[ad_1]

As choices merchants or buyers, we should concentrate on the commerce dangers and learn to management them.

Whether or not we’re buying and selling a short-term credit score unfold or investing in a long-term LEAPS, there are occasions when the commerce goes towards us.

If it goes towards us arduous sufficient that we predict the commerce isn’t salvageable, we might shut down the commerce totally.

If we’re in a slight drawdown and wish to scale back the danger within the commerce, then that is what we’re going to speak about at this time.

Take, for instance, a bull put credit score unfold the place we expect the worth of the underlying to go up.

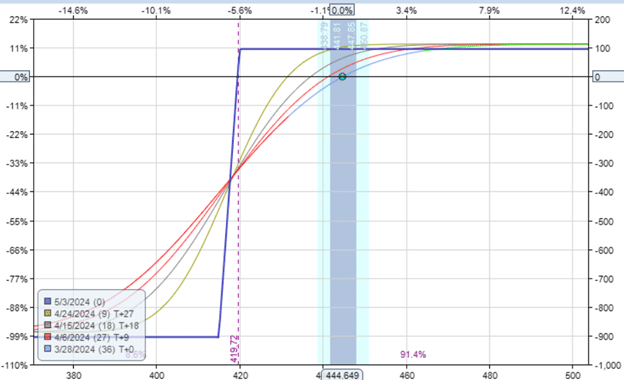

Date: March 28, 2024

Worth: QQQ @ $444.65

Purchase two contracts Might 3, 2024 QQQ $420 put @ $1.47Sell two contracts Might 3, 2024 QQQ $415 put @ $1.95

Credit score: $94

The payoff graph appears to be like as follows.

This graph can be referred to as the danger graph. It exhibits that the utmost danger within the commerce is round $900.

This max loss happens if the worth of QQQ is beneath $415 at expiration.

We are able to additionally calculate this danger by taking the width of the unfold multiplied by the variety of contracts occasions 100 and subtracting the credit score obtained.

$5 x 200 – $94 = $906

We should concentrate on this danger and comfy with it once we provoke the commerce.

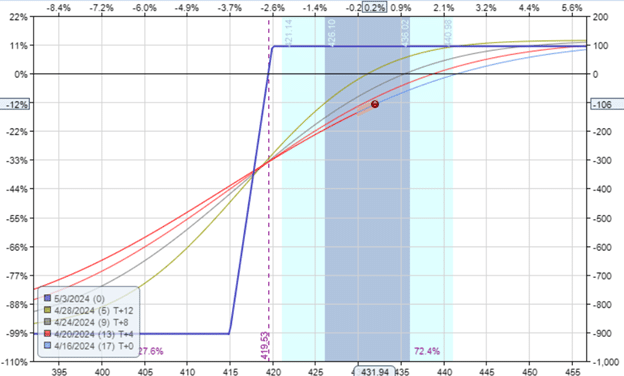

Nineteen days into the commerce, the worth of QQQ dropped right down to $432, and the P&L of the commerce is now -$106.

4 Suggestions For Higher Iron Condors

The Greeks at the moment are:

Delta: 13.5Theta: 4.82Vega: -8.58

We really feel that our preliminary thesis was improper.

Is there a method we are able to lower the danger on this commerce?

Sure, there are.

There are a number of methods.

Right now, we’ll simply offer you a technique.

We are able to promote a name credit score unfold with the identical expiration.

For instance,

Date: April 16, 2024

Worth: QQQ @ $432

Promote two contracts Might third QQQ $453 name @ $1.25Buy two contracts Might third QQQ $456 name @ $0.86

Credit score: $78

Now, have a look at the danger graph.

The max danger has gone right down to $828.

It had gone down by the quantity of the credit score obtained from promoting the bear credit score unfold.

It’s because if the worth goes down by means of each strikes of the put choices, we could have the utmost lack of the bull put unfold.

We nonetheless preserve the credit score from the bear name unfold to scale back that loss.

And the Greeks have improved:

Delta: 6.61Theta: 9.46Vega: -15.93

The Delta decreased by about half.

As a result of we’re promoting further credit score spreads, the theta and vega elevated.

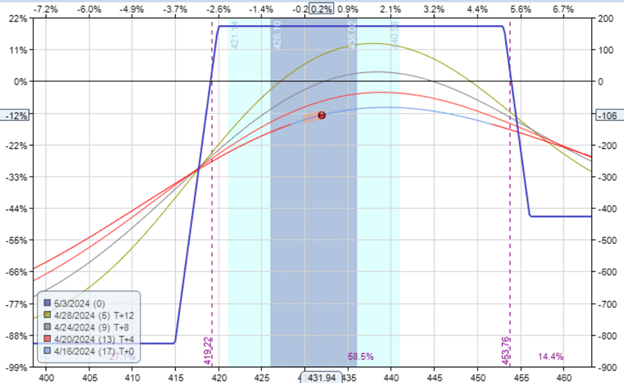

What occurs if the decision unfold loses?

For instance, if the worth goes above $456?

Then, we preserve the credit score of the put unfold, which compensates us for the loss.

The three-point large bear name unfold loss is $3 x 200 = $600.

Loss is lowered by the credit score of the put unfold and the decision unfold.

$600 – $94 – $78 = $428

The max loss is $428 if the worth of QQQ rallies arduous to breach the decision unfold.

You too can see this from the danger graph, the place the blue expiration line on the upside is horizontal on the -$428 loss stage.

We can not lose on the put unfold, and the decision unfold on the identical time.

The credit score on one helps compensate for the loss on the opposite.

We are able to scale back the danger in a credit score unfold by promoting one other opposing credit score unfold.

In our instance, we lowered the danger of a threatened bull put credit score unfold by promoting a bear name unfold, turning the commerce into an iron condor.

It’s not a balanced iron condor as a result of the decision unfold is smaller than the put unfold.

The decision unfold is 3 factors large, whereas the put unfold is 5 factors large.

On the dealer’s discretion, they will promote a name unfold with the identical width because the put unfold to have equal danger on each the upside and draw back.

They will even promote a name credit score unfold that’s wider than the unique unfold.

Nevertheless, this isn’t usually performed as a result of it will increase the danger within the commerce.

If this isn’t at first clear, attempt it out as an train in your modeling software program and study the danger graph.

We hope you loved this text on reducing the danger of credit score spreads with iron condors.

When you have any questions, please ship an electronic mail or depart a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who should not acquainted with alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link

.png)