[ad_1]

funky-data

Funding Thesis

Traders are underestimating the demand influence for renewables from AI knowledge facilities. Corporations like Amazon and Meta dedicated to 100% renewable energy procure extra renewable electrical energy at an inverse proportion to the renewable proportion of the electrical grids during which they function. I imagine that is probably a large quantity of incremental renewable energy demand and might be a share worth driver. Fluence Power, Inc. (NASDAQ:FLNC) has optimistic publicity and is positioned to be a big beneficiary with continued margin enchancment. Purchase.

How 100% Renewable Power Is Achieved

In terms of renewable vitality shares, one of the vital frequent pushbacks is that renewables cannot present the dependable energy knowledge facilities want, particularly with AI workload rising exponentially. Nevertheless, reaching 100% renewable goal might not be the identical as some traders anticipate it to be. Renewables typically, can’t present dependable energy to Apple’s retail shops, or Amazon’s warehouses, or Meta’s Metaverse, or Google’s knowledge facilities. But, Apple has claimed 100% renewable sourcing since 2018, Amazon 90% in 2022, Meta 100% since 2020, Google 100% since 2017.

Company renewable targets are largely met by company procurement of Energy Buy Agreements (C-PPAs) during which the company agrees to purchase the ability generated from utility-scale photo voltaic and/or wind tasks equal to their complete annual nonrenewable electrical energy consumption. That renewable electrical energy is then resold by the company off-taker into the grid for normal consumption by all prospects. Apple defined the way it works fairly nicely in its 2015 sustainability report.

When it’s not possible to energy our services with onsite renewable vitality, we match our load with renewable vitality generated by both Apple-owned tasks or third-party tasks. We put the clear vitality we generate onto the native grid, displacing the extra polluting types of vitality. One of the simplest ways to consider it is sort of a financial institution: You may deposit $20 in a single financial institution department, then go to a different department and withdraw $20. Renewable vitality works in the same method. And Apple’s renewable vitality method goes a step additional to ensure we “deposit” on the identical grid because the vitality we’re “withdrawing.”

That is how Google is doing it now and the way they plan to do it by 2030.

Alphabet’s renewable vitality methodology is a customized calculation and is predicated on a world method. Proportion of renewable vitality is calculated on a calendaryear foundation, dividing the quantity of renewable electrical energy (in megawatt-hours) procured for our world operations by the full quantity of electrical energy consumed by our world operations. The numerator consists of all renewable vitality procured, whatever the market during which the renewable vitality was consumed. We set a purpose to run on 24/7 carbon-free vitality on each grid the place we function by 2030, aiming to obtain clear vitality to satisfy our electrical energy wants, each hour of each day.

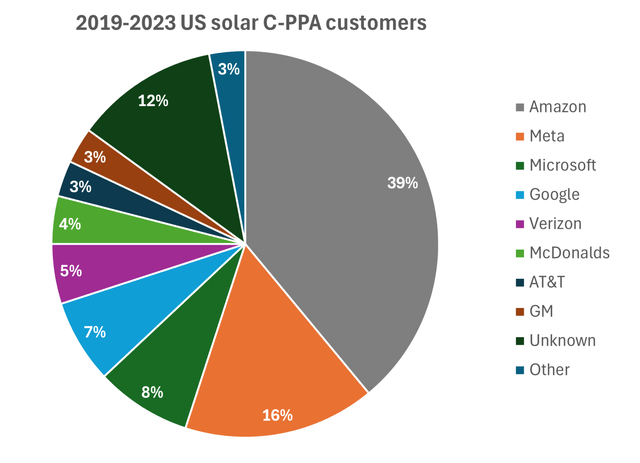

In keeping with UBS, complete US utility-scale photo voltaic installations had been 77GW 5-years ending 2023, of which signed photo voltaic C-PPAs had been 64GW or over 80% of installs. Though PPAs usually are not essentially signed in the identical yr as installs, the above numbers ought to present how vital the magnitude is.

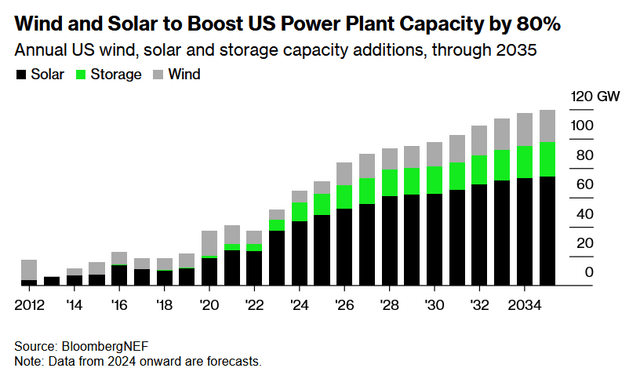

Bloomberg

UBS additionally tasks that there might be round 175TWh of incremental load progress from AI knowledge facilities by 2030, along with the beforehand forecast 175TWh from common knowledge facilities, totaling 350TWh, absolutely met by renewables (80% photo voltaic, 20% wind). With that mentioned, the quantity of energy generated by renewables remains to be not sufficient to satisfy the elevated demand for vitality, evidenced by the truth that 60% of the electrical energy at utility scale was nonetheless generated by soiled sources in 2023 for the US. This creates a backlog of demand, extending the period of demand visibility and I anticipate shares uncovered to this demand to go greater attributable to extra certainty and larger long-term demand progress.

The Set-up

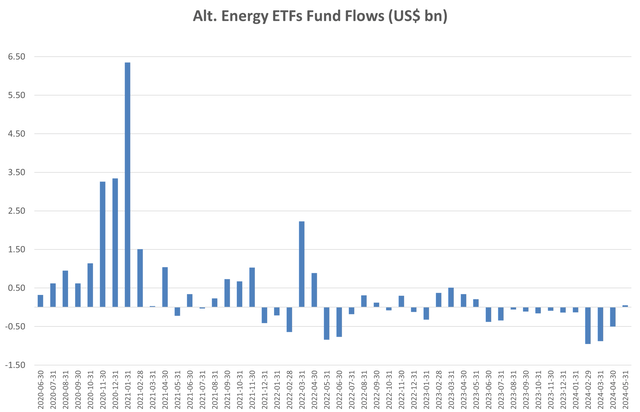

What I like concerning the renewables set-up is that the place to begin of the sentiment round this sector is so low following a downward inventory worth trajectory for the reason that peak in January 2021 and an underperformance YTD (TAN down ~19% vs SPX up ~15%). Alt Power ETF fund flows have been constantly destructive since final yr till final month. This era of destructive outflows coincided with a 44% decline within the TAN ETF earlier than the tick-up in Might. I imagine the outflows mirror a mixture of growing rates of interest/price volatility and election uncertainty. With the small optimistic influx in Might, reaching 2-3 months in a row could be a sign that investor sentiment or positioning is shifting, probably signaling the early levels of the subsequent renewables funding cycle, in my view.

Lipper

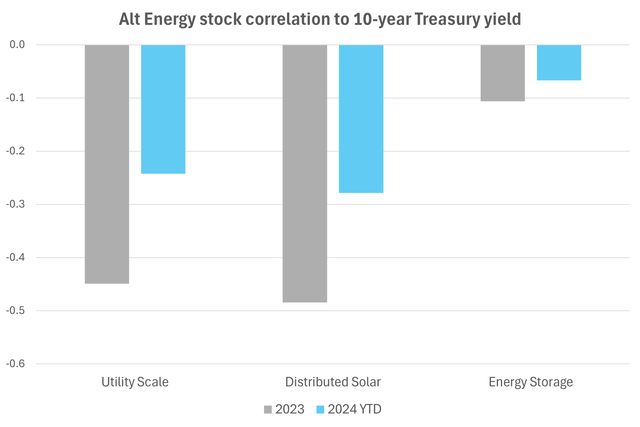

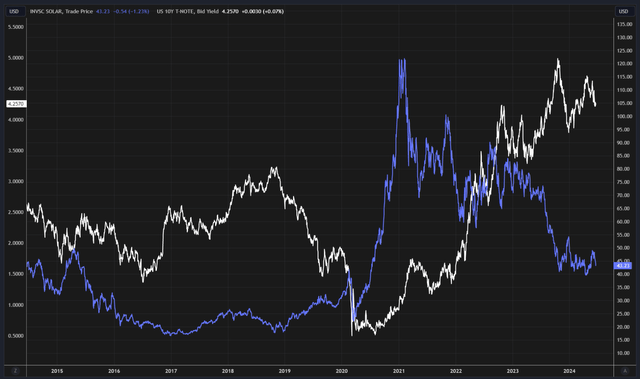

Inventory efficiency final yr was extremely negatively correlated with rates of interest, however having reached a comparatively extra steady degree YTD, I see the elevated correlation beginning to weaken. For my part, this suggests extra alternative for traders to be rewarded extra by particular person inventory selecting than by broader sector publicity choices as was the case throughout 2023. Inside utility scale, rate of interest impacts have been mitigated by greater PPA pricing supported by robust offtaker demand for renewable vitality, though volatility within the price surroundings has probably pushed some funding choices to be delayed.

Month-to-month efficiency correlation, chosen shares’ common (LSEG) TAN & 10-year Treasury yield (LSEG)

How FLNC Can Profit

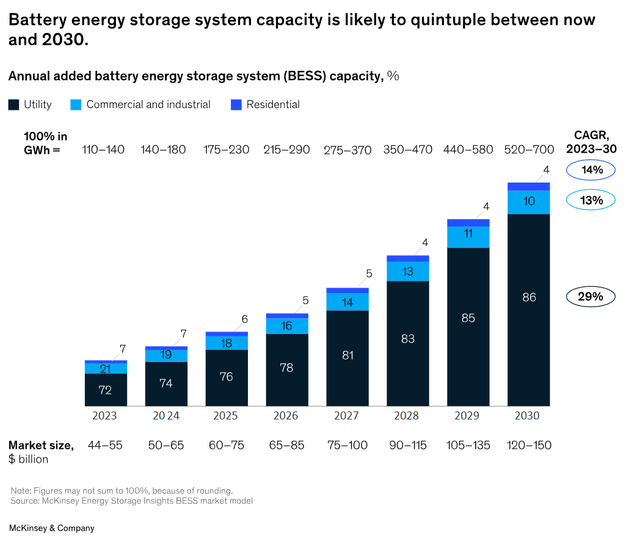

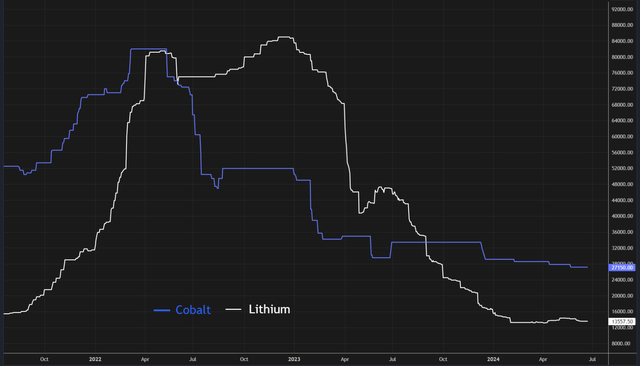

Recognizing the significance of the US electrical grid in driving emissions discount, in December 2021 as a part of Government Order 14008 – Tackling the Local weather Disaster at Dwelling and Overseas – President Biden signed an govt order which units a purpose for a carbon pollution-free electrical energy sector no later than 2035. The Inflation Discount Act and the Bipartisan Infrastructure Legislation additionally present extra help to assist drive a extra speedy transition. With this backdrop and what’s mentioned above, I believe FLNC is nicely positioned to learn from robust rising secular demand for utility-scale battery vitality storage and declining battery prices, as battery vitality storage system (BESS) is a necessary enabler of renewable vitality era.

Bloomberg McKinsey & Firm Battery enter costs ($/t) (LSEG)

To clarify additional, the demand influence for FLNC just isn’t bodily at knowledge facilities. Fairly, it is created by the 100% renewable mandates and worth volatility arbitrage. FLNC is a battery integrator that brings collectively {hardware} suppliers (batteries) and development (EPCs) in an effort to ship to the top buyer (developer, IPP, and so on) a completed utility-scale battery system, and here’s what motivates demand for its battery programs.

Deregulated electrical energy markets usually are not altruistic. Traders typically deploy capital to earn a monetary return ample for the danger to these returns, and with the ability to “assist” combine renewables is only a facet impact in my view. The entire quantity of the potential arbitrage revenue is instantly associated to the demand for batteries together with FLNC’s programs. That is the way it will play out:

Growing photo voltaic capability on the grid depresses daytime electrical energy costs. Shopping for electrical energy throughout the day and reselling electrical energy at greater night time time costs creates optimistic income. An vitality storage system is required to use this worth or time distinction.

The dimensions of the full arbitrage alternative is measured by:

width of the worth unfold the quantity that may be run by this unfold

Knowledge heart electrical energy demand progress will increase each elements by the mechanism of 100% renewable targets. Granted, arbitrage just isn’t the one method batteries could make a monetary return, but it surely is a crucial one.

FLNC’s Current Efficiency and Valuation

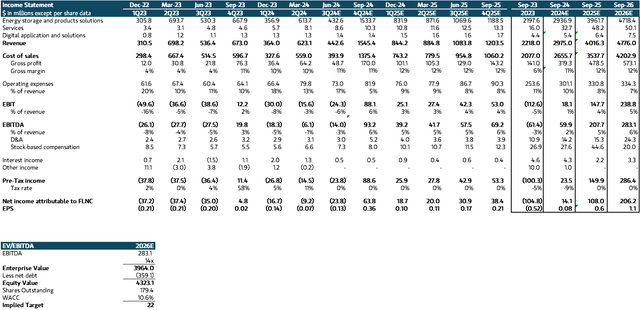

FLNC reported 2Q income of $623.1 million, beating consensus estimates of $531 million, primarily pushed by accelerated undertaking timing. Adjusted gross margins of 10.6% had been largely consistent with estimates, whereas adj EBITDA of -$6.1 million was barely forward of the anticipated -$7.61 million. Margin enlargement was fueled by a higher-margin product combine. Administration reaffirmed FY24 steerage with income projected between $2.7-3.3 billion, $50-80 million adjusted EBITDA, and $80 million FY24 recurring income, with 90% of FY24 income steerage already within the backlog.

Order consumption was about $713 million, representing a book-to-bill ratio of ~1.1x, the tenth consecutive quarter of bigger than 1.0x. The contracted backlog for Merchandise was 5.3 GW, up ~200MW from the final quarter. Companies was 3.6 GW, up ~100MW q/q, and Digital was 6.9 GW, up 1.2 GW q/q. The entire pipeline elevated to $16.3 billion, up 22% or $2.9 billion q/q.

Beneath a sturdy market backdrop of declining battery costs and growing vitality storage demand pushed by want for grid resiliency, and a pipeline of alternative now exceeding 16.3 billion and contracted backlog of $3.7 billion, I see the FY24 steerage and FY25 income progress goal of 35% as readily attainable.

The beneath mannequin is used to derive the worth goal for the inventory.

A 34% income progress in FY24 primarily based on administration’s information of $3 billion mid-point and avenue estimates, and a CAGR of 30% by FY26, anticipating it to develop on the similar pace because the market progress predicted by McKinsey & Firm. Gross margin of 12% primarily based on administration’s goal of 10-12% in FY2024. I imagine the excessive finish of the steerage is achievable attributable to a drop in battery enter costs. Opex progress no more than 50% of income progress primarily based on administration’s steerage. Goal worth is predicated on an assigned a number of of 14x my FY26 EBITDA estimate, discounted again one-year. The assigned a number of largely aligns with the typical ahead buying and selling a number of for the reason that firm’s fiscal 2023 year-end in September 2023.

In consequence, the implied goal worth for the inventory is $22 per share, representing 18% upside and 30% beneath present consensus.

Market Gems

Draw back Dangers:

1. FLNC’s income is sort of totally generated by vitality storage merchandise, and the principle driver is firms’ mandates on utilizing renewable vitality, which is an unsure issue itself. If there may be decreased demand for vitality storage merchandise, or if deployment of renewable vitality is slower than anticipated, demand for FLNC’s battery vitality storage {hardware} and software program companies could possibly be negatively impacted, resulting in destructive share efficiency.

2. FLNC’s gross sales rely upon a comparatively concentrated buyer base. In fiscal yr 2023, its high 2 prospects accounted for 49% of complete income. A lack of any vital buyer or a discount in pricing or order quantity might have a destructive influence on the corporate’s monetary outcomes.

3. FLNC sources parts and supplies from numerous worldwide distributors together with these in China, Korea, and Europe. Interruption of the movement of provide might disrupt FLNC’s potential to ship merchandise to prospects, and vital adjustments within the prices of uncooked supplies essential for the corporate’s merchandise might negatively influence its monetary outcomes.

Conclusion

Contemplating the expansion of utility-scale photo voltaic installations and AI workload, plus the truth that increasingly more firms are working in the direction of utilizing 100% renewable vitality, I imagine FLNC’s potential is underappreciated and it’s well-positioned to seize this demand with its battery system. My goal worth for the inventory implies 18% upside, however nonetheless moderately conservative in comparison with what the road thinks it ought to be buying and selling at. Purchase.

[ad_2]

Source link