[ad_1]

quantic69/iStock through Getty Photographs

Funding Thesis

I final wrote on GlobalFoundries Inc. (NASDAQ:GFS) with a impartial score forward of their first quarter of FY2024 incomes outcomes and outlook for the total fiscal yr; I’m writing to reaffirm my much less optimistic outlook on the inventory after 1Q24 incomes outcomes confirmed my concern about lumpy good cellular device-related gross sales weighing on the corporate’s monetary efficiency.

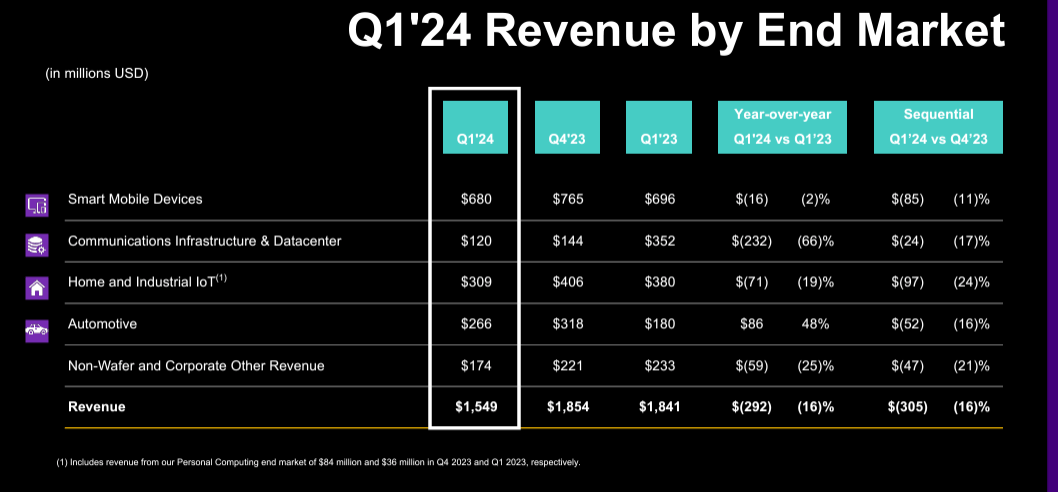

The corporate reported its good cellular system income down 11% sequentially and a pair of% from a yr in the past quarter to $680 million, in comparison with $765 million final quarter. On the earnings name, administration talked about seeing “optimistic indicators throughout the good cellular system ecosystem as extra inventories are drawing down…” I’m not too satisfied that GlobalFoundries’ optimistic indicators will flip into revenue within the near-term for 2 causes.

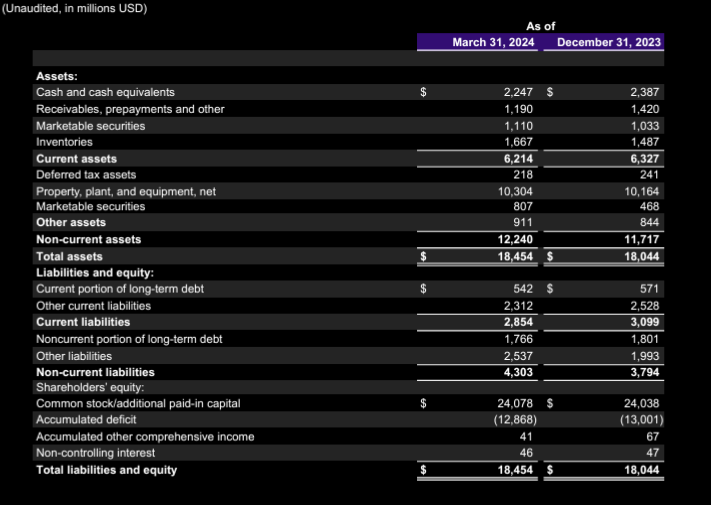

The primary is that administration’s commentary concerning buyer discount of stock ranges remains to be not exhibiting up in its monetary statements; the corporate’s stock degree is greater as of March thirty first, 2024, than it was on the finish of December thirty first, 2023. What this tells us is that stock digestion remains to be taking place and so the restocking hasn’t kicked in but if the corporate’s stock is greater. The picture under reveals GlobalFoundries’ monetary assertion from the corporate’s earnings presentation.

International Foundries Earnings Presentation

The second is that I nonetheless assume GlobalFoundries is just too uncovered to what continues to be a weak end-demand setting for smartphones; the corporate’s publicity stands at roughly 44% of its whole income. The remainder of GlobalFoundries’ income comes from communications infrastructure and knowledge facilities at 8%, house and industrial IoT at 20%, and automotive at 17%, as proven within the picture from the corporate’s earnings presentation for 1Q24.

International Foundries Earnings Presentation

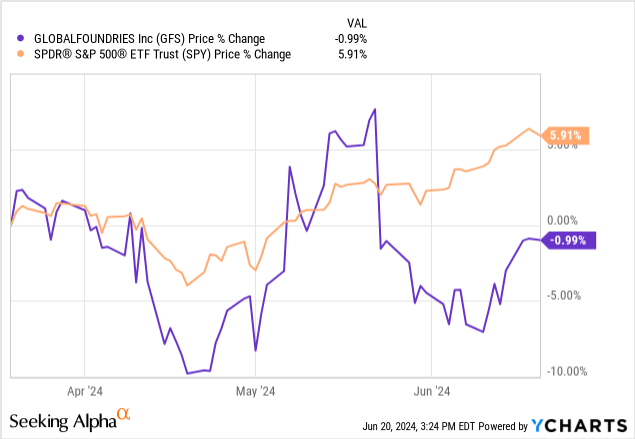

The earnings name and the Road feedback on GlobalFoundries had been extra optimistic after this quarter; the reason being due to GlobalFoundries’ better-than-expected web earnings of $134 million ($0.24 per share). The corporate really doubled web earnings compared to analyst expectations this quarter, which had been for $73.96 million (($0.13 per share). I get investor pleasure in regards to the higher web earnings, which causes the inventory to rally after the outcomes, as proven under on the inventory’s three-month chart in opposition to the S&P 500. However, the corporate nonetheless reported income that declined year-over-year to $1.55 billion in comparison with $1.84 billion. The corporate’s outlook for subsequent quarter can also be not inspiring, with income estimated to be $1.59 billion to $1.64 billion, with a midpoint roughly consistent with Wall Road expectations at $1.61 billion.

YCharts

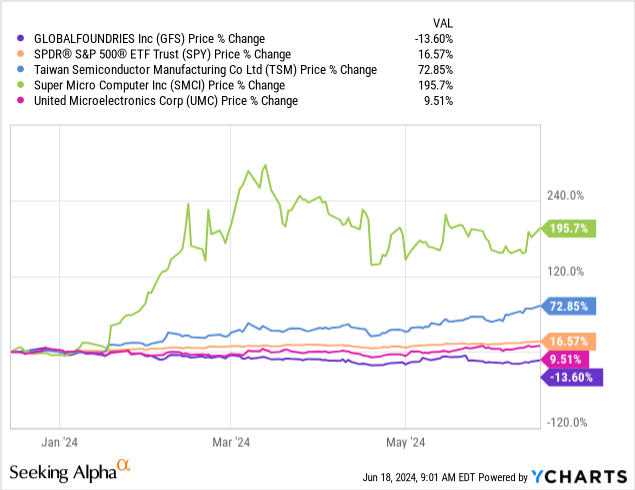

Regenerating the six-month chart of GlobalFoundries in opposition to Tremendous Micro Laptop, United Microelectronics, and the S&P 500, the identical pattern that appeared in March nonetheless stands right this moment: GlobalFoundries continues to underperform the peer group and proves much less resilient to the semi trade downturn, due to its heavy smartphone publicity, in my view. Apple (AAPL) did surge this quarter after its earnings name, however that was not on account of higher iPhone finish demand. Even Qualcomm and Skyworks outcomes this quarter verify that the tip demand for smartphones remains to be not upon us.

YCharts

What about Valuation?

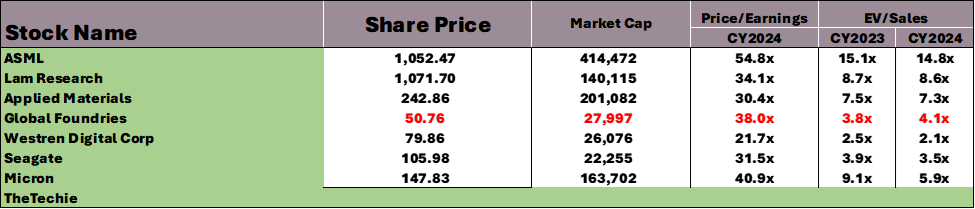

GlobalFoundries will not be costly, based mostly on a relative valuation methodology. GlobalFoundries trades at a Value/Earnings ratio of 38.0 for CY2024 whereas the peer group ratio is 35.8, as proven within the knowledge under generated from Refinitiv. The inventory trades at a ratio of 4.1 on an EV/Gross sales metric, whereas the peer group common ratio stands at 6.8. The inventory’s valuation is enticing for the prospect of good cellular system gross sales recovering in 2025 however I believe it is too early to leap in. I don’t assume the inventory is a worth cut price within the present setting. I believe it will be troublesome for the corporate to outperform its peer group within the second half of the yr.

Picture created by The Techie with knowledge from Refinitiv

What’s Subsequent?

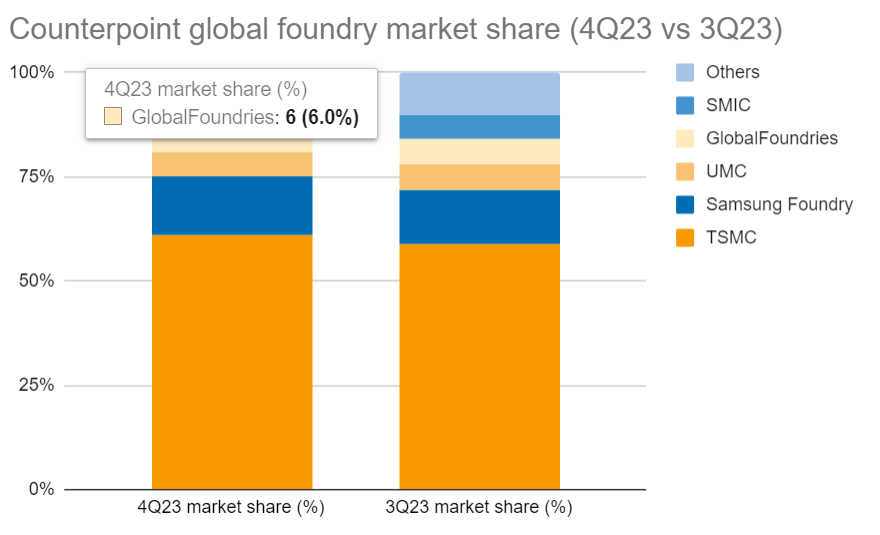

GlobalFoundries is a foundry participant competing primarily with TSMC (TSM), though retaining a a lot smaller share of the market, estimated by counterpoint to have captured 6% of the market, as proven under. The core of my pessimism on the inventory is the truth that GlobalFoundries will get nearly half of its income from smartphone demand. So as to add, GlobalFoundries doesn’t have the AI publicity that may offset one thing like this, whereas TSMC does, for instance.

Counterpoint

I don’t see extra draw back going ahead, however I believe there’s little upside to the S&P 500 within the near-term. I’ll proceed to look at for indicators of smartphone restoration from the semi peer group with publicity to Apple Skyworks, Qualcomm, and Qorvo; that’s the golden ticket to pinpoint demand restoration forward of the actual fact. I believe we’ll see higher end-demand dynamics in 2025 however I wouldn’t maintain my breath for 2024.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link