[ad_1]

Unrealized upside exists in three underbought areas of the inventory market, JPMorgan Asset Administration says.

They embrace the semiconductor, rail and parcel, and residential enchancment sectors, in keeping with the agency.

These might be nice portfolio provides as earnings progress in AI shares begins to gradual, strategists stated.

Traders are nonetheless overtaken by the frenzy for generative AI — however there are underappreciated areas of the market that might supply positive factors like “coiled springs,” in keeping with JPMorgan Asset Administration.

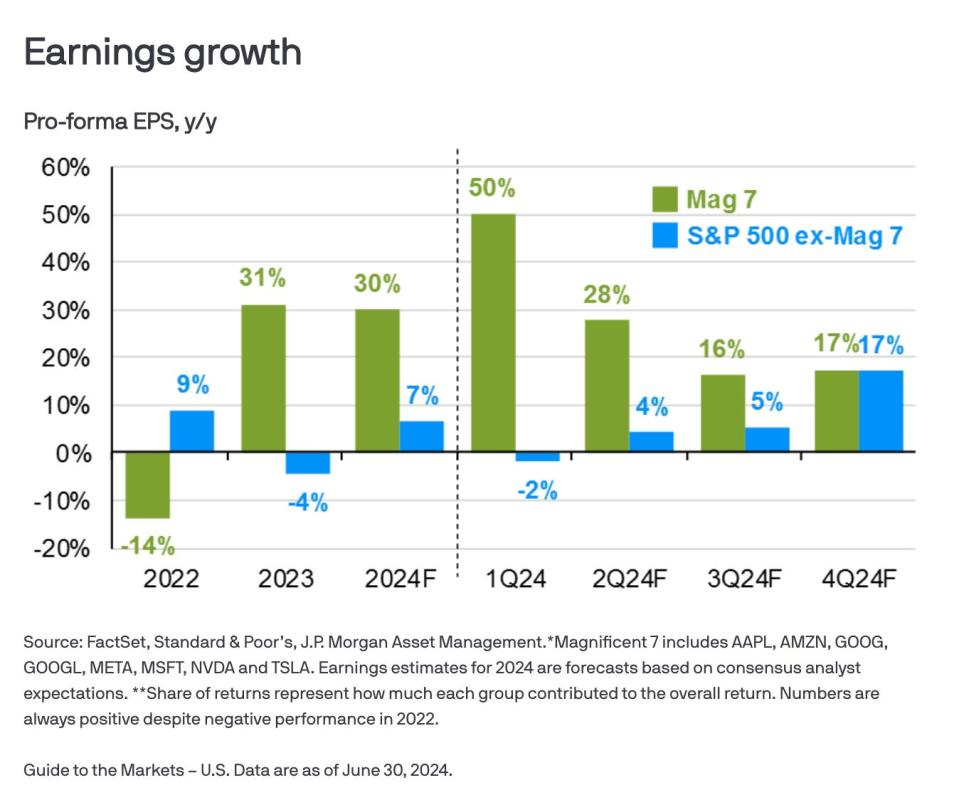

Whereas the Magnificent Seven shares — which embrace tech giants like Nvidia, Meta, and Microsoft — noticed 50% annualized earnings-per-share progress within the first quarter, the remainder of the S&P 500 is because of catch up.

By the fourth quarter of 2024, JPMorgan expects earnings enlargement for the opposite 493 S&P 500 shares to match that of the Magnificent 7, a dynamic proven within the chart beneath.

“Taking a longer-term view, vital fiscal spending, notably on infrastructure (such because the Inflation Discount Act and the CHIPS and Science Act), coupled with rising enthusiasm round generative Synthetic Intelligence, ought to present an accommodative backdrop for stronger secular progress transferring ahead,” strategists stated. “Markets do not appear to have totally priced on this prognosis, mirrored within the slim (and narrowing) nature of the fairness market rally.”

Traders searching for unrealized upside can be well-served to hunt non-Magazine 7 shares with “depressed” valuations that are not but pricing within the earnings-growth catchup.

“These names might due to this fact perform like ‘coiled springs,'” the observe added, highlighting three explicit industries:

Semiconductors. JPMorgan says there’s loads of alternative in semis outdoors of the AI commerce.

“Depressed areas like private electronics, communications and enterprise, could quickly bounce again as demand is reinvigorated off low ranges left behind by pandemic ‘over-ordering,'” the agency wrote.

Rail and parcel. These shares are certain to see upside resulting from “surprising resiliency” within the US economic system and the rising want to move supplies. Automation within the trade can be anticipated to extend effectivity, which might increase upside.

House enchancment. People have put a pause on their residence renovations, held again by excessive rates of interest and the truth that many already renovated their properties throughout the pandemic. However that pattern is more likely to reverse sooner or later, strategists stated.

“With the common US residence age rising, the probability of great upkeep expenditure is rising. Furthermore, labor-related backlogs in older tasks are clearing, as immigration has helped clear up labor shortages,” they stated.

Story continues

JPMorgan’s strategies are indicative of Wall Avenue’s shift in direction of recommending diversification, relatively than persevering with to chase Magazine 7 positive factors. This has been the case as uncertainty swirls across the election and Fed fee cuts within the 12 months forward. Some defensive investments, like power and utility shares, have seen outsized positive factors over the previous 12 months, with returns surpassing even prime AI picks like Nvidia.

Learn the unique article on Enterprise Insider

[ad_2]

Source link