[ad_1]

Dragon Claws/iStock through Getty Photos

Introduction

Not too long ago, I’ve seen a number of push to put money into Schwab US Dividend ETF (ARCX: SCHD). Frankly, I’ve by no means understood the fascination. Whereas it’s a good fund for what it does, I really feel there are higher alternatives elsewhere. For instance, I lately wrote a chunk the place I felt that World X S&P High quality Dividend ETF (ARCX: QDIV) was a much better choice than SCHD.

Now I’ve come throughout an alternative choice that I really feel is best than SCHD. It’s the PACER US Money Cows 100 ETF (BATS: COWZ). I’ll spend the remainder of my time right here outlining why COWZ is best than SCHD. Trace: It’s all in regards to the efficiency of the underlying index.

Earlier than we begin, right here is a few key knowledge about SCHD and COWZ, and the way they examine to SPDR S&P 500 Belief (ARCX: SPY):

Months

(January 2017-January 2024)

Schwab Str: US Div Eq ETF (ARCX: SCHD)

Pacer US Money Cows 100 (BATS: COWZ)

SPDR S&P 500 ETF (ARCX: SPY)

Common Complete Return

13.28% (±17.36%)

15.55% (±22.16%)

15.05% (±18.03%)

Sharpe Ratio

0.63

0.60

0.70

Sortino Ratio

0.93

0.77

1.00

Return/Threat

0.77

0.70

0.84

Technique

Customary Lengthy

Quant Mannequin

Customary Lengthy

Type

Fairness Earnings

Normal

Normal

Dimension

Massive Cap

Massive Cap

Massive Cap

Yield

3.45%

1.93%

1.45%

Beta

0.81

0.94

1.00

Morningstar Score

5-Stars

5-Stars

4-Stars

Lipper Leaders Score

5-Stars

5-Stars

5-Stars

Searching for Alpha Analysts Score

BUY

HOLD

HOLD

Click on to enlarge

COWZ has a shorter historic interval, so not sufficient annual knowledge exists to investigate it the best way I’m accustomed. Regardless of that, it does seem that COWZ has been a greater performer over the previous seven years. The chance metrics, although, may give one pause earlier than they embody it of their portfolio. I’ll tackle that once I discuss in regards to the underlying indices.

The Indices

SCHD makes use of the Dow Jones Dividend 100 Index as its underlying methodology. Listed here are the standards:

Solely firms which have paid a dividend within the final ten years qualify. It selects the highest 100 firms based mostly on the indicated annual dividend yield. It is not going to embody REITs Ensures the liquidity of the safety. Weights of the businesses based mostly on dividend yield. It rebalances yearly in March and applies day by day capping when wanted.

COWZ makes use of the Pacer Money Cows 100 Index and makes use of a separate set of standards:

Excluding financials, it limits its universe to the Russell 1000. It’s going to embody REITs. It screens firms based mostly on their common consensus forward-year free money flows and earnings estimates, excluding these with damaging values. It ranks firms by their free money circulate yield. It selects the highest 100 firms based mostly on free money circulate yield. It weights firms by their free money circulate. It rebalances quarterly.

If one is occupied with shadowing the methodology of COWZ, listed here are its prime ten holdings:

AbbVie Inc. (XNYS: ABBV) Reserving Holdings Inc. (XNAS: BKNG) Qualcomm Included (XNAS: QCOM) Lennar Company (XNYS: LEN) Valero Power Company (XNYS: VLO) Marathon Petroleum Company (XNYS: MPC) Phillips 66 (XNYS: PSX) CVS Well being Company (XNYS: CVS) D.R. Horton, Inc. (XNYS: DHI) Nucor Company (XNYS:NUE)

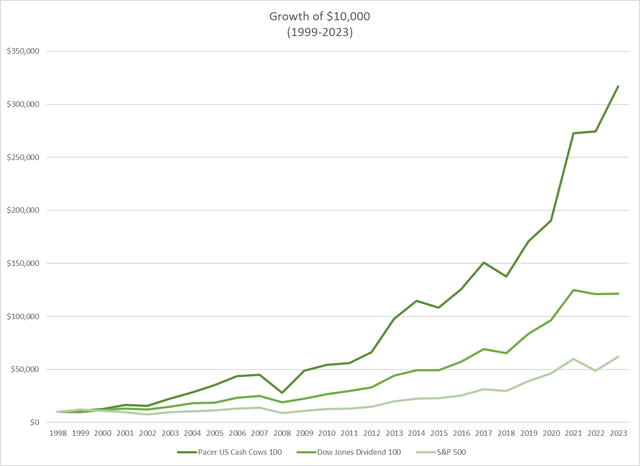

Morningstar offers us with backtested knowledge to see how the 2 underlying indices would have carried out in opposition to the S&P 500:

Money Cow, DJ Dividend, and S&P 500 Comparability (Writer Generated)

Statistics

Years (1999-2023)

DJ US Dividend 100 Index

Pacer US Money Cows 100 Index

S&P 500 Index

Common Complete Return

25

10.50% (±13.31%)

14.82% (±21.17%)

7.56% (±19.77%)

Up Markets

19

14.95%

21.18%

17.11%

Down Markets

6

-2.50%

-3.18%

-17.83%

Modified Sharpe Ratio

0.77

0.79

0.57

Modified Sortino Ratio

0.92

0.90

0.62

Return/Threat Ratio

0.79

0.70

0.38

Click on to enlarge

One ought to see that each indices outperform the broader S&P 500 index. That, partially, is what makes SCHD favored by so many. What makes the Money Cows Index particular is that it outperforms the broader market index throughout up and down markets. That isn’t a typical feat and one thing one shouldn’t ignore. Notice that the Money Cows strategy has a extra unstable efficiency. That’s as a result of outsized return it had in 2009 when it yielded 72.96%.

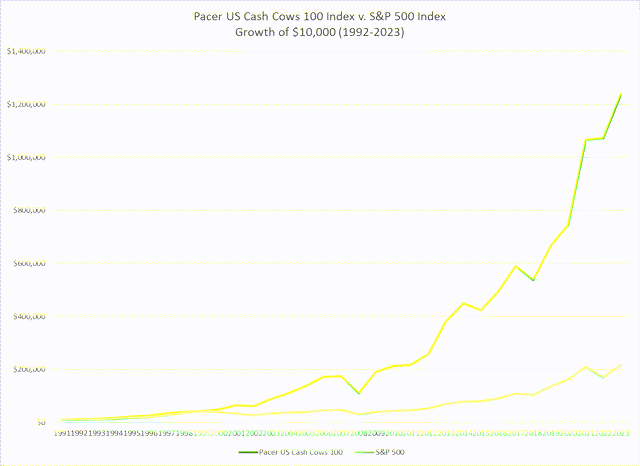

Knowledge for the Money Cows Index dates earlier to 1992. For 1992-2023, the outcomes are sobering for many who insist on investing solely within the S&P 500.

Money Cows and S&P 500 Comparability (Authored Generated)

Statistics

Years (1992-2023)

Pacer US Money Cows 100 Index

S&P 500 Index

Common Complete Return (Annual)

32

16.25% (±19.25%)

10.07% (±18.88%)

Up Markets

26

21.26%

17.75%

Down Markets

6

-3.18%

-17.83%

Modified Sharpe Ratio

0.76

0.52

Modified Sortino Ratio

0.93

0.83

Return/Threat Ratio

0.84

0.53

Click on to enlarge

Once more, the consistency within the outperformance is affirmed. The Money Cows Index outpaces the S&P 500 throughout up and down markets. The chance ratios additionally present that one is just not taking pointless dangers to faucet into this type of investing.

It turns into vital so as to add, for disclosure, that one can not put money into an index instantly. Investing in an ETF is just not investing instantly in an index, however solely in a facsimile of the index. Regardless of that, it is very important present how a lot is the monitoring divergence when one compares an ETF with its underlying index. SPY has outperformed the S&P 500 by 0.11% (±0.09%) per 12 months. SCHD has underperformed its underlying index by -0.53% (±1.48%). In the meantime, COWZ has exceeded its index’s return by 0.66% (±0.61%).

A Latest Piece About SCHD and COWZ

I lately learn a wonderful piece from John Bowman the place he outlines his thesis on why Schwab US Dividend Fairness ETF (ARCX: SCHD) is best than Pacer US Money Cows 100 ETF (BATS: COWZ). Mr. Bowman’s thesis is obvious and arranged however leaves out a key evaluation of the underlying indices for every ETF.

The thesis of Bowman’s article outlines the next causes for his perception that SCHD is a greater choice (barely) than COWZ:

SCHD pays a greater dividend yield. SCHD yields 3.49% v. COWZ dividend yield of 1.93% COWZ is positioned higher on the subject of issue publicity as a result of it’s extra diversified. SCHD has a extra rigorous methodology than COWZ, thus Bowman prefers SCHD. COWZ has much less inventory danger than SCHD, giving it a better desire for Bowman. Primarily based on knowledge from Searching for Alpha, SCHD has a greater quant score than COWZ.

Mr. Bowman’s evaluation is deep and far-ranging and is to be admired. I confirmed, nevertheless, that he’s lacking one key aspect in his evaluation, and that’s underlying index efficiency. I consider that if one had been to take a look at the underlying indices, one would see that COWZ is a much better choice for constructing wealth. Ultimately, it was, is, and at all times will likely be about efficiency.

My Take

We’ve got entered a interval the place we are able to entry over 25 years’ value of information to see how specialty indices have carried out. The expertise, analysis, and backtesting permit us to present correct evaluation to see if a specific technique works. I’ve studied ETFs and their building to see if sure strategies assist an investor obtain market-beating returns. With this train, we’ve got robust knowledge to indicate that specializing in free money circulate is vital.

Mr. Bowman believes that SCHD is a greater choice than COWZ. His level system provides SCHD a slight edge. In my humble opinion, the info about whole returns for the underlying indices make the conclusion fairly apparent. COWZ is a greater ETF than SCHD.

Have enjoyable and maintain investing.

[ad_2]

Source link