[ad_1]

EUR/USD: Storms and Tempests on September 18, 19, and 20

● The previous week may be divided into two elements – from September 9 to 11, and from the twelfth to the thirteenth. Initially, the greenback strengthened, then it misplaced floor. The pattern shift occurred after knowledge launched on Wednesday, September 11, indicated a slowdown in US inflation and the labour market.

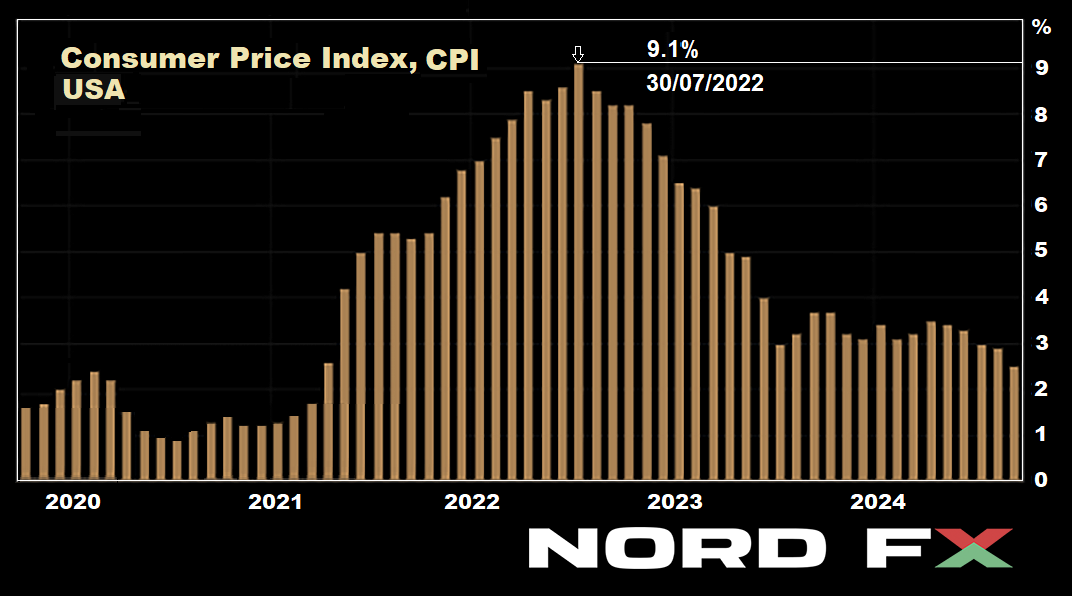

In response to the US Division of Labor’s report, client costs (CPI) in August rose by a mean of two.5% year-on-year, the bottom determine since February 2021. By comparability, the annual inflation price in July was 2.9%. Thus, in only a month, the speed of client worth development slowed by 0.4%. It’s value noting that the nation’s annual inflation price has been declining for a number of months. As an illustration, by the top of July, CPI development had already fallen to its lowest since March 2021. And though 2.9% just isn’t but the goal 2.0%, it’s a far cry from the 9.1% seen two years in the past. The sunshine on the finish of the tunnel is turning into seen. The identical can’t be stated for the labour market. Let’s recall that the Bureau of Labor Statistics report on September 6 confirmed that the variety of new jobs created exterior the US agricultural sector (Non-Farm Payrolls) was solely 142K, in comparison with the anticipated 164K. The variety of preliminary unemployment claims, revealed on September 12, was additionally considerably disappointing. With a earlier determine of 228K and a forecast of 227K, the quantity truly rose to 230K. The distinction is small, in fact, however the pattern continues to be adverse.

The market reacted to all this knowledge in a really logical approach. Earlier than its launch, the chance of a 25 foundation level (bps) minimize within the federal funds price on the FOMC (Federal Open Market Committee) assembly of the US Federal Reserve on September 17-18 was 87%. Afterward, it dropped to 55%. In the meantime, the probabilities of a 50 bps minimize jumped from 13% to 45%. The pondering goes: the economic system wants saving, and the battle towards inflation can wait. Nevertheless, we nonetheless consider that the Fed will train warning and begin with a quarter-point minimize quite than half a %.

● On the information talked about above, the EUR/USD pair was unable to interrupt by way of the 1.1000 assist stage. After wavering close to it, the pair reversed and moved upwards. Whereas the market’s response to the US Division of Labor’s statistics was logical, the euro’s strengthening following the European Central Financial institution (ECB) assembly is tougher to clarify.

On Thursday, the ECB resumed its financial easing cycle (QE), which had been paused in July. The important thing rate of interest was lowered from 4.25% to three.65%, a minimize of 0.6%. Why 0.6% and never a spherical 0.5% stays a thriller. However this isn’t the principle level. What issues is that such a transfer ought to have weakened the euro. But, the other occurred. The explanation for that is probably ECB President Christine Lagarde, who, on the post-meeting press convention, didn’t give the slightest trace that the QE cycle might proceed in October.

Regardless of the potential inflation slowdown in September, an increase is forecast in direction of the top of the 12 months. The ECB expects inflation to be at 2.5% by the top of 2024, 2.2% in 2025, and solely beneath the goal 2.0% at 1.9% by the top of 2026. So why proceed chopping charges so drastically when they’re already fairly low? Christine Lagarde even admitted that whereas the June minimize had been deliberate prematurely, the choice to ease financial coverage on the July assembly was, the truth is, deemed hasty.

After Madame Lagarde’s speech, the futures market lowered the chance of additional ECB financial easing in October from 40% to twenty%, which led to the rise in EUR/USD. Derivatives now count on the US Federal Reserve to decrease charges by 25 foundation factors 10 instances over the subsequent 12 months, whereas solely 7 related strikes are anticipated from the ECB. This might lend energy to the bulls on this pair.

● Consequently, the EUR/USD closed the previous week at 1.1075, nearly precisely the place it started. Specialists’ opinions on its short-term efficiency are divided as follows: 25% of analysts assist a stronger greenback and a decline within the pair, 50% favour its rise, whereas the remaining 25% keep a impartial place. Nevertheless, the medium-term outlook paints a distinct image. Right here, 70% are in favour of the US greenback, whereas solely 30% are towards it.

In technical evaluation on D1, the pattern indicators present an awesome majority supporting the bulls, with 80% within the inexperienced camp and 20% siding with the bears. Amongst oscillators, the image is extra combined: 25% are inexperienced, 40% are pink, and the remaining 35% are impartial (gray).

The closest assist for the pair is within the 1.1000-1.1025 zone, adopted by 1.0880-1.0910, 1.0780-1.0805, 1.0725, 1.0665-1.0680, and 1.0600-1.0620. Resistance zones are positioned round 1.1100, then 1.1135-1.1150, 1.1190-1.1200, 1.1240-1.1275, 1.1385, 1.1485-1.1505, 1.1670-1.1690, and 1.1875-1.1905.

● As for the upcoming week, the calendar shall be filled with vital financial occasions that may undoubtedly result in elevated volatility. On Tuesday, September 17, US retail gross sales knowledge shall be launched. On Wednesday, September 18, key inflation indicators such because the Shopper Value Index (CPI) for the UK and the Eurozone shall be made public. On the identical day, the US Federal Reserve’s FOMC will announce its determination on rates of interest. Following the Fed assembly, related conferences shall be held by the Financial institution of England (BoE) on September 19 and the Financial institution of Japan (BoJ) on September 20. Naturally, moreover the particular choices, merchants and traders pays shut consideration to the statements and feedback from the heads of those three central banks relating to future financial coverage.

CRYPTOCURRENCIES: Will the New US President Determine BTC’s Destiny?

● In our mid-week crypto market evaluate, we have been happy to report some optimistic information from the analytics service Coinglass. In response to their knowledge, September 9 marked the top of the longest part of capital outflows from US spot BTC-ETFs. The capitalisation of those funds had been declining since August 26, leading to a lack of $1.2 billion. Nevertheless, on Monday, September 9, bitcoin ETFs managed to draw $28.6 million in capital, breaking the streak of losses. However… the celebration was untimely. By Wednesday, US-traded spot bitcoin funds recorded one other outflow, ending the transient two-day influx interval, with losses totalling $43.97 million.

And right here’s a bit extra knowledge: in line with CryptoQuant, there was a notable shift in bitcoin possession dynamics over current months. Quick-term holders (these proudly owning BTC for 155 days or much less) have considerably lowered their positions, particularly in July and August. In the meantime, long-term holders have been rising their holdings. Because of this redistribution, whales now management practically 67% of the circulating provide of bitcoin and over 43% of ethereum reserves.

● Is that this good or dangerous? General, the statistics appear quite contradictory. “The truth that short-term holders should not accumulating positions could point out weak demand for bitcoin,” notes CryptoQuant. Nevertheless, in addition they recommend that the capital circulate from weak palms (short-term holders) to robust palms (long-term holders) might set the stage for a possible market restoration, as elevated accumulation by HODLers could stabilise costs. However, as analysts at Santiment level out, until whales (the first goal of BTC-ETFs) begin shopping for bitcoin once more, a bullish rally is unlikely within the close to time period.

● Evaluating the present state of affairs, Greg Cipolaro, head of analysis at Bitcoin New York Digital Funding Group, urged bitcoin holders to be affected person. In his view, September is unlikely to deliver any surprises when it comes to worth development for the main cryptocurrency. The important thing issue influencing BTC, in line with Cipolaro, would be the upcoming US presidential election on November 4. He believes the end result of the election shall be a pivotal occasion for your entire crypto market, no matter who wins. Nevertheless, Cipolaro declined to foretell whether or not Donald Trump or Kamala Harris would emerge victorious. The analyst can be satisfied that elements reminiscent of employment knowledge, inflation ranges, and even modifications within the Fed’s rate of interest at its September 17-18 assembly is not going to have an enduring affect on bitcoin’s worth.

● Greg Cipolaro’s colleagues at 10x Analysis disagree with him. They consider {that a} potential 50 foundation level price minimize by the Federal Reserve might negatively affect bitcoin and different cryptocurrencies.

“A pointy price minimize is an indication of financial concern, not confidence,” say analysts at 10x Analysis. Of their view, a 50 bps discount in borrowing prices could sign that the regulator is struggling to deal with an impending downturn within the labour market. They argue that the group’s expectations for bitcoin’s worth enhance could go unfulfilled, as there aren’t any clear development catalysts, and the Fed is targeted on balancing its efforts between combating unemployment and inflation.

● With only some days left till the Federal Reserve assembly, there’s nonetheless over a month till the US presidential election. On September 10, the primary debate between presidential candidates Donald Trump and Kamala Harris happened. Though cryptocurrencies weren’t talked about, the controversy consequence negatively impacted the costs of main digital belongings. Earlier than the controversy, Trump held a slight lead in prediction markets. For instance, on Polymarket, his probabilities of victory have been at 53%, in comparison with Harris’s 46%. Nevertheless, after the controversy, each candidates’ odds levelled out at 49%. On one other prediction platform, PredictIt, the distinction was extra pronounced: Harris’s probabilities rose to 56%, whereas Trump’s fell to 47%.

Since Trump portrays himself as a supporter of cryptocurrencies, whereas Harris has not but taken a transparent stance, the shift in stability had a adverse impact on bitcoin and different digital belongings. After the controversy, the worth of BTC dropped by about 3%. Nevertheless, it quickly recovered, as verbal sparring is much from the ultimate vote consequence.

● It’s value noting that the rhetoric of the US presidential candidates is kind of completely different. Trump guarantees that the US will change into the “world capital of bitcoin and cryptocurrencies.” In distinction, Harris’s programme avoids any point out of digital belongings. Based mostly on this, specialists at Bernstein have outlined their forecast for the crypto market. In response to their predictions, bitcoin might check the $80,000 to $90,000 vary if Donald Trump wins, and the $30,000 to $40,000 vary if Kamala Harris turns into the subsequent president. “Whereas some crypto trade leaders harbour hopes for a extra constructive coverage from Harris, we count on a major distinction between the 2 outcomes. A Harris victory would keep the difficult regulatory setting that has stifled market development lately,” Bernstein acknowledged.

Analysts at Matrixport have additionally launched a forecast on bitcoin’s worth following the election outcomes. Of their view, bitcoin will proceed to rise whatever the voting consequence. Matrixport famous that in Donald Trump’s presidency from 2016 to 2020, bitcoin grew by 1,421%. Underneath Joe Biden, from 2020 to 2024, BTC’s worth elevated by 313%. “Bitcoin can proceed to thrive no matter who wins the presidential election in November and takes the White Home,” Matrixport analysts wrote. They consider the subsequent president is more likely to have a better affect on cryptocurrency market regulation than on bitcoin’s worth itself.

● Amidst this unsure backdrop, a press release from MicroStrategy founder Michael Saylor appeared like a balm for bitcoin lovers. Saylor predicted that bitcoin will quickly enhance in worth by 70 instances—reaching a staggering $3.85 million. The billionaire defined his forecast by highlighting the technological superiority of the main cryptocurrency over different belongings and its annual returns. Since MicroStrategy started buying BTC in August 2020, the cryptocurrency has delivered a mean annual return of 44% to traders. As compared, the S&P 500 index has grown by round 12% per 12 months over the previous 4 years.

Saylor can be assured that the long run belongs to HODLers (long-term traders), who will finally outperform merchants centered on short-term worth fluctuations. In the long run, the billionaire forecasts that bitcoin might attain $13 million, although this could solely occur by 2045. By 2050, he predicts that bitcoin’s market capitalisation will account for 13% of the world’s whole capital (for reference, it presently stands at simply 0.1%).

● As of the night of Friday, September 13, on the time of writing, the BTC/USD pair surged sharply after a weakening of the US greenback, reaching the $59,900-60,000 zone. The entire crypto market capitalisation rose barely above the psychologically vital $2.0 trillion stage, now standing at $2.10 trillion (in comparison with $1.87 trillion every week in the past). Bitcoin’s Crypto Worry & Greed Index elevated from 22 to 32 factors, shifting from the Excessive Worry zone into the Worry zone.

● And in conclusion, since we started our evaluate with statistics, we’ll finish it with them as effectively. Specialists from Gemini performed a survey amongst 6,000 respondents from the USA, the UK, France, and Singapore and located that amongst digital asset homeowners, 69% are males and 31% are ladies. However that is not all. In response to Date Psychology, it turned out that almost all of ladies (77%) contemplate cryptocurrency lovers unattractive. They understand solely those that gather Funko figures (toys devoted to characters from films, comics, cartoons, and many others.) as worse. Maybe it’s because ladies view digital belongings as unserious and mission this perspective onto the boys who’re concerned with them.

Probably the most engaging to the feminine respondents have been males preferring hobbies reminiscent of studying, studying overseas languages, and enjoying musical devices. Nevertheless, as different surveys present, ladies working within the crypto trade obtain nice success and sometimes maintain greater positions than their male colleagues. Draw your personal conclusions, gents!

NordFX Analytical Group

https://nordfx.com/

Disclaimer: These supplies should not an funding advice or a information for engaged on monetary markets and are for informational functions solely. Buying and selling on monetary markets is dangerous and may lead to a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #foreign exchange #forex_forecast #nordfx #cryptocurrencies #bitcoin

[ad_2]

Source link