[ad_1]

skynesher

One firm that I’ve been persistently bearish on is a agency by the identify of Cryoport, Inc. (NASDAQ:CYRX). For these not conversant in the enterprise, it gives prospects with specialty provide chain options. Particularly, the agency caters to the life sciences house to which it affords up managed temperature storage, specialised packaging, product labelling, and regulatory companies. It even engages in drug return dealing with and destruction companies, to not point out different actions.

Since I final wrote concerning the enterprise in March of this 12 months, shares have taken a tumble, plunging by 41.9%. That’s far worse than the 9.6% enhance seen by the S&P 500. Happily, due to the corporate’s general basic situation, I had a ‘promote’ ranking on it. So my name has thus far confirmed to be right. However that is not all. Since I initially rated it a ‘promote’ two years in the past in July 2022, the inventory is down a whopping 76.7% at a time when the S&P 500 is up 36.1%.

Many of the agency’s draw back has been latest, as you may inform. Since reporting monetary outcomes masking the primary quarter of the corporate’s 2024 fiscal 12 months on Could seventh, the inventory is down 47.1%. To many, this could be seen as shopping for alternative. Typically talking, I might agree. Nevertheless, with fundamentals persevering with to worsen, I would not be stunned if further draw back is skilled from right here.

Shares are on ice

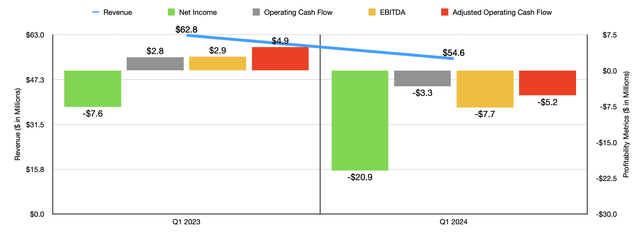

After I final wrote about Cryoport earlier this 12 months, we had information masking the 2023 fiscal 12 months in its entirety. Immediately, that information now extends via the primary quarter of 2024. Throughout that window of time, the image for the enterprise has weakened materially. Take income for instance. Within the first quarter of 2023, income for the enterprise was $62.8 million. From that point to the primary quarter of this 12 months, it plummeted 13.1% to $54.6 million. Surprisingly, this occurred at a time when its Life Sciences Providers operations really noticed income tick up from $35.8 million to $36.8 million. This enchancment was pushed largely by a 9.2% enhance involving its BioStorage/BioServices operations and by a 9.1% enchancment in Cell & Gene remedy income.

Creator – SEC EDGAR Knowledge

The ache for the enterprise, then, got here from a plunge in Life Sciences Merchandise income from $27 million to $17.8 million. Pushed principally by weak spot in demand from China, the corporate noticed a fabric decline in income related to its cryogenic freezer techniques. Contemplating that almost all of income beneath this class comes from these techniques and associated merchandise, it isn’t stunning to see weak spot have an effect on the corporate extra broadly.

For an organization that already has had issues from a profitability perspective, it ought to come as no shock {that a} decline in income, a decline thoughts you that was $4.1 million worse than analysts anticipated, would end in ache on the underside line. For the primary quarter of the 12 months, the corporate generated a internet lack of $20.9 million. That is almost triple the $7.6 million loss reported one 12 months earlier. Whereas there have been a number of contributors to this, the most important by far was a leap in promoting, basic, and administrative prices from $33.2 million to $38.3 million. That is a rise from 52.9% of gross sales to 70.2%.

To be completely honest to administration, they did specify that this enhance was pushed by investments within the firm’s ‘competencies and infrastructure’ that included each natural initiatives and acquisitions. In a way, which means at the least a few of this enhance might be chalked as much as one-time investments that ought to not repeat in the long term. Different profitability metrics adopted an identical trajectory. Working money circulation went from $2.8 million to a destructive $3.3 million. If we alter for modifications in working capital, we get a change from $4.9 million to a destructive $5.2 million. And lastly, EBITDA for the corporate fell from $2.9 million to destructive $7.7 million.

Past any doubt, these outcomes have been painful. What makes the scenario extra difficult is the truth that administration has not likely offered a lot in the best way of element in relation to the whole lot of the 2024 fiscal 12 months. The one numbers that they offered concerned income. If all goes in accordance with plan, general gross sales might be anticipated to be between $242 million and $252 million. On the midpoint, the $247 million would characterize a year-over-year enchancment of 5.9%.

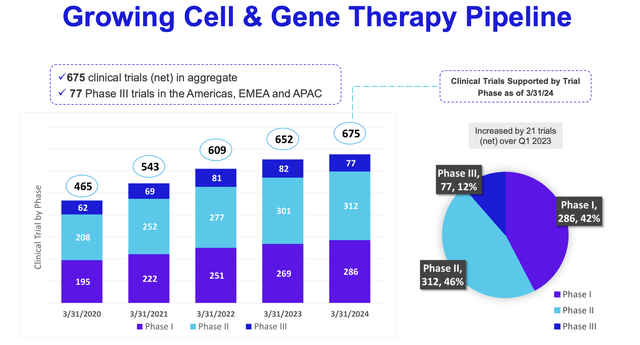

Cryoport

From a longer-term perspective, I think that the corporate shall be alright in relation to income. I say this as a result of administration has been profitable in persevering with to develop the corporate’s community, even at a time when gross sales have pulled again. In the latest quarter, as an illustration, the corporate was offering companies for 675 medical trials. This represents a rise over the 652 reported one 12 months earlier.

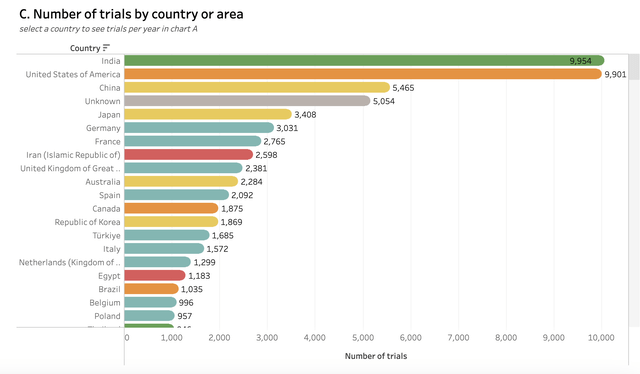

WHO

Whereas the corporate noticed a decline within the variety of Section III trials that it’s offering companies for, it skilled enticing progress related to Section I and Section II trials. To place this in perspective, simply within the US alone, there have been an estimated 9,901 medical trials in 2022. And when you think about that Cryoport has operations unfold throughout 50 totally different areas in 17 nations, the last word alternative for the enterprise is promising.

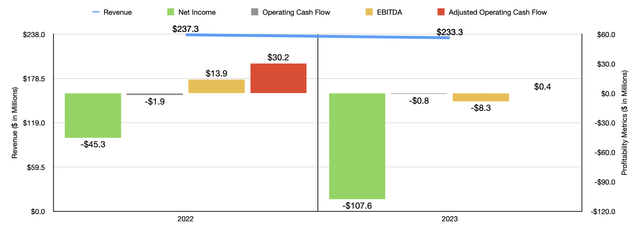

Creator – SEC EDGAR Knowledge

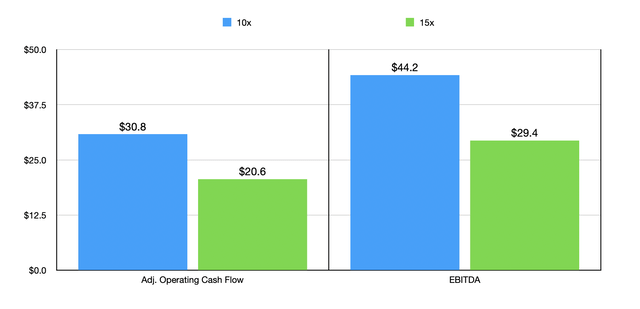

Sadly, till we see some enchancment from a profitability perspective, this example nonetheless appears scary. This 12 months is already trying worse than final 12 months was from a revenue and money circulation perspective. As you may inform within the chart above, outcomes for 2023 have been fairly a bit worse than they have been the 12 months prior. So that is half of a bigger pattern for buyers to take care of. You possibly can’t actually worth an organization that’s producing destructive earnings and money flows. However what you are able to do is to see how a lot money the corporate must generate as a way to be pretty valued. Within the chart under, you may see this in motion, with situations for the way a lot money circulation the corporate would want to generate to commerce at both 10 occasions or 15 occasions on a price-to-adjusted working money circulation foundation or 10 occasions or 15 occasions on an EV-to-EBITDA foundation. To get from the place we’re immediately to those sorts of ranges isn’t unimaginable, but it surely’s quite a lot of work simply to achieve honest worth.

Creator – SEC EDGAR Knowledge

Takeaway

As fascinating as Cryoport is and as a lot because the inventory has fallen, the very fact of the matter is that the basic situation of the enterprise has solely worsened in the previous couple of months. Whereas some may view this as shopping for alternative, I might argue that till we see backside line outcomes stabilize, or ideally enhance, the danger is simply too nice. Due to this, I’ve determined to maintain the corporate rated a ‘promote’ for now.

[ad_2]

Source link