[ad_1]

If a dealer needs to provoke an at-the-money non-directional butterfly, what distinction wouldn’t it make if the fly had wider or narrower wings?

Contents

Properly, let’s check out each on the SPX index.

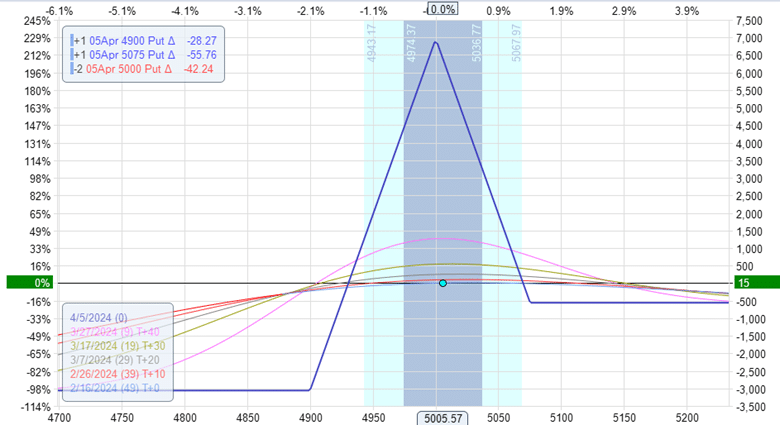

First, take into account a wider fly with an higher wing width of 75 factors and a decrease wing width of 100 factors.

Date: February 16, 2024

Worth: SPX @ 5005

Purchase one April 5 SPX 4900 put

Promote two April 5 SPX 5000 put

Purchase one April 5 SPX 5075 put

Debit: -$560

The max threat is $3060, and the theoretical max revenue is about $7000, as proven within the payoff graph beneath.

This provides a reward-to-risk of two.3.

The Greeks are:

Delta: 0.52

Gamma: -0.03

Theta: 7.35

Vega: -93.42

Theta/Delta: 14.2

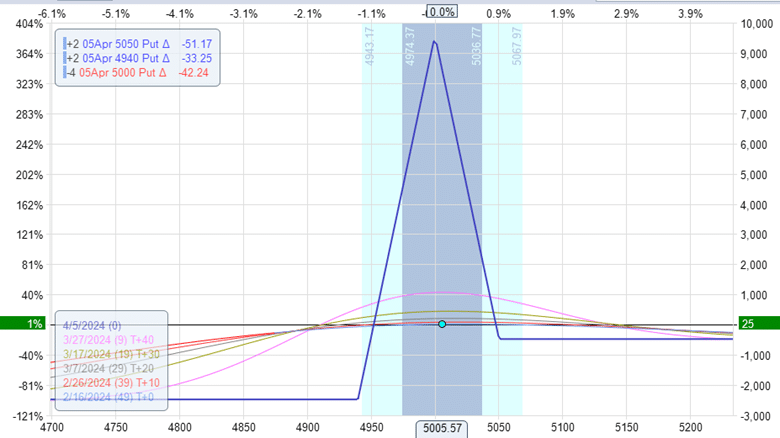

Now take into account a narrower fly with 50/60 higher and decrease wing widths.

Date: February 16, 2024

Worth: SPX @ $5005

Purchase two April 5 SPX 4940 put

Promote 4 April 5 SPX 5000 put

Purchase two April 5 SPX 5050 put

Debit: -$480

We’re utilizing two contracts right here to get the capital utilization of the slim fly to be virtually similar to the capital utilization of the vast fly.

Whereas the reward-to-risk ratio and the ratio between the Greeks is not going to change primarily based on the variety of contracts, absolutely the worth of the Greeks is cumulative relying on the variety of contracts.

This can make it a fairer comparability.

With two contracts, the max threat of the slim fly is $2475, and the max reward is $9400 – a few 3.8 reward-to-risk:

Delta: 0.46

Gamma: -0.02

Theta: 5.51

Vega: -77.86

Theta/Delta: 12

4 Suggestions For Higher Iron Condors

The narrower fly has a greater reward-to-risk ratio.

The broader fly has a better theta, leading to a much bigger theta-to-delta ratio – each of which we would like.

With larger theta, we additionally get bigger gamma (which we don’t need).

The expiration break-even factors are nearer (or narrower) within the slim fly.

The graph of the slim fly exhibits that they’re at $4950 and $5050.

These are the costs at which the expiration graph crosses the zero-profit horizontal axis.

Meaning the commerce needs to be worthwhile if SPX is between $4950 and $5050 at expiration.

Narrower break-even factors imply a narrower vary of profitability.

The break-even factors for the vast fly are roughly $4930 and $5070.

This vary is wider by 40 factors, giving a wider vary of profitability.

The Narrower Fly Has Much less Capital At Danger. Is This The Cause Why It Has Much less Theta?

No.

On this instance, two contracts for the slim fly are nonetheless much less capital than these for the one massive fly.

Rightly so, the extra capital that’s within the commerce will present extra theta (with different issues being equal).

Nevertheless, that’s not why the slim fly has much less theta.

Wanting on the slim fly, we bought 5.51 theta from $2475 capital of threat; this means that if we have now $3060 of threat as within the vast fly, then math would say that we should always get 6.8 theta:

$3060 x 5.51 / $2475 = 6.8

Nevertheless, the empirical proof exhibits that the massive fly bought 7.35 of theta – greater than what the slim fly would get even when we bump up the capital utilization of the slim fly to $3060.

There’s something inherent concerning the wider fly that offers it extra theta.

Why Do Slender Flies Have Much less Theta Than Wider Flies?

The slim flies have the lengthy choices nearer to the brief choices.

It’s the brief choices which can be giving us optimistic theta.

The lengthy choices have destructive theta.

The nearer the lengthy choices are to the brief choices, the extra the lengthy choices negate the optimistic theta results of the brief choices.

If we didn’t have the lengthy choices, we might have a straddle that might give us extra theta than a butterfly on the identical strike and expiration.

On a per-contract foundation, wider flies use extra capital in danger than slim flies.

One can consider straddles as infinitely vast butterflies.

They’ve limitless threat.

As a result of straddles are solely brief choices unhedged by any lengthy choices, they’ll generate massive quantities of theta.

That is additionally why wider flies can generate extra theta than narrower flies as a result of their lengthy choices don’t hedge their brief choices as a lot because the slim flies.

Slender flies look skinnier within the graphs and have a better reward-to-risk ratio. However that additionally means they’ve a decrease chance of revenue resulting from narrower expiration break-even factors.

There are execs and cons to vast and slim flies. Hope this text offers you a way of the traits of the 2 so you may decide one thing in between.

We hope you loved this text on the distinction between vast vs slim butterflies.

If in case you have any questions, please ship an electronic mail or depart a remark beneath.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who will not be aware of change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link