[ad_1]

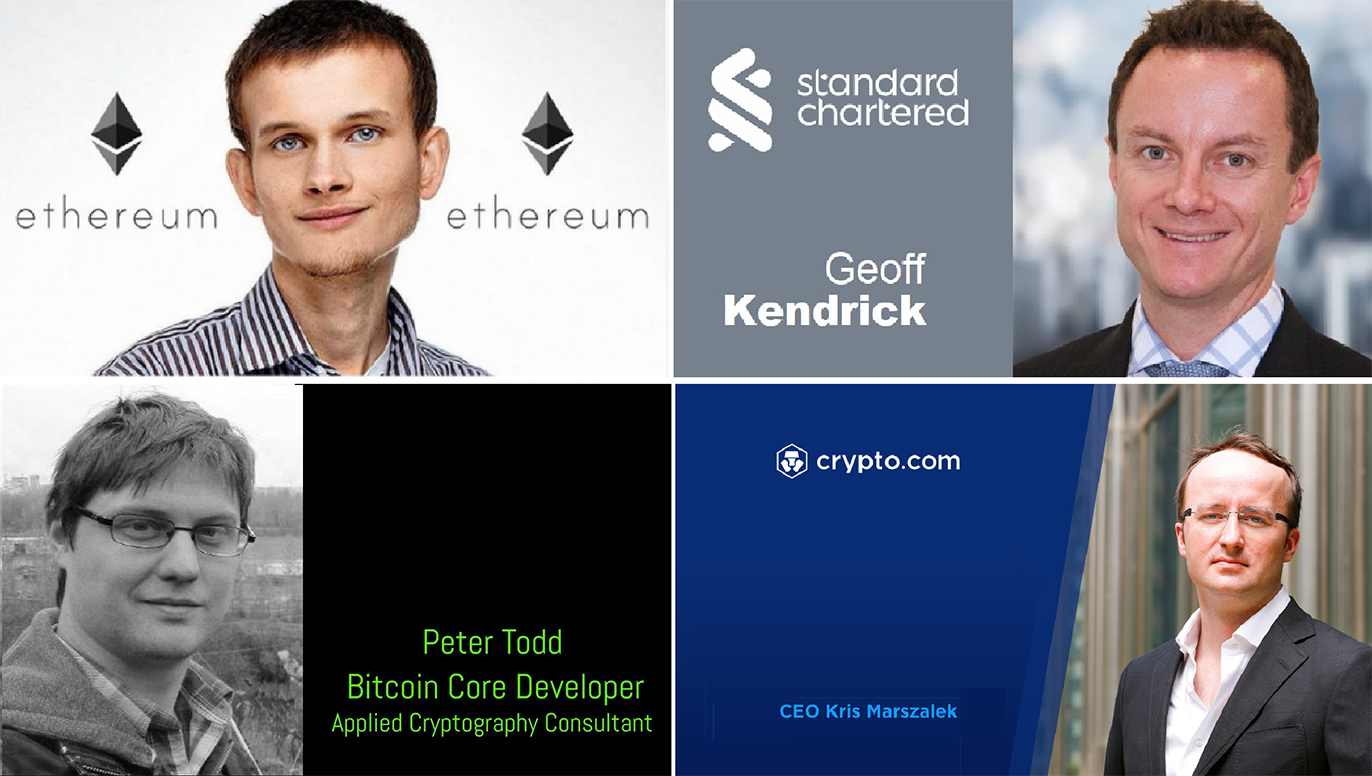

– Geoff Kendrick, Head of Crypto Analysis at Normal Chartered Financial institution, predicts that if Donald Trump is elected President of the US, the worth of bitcoin might triple by the top of 2025, whereas Solana might see a fivefold enhance. The knowledgeable believes {that a} Trump administration can be extra beneficial in direction of the Solana ecosystem in comparison with a Harris administration. Subsequently, if Kamala Harris turns into the occupant of the White Home, bitcoin is anticipated to outpace Ethereum by way of development, whereas Ethereum, in flip, would surpass Solana and attain a degree of $7,000. Kendrick additionally means that bitcoin might attain $200,000 by the top of 2025, whatever the final result of the November 5 elections.

– As promised, the American tv community HBO aired the documentary *Digital Cash: The Thriller of Bitcoin* on 9 October. The premiere garnered vital curiosity from the crypto neighborhood, because the filmmakers claimed to disclose the identification of bitcoin’s creator, identified below the pseudonym Satoshi Nakamoto. In line with the filmmakers, it was a 39-year-old Canadian, Peter Todd, who was one of many early builders of Bitcoin Core however had by no means been among the many primary suspects within the function of Satoshi.

The filmmakers offered a lot of arguments, together with using British/Canadian spelling and a correlation between the timing of Satoshi’s publications and Todd’s examine schedule. The important thing “proof” was a message allegedly posted by Todd on the Bitcoin discussion board in 2010, below Nakamoto’s title. Nonetheless, the arguments offered within the documentary did not persuade most viewers, with CryptoQuant CEO Ki Younger Ju even describing the movie as “appalling” and expressing shock on the extent of the filmmakers’ mistaken conclusions.

– Over the previous yr, the variety of Brazilian residents proudly owning digital belongings has elevated by greater than 70%: rising from 14% of the nation’s inhabitants in 2023 to 24% in 2024. Consultants imagine that residents are starting to grasp that integrating digital belongings into the actual financial system and on a regular basis life will help scale back prices and safety dangers when conducting business transactions, and may additionally function a method of combating inflation. Analysts at Mercado Bitcoin be aware that if the present price of digital asset adoption continues among the many Brazilian inhabitants, the variety of cryptocurrency holders might attain and even exceed half of the nation’s inhabitants by 2030, amounting to almost 120 million individuals.

– The crypto funding firm Canary Capital, following Bitwise, has submitted an utility to the U.S. Securities and Trade Fee (SEC) to launch a spot XRP ETF based mostly on Ripple. The Canary XRP ETF is designed to supply traders with entry to one of many largest altcoins by means of a standard brokerage account, with out the dangers related to straight buying and holding cryptocurrency. That is undoubtedly constructive information.

The applying was filed utilizing Kind S-1, which implies there are not any specified deadlines for the regulator to challenge a call. That is the draw back, because the assessment course of might vary from “prolonged” to “countless.” Moreover, the second obligatory step for launching an ETF entails submitting one other utility, which have to be filed with the SEC by the inventory alternate the place the brand new product might be listed. To date, the regulator has not acquired such an utility.

– In the US, not solely can authorities file lawsuits towards business organisations, however the reverse can also be doable. As an example, the cryptocurrency alternate Crypto.com has filed a lawsuit towards the Securities and Trade Fee (SEC), accusing the company of overstepping its authority in regulating the crypto business. This was introduced by the platform’s co-founder and CEO, Kris Marszalek.

“This unprecedented motion by our firm towards a federal company is a justified response to the SEC’s enforcement actions, which have harmed greater than 50 million American cryptocurrency holders,” he wrote on his social media web page. In line with Marszalek, the Fee has exceeded its authorized boundaries and now features as an illegal entity, labelling almost all cryptocurrencies as securities. The top of Crypto_com additionally promised that the corporate would use “all obtainable regulatory instruments” to convey readability to the business and to guard the way forward for the crypto business in the US by means of authorized means.

– Famend economist Tyler Cowen has nominated Ethereum co-founder Vitalik Buterin as a candidate for the Nobel Prize in Economics. This initiative has additionally been endorsed by one other outstanding knowledgeable, Professor Alexander Tabarrok.

Each economists praised Vitalik Buterin for his vital contributions to the financial economics of cryptocurrencies, emphasising that his work has far surpassed that of some other economist. In line with Tyler, Vitalik constructed the ingenious Ethereum platform and created a digital forex that challenges Mises’ regression theorem.

For reference, the regression theorem posits that the worth (or price) of cash will be traced again (“regressed”) to the worth of products and companies it initially represented.

Cowen and his colleagues additionally recommended Buterin’s continued efforts to develop the Ethereum community. They highlighted that he would make a wonderful speaker on the Nobel Prize ceremony (if, in fact, he’s chosen), noting his repute as a really courteous particular person.

– In line with analysts at MatrixPort, cryptocurrencies might transition from a distinct segment market to part of mainstream monetary methods by 2025. MatrixPort’s calculations point out that, amidst a world easing of restrictions on the shopping for and promoting of digital belongings, round 7.51% of the world’s inhabitants has begun utilizing cryptocurrencies frequently. Bitcoin has emerged as the first driver behind this adoption, with “digital gold” changing into a serious subject of dialogue in monetary circles, each on the company and governmental ranges. The MatrixPort report highlights the rising affect of institutional participation, together with main banking firms and asset administration companies like BlackRock, which have considerably elevated their investments in crypto belongings following the launch of spot BTC-ETF and ETH-ETF merchandise.

Analysts predict that if world adoption of digital belongings surpasses 8% in 2025, it could function a transparent sign of a possible shift of cryptocurrencies into mainstream monetary methods. Nonetheless, MatrixPort additionally notes that attaining such a degree of adoption might face challenges from authorities regulators. The event of the business is additional constrained by the volatility of the crypto market and retail traders’ issues concerning the safety of their belongings.

[ad_2]

Source link