[ad_1]

batuhan toker/iStock by way of Getty Photographs

We’re initiating protection on the Dimensional Worldwide Core Fairness 2 ETF (BATS:DFIC) with a Promote score. Our detrimental view of the fund is pushed by the fund’s overly diversified method to investing in worldwide equities, the multitude of obligations that the PM staff has exterior of managing this fund, and the dearth of PM funding within the fund alongside LPs (which is a non-starter for us).

By the use of background, DFIC goals to offer publicity to a broad vary of developed market shares exterior the US, with a tilt towards smaller-cap corporations, and those who exhibit extra engaging worth and profitability metrics. Nevertheless, we imagine the fund’s extraordinarily diversified portfolio of over 4,000 holdings makes it difficult for the supervisor’s funding course of and standards to meaningfully impression long-term returns.

As we’ve mentioned in earlier fund write ups, we favor funds with fewer, high-conviction positions run by PM groups who know what they personal and why.

Moreover, whereas we respect the pedigree of the PM staff, none have DFIC as their sole duty. The named PMs oversee numerous different methods and funds at Dimensional, elevating questions on their means to dedicate enough time and focus to DFIC. Compounding this concern is the truth that not one of the PMs have invested their very own cash within the fund. In our view, this creates poor alignment of pursuits with DFIC buyers.

We’ve seen different write ups touting DFIC’s low expense ratio as purpose sufficient to speculate (we received’t identify names), however with the administration staff stretched as skinny as they’re, all whereas not consuming their very own cooking, we might warning potential buyers from changing into too enticed with the perceived value benefit.

At FV Capital we solely care about long-term, after-fee and after-tax returns. And whereas we respect decrease value funds, we’d be even happier to pay up for a fund with higher long-term web returns.

Agency & Fund Overview

DFIC remains to be a comparatively new fund, having launched in March 2022 throughout the depths of Covid-induced market volatility.

The fund has raised important property over the brief time period since its inception, with complete fund AUM reaching $5.8 billion by the tip of Q1 2024. Although a few of this demand doubtless got here from present Dimensional funds somewhat than new buyers.

Dimensional has an extended historical past of providing factor-based methods by mutual funds. Lately, the corporate has been changing many of those mutual funds into ETFs to fulfill evolving investor preferences and stem outflows from their legacy mutual fund enterprise. We expect it is possible {that a} portion of DFIC’s AUM got here from buyers in Dimensional’s present mutual funds who had been shifted into the newly launched ETF.

Portfolio & Valuation

DFIC’s portfolio is manner too diversified, in our view, holding greater than 4,000 particular person positions.

At FV Capital, we view threat because the chance of everlasting capital impairment. Importantly, we don’t view volatility as threat. In our expertise, the trail to superior long-term returns isn’t a straight line. You’ll want to be keen to tolerate (and reap the benefits of) intervals of typically extreme volatility with the intention to outperform the market over lengthy intervals.

Whereas broad diversification may also help scale back volatility, we predict this degree of diversification considerably limits the fund’s means to generate significant outperformance over time. The portfolio is so diluted that it is successfully closet indexing whereas nonetheless charging lively administration charges (albeit very low lively administration charges, with a web expense ratio of 23bps).

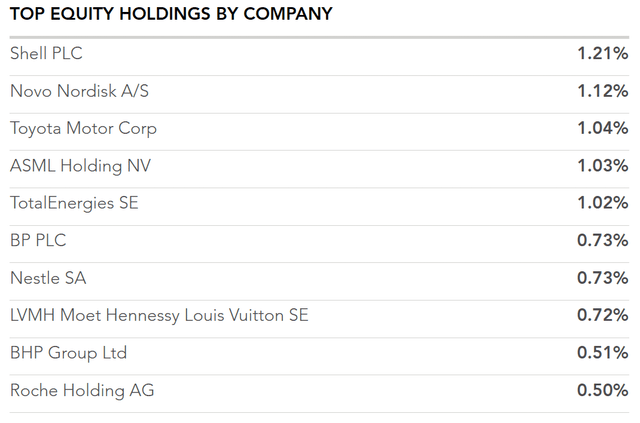

The fund’s high 10 positions, outlined within the desk under, account for lower than 10% of property, and no single place presently exceeds 1.3%. We all know the fund is reasonable, nevertheless it’s unclear to us why buyers on this fund wouldn’t simply personal an index fund and pay even much less in charges. If low-cost and broad diversification is what you’re in search of, lively administration might be not for you.

DFIC Prime 10 Holdings (Dimensional Fund Advisors)

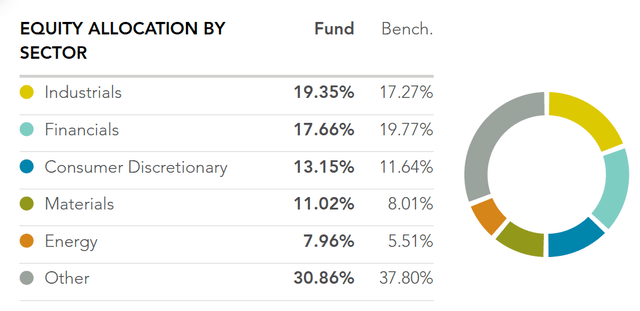

DFIC’s sector and geographic exposures carefully resemble these of its benchmark, underscoring what we view because the fund’s closet indexing method.

From a sector perspective, the portfolio’s largest weights are in Industrials (~19%), Financials (~18%), and Shopper Discretionary (~13%). Whereas these sector allocations are modestly totally different than its benchmark, the deviations are usually not important sufficient to materially impression efficiency in our view.

DFIC Sector Allocation (Dimensional Fund Advisors)

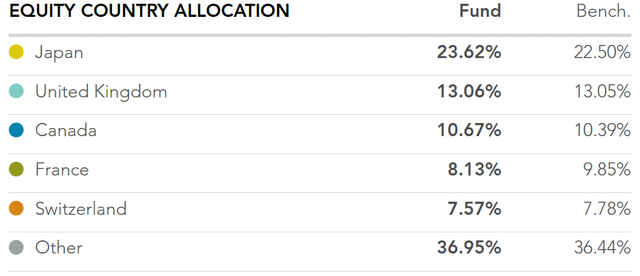

Geographically, DFIC’s largest nation weights are Japan (~24%), the UK (~13%) and Canada (~11%), and are carefully aligned with the exposures of its benchmark.

DFIC Nation Allocation (Dimensional Fund Advisors)

The fund’s sector and nation positioning seems to be extra a perform of its broad, impartial method somewhat than lively bets on specific areas of the market. We would count on extra pronounced sector and geographic tilts in a very actively managed fund.

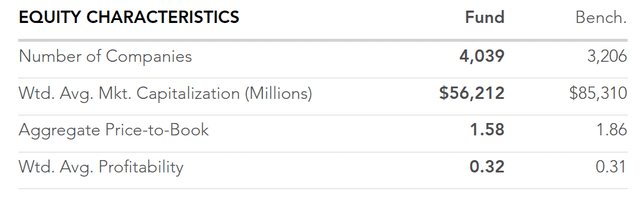

From a valuation standpoint, as of Q1 2024, the DFIC portfolio was buying and selling at an mixture P/B of 1.58x, in comparison with 1.86x for its benchmark, the MSCI World ex USA IMI Index. So DFIC presently trades at a marginal low cost to its benchmark. From profitability standpoint, the DFIC portfolio is almost equivalent to the benchmark. Given the fund’s purported deal with attractively valued, extra worthwhile shares, we might count on an even bigger delta relative to the benchmark for these metrics…

DFIC Portfolio Traits (Dimensional Fund Advisors)

Efficiency

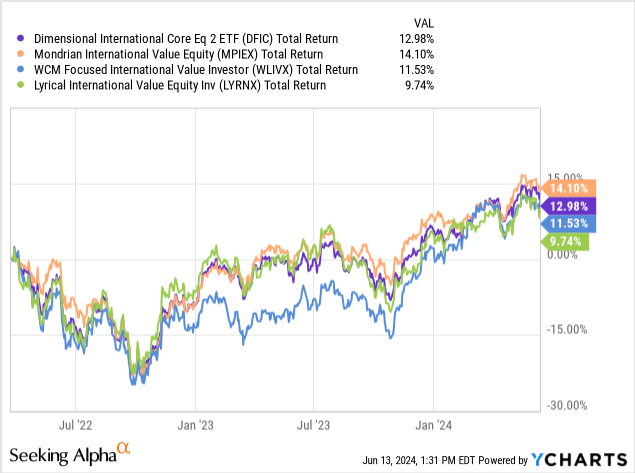

As a comparatively new fund, DFIC has a restricted efficiency observe file. Since its inception in March 2022 (by 3/31/24), the fund generated an annualized return of 5.72% on a NAV foundation, barely outperforming the MSCI World ex USA IMI Index which returned 5.31% over the identical interval.

If we examine DFIC’s efficiency since inception to extra concentrated Worldwide Worth funds over the identical interval, we see that DFIC is in the midst of the pack. However once more, we’re taking a look at such a brief interval that it is troublesome to attract any actual conclusions from this, in our view.

Trying forward, we imagine the fund’s overly diversified portfolio and suboptimal portfolio administration dynamics will make it troublesome to persistently outperform over a full market cycle. The fund’s short-term outperformance relative to its benchmark since inception, and respectable efficiency relative to extra concentrated funds, doesn’t alter our considerations concerning the fund’s means to generate alpha over lengthy intervals.

Dangers

The primary dangers for DFIC in our view are associated to the competing obligations of its portfolio managers, and their lack of funding within the fund.

By holding over 4,000 shares, the fund additionally mutes the potential for its funding method to generate alpha.

This problem is exacerbated by the truth that DFIC’s PMs have obligations throughout a number of methods and funds at Dimensional. None of them are solely devoted to this ETF.

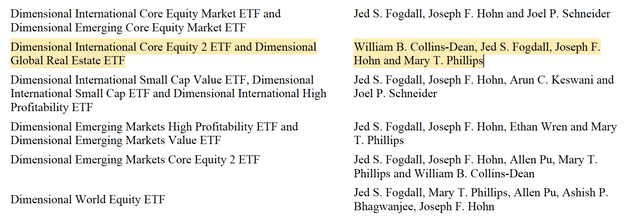

The under screenshot from the Dimensional ETF Belief’s Assertion of Further Info outlines the fund administration obligations of the named PMs on DFIC.

Dimensional Fund Advisors

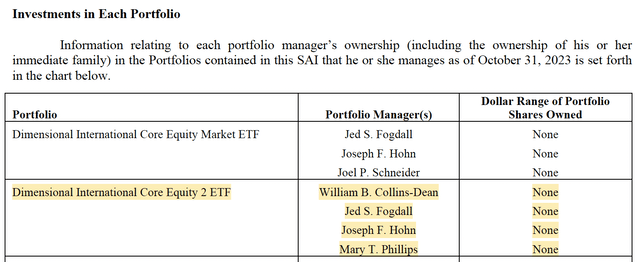

Maybe most significantly, we predict there is a clear lack of alignment between DFIC’s PMs and the buyers within the fund. Not one of the named PMs have invested any of their very own capital within the fund. We imagine managers who eat their very own cooking are extra invested within the success of their fund(s) and subsequently within the efficiency end result for buyers. DFIC’s PMs haven’t any pores and skin within the recreation, which is a non-starter for us.

This info, which we present within the screenshot under, will be present in the identical Assertion of Further Info referenced to earlier.

Dimensional Fund Advisors

Promote Score Abstract

The fund’s overly diversified portfolio, suboptimal portfolio administration construction, and lack of supervisor funding alongside LPs underpin our detrimental view of DFIC.

As such, we’re initiating protection on DFIC with a Promote score.

[ad_2]

Source link