[ad_1]

Delinquency charges for mortgages backed by business properties elevated barely throughout the third quarter of 2024. That is in accordance with the Mortgage Bankers Affiliation’s newest business actual property finance Mortgage Efficiency Survey, launched in October.

Delinquency charges for business mortgages backed by workplace properties continued to extend throughout the third quarter however declined for loans backed by lodging, retail and industrial properties. The business mortgage market is giant and various, overlaying a spread of property varieties, sizes and ages, geographic markets and submarkets, borrower varieties, vintages and extra. Every of these variations is affecting mortgage efficiency, some to the nice and a few to the unhealthy.

The stability of economic mortgages that aren’t present elevated barely within the third quarter of 2024.

96.8 p.c of excellent mortgage balances had been present or lower than 30 days late on the finish of the quarter, down from 97.0 p.c the earlier quarter.

2.7 p.c had been 90+ days delinquent or in REO, up from 2.5 p.c the earlier quarter.

0.3 p.c had been 60-90 days delinquent, up from 0.2 p.c the earlier quarter.

0.3 p.c had been 30-60 days delinquent, down from 0.4 p.c the earlier quarter.

READ ALSO: Capital Concepts: What to Look ahead to within the Trump Presidency

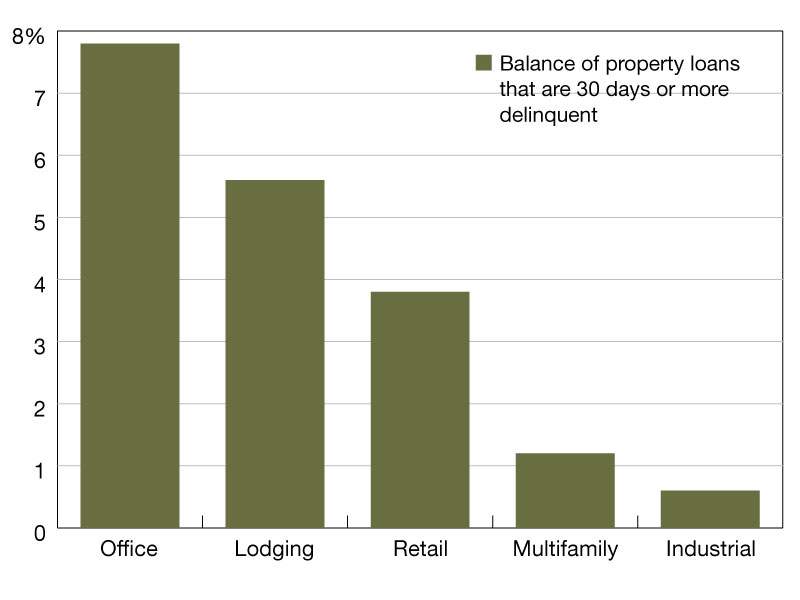

The share of loans that had been delinquent elevated for some property varieties, notably workplace, and decreased for industrial, lodging and retail properties.

7.8 p.c of the stability of workplace property mortgage balances had been 30 days or extra days delinquent, up from 7.1 p.c on the finish of final quarter.

5.6 p.c of the stability of lodging loans had been delinquent, down from 5.8 p.c the earlier quarter.

3.8 p.c of retail balances had been delinquent, down from 4.5 p.c.

1.2 p.c of multifamily balances had been delinquent, up from 1.1 p.c.

0.6 p.c of the stability of commercial property loans had been delinquent, down from 0.8 p.c.

Amongst capital sources, CMBS mortgage delinquency charges noticed the very best ranges however had been flat throughout the quarter.

4.8 p.c of CMBS mortgage balances had been 30 days or extra delinquent, unchanged from the final quarter.

Non-current charges for different capital sources remained extra reasonable.

0.9 p.c of FHA multifamily and well being care mortgage balances had been 30 days or extra delinquent, unchanged throughout the quarter.

0.9 p.c of life firm mortgage balances had been delinquent, down from 1.0 p.c.

0.5 p.c of GSE mortgage balances had been delinquent, up from 0.4 p.c the earlier quarter.

[ad_2]

Source link