[ad_1]

Key Takeaways

Ethereum ETF launch anticipated to draw institutional traders in Q3 2024

Cardano’s Chang exhausting fork goals to implement decentralized governance by July’s finish

Share this text

Three main catalysts are set to influence the crypto market in Q3 2024, in keeping with the most recent version of IntoTheBlock’s e-newsletter “On-chain Insights”. The occasions embody the buying and selling begin of spot Ethereum (ETH) exchange-traded funds (ETF) within the US, the Uniswap V4 launch, and Cardano’s Chang exhausting fork.

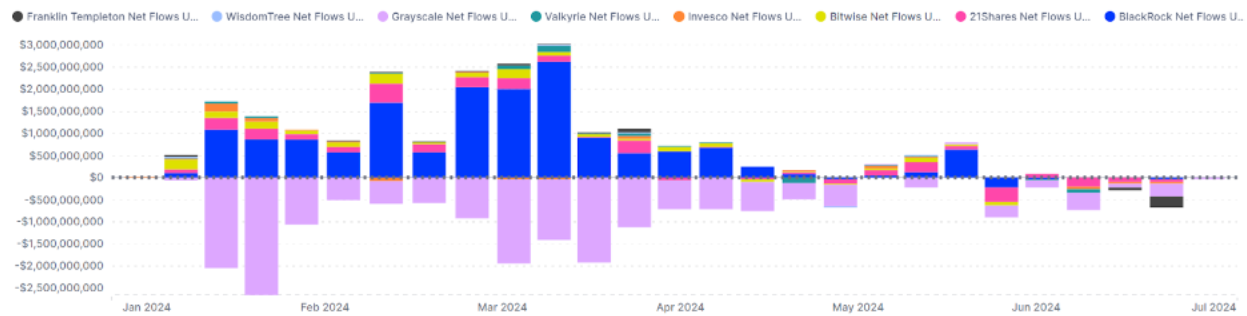

The Ethereum ETF is anticipated to launch this quarter, doubtlessly attracting institutional traders. Analysts at IntoTheBlock predict ETH ETF inflows might attain 30% of these seen throughout the Bitcoin ETF introduction, which noticed $5 billion in web inflows over its first 5 months.

As reported by Crypto Briefing, asset administration agency Bitwise’s CIO predicted that Ethereum ETFs might entice $15 billion by the top of 2025.

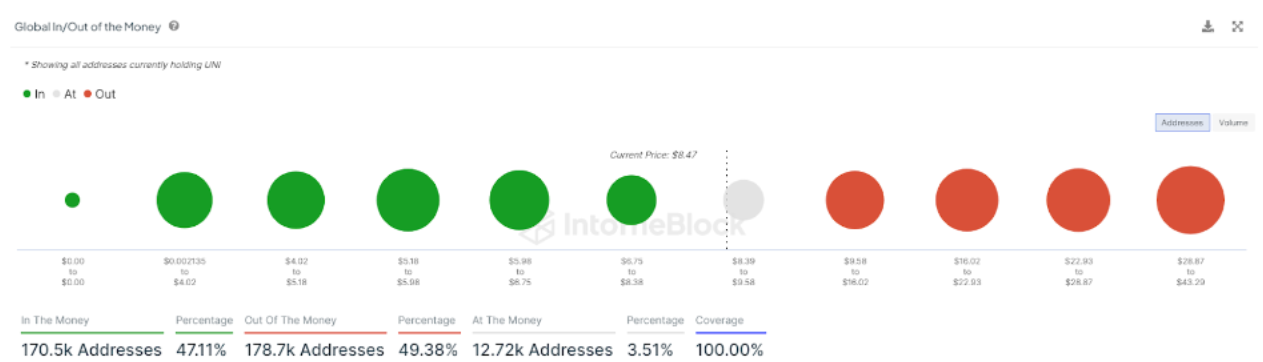

Uniswap, the most important decentralized alternate by complete worth locked, plans to launch its V4 model. That is the second growth in crypto seen by IntoTheBlock analysts as a possible catalyst for costs in Q3.

Notably, the V4 replace introduces “hooks” for personalisation, dynamic charges, on-chain restrict orders, and time-weighted common market maker performance.

Furthermore, Cardano goals to implement the Chang exhausting fork by the top of July, introducing decentralized, community-run governance. The Chang improve will proceed as soon as 70% of stake pool operators have examined and up to date their programs.

That is additionally a growth in crypto that would enhance costs on this quarter, the analysts identified.

These developments comply with historic developments of catalysts boosting asset values. Through the month main as much as Cardano’s final exhausting fork in September 2021, ADA’s value elevated by 130%, rising from $1.35 to $3.10.

The On-chain Insights e-newsletter additionally mentions the applying for a Solana ETF made by Bitcoin ETF issuers VanEck and 21Shares, additional increasing institutional crypto entry. Though it’s unlikely to get accepted in 2024, a lot much less in Q3, this motion might enhance traders’ sentiment.

Share this text

[ad_2]

Source link