[ad_1]

Featured Content material

Alamos Gold Inc. (AGI) is a Canadian-based gold mining firm that focuses on the acquisition, exploration, and growth of mineral properties in North America. Based in 2003, Alamos Gold has established itself as a dependable producer of gold, with operations primarily in Canada and Mexico.

The corporate’s mission is to create long-term worth for its shareholders by growing high-quality gold belongings and working towards sustainable mining. Alamos Gold operates a number of key belongings, together with the Younger-Davidson and Island Gold mines in Ontario, Canada, in addition to the Mulatos mine in Sonora, Mexico.

The corporate is thought for its dedication to accountable mining practices, prioritizing environmental stewardship, neighborhood engagement, and security all through its operations. Alamos Gold’s exploration efforts give attention to increasing its present assets and discovering new gold deposits, which boosts its progress potential and ensures a gentle pipeline of initiatives.

The principle drivers of progress for Alamos Gold embody the growing world demand for gold, significantly as a safe-haven asset throughout financial uncertainty. With rising gold costs, the corporate is well-positioned to capitalize on its established operations and ongoing exploration initiatives.

Moreover, Alamos Gold’s dedication to operational effectivity and value administration permits it to keep up profitability even in fluctuating market situations. The corporate’s strategic give attention to sustainability and neighborhood relations additionally enhances its status and helps long-term success. Be taught extra at Alamos Gold Inc..

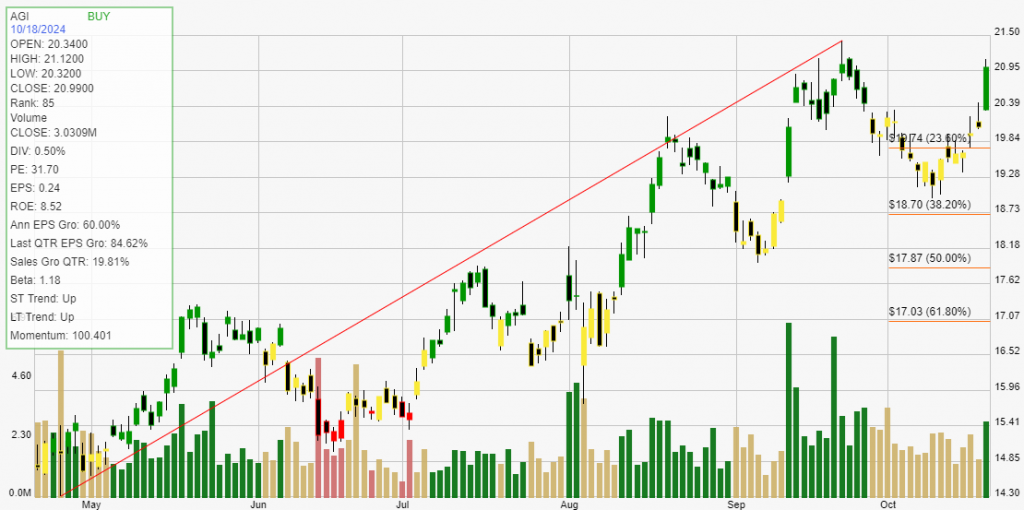

Click on The Picture For Present Dwell Chart

Backtesting a inventory can present traders with crucial statistical knowledge. These outcomes offer you an knowledgeable perspective on how a inventory trades inside your chosen shopping for and promoting technique of research. The definition of commerce expectancy is outlined as: commerce expectancy = (chance of win * common win) – (chance of loss * common loss). If the calculation returns a optimistic quantity, a dealer ought to earn money over time.

The typical share gained on optimistic, cash making trades was 16.5%. Whereas the common p.c loss on cash shedding trades was 0.00%.

Commerce expectancy consists of each winners and losers. Commerce expectancy is displayed as a share. This backtest shows the greenback worth, share, annual commerce expectancy, and annual p.c. Annual expectancy is the commerce expectancy share multiplied by the variety of trades per 12 months.

The Commerce expectancy % for AGI over the previous 12 months is 16.5%. The variety of trades generated per 12 months was 3 giving an Annual Commerce Expectancy of 49.51%

The typical days in a commerce is 86 and the common days between trades is 63.

With any technique of research that makes use of previous efficiency, it may be stated that previous efficiency shouldn’t be indication of future efficiency. What’s does present is a probabilistic have a look at a inventory’s value exercise traits over time.

Click on To Obtain Report and Backtest Information ![]()

[ad_2]

Source link