[ad_1]

Natallia Pershaj/iStock by way of Getty Photographs

Liquid Pure Gasoline, generally known as LNG, had a surge in 2022. This was attributable to Russia’s invasion of Ukraine, which brought on European nations to vary their shopping for patterns. LNG delivery costs elevated accordingly.

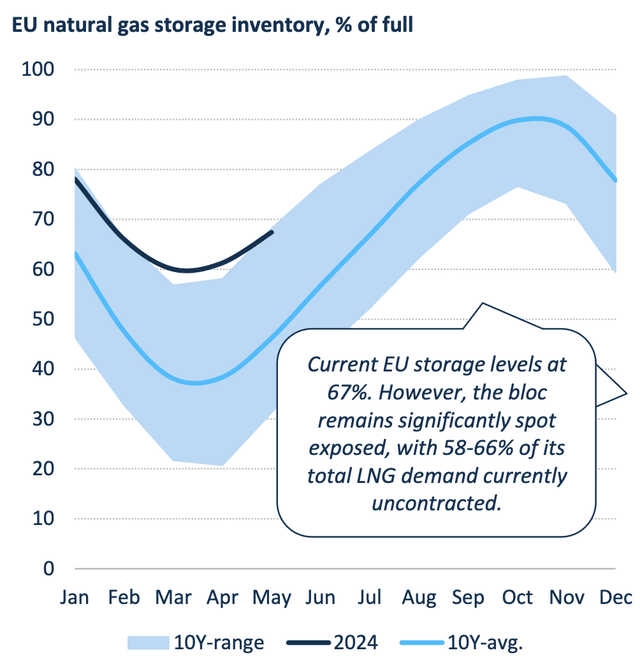

Europe stays the largest importer of LNG, but it surely seems to be adopting extra of a wait and see method in 2024, with as much as 66% of its LNG demand uncontracted:

FLNG website

Larger charges in 2022 allowed FLEX LNG Ltd. (NYSE:FLNG) to safe greater long-term constitution charges for its vessels. In addition they gave administration the wherewithal to lift dividends considerably.

Firm Profile:

Flex LNG Ltd. is an LNG delivery firm with a fleet of 13 gas environment friendly, fifth era LNG carriers. Its fleet consists of 9 M-type, Electronically Managed, Gasoline Injection (“MEGI”) LNG carriers, and 4 Era X Twin Gas (“X-DF”) LNG carriers constructed between 2018 and 2021. It additionally gives chartering and administration companies. Flex LNG Ltd. was included in 2006 and relies in Hamilton, Bermuda. (FLNG website.)

Fleet:

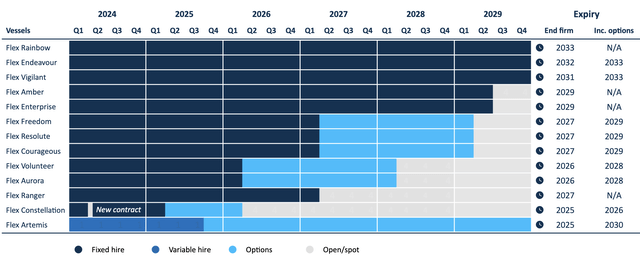

FLNG’s fleet has 50 years of minimal constitution backlog, which can develop to 69 years with charterer’s extension choices. FLNG has 3 charters fastened into 2030-2033, 2 fastened into 2029, 4 into 2027, and a couple of into 2026. The corporate’s shortest constitution is for the Flex Constellation. In January 2024, the charterer of Flex Constellation despatched discover that they won’t make the most of their extension possibility beneath the time constitution.

Nevertheless, Flex Constellation accomplished her 5-year particular survey in April, and traded in a difficult spot marketplace for a brief interval, earlier than commencing a agency time constitution of 312 days + 1-year charterer’s possibility.

The Flex Brave vessels progressing in keeping with schedule and funds. She is now at the moment out of drydock berthed alongside quay for finalization and anticipated to be again in service at end-Might.

Hidden Dividend Shares Plus

Business Tendencies:

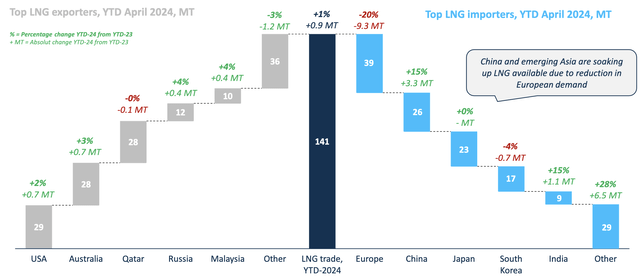

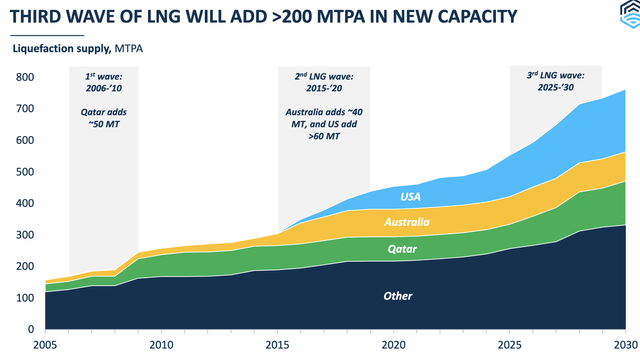

Whereas Europe remains to be the highest LNG importer, its 2024 utilization is down 20%, which has been changed by China, up 15%, and India, additionally up 15%, with different rising nations additionally profiting from decrease LNG costs.

The US, Australia, and Qatar are the highest 3 LNG exporters, with the US and Australia’s quantity each up 3%, and Qatar’s down barely in 2024, as of April.

FLNG website

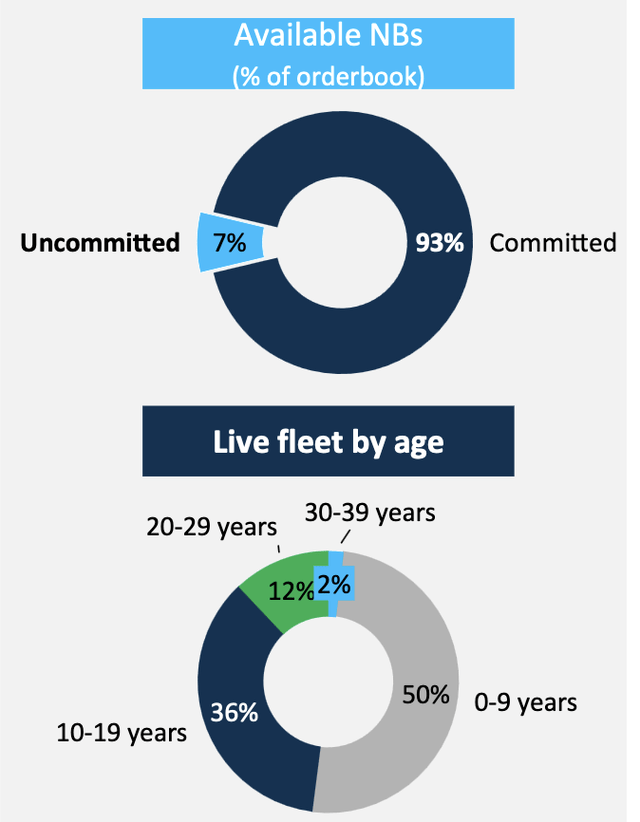

Whereas there’s a glut of newbuild vessels coming on-line in 2025–2027, however solely 7% are uncommitted, which ought to assist help delivery charges. FLNG is 100% booked in 2024, and 91% booked in 2025.

FLNG website

Countering the brand new provide of vessels is a third wave of LNG manufacturing, which ought to begin coming on-line in 2025:

FLNG website

Earnings:

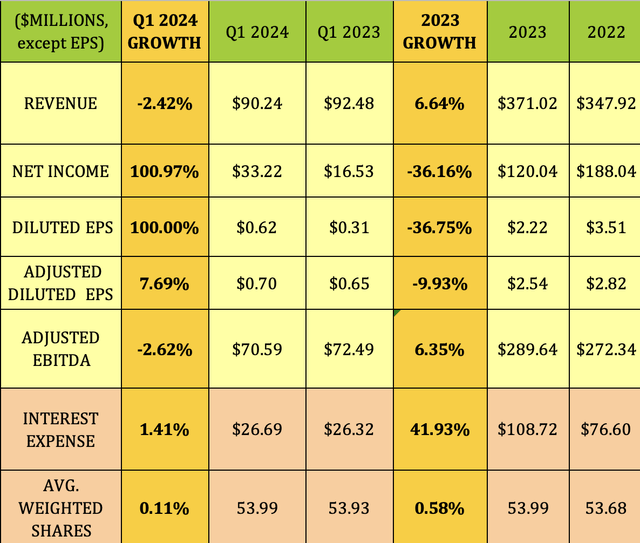

Q1 ’24: Income was decrease, as a result of drydocking operations. As well as, the common Time Constitution Equal (“TCE”) price was $76,539/day, vs. $81,114 per day for This fall 2023.

Internet Earnings and Diluted EPS each jumped ~100%, attributable to a $7M acquire on derivatives, vs. an $11M loss in Q1 ’23. Excluding that merchandise, Adjusted EPS rose 7.7%, whereas Adjusted EBITDA was down 2.6%. Curiosity expense and the share rely have been each ~flat.

2023: Income was up 6.6%, however Internet Earnings was down 36%, attributable to a $32M enhance in Curiosity expense, and an $80M lower in beneficial properties on derivatives. Adjusted internet revenue for the 12 months ended December 31, 2023, was $137.3 million and primary adjusted EPS of $2.56, in comparison with an adjusted internet revenue of $150.7 million and primary adjusted EPS of $2.83 for the 12 months ended December 31, 2022.

Hidden Dividend Shares Plus

2024 Outlook:

“Q2 is the softest quarter as a result of seasonality, so we do count on our Time Constitution equal earnings to be decreased barely in Q2, which has been the norm since we began this firm.

We count on these common charges to be round $72,000 to $74,000, as we do have one ship on variable greater constitution, and we additionally had Constellation uncovered to the spot marketplace for a brief time frame in Q2. Thus, revenues with two ships out of drydocking and the spot market as talked about, we count on revenues to be near $85 million for Q2.”

“Sometimes in Q3, we may have all ships again in operation. That are usually a greater quarter impacting the ship now we have on a variable greater, and often This fall is the strongest quarter as we’re heading into the winter season, the place demand is peaking.” (Q1 ’24 name.)

Dividends:

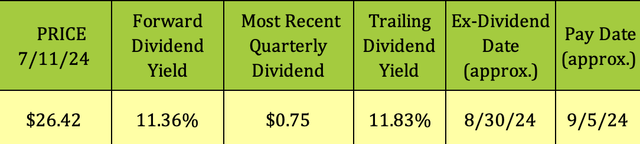

At its 7/11/24 value of $26.42, FLNG’s ahead dividend yield is 11.36%, whereas its trailing dividend yield is 11.83%. It ought to go ex-dividend subsequent on ~8/30/24, with a ~9/5/24 pay date.

Hidden Dividend Shares Plus

FLNG has an enormous 5-year dividend progress price of ~254%, as a result of huge ramp up in payouts in 2021 to $1.85, vs. simply $.20 in 2020.

Administration makes use of a mix of variables to find out dividend quantities, together with earnings, money move, liquidity, debt maturities, and capex liabilities, amongst others.

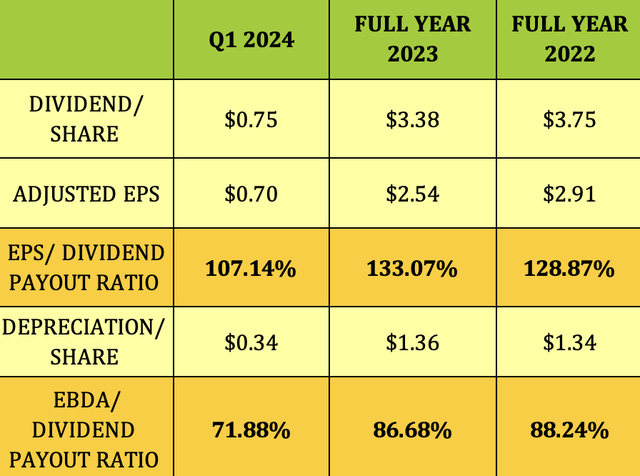

On an Adjusted EPS foundation, the Dividend Payout Ratio rose to 133% in 2023, vs. 129% in 2022, and improved to 107% in Q1 ’24, however was nonetheless over 100%.

Taking a look at protection on an EBDA foundation exhibits comparable ratios of ~87-88% in 2022-2023, and an improved ratio of 72% in Q1 ’24.

Hidden Dividend Shares Plus

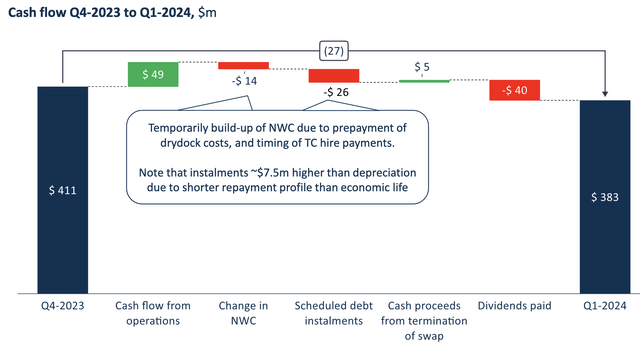

Money move from operations was $49M in Q1 ’24, vs. $40M in paid dividends, and -$40M in internet working capital adjustments & debt funds, leading to money declining by $28M to $383M, as of three/31/24.

FLNG website

Profitability & Leverage:

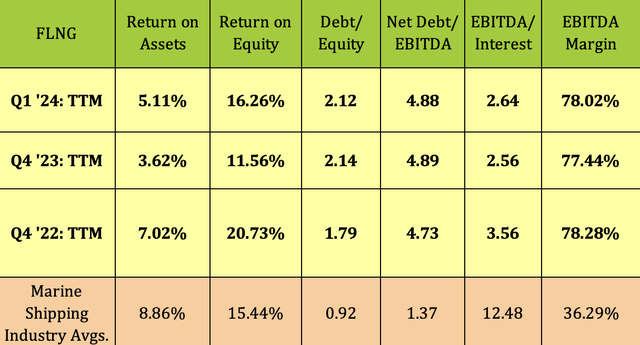

ROA and ROE each rose once more in Q1 ’24, after dropping in 2023, with ROA under Marine Transport averages, and ROE barely above them. The EBITDA Margin was secure, and far greater than common.

The Marine Transport trade usually does not use quite a lot of leverage — FLNG’s Internet Debt/EBITDA has been secure, however a lot greater than common up to now 2 years, whereas its Debt/Fairness can also be greater than common.

Hidden Dividend Shares Plus

Debt & Liquidity:

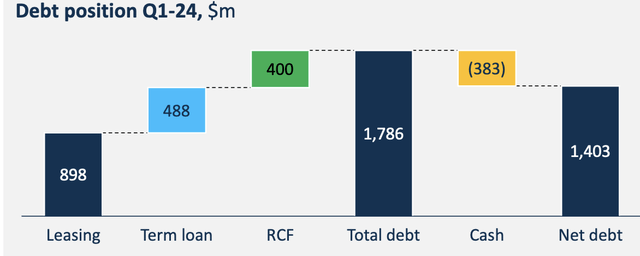

Administration makes use of a combo of fastened price leasing, $898M, and debt, $888M, to finance the fleet, ~evenly cut up:

FLNG website

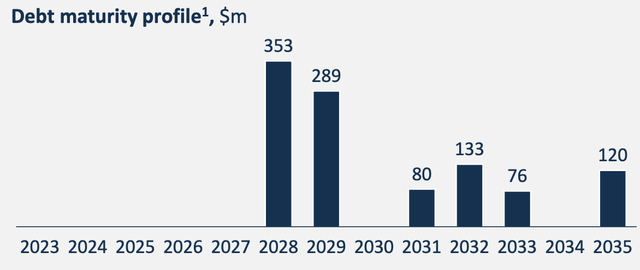

FLNG has no debt maturities till 2028, when 2 of its credit score services come due.

FLNG website

Efficiency:

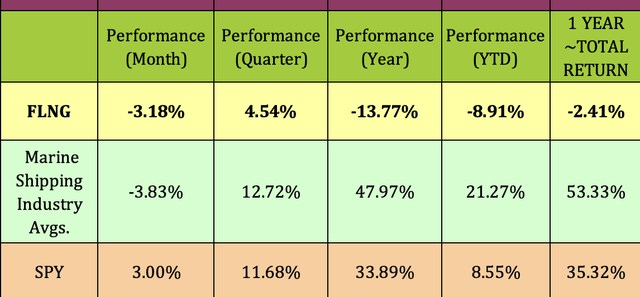

FLNG has lagged its trade by extensive margins over the previous quarter, 12 months, and up to now in 2024. It has been one of many worst performers in its trade, attributable to issues about attainable dividend cuts.

“So we attempt to all the time measure sort of if we’re shopping for different ships, we do not need to influence our dividend capability negatively. So if shopping for ships and getting a decrease return on that, then paying our dividends is what now we have to do, we moderately pay out the dividend.” (Q1 name)

Hidden Dividend Shares Plus

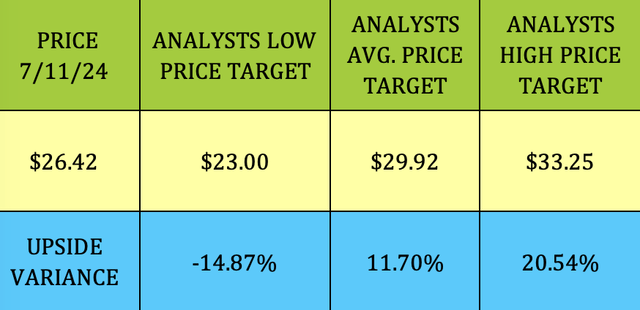

Analysts’ Worth Targets:

FLNG obtained a downgrade from Jefferies in February ’24, from maintain to underperform, with their goal dropping from $32 to $23.

At $26.42, FLNG is ~under 15% above avenue analysts’ low goal, and ~12% under the $29.92 common value goal.

Hidden Dividend Shares Plus

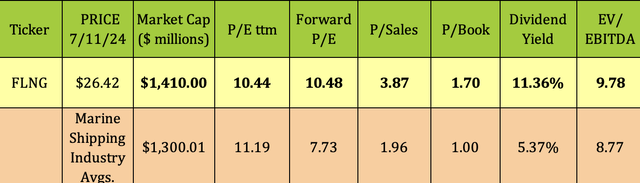

Valuations:

Whereas its trailing P/E is cheaper than the trade common, FLNG’s ahead 2025 P/E is way greater than common, as are its P/Gross sales, P/E-book, and EV/EBITDA. Its dividend yield is over 2X the trade common.

Hidden Dividend Shares Plus

Parting Ideas:

At $26.42, FLNG is ~9% above its 52-week low. It ought to declare the subsequent quarterly dividend and report Q2 earnings in mid-August. We’re staying on the sidelines for now. Though FLEX LNG Ltd.’s enterprise seems to be to be in a great place close to time period, we do not see any undervaluation at current.

All tables furnished by Hidden Dividend Shares Plus, except in any other case not

[ad_2]

Source link