[ad_1]

Contents

Unsure occasions are occasions with unknown outcomes.

There are particular forms of “unsure occasions” which have “double uncertainty” related to them.

As I’m penning this simply previous to america sixtieth presidential election of 2024 between Donald Trump and Kamala Harris, let’s use the election for example.

Whereas we all know that it’ll occur on November fifth of 2024, we have no idea the result as to who would win.

That is the primary uncertainty.

Even should you imagine you’ll know who will win, you’ll not know the way the market will react to that particular person’s win.

Will the market go up? Or will the market go down?

That is the second uncertainty.

And that is what I meant by “double uncertainty”, for a scarcity of a greater phrase.

Moreover, you additionally don’t know what could be the potential aftermath of the election. Will or not it’s a contested election? And the way would the market reply?

Free Wheel Technique eBook

Coincidentally, there may be an FOMC assembly later that week of the election.

That is when the Federal Open Market Committee (FOMC) will announce its resolution on financial coverage and rates of interest, reminiscent of whether or not to keep up, elevate, or decrease the federal funds charge.

That is the primary uncertainty.

Okay, perhaps many individuals can have a good suggestion previous to the announcement as to what they’ll most certainly announce.

Nonetheless, there may be the second uncertainty as to how it might transfer the inventory market costs the day of or the following day.

Whereas one would possibly logically motive that if the charges go up or down, then based mostly on macro-economic rules that must be good or unhealthy for the inventory market, and so forth.

However does the market all the time behave based mostly on logic?

I might submit that it doesn’t.

You might say that it’s only widespread sense that the market would do that.

However does the market transfer based mostly on widespread sense?

It doesn’t, no less than not within the quick time period.

By definition, widespread sense is what most typical individuals would imagine would occur. If the market moved as what most individuals imagine it might transfer.

Then most individuals ought to be capable of predict the market. However the statistics don’t bear this out, no less than in brief time period buying and selling.

Maybe in long run investing, it might be true that the market tends to go up in the long term.

I as soon as heard, or learn, that the market is designed to idiot the general public more often than not. Whether or not that is true or not, I don’t know.

However the short-term actions of the market are removed from sure.

One might argue that if the inventory earnings announcement beats analysts estimates, the inventory value ought to go up.

And that if earnings missed expectations, the inventory ought to drop.

That is widespread sense, however I can discover many examples on the contrary.

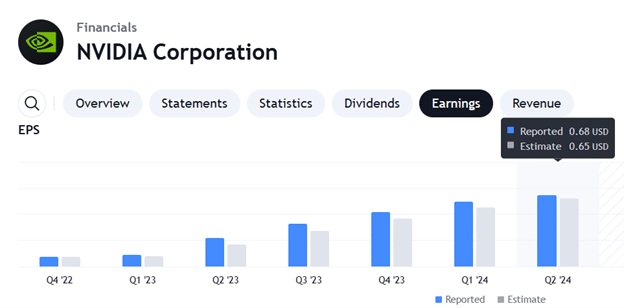

The newest 2nd quarter NVidia (NVDA) earnings beat estimate.

It reported 0.68, which is over the estimate of 0.65.

Supply: tradingview.com

But the inventory value dropped the next day (August 29, 2024) after the earnings announcement the night of…

An investor might have predicted accurately the primary uncertainty and would have guessed that NVDA would beat expectations.

However then the investor might not have guessed accurately on the second uncertainty as as to if NVDA would transfer up or down on the report.

That isn’t an remoted one-off instance.

It’s simple to search out different examples.

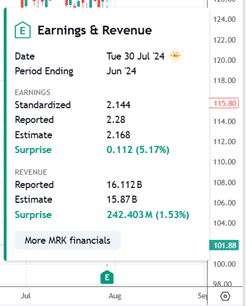

Have a look at the drop that occurred to Merck (MRK) proper after the morning earnings report on July 30, 2024…

Was that attributable to a foul earnings report?

No, the earnings reported higher than estimated…

Right here is an reverse instance.

The corporate Dow Inc stories incomes the morning of July twenty fifth, 2024.

It reported 0.68 which is decrease than the estimate of 0.71.

So one would possibly assume that the inventory would drop.

But, the inventory rallied that day of the announcement.

Have a look at that huge inexperienced candle on the chart.

With a purpose to get the path of an earnings transfer right, one wants to have the ability to predict each the earnings report and the market’s response to that report.

It doesn’t matter whether or not there are two uncertainties to foretell or a number of ten uncertainties to foretell.

Since there are solely two outcomes, you’ve gotten a 50-50 likelihood of getting it right.

Simply flip a coin and don’t give it some thought.

The quick time period motion of the market is tough to foretell as a result of a number of elements of uncertainty concerned.

All of us would love for the markets to be logical and predictable.

However it isn’t.

As economist John Maynard Keynes as soon as stated, “The market can stay irrational longer than you’ll be able to stay solvent.”

We hope you loved this text on unsure occasions.

In case you have any questions, please ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who are usually not conversant in change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link