[ad_1]

Alistair Berg

Shares of F&G Annuities & Life (NYSE:FG) have been a powerful performer over the previous 12 months, rising 34%; nonetheless, the inventory is down practically 20% since its latest excessive amid the broader market pullback. Given its higher-risk funding portfolio, shares can exhibit important market sensitivity, however the magnitude of this drop has been jarring. Due to this pullback, shares are down 9% since my Could article, recommending them as a “purchase.” That makes Monday evening’s earnings launch well-timed, and I stay bullish on FG.

Searching for Alpha

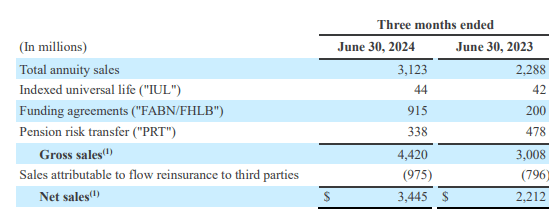

Within the firm’s second quarter, F&G earned $1.10, beating consensus by $0.02, as product sales rose by 47% to $4.4 billion. This represented a report degree of product sales, given the sturdy demand for annuity merchandise. Web gross sales of $3.4 billion have been additionally up 30% from final 12 months. As traders look to lock in present charges, we now have seen important demand for annuities, with whole annuity gross sales up 36% from final 12 months.

F&G

As well as, F&G has meaningfully elevated funding agreements gross sales. Right here, it sells bonds which can be backed by an insurance coverage coverage. It then makes use of the proceeds to spend money on its basic account, and it earns the web unfold between its invested rate of interest and what it pays on the notes. These are purely a internet funding earnings car with no materials underwriting danger. Pension danger switch (PRT) gross sales are typically risky as they’re often giant chunks of plans.

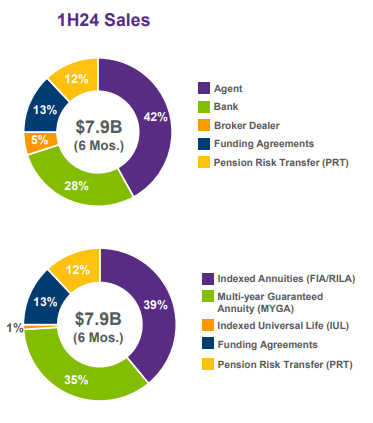

Thus far in 2024, listed annuities account for the plurality of gross sales, adopted by assured annuities. Annuities account for about 75% of gross sales. Q2 noticed a bit much less pension danger switch exercise and a bit extra funding settlement. F&G additionally continues to take care of a reasonably various gross sales stream, counting on each brokers and accomplice banks and dealer sellers.

F&G

Whereas product sales have been very sturdy, there has additionally been elevated give up exercise. As an example, F&G had $578 million of internet fastened index annuity (FIA) flows. That is down from $628 million final 12 months even with product sales rising considerably, because of elevated terminations. Throughout a time frame after shopping for an annuity, the patron can give up the coverage and obtain money. A policyholder might select to do that when charges have risen considerably as their coverage got here at decrease charges. With money, the policyholder can purchase a brand new coverage at at the moment’s charges.

Now, you will need to observe that when a policyholder chooses to terminate the coverage that they pay a penalty. This results in a give up payment and permits the insurer to e-book a revenue. It additionally frees up the capital related to that coverage for use for brand spanking new insurance policies, which is why we’re seeing such sturdy gross sales exercise. Importantly, even with give up exercise elevated, F&G continues to develop. Its AUM of $52.2 billion was up 13% from final 12 months.

Due to greater rates of interest and a rising portfolio, F&G earned $684 million of funding earnings from $252 million final 12 months. $145 million of funding earnings got here from alternate options. This underperformed expectations by $20 million or $0.15. Over the long-term, F&G targets a10% return in alternate options; nonetheless, they’ve generated 8.1% this 12 months.

Now, F&G has earned a 13% historic common return on this allocation, so it has been a prudent investor. Different returns will be risky. Whereas the sturdy inventory market needs to be supporting returns, elevated rates of interest have weighed on personal fairness and personal actual property valuations. Returns right here can lag public markets by a few quarter, so if we do see the latest market weak point persist that’s more likely to be a headwind for outcomes, however it could affect This autumn earnings greater than Q3 earnings.

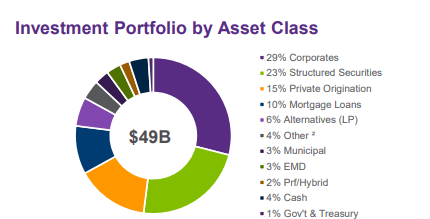

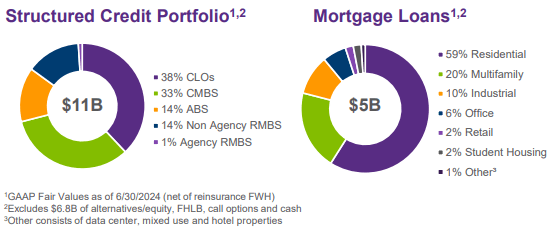

Inside its funding portfolio, 96% of fastened earnings is funding grade. Nonetheless, its fastened earnings allocation contains exposures to much less liquid markets which have greater perceived danger. On account of this, I’ve talked about that we will see F&G come below stress in periods of market turmoil, as we now have seen just lately. Notably, it has 23% in structured securities and 15% in personal debt, in addition to a significant publicity to actual property.

F&G

Structured securities are typically much less liquid, as their tranche sizes will be comparatively small. During times of market stress when liquidity is diminished, illiquid securities can have even wider value swings, inflicting exaggerated market actions. This may result in painful losses if a pressured vendor. Importantly, given the long-term nature of annuity contracts, F&G is very unlikely to be a pressured vendor and might as a substitute experience out intervals of stress. What’s crucial is that its securities mature at par and don’t default.

F&G

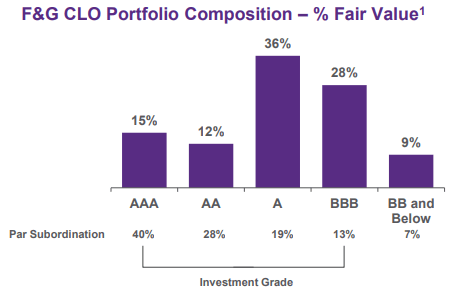

F&G is a “purchase and maintain” investor, which permits it to abdomen illiquidity. In fact, even purchase and maintain traders face losses if the underlying safety defaults. That’s the reason I’m comforted by the truth that just one.8% of the portfolio is in workplace, the business actual property sector with probably the most stress. Its CLO publicity can be a supply of focus, given these securities are backed by loans to extra levered corporations, which face higher danger of default in an financial downturn.

Because of this you will need to emphasize F&G largely invests excessive within the CLO capital construction, offering it important credit score safety, a purpose why CLOs have traditionally carried out effectively, even throughout financial downturns like 2008. As an example, an “A” rated CLO has 19% par subordination. This implies the underlying pool of loans may lose 19% on defaults earlier than an A-rated safety faces any losses. Past par subordination, the underlying portfolio has the next rate of interest than the debt, offering additional safety.

F&G

Whereas it has some high-yield CLO publicity, as you possibly can see above, the overwhelming majority of its portfolio is funding grade. On common, there’s over 20% subordination. Given losses on mortgage defaults are typically lower than 50%, there might be a surge of company defaults earlier than we see losses on CLO debt. As a result of it has a big, securitized portfolio, traders will proceed to deal with F&G with warning throughout bouts of volatility, however I view its investing program as sound.

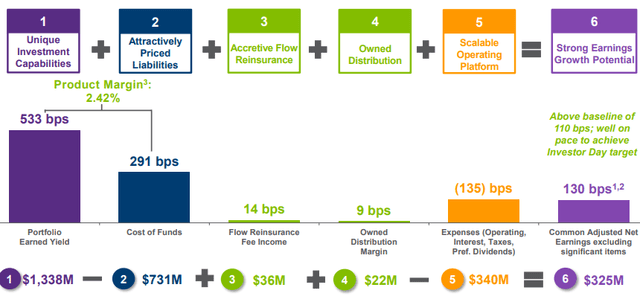

Through the quarter, it generated a 0.98% return on property. Excluding the underperformance of alternate options, it generated a 1.3% return on property, 20bps above goal. Certainly, credit score losses proceed to run under mannequin at about 5bps, supporting additional returns. As you possibly can see, it’s incomes a 241bp internet funding unfold.

F&G

Over the approaching quarters, I anticipate to see its price of funds enhance, because it sells extra annuities within the present charge world. Even because the Federal Reserve prepares to chop charges, will probably be a while earlier than we’re again under 3%. Nonetheless, funding yields are additionally considerably greater, and so the portfolio yield ought to proceed to rise.

Within the coming quarters, I see three objects to deal with. First, we are going to wish to see credit score losses stay low to validate my view that the structural protections in its securities are enough. I consider we would want to see a fabric financial downturn to inflict important losses, not only a additional slowing. This isn’t my base case.

Subsequent, it’s my expectation that various funding returns will stay under long-term averages as long as market volatility persists. Whereas I don’t see returns rising again to 10% within the subsequent few quarters, I do anticipate them to stay constructive, possible at 5-8%. Underperformance under this threshold can be an space of concern.

Lastly, one damaging within the quarter was that it had $16 million of actuarial mannequin replace prices. Insurers are all the time reviewing previous insurance policies to see how they’re performing vs expectations and sometimes alter reserves. It’s all the time preferable to see a good reserve revision. This adjustment was minor, and its fastened index annuities are comparatively easy vs the extra complicated variable annuities that have been regularly bought 10-20 years in the past. I’ve considered F&G as dealing with extra funding than underwriting danger.

It is a small revision that doesn’t make me but query that underlying view. Nonetheless, additional damaging updates would possible weigh on shares. This setting is probably going going to make it troublesome for F&G to commerce previous its $42.52 e-book worth, as there’s some uncertainty over market ranges on its property in addition to a construct in reserves. Importantly, F&G maintains a strong steadiness sheet. It has a 26.4% debt to capital because of issuing debt to pre-fund a 2025 maturity. Adjusting for this funded maturity, debt to capital is 23.5%, under its 25% goal.

In my prior article, I argued F&G may commerce to 1.1x e-book worth or $45, which it did attain briefly. Until we see the market rebound, I don’t see F&G recovering all that means. Nonetheless, with over $4.10 in earnings energy, I do consider shares ought to commerce at e-book worth or about $42.50. That gives about 15% upside, alongside a 2% dividend. Whereas F&G will exhibit a excessive beta to the market, the underlying danger in its portfolio is extra mark-to-market than credit score danger. As such, I’d use this drop to purchase and see shares recovering a lot of their losses.

[ad_2]

Source link