for patrons.

Supply: S&P International

On account of these low costs, Chinese language metal made up 73% of India’s whole metal imports in July 2024, the best stage within the final seven years. This flood of low-cost metal is hitting home producers laborious as a result of they simply can’t compete with such low prices.

By the way in which, Japan can be exporting metal to India at costs just like China’s. However the reason being totally different. Japan’s low costs aren’t on account of dumping however due to a Free Commerce Settlement (FTA) with India. This FTA cuts down tariffs and commerce boundaries, permitting Japanese metal to enter the Indian market extra simply and cheaply. However on condition that these items are nonetheless decrease than India’s costs, it’s hurting Indian metal makers.

Right here in India, there’s numerous discuss easy methods to shield native steelmakers from these low-cost imports. Metal Minister H.D. Kumaraswamy is pushing to boost import duties from 7.5% to 10-12% to cope with Chinese language metal. In the meantime, Commerce Minister Piyush Goyal is suggesting a Border Adjustment Tax (BAT) to stability out the taxes paid by Indian producers.

The difficulty, although, is that there are doubts about whether or not a BAT would actually make a lot of a distinction, as it’d solely barely increase import costs. The dearth of a transparent and unified plan is leaving the metal trade in a little bit of a tricky spot.

General, the worldwide metal market is in chaos, particularly for rising nations like India. China’s aggressive technique of exporting its home issues is placing numerous stress on India’s metal trade, which is feeling the squeeze from all sides. It’ll be fascinating to see how issues play out within the coming months.

Thanks for studying. Do share this with your folks and make them as good as you might be ![]()

[ad_2]

Source link