[ad_1]

BING-JHEN HONG

It’s all the time a problem for buyers to determine rising development themes, as they’re largely solely identified with hindsight. Having mentioned that, one factor all megatrends have is they’re largely centered round disruption by elevated productiveness and effectivity. That is largely why the Tech sector has been the darling of most portfolios. With rising velocity and enormous information, mega-cap firms can get more and more fine-tuned on squeezing extra from much less by automation and data.

On condition that it may be exhausting to identify these firms simply on the sting of accelerating development, it’s price contemplating outsourcing the identification course of by lively ETFs that do this for you. That’s the place the AB Disruptors ETF (NYSEARCA:FWD) comes into play. This fund offers publicity to modern leaders who’re more likely to disrupt their respective industries and ship outperformance relative to cap-weighted indices. That is an lively fund that makes use of basic, bottom-up analysis to determine future disruptors throughout the globe.

However, does the fund ship? In spite of everything, everyone knows lively administration, normally, doesn’t actually outperform relating to inventory choosing. Is FWD an exception?

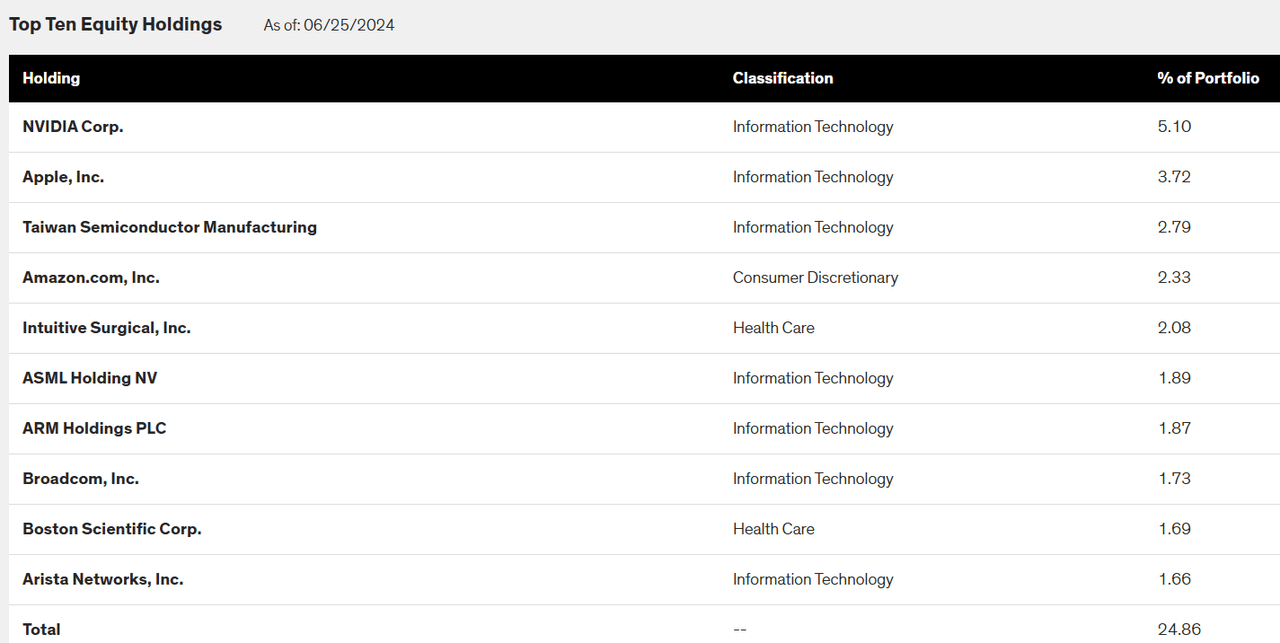

A Look At The Holdings

The ETF holds 80 to 100 particular person positions. No place makes up greater than 5.1%, and we will see from the highest 10 holdings that almost all are within the tech area. And, in fact, my favourite inventory on the planet, Nvidia, is on the high.

AllianceBernstein

The important thing to recollect right here is that that is an lively fund. Meaning, for all we all know, the highest 10 positions might look fully totally different in a couple of weeks from now. This isn’t essentially a nasty factor if these firms are being changed by excessive performing new disruptors, nevertheless it makes any conclusions on the portfolio primarily based on the highest holdings exhausting to have faith in.

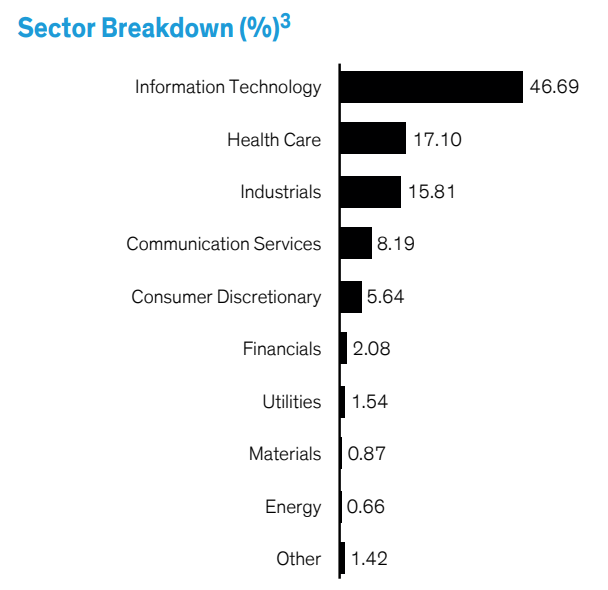

Sector Composition and Weightings

After we take a look at the sector composition, we discover that just about half of the portfolio is in Tech, with Well being Care and Industrials a distant 2nd and third respectively. No Utilities, Supplies, or Vitality publicity to talk of given their minimal weightings.

AllianceBernstein

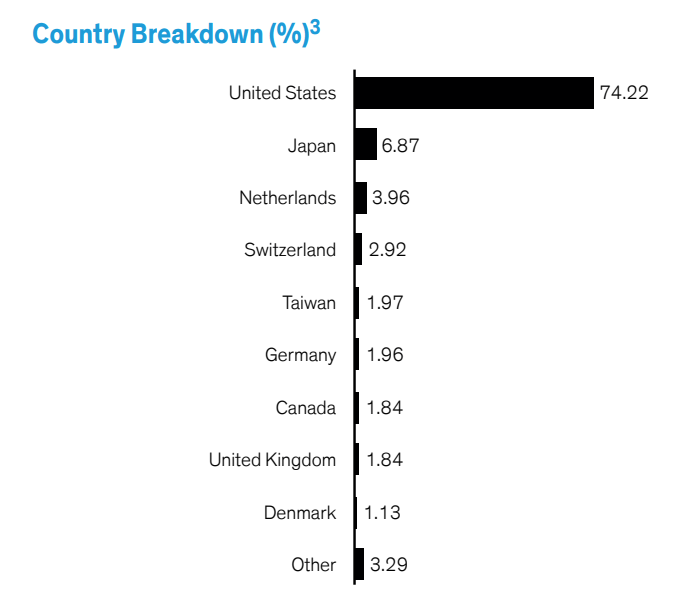

I famous earlier than, this fund is world. The bulk although stays US, with it making up 74% of the fund. Whereas I discover it exhausting to consider there aren’t loads of worldwide firms that might be thought-about disruptors of their sectors, the fact is any fund that has a heavy tech publicity will nearly routinely be US dominant.

AllianceBernstein

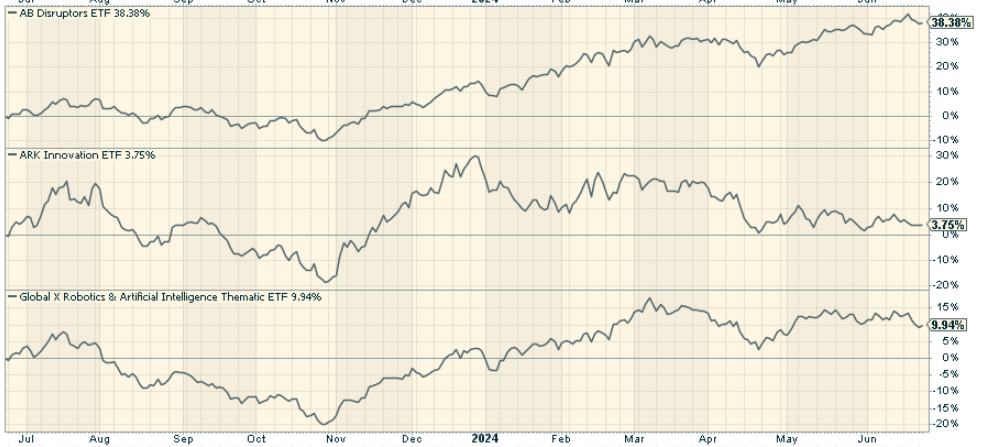

Peer Comparability

Two funds price evaluating the AB Disruptors ETF to are the ARK Innovation ETF (ARKK) and the International X Robotics & Synthetic Intelligence ETF (BOTZ). Whereas ARK Innovation ETF is run by ARK Make investments and shares a deal with disruptive innovation, its mandate is way broader and consists of genomics, fintech and autonomous know-how. The International X Robotics Synthetic Intelligence ETF has a centered mandate on robotics and AI – however isn’t solely focused on the speedy adoption part of the S-curve, just like the AB Disruptors ETF. It’s this thematic proposition that differentiates the AB Disruptors ETF from different sectoral or thematic funds.

After we take a look at the efficiency of the three funds to one another, FWD wins out. It wouldn’t be truthful to attribute this solely to the Nvidia place, however clearly that has helped, given ARK did not allocate there all through this enjoyable.

StockCharts.com

Execs and Cons

On the optimistic aspect, FWD offers buyers with publicity to a group of innovation-focused firms. The thematic overlay ensures that the portfolio is strategically positioned to learn from secular development traits reminiscent of cloud infrastructure, AI, digital funds, medical innovation, and so forth. And there may be loads of analysis to counsel that thematic funding certainly generates superior long-term returns relative to a extra commonplace sector framework. Furthermore, the lively administration method addresses sure drawbacks of thematic investing. So, if, for instance, one of many thematic holdings experiences an prolonged interval of underperformance, the ETF would dynamically regulate the portfolio’s publicity to seize new alternatives as they grow to be out there.

However you may land in bother with the AB Disruptors ETF too due to its heavy sector allocation to Tech. And remember the fact that as a result of the fund invests in rising and fast-growing firms, it possible might be extra delicate to swings in markets and unsure macro backdrops.

Conclusion

I believe this can be a first rate fund total. FWD permits buyers who want to entry modern firms which may profit from secular development traits a straightforward means to take action. Simply remember the fact that it’s nonetheless a comparatively new fund (launched in March 2023) and we don’t know the way the lively administration might help throughout a broad market correction. Nonetheless, I believe it’s promising thus far in comparison with different alternate options and value contemplating.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you uninterested in being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis instrument designed to provide you a aggressive edge.

The Lead-Lag Report is your each day supply for figuring out danger triggers, uncovering excessive yield concepts, and gaining useful macro observations. Keep forward of the sport with essential insights into leaders, laggards, and every part in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report immediately.

Click on right here to achieve entry and check out the Lead-Lag Report FREE for 14 days.

[ad_2]

Source link