[ad_1]

American Airways Boeing 777-323(ER) taking off from Kingsford Smith Airport Sydney Australia mccawleyphoto/iStock Editorial by way of Getty Photographs

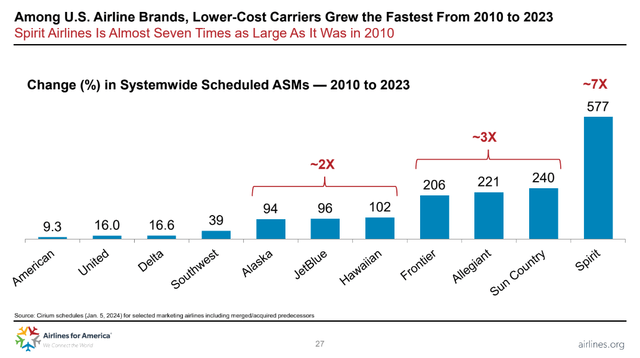

American Airways Group Inc. (NASDAQ:AAL) got here out of the pandemic with optimism that the {industry} reset that impacted all airways would give it an opportunity to vary the trajectory of its monetary underperformance to the {industry} that included a lot of the last decade earlier than the COVID disaster. Regardless that American Airways (underneath AMR Company) was restructured underneath Chapter 11 of the U.S. chapter code from 2011 to 2013, ending in its emergence as AAL and its merger with US Airways, AAL’s income technology remained under its friends and its prices had been excessive, partly because of offers which had been made with labor to safe their backing for the US Airways merger over AMR’s standalone restructuring plan. Though American and US Airways acknowledged that one of many main aims of the merger was to have the ability to compete with Delta Air Traces, Inc. (DAL), which initiated the megamerger cycle by way of its merger with Northwest, United Airways Holdings, Inc. (UAL), which merged with Continental, and Southwest Airways Co. (LUV), which acquired AirTran Airways, American struggled to compete within the main aggressive coastal markets together with New York Metropolis in addition to worldwide markets within the late 2010s, leading to its diminished attractiveness to high-value enterprise vacationers.

With the biggest workforce and a objective of retaining airline staff on the job and in a position to serve the general public when demand returned, American acquired essentially the most federal grant cash throughout the pandemic as its unions and executives had been influential within the strategy of acquiring authorities assist for the {industry}. American and Southwest each aggressively added capability within the early levels of the pandemic every time it appeared there may be the potential for demand restoration.

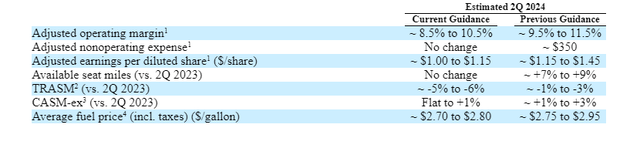

American revised its steering on Might 28 with an extra deterioration of income and working margin with barely improved non-fuel and gasoline prices.

AAL steering 2Q2024 28May (aa.com)

Income Underperformance

American’s income efficiency relative to Delta and United could be seen from the next:

Complete Income per Out there Seat Mile (% change)

Full yr 2023 4Q2023 1Q2024

American +1 -6.4 -4.9

Delta +3 -3 +1

United +1.7 – 4.2 +0.6

DAL has lengthy been recognized to generate a income premium to the {industry} which is a big driver of its larger earnings standing in distinction to AAL’s underperformance together with to UAL. Deterioration of the income atmosphere within the latter a part of 2023 and into the winter of 2023-24 (second quarter 2023 and first quarter 2024) could be seen within the knowledge above. Since worldwide journey usually contributes earnings within the center two quarters however much less so in at the start and finish of the yr, AAL’s underperformance could be considerably understood but it surely nonetheless underperformed for 2023 as an entire. Different knowledge exhibits that they’re underperforming in income technology even within the home market.

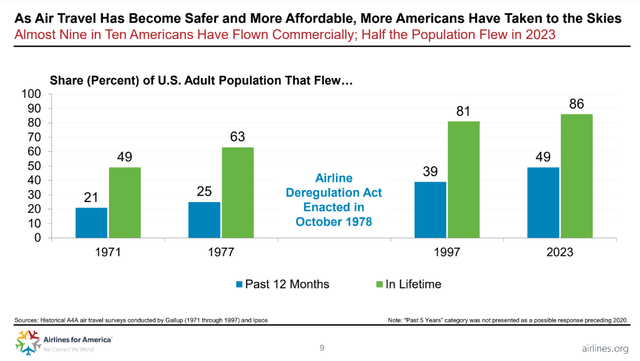

Journey Affordability (Airways.org)

As post-pandemic demand returned first within the home sector, American confirmed promise of having the ability to overcome its monetary woes of the earlier decade. Nonetheless, within the following yr, as worldwide demand started to return, American more and more was left behind by Delta and United, each of which had bigger worldwide route techniques pre-pandemic and had been dedicated to restarting their worldwide operations, though the 2 employed totally different methods to fulfill the returning worldwide demand. American, like Delta, retired older and fewer environment friendly worldwide plane throughout the pandemic however DAL needed to regrow its worldwide fleet as a way to rebuild its community. United, in distinction, didn’t retire worldwide or home plane throughout the pandemic, stating that it could be able to develop when demand returned. Certainly, within the third quarter of 2022, United generated considerably larger margins than American and Delta as a result of it was in a position to meet worldwide demand which most different world airways weren’t ready to serve however that benefit lasted just for one quarter.

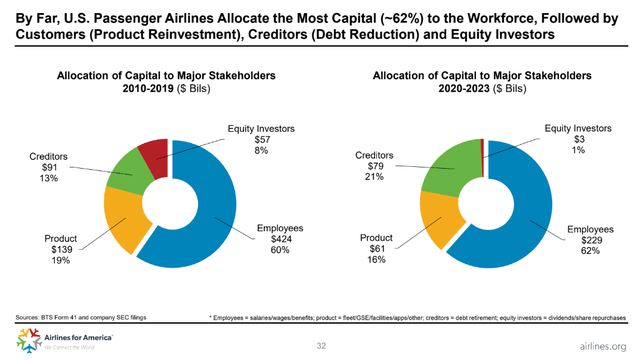

Allocation of capital by class (Airways.org)

Delta had an intensive order ebook with Airbus SE (OTCPK:EADSY) for widebody long-haul plane whereas American had a comparatively small The Boeing Firm (BA) 787 order ebook; United added to its 787 order ebook and now could be the biggest buyer for that plane kind, anticipating to have the ability to aggressively develop. American acknowledged throughout the pandemic that it couldn’t efficiently compete in a lot of the transpacific markets it beforehand flew and didn’t try to switch the transpacific capability it had pre-COVID. Demand throughout the Atlantic post-COVID has been sturdy however American’s European profitability has lengthy been centered in London the place it operates a three way partnership hub with Worldwide Consolidated Airways Group S.A. (OTCPK:ICAGY). A lot of AAL’s continental European locations have lengthy underperformed DAL and UAL by way of income and the corporate equally has chosen to not develop its fleet to chase transatlantic demand. U.S. DOT knowledge exhibits that American misplaced cash flying each the Atlantic and Pacific in 2023 with its small worldwide earnings coming solely from its Latin America route system centered round Miami the place it has a close to monopoly place amongst U.S. carriers to Latin America. Whereas AAL acknowledged it was going to be a lot smaller to Europe and throughout the Pacific, it missed out on the worldwide income progress that has buoyed the outcomes of Delta and United.

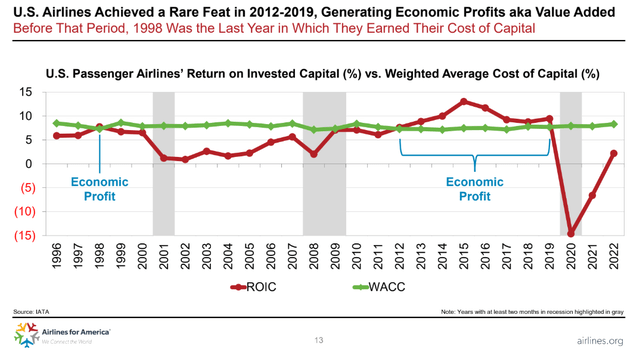

U.S. Airline ROIC (Airways.org)

American’s income points have additionally concerned home markets. AAL’s home passenger income per seat mile was down 2.8% within the first quarter of 2024, in keeping with its transatlantic system; in distinction, DAL’s home RASM for the quarter was up 3%. A number of U.S. airways noticed unit income declines in Latin America because of giant will increase in capability whereas the Pacific was significantly troubling for American because of heavy aggressive capability will increase despite the fact that AAL’s Pacific capability was down.

As I’ve highlighted in earlier articles together with most not too long ago in March 2024, American has been targeted on decreasing its gross sales prices. Rising proof signifies these efforts weren’t profitable and alienated a few of American’s prime clients together with company and different high-value clients. American’s Chief Business Officer left the airline in June after a 20-year profession on the firm. He was an architect of AAL’s methods to cut back the airline’s distribution prices which included incentivizing reserving journey via essentially the most environment friendly applied sciences but in addition withholding advantages to vacationers which might be booked via extra conventional mechanisms. As well as, the corporate reversed a number of of the distribution insurance policies that had been carried out underneath Mr. Raja.

AAL’s methods seem to have raised considerations with a few of American’s closest enterprise companions as effectively. British Airways made airline information by deciding to implement a codeshare settlement with Alaska Air Group, Inc. (ALK) and JetBlue Airways Company (JBLU) despite the fact that the U.Ok. airline has a income sharing three way partnership with American. Alaska, with its largest hub in Seattle, is a part of the identical oneworld alliance as American and British Airways however isn’t a part of the transatlantic three way partnership. New York Metropolis-based JetBlue isn’t within the oneworld alliance or the three way partnership. British Airways’ actions are doubtless as a result of it’s both seeing or fears seeing an impression on its company gross sales efforts within the U.S.

Labor and Service Points

Along with its income and strategic challenges, American is going through a deteriorating labor scenario with its flight attendants that are the one workgroup on the Ft. Value-based airline that has not seen a brand new contract after COVID. Airline labor contracts are ruled by the Railway Labor Act and people contracts don’t expire however grow to be amendable. Most airline labor contracts grew to become amendable throughout the COVID period however airways and unions postponed settlement till stability was reached within the {industry}. American’s flight attendant union contract grew to become amendable in 2019 which suggests the corporate has not given any pay raises in 5 years. American and its flight attendant union have been in federal mediated negotiations for months together with a uncommon session in Washington, D.C. on Saturday after “final ditch” negotiations final week didn’t end in a settlement. The union has arrange a strike heart. The union doesn’t have the assets to pay strike pay. The union launched an announcement Sunday saying that the corporate and union stay in negotiations which suggests the Nationwide Mediation Board can not declare an deadlock which might be essential for the union to strike.

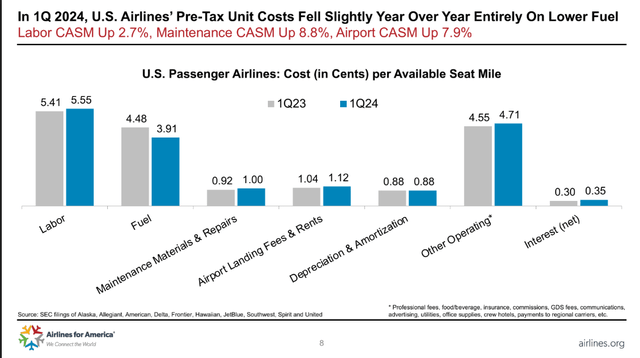

Airline Business Unit Prices by Class (Airways.org)

Delta kicked off the post-covid pay raises among the many massive 4 airways with a brand new contract with its pilots in December 2022 adopted by raises in 2023 for its largely non-union workforce, together with its flight attendants. Among the many massive 4, Southwest settled with its flight attendants earlier this yr, including to its prices however serving to to unify the workforce on the embattled service. Southwest’s contract with its flight attendants offers retroactive pay, one thing Delta didn’t provide its non-union staff since they acquired pay raises early within the post-COVID restoration. American’s flight attendant union requested for pay raises in keeping with what pilots acquired. After Southwest’s contract approval with retroactive pay was introduced, American’s flight attendant union added retroactive pay to its listing of calls for though it’s not sure if American or United, which additionally has an impressive flight attendant contract, would provide retroactive pay to flight attendants. Every of the massive 3 airways spent the higher a part of $1 billion in retroactive pay for his or her unionized pilots. American, with the weakest earnings and stability sheet of the massive 4, would doubtless battle to pay retroactive pay in addition to vital pay raises to its 25,000 flight attendants, its largest workgroup.

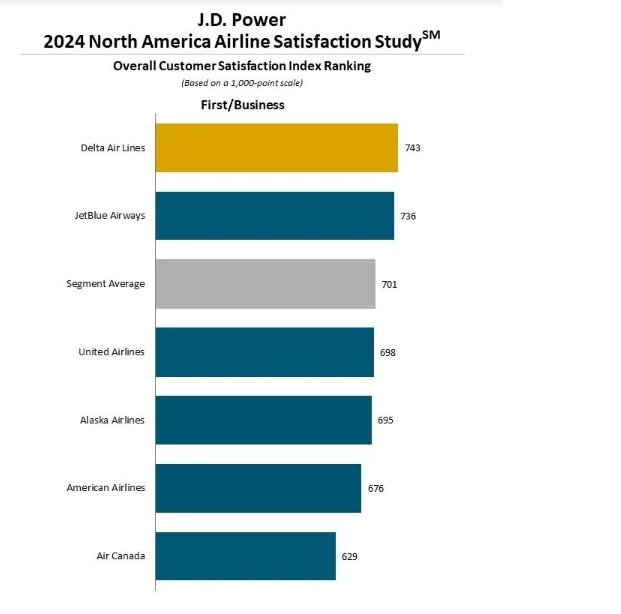

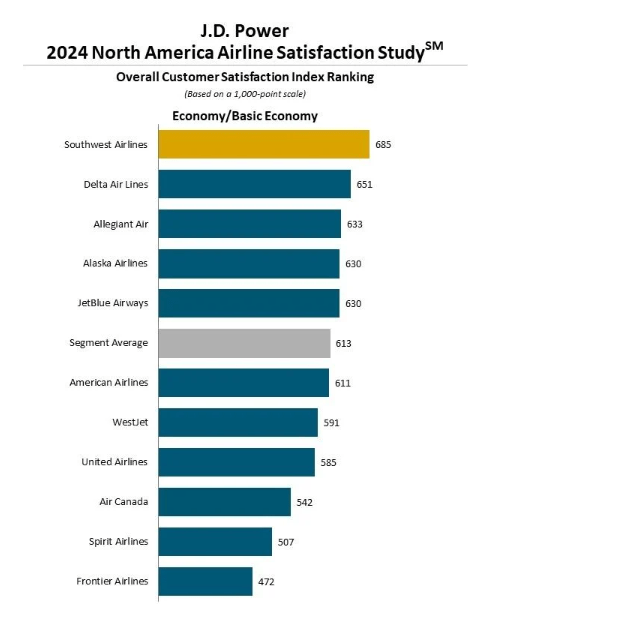

Since flight attendants spend extra time with airline passengers than every other workgroup, the extended negotiations have had an impression on American’s service ranges. Many purchasers have perceived that American’s cost-cutting efforts have tarnished its customer support whereas others consider the service affords comparable service to Delta and United. Whereas people have totally different perceptions of high quality, J.D. Energy ranks American decrease than each Delta and United for premium cabin service and decrease than Southwest and Delta for economic system passengers however above United.

JD Energy 2024 First/Enterprise Scores (JD Energy) JD Energy 2024 economic system rankings (JD Energy)

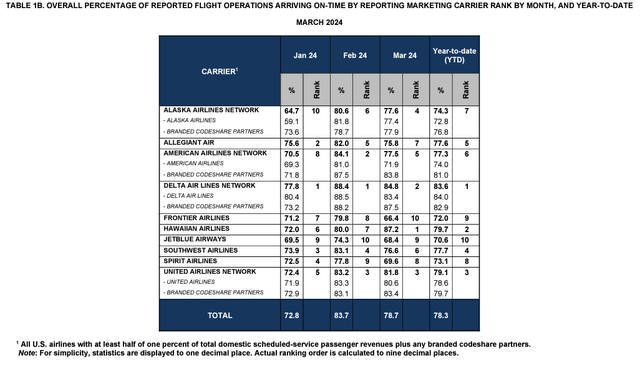

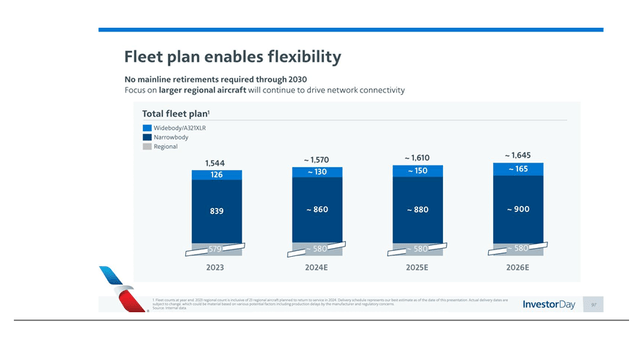

American targeted on operational reliability in 2023 and made vital progress. Efficiency this yr has not been nearly as good, compounded by unhealthy climate esp. in Might at American’s hub at Dallas/Ft. Value airport, the nation’s second-largest. There’s a lag of a minimum of two months for DOT knowledge to be launched however, via March, American ranks because the #6 airline YTD despite the fact that AAL’s on-time is simply 1% under common and just like Southwest. Non-public sector knowledge offers extra up to date info displaying AAL’s decline in on-time relative to different carriers.

US Airline Home On-Time YTD March 2024 (U.S. Dept. of Transportation) US Airline On-Time Traits (CrankyFlier.com)

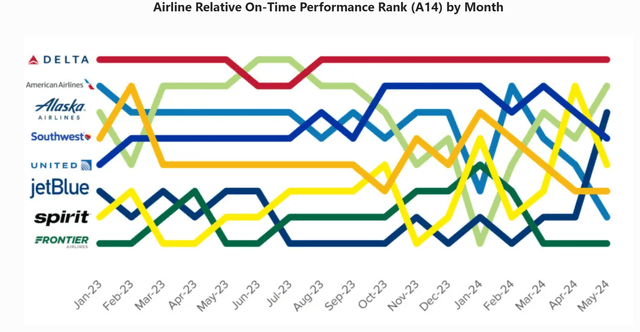

American’s baggage dealing with has persistently been close to the underside of the {industry} and DOT knowledge exhibits that AAL and UAL share the underside spot. American additionally holds the bottom spot of the massive airways for involuntary denied boarding. American’s low customer support efficiency is for certain to negatively impression its potential to amass high-value passengers, esp. when mixed with the corporate’s gross sales methods.

US Airline Baggage Mishandling (U.S. Dept. of Transportation)

Slower Development

Regardless that American positioned an order for over 225 plane in March 2024, cut up between Airbus, Boeing, and Embraer S.A. (ERJ), the corporate introduced in late June that it was suspending pilot hiring for the rest of 2024, blaming supply delays from Airbus and Boeing. Different airways together with Southwest have additionally suspended pilot hiring for 2024. Suspending pilot hiring is especially vital for American because it has one of many oldest pilot workforces amongst U.S. airways and expects roughly 800 pilots/yr to succeed in obligatory retirement age within the subsequent few years.

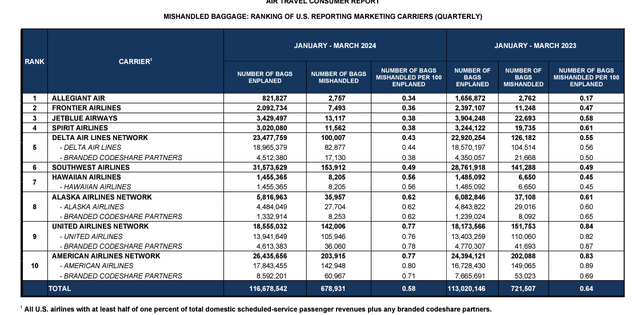

AAL Fleet Plan March 2024 (AA.com)

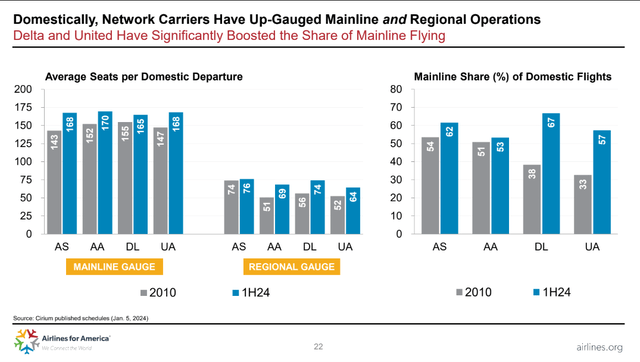

AAL’s fleet plan requires pushing past 1000 mainline plane, one thing United has additionally launched as a part of its fleet plan however which Delta might obtain first. American’s fleet plan does see progress in its widebody fleet which, by way of the variety of plane, is nearly as excessive as its home narrowbody fleet. American isn’t backing down on its dedication to regional jets, sustaining a fleet of 580 regional jets together with these flown by its wholly owned subsidiaries. A part of the current order contains E175 jets which is able to change older and smaller regional jets and guarantee American’s regional jet operation stays giant effectively past 2030. American at the moment operates the best share of its community on regional jets which brings its common plane dimension to the bottom dimension among the many massive 3 airways plus ALK that use regional jets.

Common seats per departure (Airways.org)

Whereas American will doubtless gradual mainline capability progress, despite the fact that it has not been introduced, it has not retreated from its dedication to serve small cities with regional jets, esp. from its southern U.S. hubs of Charlotte and DFW. Whereas AAL says that its technique of connecting small cities to its world community offers a singular benefit, it’s not clear that the benefit has translated into elevated revenues. As pilot hiring on the giant jet airways slows, the result’s elevated numbers of pilots at regional airways so different airways are additionally rising their service to small cities.

Development charges by service (Airways.org)

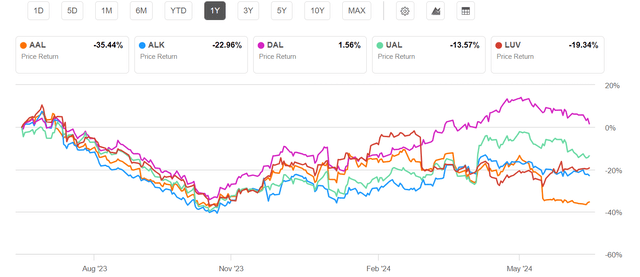

AAL inventory has upset

American Airways is without doubt one of the massive 3 world carriers which have loved a surge in world demand. Whereas economists have steadily recommended {that a} weakening of demand would come to the airline {industry}, friends Delta and United have seen sturdy demand that has defied these macroeconomic expectations; American must be extra intently aligned with the efficiency of worldwide carriers DAL and UAL somewhat than low price and ultra-low-cost carriers which have seen a big deterioration of their funds. Additional, AAL’s smaller order ebook implies that it may very well be spared a few of the challenges that different airways are experiencing because of Boeing’s supply delays and issues with the Pratt and Whitney, a subsidiary of RTX Company (RTX), Geared Turbofan engine which American doesn’t function. Lastly, it’s attainable that American will attain an settlement with its flight attendant union which will probably be inside what the corporate can afford with out degrading AAL’s monetary efficiency. It’s attainable, due to this fact, that AAL may overcome the challenges that I’ve recommended and proceed its upward pattern which I recommended earlier this yr the corporate ought to have the ability to do.

Nonetheless, many people, myself included, had hope that American Airways may regain its place as a frontrunner within the U.S. airline {industry}, the sheer variety of challenges AAL faces on prime of the inventory value declines make it unlikely that AAL will ship even industry-comparable inventory efficiency. One of the best giant jet U.S. airline inventory has been DAL and it’s almost again to its year-ago degree. AAL is 35% decrease over the previous yr, the worst of the massive 6 airways. On a year-to-date foundation, DAL and UAL are up 18% whereas AAL is down the identical quantity. AAL has been one of many worst performers on Wall Avenue and has not too long ago been essentially the most shorted S&P 500 industrial shares; AAL can not shake investor pessimism and the large-scale points it continues to face make it unlikely that it’s going to persuade traders that it may be rotated.

Huge 6 US Airline 1 yr Chart (Looking for Alpha)

A assessment of airline shares during the last 3 years exhibits that airline shares post-COVID have declined in the summertime and into the autumn, regaining energy within the winter, solely to repeat the cycle within the following yr. Airline {industry} shares for 2024 seem like following an analogous trajectory, doubtless as traders obtain steering about the perfect income durations of the yr solely to see doubts about long-term efficiency form investor mindsets into the autumn.

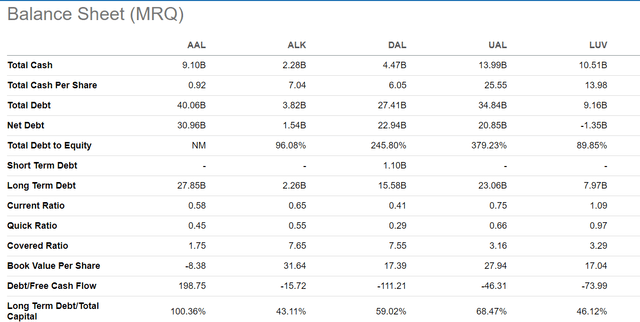

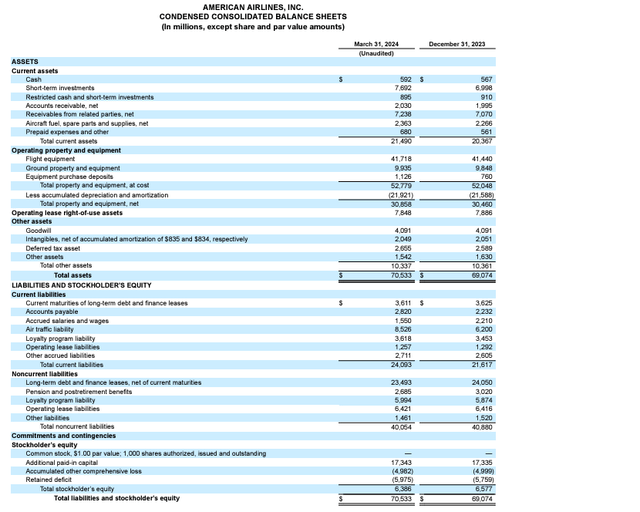

AAL’s greatest adverse stays its debt despite the fact that the corporate has tried to pay down debt. AAL had a retained deficit of $5.9 billion on March 31, 2024.

AAL vs {industry} stability sheet (Looking for Alpha) AAL stability sheet 1Q2024 (AA.com)

Contemplating the trajectory of U.S. airline shares, AAL’s eroded place within the {industry}, and its challenges together with below-average income technology and sure intensifying labor and customer support points, a SELL ranking is acceptable for AAL.

[ad_2]

Source link