[ad_1]

The US is residence to roughly a million companies that function car fleets, with a mean of 40 automobiles per fleet. Managing a industrial fleet entails quite a few concerns, together with financing, upkeep, route optimization, insurance coverage, and fueling. Coast affords a complete fleet administration platform and built-in cost card system particularly designed for fleet car bills. This resolution supplies real-time visibility for gasoline purchases, seamless worker spend monitoring, and integration with present fleet administration instruments. Coast focuses on companies with discipline service fleets like HVAC, plumbing, and development companies. The cost playing cards are accepted anyplace Visa is accepted. On the income facet, Coast earns an interchange payment together with a $4 per thirty days payment per issued card. Fleet operators earn a $.02 rebate per gallon of gasoline bought whereas guaranteeing that worker car and gasoline spend are each aligned with expense insurance policies with elevated oversight.

AlleyWatch caught up with Coast Founder and CEO Daniel Simon to study extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, and far, way more…

Who had been your buyers and the way a lot did you elevate?We raised a $40M Collection B fairness financing, led by ICONIQ Progress. They had been joined within the spherical by present buyers Accel, Perception Companions, Vesey Ventures, and Avid Ventures, in addition to new buyers Thomvest. This brings Coast’s whole fairness funding to about $100M.

Inform us concerning the services or products that Coast affords.Coast supplies a contemporary, tech-forward expense administration software program platform with a industrial cost card – analogous to options from firms like Ramp or Brex – however particularly designed for the huge and underserved sector of companies that function car fleets.Fleets like these have knowledge wants that common company playing cards don’t present. They want detailed visibility on the line-item stage into their workers’ spending. For instance, they need to know what number of gallons of which gasoline grade are being purchased for which car, and to make it possible for their workers’ spending complies with firm insurance policies when these staff are within the discipline.Coast supplies a easy method for the workers of those companies to pay for gasoline and different car bills after they’re on the job, wherever Visa is accepted. Coast provides finance and fleet administration groups highly effective instruments to manage expense insurance policies and have insights into worker spending, to allow them to spend their time rising their companies sooner.

What impressed the beginning of Coast?

We began this enterprise on the top of the COVID-19 pandemic, when logistics and cellular workforces, important staff on the entrance strains retaining the financial system functioning, had been beneath large pressure. These “actual world” enterprise workers — supply individuals, plumbers, HVAC installers, taxi and limo drivers — are generally missed by the expertise trade. However they’re the hidden pressure that powers the digital age, making potential each Amazon cargo or Shopify buy, each DoorDash supply or Uber experience. As our society demanded an increasing number of of those staff throughout the pandemic, their group’s wants and ache factors turned much more obvious to us. We got down to construct a enterprise that will enhance the working lives of cellular workforces whereas serving to their employers’ companies thrive.

We began this enterprise on the top of the COVID-19 pandemic, when logistics and cellular workforces, important staff on the entrance strains retaining the financial system functioning, had been beneath large pressure. These “actual world” enterprise workers — supply individuals, plumbers, HVAC installers, taxi and limo drivers — are generally missed by the expertise trade. However they’re the hidden pressure that powers the digital age, making potential each Amazon cargo or Shopify buy, each DoorDash supply or Uber experience. As our society demanded an increasing number of of those staff throughout the pandemic, their group’s wants and ache factors turned much more obvious to us. We got down to construct a enterprise that will enhance the working lives of cellular workforces whereas serving to their employers’ companies thrive.

How is Coast completely different?Coast reimagines the product class with best-in-class safety and spend controls, real-time transaction knowledge and reporting, and integrations with fleet administration and telematics software program. Coast’s software program provides fleet managers highly effective insurance policies and controls that they will tailor to the on-the-job wants of various workers and automobiles of their fleets.

What market does Coast goal and the way huge is it?The fleet gasoline funds on these specialised playing cards add as much as a staggering estimated $120B transacted yearly within the US.Coast focuses on discipline companies fleets, e.g. HVAC, plumbing, development companies, in addition to passenger transport and native supply fleets.

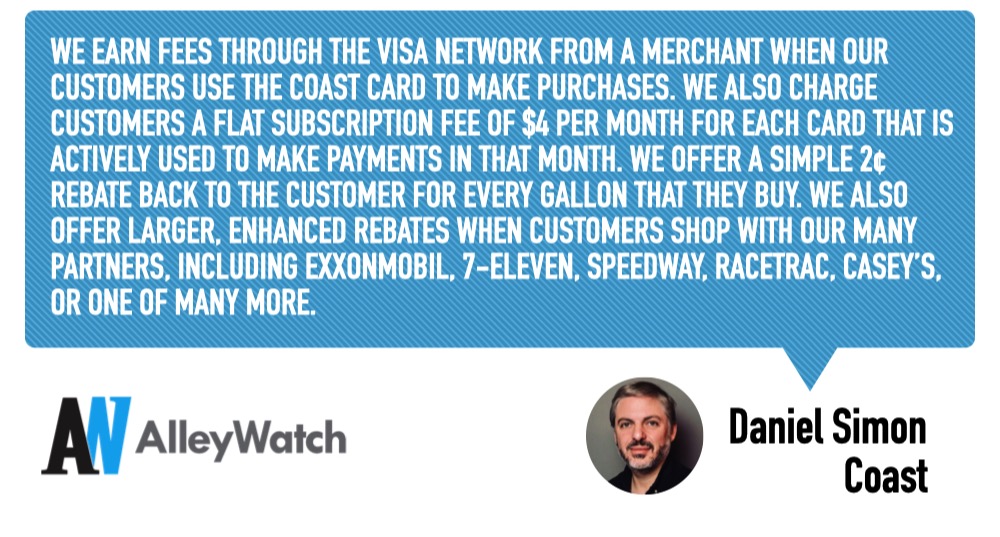

What’s your enterprise mannequin?We earn charges via the Visa community from a service provider when our clients use the Coast card to make purchases. We additionally cost clients a flat subscription payment of $4 per thirty days for every card that’s actively used to make funds in that month. We provide a easy 2¢ rebate again to the client for each gallon that they purchase. We additionally supply bigger, enhanced rebates when clients store with our many companions, together with ExxonMobil, 7-Eleven, Speedway, RaceTrac, Casey’s, or considered one of many extra.

How are you getting ready for a possible financial slowdown?To start with, this fundraise ensures the corporate has the assets to climate any storm that could be coming, so long as Coast responsibly stewards its capital. Extra essentially, Coast avoids focus in its buyer portfolio and serves hundreds of companies throughout trade classes. Whereas Coast shares within the progress of firms that profit from increase instances, like development, we additionally serve firms which have much less publicity to financial cycles, like these in residential companies for plumbing or electrical. This broad buyer base ensures the corporate can keep income even in a downturn.

What was the funding course of like? As we began to construct a relationship with ICONIQ Progress over some months, each groups grew more and more excited concerning the potential to work collectively. ICONIQ understood and believed in our imaginative and prescient, and knew we had the tenacity to make it occur, and we had been equally impressed with the assets and dedication with which ICONIQ helps its portfolio firms to develop. With our bold progress targets and an unsure capital markets atmosphere, it made sense to arm the corporate with extra capital, and ICONIQ appeared to us to be good companions in that function.

What are the most important challenges that you simply confronted whereas elevating capital?The enterprise capital markets have proven considerably lowered exercise after 2021 and capital isn’t as simply accessible to startups because it was in prior years. That stated, Coast’s demonstrated progress, sustainable enterprise mannequin, and dependable clients impressed the continued enthusiasm of our present buyers and sparked the curiosity of our new lead investor, who dug deep into our product and market and have become excited to get entangled.

What components about your enterprise led your buyers to put in writing the test?The big market alternative, quick progress and industrial traction, and the event of a number of efficient channels for buying clients throughout advertising and marketing, gross sales, and distribution companions. However most of all, listening to from our clients that they love the Coast product and that it’s categorically higher than something they’ve used earlier than for fleet and gasoline funds.

![]()

What are the milestones you intend to realize within the subsequent six months?

Launching a first-of-its-kind cellular app that eases the gathering and verification of transaction knowledge for fleet funds.

Constructing out specialised expense administration performance that helps our clients’ monetary processes, together with job codes and integrations with discipline companies administration software program.

Integrating with new platforms that our clients use, throughout fleet administration, telematics, accounting, and ERP platforms.

Launching extra partnerships with gasoline manufacturers, fleet administration firms, discipline service software program suppliers, and different important distributors for our clients.

Rising the workforce throughout our New York Metropolis headquarters and our increasing Utah workplace.

What recommendation are you able to supply firms in New York that shouldn’t have a recent injection of capital within the financial institution?Deal with worthwhile and capital-efficient buyer acquisition and unit economics. however don’t neglect investing in progress. You probably have a really differentiated product and your clients are sticking along with your product, the capital is on the market to gasoline fast-growing merchandise that clients love.

The place do you see the corporate going within the close to time period?We intend to make use of the brand new capital to proceed to spend money on constructing a best-in-class product for the fleets vertical, together with increasing to different monetary companies wants of its enterprise clients, resembling accounts payable automation and invoice funds. We presently have a workforce of round 65 workers, largely headquartered in New York Metropolis, and a rising presence at our second workplace in Utah, which we opened earlier this yr. The corporate is actively hiring to develop headcount throughout its features. We’ll give attention to product growth, including new integration companions in addition to supporting enterprise bills past gasoline. Over time, with developments in different car vitality and facilitating the acquisition of gasoline that fuels an inner combustion engine, we can even be powering the transaction that costs an electrical car battery that will get the HVAC installer to his job or the bundle supply driver to her vacation spot.

What’s your favourite summer time vacation spot in and across the metropolis?The pond in Prospect Park in Brooklyn!

You might be seconds away from signing up for the most well liked record in NYC Tech!

Enroll in the present day

[ad_2]

Source link