[ad_1]

This information outlines the steps to commerce Lined Requires newbies on Interactive Brokers.

Understanding the mechanics of lined calls can improve your buying and selling technique and generate further earnings.

Contents

A lined name is an choices technique that entails holding a protracted place in an asset and promoting name choices on that very same asset.

This technique can present earnings from choice premiums whereas probably permitting for some capital appreciation.

It’s important for merchants to know the dangers and rewards related to this technique earlier than continuing.

Interactive Brokers presents a strong platform for buying and selling choices.

This information makes use of the basic Dealer Workstation (TWS) interface.

Free Interactive Brokers Information

Begin by getting into the inventory ticker into the platform.

For instance, think about using Apple.

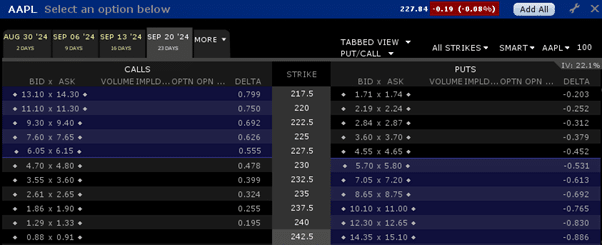

As soon as the inventory is chosen, navigate to the choice chain.

Determine a name choice barely out of the cash, such because the 235 strike worth, for month-to-month lined calls.

Place an order to purchase 100 shares of the chosen inventory.

Set the order on the midpoint worth for faster execution.

After the inventory buy is crammed, promote one contract of the out-of-the-money name choice on the midpoint worth.

For tightly traded shares like Apple, this step can usually be executed with minimal delay.

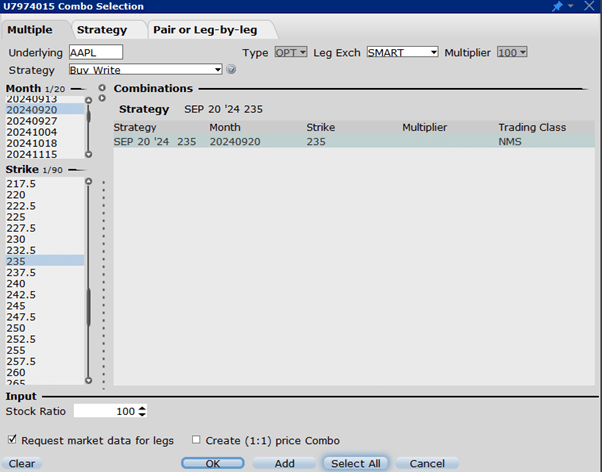

For merchants preferring combining the purchase and promote orders right into a single transaction, Interactive Brokers permits this by way of the Choices Mixture characteristic:

Within the choice combos part, select the Purchase Write technique.

This feature means that you can purchase 100 shares whereas concurrently promoting a name choice.

Specify your required expiration date and the strike worth for the decision choice.

Guarantee to pick the Purchase Write choice, not the promote choice.

If establishing trades after hours, decide the midpoint of the inventory worth and the decision choice worth.

Use an exterior device, resembling Excel, to calculate the suitable costs on your orders.

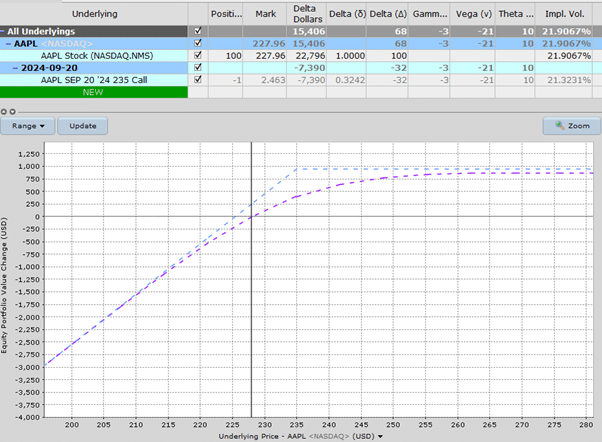

Earlier than executing any commerce, assess the chance utilizing Interactive Brokers’ Threat Navigator.

Enter the parameters of your lined name, together with the inventory and choices particulars.

Look at the chance graph for potential outcomes and make sure that the Greeks align along with your buying and selling technique.

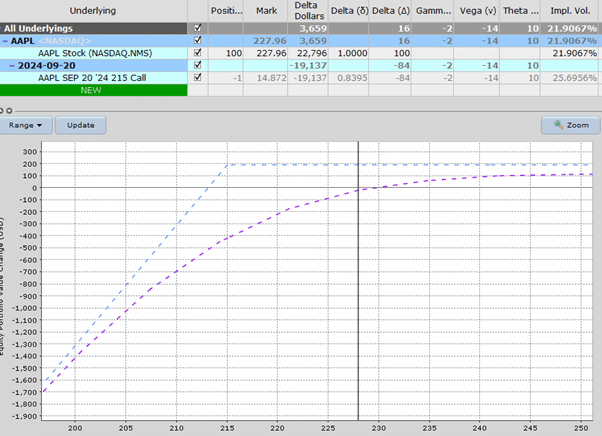

Some merchants may think about deep in-the-money lined requires decrease threat and lowered volatility.

For example, select an choice with a strike worth round 215.

Evaluate the revenue potential with that of an ordinary out-of-the-money name.

Whereas the deep in-the-money name offers a smaller revenue potential, it might additionally cut back threat publicity.

Executing lined calls on Interactive Brokers isn’t overly troublesome when you get the cling of it.

By understanding the mechanics, merchants can implement this technique with minimal fuss.

We hope you loved this text on Lined Requires newbies on Interactive Brokers.

If in case you have any questions, please ship an e-mail or depart a remark under.

Commerce secure!

Disclaimer: The data above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for buyers who should not accustomed to alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link