[ad_1]

Entry Parameters: Fundamentals and Configuration

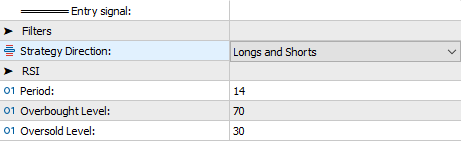

By adjusting the Interval, Overbought Stage, and Oversold Stage fields of the RSI, customers can fine-tune the pattern reversal indicators generated by Heikin-Ashi.

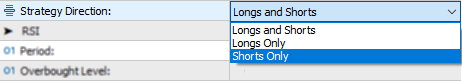

Moreover, the Technique Route area permits customers to optimize parameters for a selected buying and selling route or apply the identical configuration to each.

This characteristic makes it attainable to run a number of cases of SENTINEL Heikin-Ashi on the identical account, even working on the identical image.

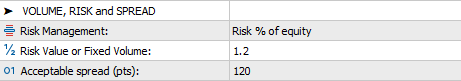

The entry sign is complemented by exact danger publicity changes. The professional advisor calculates the place measurement primarily based on the gap between the preliminary cease loss and the entry value, following the user-defined values within the VOLUME, RISK, and SPREAD parameter group. If the calculated measurement exceeds the accessible leverage, it will likely be mechanically decreased to adjust to restrictions. If the dealer’s minimal measurement for the image prevents the commerce from being executed, the entry is not going to happen, even with a sound sign.

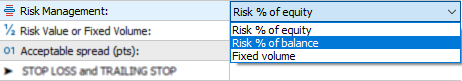

The Danger Administration menu gives three choices for outlining publicity: as a share of fairness, stability, or as a set quantity. When deciding on Danger % of fairness or Danger % of stability, the system interprets the worth within the Danger Worth or Mounted Quantity area as the specified share. Conversely, if Mounted quantity is chosen, this worth corresponds to what’s outlined in MetaTrader’s “Quantity” area.

The third area within the group, Acceptable unfold (pts), defines the utmost unfold allowed to execute trades, avoiding entries throughout high-spread market circumstances. The configured worth represents the system’s most unfold threshold for order execution. Customers could go for a better worth in larger timeframes and a tighter worth in timeframes the place smaller value strikes are anticipated.

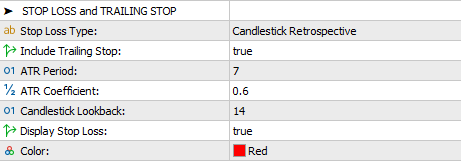

This model of SENTINEL units Candlestick Retrospective because the default worth for the Cease Loss Sort area. This selection determines the cease loss primarily based on the excessive or low of a specified variety of earlier candles, which is outlined within the Candlestick Lookback area. Moreover, a volatility-based margin will be added, the dimensions of which is set by the worth within the ATR Coefficient area. The sensitivity of the ATR will be adjusted by means of the ATR Interval area.

The Embody Trailing Cease area permits the cease loss standards to be up to date firstly of every new candle (this adjustment solely happens if the change favors the commerce). Cease loss stage modifications are displayed on the value chart if the Show Cease Loss area is about to true.

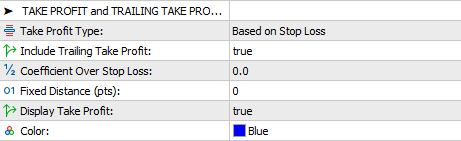

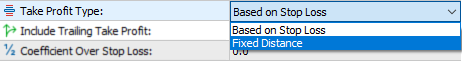

The Take Revenue Sort area offers two choices: Primarily based on Cease Loss and Mounted Distance.

When deciding on the Primarily based on Cease Loss possibility, the take revenue distance is adjusted in direct proportion to the cease loss distance. This ratio is set as a fraction or a number of of the cease loss distance, as specified within the Coefficient Over Cease Loss area.

With the Mounted Distance possibility, the take revenue stage is about at a selected distance in factors, outlined by the worth within the Mounted Distance (pts) area.

Much like the cease loss, the take revenue configuration contains the Embody Trailing Take Revenue area, which permits the take revenue stage to be up to date firstly of every new candle. This adjustment solely happens if the change favors the commerce. Take revenue stage modifications are displayed on the value chart if the Show Take Revenue area is about to true.

Sensible Instance: Commerce Evaluation

The next picture showcases a commerce executed by SENTINEL Heikin-Ashi, which we’ll use for instance as an example the applying of among the parameters described above. For this function, the chart contains candlesticks with value ranges in addition to the ATR and RSI indicators. Let’s analyze the setup.

The tip of the blue arrow marks the world the place the Heikin-Ashi reversal occurred, coinciding with the RSI exiting the oversold zone. This triggered an extended entry, accompanied by its corresponding cease loss (SL) and take revenue (TP). Right here’s how their respective ranges had been decided. To simplify the reason, we assume the Embody Trailing Cease and Embody Trailing Take Revenue fields are set to false.

We will deduce that the Candlestick Lookback area has a minimal worth of three. Since it is a lengthy commerce, the system used the low of the final three candles, marked on the chart as 1.08826. Nevertheless, the SL stage is about under this worth, indicating that the ATR Coefficient is bigger than 0. Whereas the precise coefficient worth can’t be decided from the chart, we all know the distinction is the product of 0.00054 and the coefficient worth. The ATR Interval was set to five, yielding the 0.00054 worth on the time of the entry sign. That is how SENTINEL calculated the SL stage.

Relating to the TP stage, it’s evident from the chart that the Take Revenue Sort menu was set to Primarily based on Cease Loss. This implies the Coefficient Over Cease Loss area will need to have a price larger than zero. On this case, because the TP distance is clearly shorter than the SL distance, the coefficient is lower than 1. Visually, it seems to be between 0.5 and 0.6.

When you have any questions on this rationalization, be at liberty to depart a remark.

The outcomes obtained from utilizing the software program referenced on this information usually are not assured. Buying and selling in monetary markets includes important danger and might not be appropriate for all buyers. The developer of this module will not be chargeable for any losses or damages ensuing from its use. The developer doesn’t assure ongoing assist or updates. Use the software program at your personal danger.

[ad_2]

Source link