[ad_1]

haydenbird

The Eaton Vance Tax-Advantaged International Dividend Alternatives Fund (NYSE:ETO) is a well-liked world closed-end fund that buyers can use to earn a excessive stage of revenue with no need to sacrifice their fairness publicity. The fund manages to do pretty properly at this activity, because it yields 8.25% on the present value, which is considerably greater than any of the key home or world fairness indices:

Index

TTM Yield

S&P 500 Index (SP500)

1.26%

MSCI World Index (URTH)

1.54%

MSCI All-Nations World Index (ACWI)

1.69%

Click on to enlarge

Nonetheless, as is steadily the case with Eaton Vance funds, the yield of the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is decrease than that of a lot of its friends:

Fund Identify

Morningstar Classification

Present Yield

Eaton Vance Tax-Advantaged International Dividend Alternatives Fund

Hybrid-International Allocation

8.25%

Calamos International Dynamic Revenue Fund (CHW)

Hybrid-International Allocation

8.82%

Clough International Alternatives Fund (GLO)

Hybrid-International Allocation

11.01%

LMP Capital and Revenue Fund (SCD)

Hybrid-International Allocation

8.68%

PIMCO International StocksPLUS & Revenue Fund (PGP)

Hybrid-International Allocation

10.88%

Virtus Complete Return Fund (ZTR)

Hybrid-International Allocation

10.45%

Click on to enlarge

As could be clearly seen, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund has a decrease yield than different world hybrid funds. This might show to be one thing of a turn-off for potential buyers, notably since many buyers who would in any other case be keen on a fund similar to this one want to maximize the incomes that they obtain from their property.

With that mentioned, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund does focus its consideration extra on equities than another hybrid funds, and this might give it some benefits over its friends. Specifically, the fund will in all probability do significantly better at defending its shareholders in opposition to inflation than a fund that’s extra closely weighted towards bonds. As I defined in a current article:

One of many good issues about this fund is that it invests in fairness securities, so it offers a certain quantity of safety in opposition to inflation, which can be a much bigger drawback going ahead than it has been prior to now. In any case, the projections for big fiscal deficits going ahead are well-known, and it’s tough to see any method for these deficits to be funded by any technique other than the creation of latest forex. Traditionally, equities, actual property, and gold have been the perfect methods to protect the buying energy of your cash in opposition to inflation.

The very fact, then, that the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund primarily focuses on equities may make it extra engaging than bond-focused hybrid funds for long-term buyers who’ve to fret about inflation chipping away on the buying energy of their cash.

As common readers may bear in mind, we beforehand mentioned the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund in mid-February of this yr. The fairness market, each domestically and internationally, has been remarkably sturdy since that point. Thus, we’d anticipate that this fund has offered a reasonably engaging return for its buyers over the intervening six-month interval.

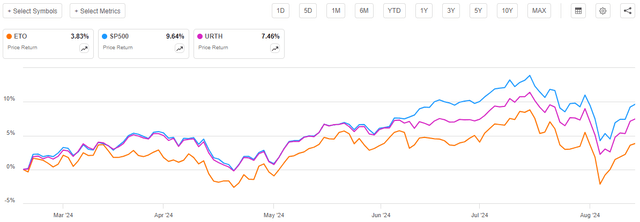

This has been the case, however sadly, the fund’s efficiency was not almost nearly as good as is likely to be anticipated. As we are able to see right here, the fund’s share value solely elevated by 3.83% for the reason that publication date of my earlier article. That’s worse than each the S&P 500 Index and the MSCI World Index delivered over the identical interval:

Searching for Alpha

That is definitely not what most potential buyers need to see. Whereas the fund delivered a optimistic return over the interval, no one likes to underperform the broader market by almost 600 foundation factors. Buyers who’re interested in revenue are typically prepared to just accept a decrease return in change for a better stage of revenue, however this could possibly be an excessive amount of underperformance to abdomen.

Nonetheless, it is very important remember the fact that buyers on this fund will at all times do higher than the share value efficiency suggests. As I defined in my earlier article on this fund:

The above chart doesn’t precisely present the return that buyers within the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund obtained over the interval. It is because the modus operandi for a closed-end fund like that is to pay out all of its funding income to the shareholders within the type of distributions whereas making an attempt to keep up a comparatively secure web asset worth. As such, the distributions play a a lot bigger position within the whole return that buyers obtain than it does in an index fund. As such, we have to embrace the distributions within the efficiency chart above to see how buyers within the fund really did.

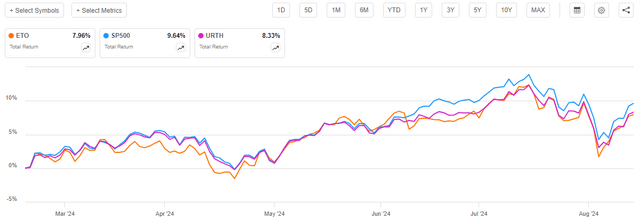

This various chart reveals what occurs after we add the distributions paid by each the indices and the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund to the share value efficiency:

Searching for Alpha

This definitely makes it simpler to abdomen the efficiency of the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund. As we are able to see, the fund’s shareholders obtained a 7.96% whole return over the interval, which remains to be shy of each indices however not almost to the identical extent. There are undoubtedly some buyers who is likely to be prepared to just accept this relative efficiency in change for the upper yield offered by this fund.

As six months have handed since our earlier dialogue, we are able to anticipate that a whole lot of issues have modified which will have an effect on our thesis relating to this fund. This text will focus particularly on these adjustments, with a concentrate on the contents of the fund’s lately launched semi-annual report.

About The Fund

In response to the fund’s web site, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund has the first goal of offering its buyers with a excessive stage of after-tax whole return. This makes a certain quantity of sense for an fairness fund, since equities are by their nature, whole return autos. Buyers who buy frequent equities usually accomplish that as a result of they want to obtain a certain quantity of revenue through the dividends and distributions paid out by the issuing firm to its stockholders in addition to profit from the truth that the securities ought to rise in value because the issuing firm grows and prospers.

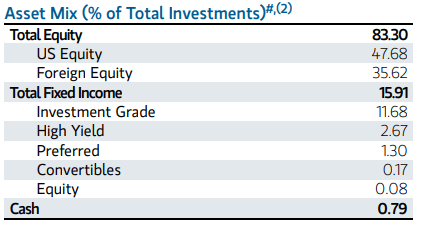

Nonetheless, we noticed within the introduction that the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is classed as a hybrid fund by Morningstar. This implies that the fund invests in each frequent equities and fixed-income securities. No point out is made from this on the web site, though the very fact sheet does state that the fund invests in each frequent and most popular shares. From the very fact sheet:

The Fund invests primarily in world dividend-paying frequent and most popular shares and seeks to distribute a excessive stage of dividend revenue that qualifies for favorable federal revenue tax remedy.

The very fact sheet says nothing in regards to the anticipated weights that the fund will assign to frequent equities or most popular shares. As of proper now, the fund’s portfolio is primarily invested in equities:

Fund Reality Sheet

Nonetheless, the very fact sheet doesn’t state whether or not or not this can at all times be the case. These buyers who’re in search of inflation safety would in all probability desire that the fund stay centered on equities because of the truth that inflation causes company income to rise and that ought to push up the worth of frequent equities issued by these corporations which are benefiting from these rising income. Mounted-income securities don’t have any such safety, since there isn’t any hyperlink to the expansion and prosperity of the issuing firm.

Nonetheless, fixed-income securities (particularly most popular shares) do have considerably greater yields. We will see that fairly merely in the truth that the ICE Change-Listed Most popular & Hybrid Securities Index (PFF) has a trailing twelve-month yield of 6.32%. That’s clearly a lot greater than the yields of the frequent fairness indices offered within the introduction. Thus, by rising the proportion of its portfolio invested in these securities, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund may earn a better stage of revenue that may be distributed to its shareholders. There’s, subsequently, a trade-off in place. It’s price noting although that the MSCI World Index has delivered a considerably greater whole return than most popular shares over the previous 5 years:

Searching for Alpha

The upper yields of most popular shares had been clearly not sufficient to make up for the truth that they’ve very restricted capital appreciation potential. There isn’t a cause to suspect that this dynamic will change sooner or later, so buyers will in all probability be greatest served by this fund focusing its efforts on frequent equities. That is at the moment the case, however there’s nothing within the truth sheet or on the web site that claims something about whether or not or not administration can change their minds.

The fund’s prospectus likewise says nothing a couple of particular mandate being in place for the diploma to which the fund will spend money on frequent shares versus most popular shares. This doc describes the fund’s technique thusly:

Beneath regular market circumstances, the Fund will make investments no less than 80% of its whole managed property in dividend-paying frequent and most popular shares of U.S. and international issuers that the portfolio managers consider on the time of funding are eligible to pay dividends which will represent certified dividend revenue and, subsequently, qualify for federal revenue taxation at charges relevant to long-term capital positive factors. Distributions of funding revenue correctly reported by the Fund as derived from tax-advantaged dividend revenue will probably be taxed within the arms of people on the charges relevant to long-term capital achieve, offered holding interval and different necessities are met at each the shareholder and Fund stage. The rest of the Fund’s portfolio could also be invested in shares and different investments that pay dividends, distributions or different quantities taxable for federal revenue tax functions at charges relevant to atypical revenue. The portfolio managers retain broad discretion to allocate the Fund’s investments in a way that they consider will greatest effectuate the Fund’s goal.

The final sentence on this quote is the one assertion that the fund’s prospectus makes in regards to the relative weighting between frequent and most popular shares, and it principally says that administration can use its greatest judgment. This has, over the previous decade no less than, favored frequent shares, however there isn’t any assure that this can at all times be the case. Excessive-rated bonds are often thought of to be preferable to frequent shares throughout a recession, which could prolong to most popular shares as properly. The one factor that could possibly be labeled as a recession over the previous ten years was a really quick time period in 2020 when the lockdowns had been in full power, and all people was fearful of the COVID-19 virus. From the beginning of February 2020 till the beginning of Could 2020, most popular shares did outperform the MSCI World Index:

Searching for Alpha

It’s potential that this can occur once more when the subsequent recession strikes. There’s definitely no assure of this, nonetheless, and contemplating that varied central banks would in all probability implement quantitative easing fairly shortly and start flooding the world with extra money, we’d in all probability see any benefit that most popular shares might need shortly get erased. As such, I can’t actually understand a time when it will be acceptable for the fund to be extra closely weighted towards most popular shares than frequent shares. It’s good to know that the fund has that possibility, nonetheless, even when it does make us a bit much less sure about what the fund is likely to be holding at any given second.

In varied earlier articles, we have now seen that lots of the Eaton Vance closed-end funds have very excessive publicity to the American mega-cap know-how corporations which have turn out to be an outsized proportion of many portfolios over the previous fifteen years. This one isn’t any exception, as we are able to see by trying on the largest holdings within the fund:

Eaton Vance

We will see right here that there are six firm corporations on the listing – Microsoft (MSFT), Alphabet (GOOG), NVIDIA (NVDA), Amazon.com (AMZN), Apple (AAPL), and Micron Know-how (MU) – which mixed account for twenty-four.34% of the fund’s web property. Apparently, that is barely beneath the allowable stage. In response to the fund’s prospectus (linked earlier):

The Fund might not make investments 25% or extra of its whole managed property within the securities of issuers in any single trade. The Fund might make investments a good portion of its property within the securities of any single trade or sector of the economic system if corporations in that trade or sector meet the Fund’s funding standards. The Fund might make investments a good portion of its property in every of the power, uncooked supplies, actual property, utilities and monetary companies sectors.

Because the six know-how corporations proven within the fund’s largest positions listing put it slightly below the 25% most allowable stage, we’d make the idea that the fund has no different know-how holdings. Nonetheless, the schedule of investments discovered within the semi-annual report lists Adobe (ADBE), Intuit (INTU), Taiwan Semiconductor Manufacturing (TSM), ASML Holding (ASML), and Infineon Applied sciences (OTCQX:IFNNF) along with the businesses proven above. The fund will get round this 25% mandate by claiming that Amazon.com is a retailer and Alphabet is a media firm. Many buyers will doubtless query these classifications, particularly given the truth that all of them have a number of strains of enterprise and in Amazon’s case, its cloud computing providing has lengthy been believed to be way more worthwhile than the retail arm. Thus, we may make a great argument that the fund is in violation of its personal diversification mandate with these holdings.

Most buyers, particularly American buyers, are inclined to have already got a considerable quantity of publicity to all of the mega-cap know-how corporations because of their dominant positions in the entire main indices that embrace U.S. frequent shares. Thus, this fund holding them does little to enhance the diversification of a mean portfolio that’s already reliant on the efficiency of a handful of huge corporations. Potential buyers ought to take this into consideration earlier than buying this fund.

Leverage

As is the case with most closed-end funds, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund employs leverage as a way of boosting the efficient yield and whole returns that it earns from the property in its portfolio. I defined how this works in my final article on this fund:

In brief, the fund borrows cash after which makes use of that borrowed cash to buy frequent shares or different property. So long as the bought property ship a better whole return than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly properly to spice up the efficient return of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can often be the case.

Nonetheless, using debt on this style is a double-edged sword. It is because leverage boosts each positive factors and losses. As such, we need to be certain that the fund just isn’t utilizing an excessive amount of leverage as a result of that may expose us to an excessive amount of danger. I don’t typically wish to see a fund’s leverage exceed a 3rd as a share of its property for that cause.

As of the time of writing, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund has leveraged property comprising 19.12% of its general portfolio. This can be a slight enhance over the 18.92% leverage that the fund had the final time that we mentioned it, which is slightly shocking. In any case, the fund’s share value has elevated for the reason that date of our earlier dialogue, so we’d anticipate that the leverage ratio would have come down a bit.

The truth that the fund’s leverage ratio has elevated is much more shocking after we think about that the fund’s web asset worth has elevated since our final dialogue. We will see that fairly clearly right here:

Barchart

As proven, the fund’s web asset worth has elevated by 2.87% since our earlier dialogue. Logically, that ought to have decreased the fund’s leverage ratio, for the reason that leverage ratio is a share of debt to whole property. Nonetheless, if the fund really borrowed extra money within the final six months, that may clarify the rise in leverage. In reality, that’s the solely potential clarification right here.

Regardless of the rise in leverage, the fund stays properly beneath the one-third most that we ordinarily think about to be acceptable for an fairness closed-end fund. It’s also beneath the extent of most of its friends:

Fund Identify

Leverage Ratio

Eaton Vance Tax-Advantaged International Dividend Alternatives Fund

19.12%

Calamos International Dynamic Revenue Fund

31.83%

Clough International Alternatives Fund

30.48%

LMP Capital & Revenue Fund

19.06%

PIMCO International StocksPLUS & Revenue Fund

18.01%

Virtus Complete Return Fund

30.63%

Click on to enlarge

(all figures from CEF Information)

We will clearly see that the present leverage of the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is consistent with its extra conservatively financed friends. It’s nowhere close to the aggressive ratios utilized by the Calamos, Clough, or Virtus funds. As such, we are able to conclude that the fund’s present stage of leverage is affordable given its technique. We must always not fear about it an excessive amount of.

Distribution Evaluation

The first goal of the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is to supply its buyers with a really excessive stage of whole return. As is the case with most closed-end funds, it primarily delivers this return via direct funds to its shareholders. In accordance with this technique, the fund pays a month-to-month distribution of $0.1733 per share ($2.0796 per share yearly). This provides the fund an 8.25% yield on the present share value, which as we have now already seen is a bit decrease than a lot of its friends possess.

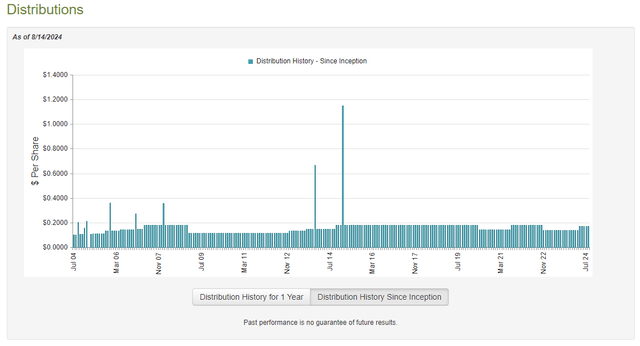

The fund has not been particularly in step with respect to its distributions over its historical past:

CEF Join

From my earlier article on this fund:

This will likely scale back the fund’s attraction to these buyers who’re in search of to earn a secure and safe revenue from the property of their portfolios. The truth that the fund reduce its distribution again in 2022 could possibly be particularly disheartening due to the extremely excessive stage of inflation that we have now seen for the reason that finish of the pandemic. This inflation has decreased the buying energy of the distributions that we obtain from funds like this, so buyers want a better stage of revenue to keep up a sure way of life. A distribution reduce has the other impact, because it reduces revenue and vastly reduces the variety of items and companies that may be bought with the distribution. Thus, buyers who’re depending on the distribution that this fund pays out have undoubtedly felt themselves getting poorer and poorer over the previous few years.

The fund did, happily, enhance its distribution again in April and the present fee is 26.13% greater than what the fund was beforehand paying out. This definitely beat inflation over the previous yr or two, however it’s nonetheless decrease than what the fund was paying out previous to the 2022 reduce. Thus, revenue buyers are nonetheless worse off than they had been again in 2021.

We nonetheless ought to examine the fund’s capability to keep up its distribution on the present stage, since that’s by far crucial factor for any potential investor who is likely to be contemplating buying the fund’s shares at the moment.

As of the time of writing, the newest monetary report that’s accessible for the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is the semi-annual report for the six-month interval that ended on April 30, 2024. A hyperlink to this report was offered earlier on this article. This can be a a lot newer report than the one which was accessible the final time that we mentioned this fund, which is sweet, as it’ll work properly for an replace.

For the six-month interval that ended on April 30, 2024, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund obtained $10,439,404 in dividends and $2,347,747 in curiosity from the property in its portfolio. When mixed with a small quantity of revenue from different sources, the fund had a complete funding revenue of $12,809,995 for the interval. It paid its bills out of this quantity, which left it with $7,165,715 accessible to shareholders. That was not almost sufficient to cowl the $14,098,715 that the fund paid out in distributions over the interval.

As is likely to be anticipated, given the distribution enhance, the fund was in a position to make up the distinction via capital positive factors. For the six-month interval that ended on April 30, 2024, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund reported web realized positive factors of $12,376,371 together with web unrealized positive factors of $58,356,277. The fund’s web property elevated by $63,799,648 after accounting for all inflows and outflows through the interval.

Thus, it definitely seems that the distribution is secure proper now, though a market correction may nonetheless jeopardize it if the fund fails to understand a few of these unrealized positive factors.

Valuation

Shares of the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund are at the moment buying and selling at a 7.39% low cost to web asset worth. This isn’t as engaging because the 8.60% low cost that the shares have averaged over the previous month. As such, it is likely to be potential to get a greater value by ready for a bit bit.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged International Dividend Alternatives Fund is an attention-grabbing closed-end fund that invests in each fixed-income securities and customary shares from all over the world. The fund’s administration seems to have quite a lot of freedom relating to the weightings of every safety kind, however traditionally frequent shares have delivered higher whole returns, so the fund is concentrated on these for now. This flexibility may work to the fund’s benefit within the occasion of a recession or comparable financial occasion, nonetheless. It’s unsure whether or not or not the U.S. economic system will enter right into a recession within the close to future, however that might nonetheless be a safety that’s worthwhile to have.

The fund is absolutely overlaying its distribution, and it’s buying and selling at a reduction, though its yield is decrease than some friends.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link