[ad_1]

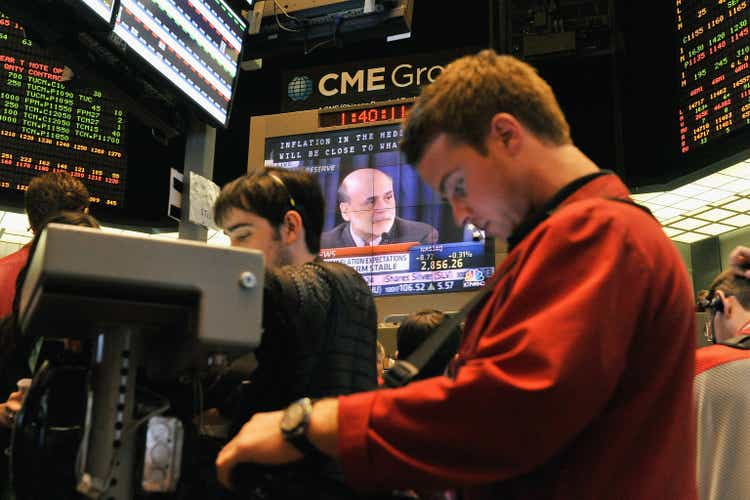

Brian Kersey

J.P. Morgan downgraded CME Group (NASDAQ:CME) to Underweight from Impartial as a brand new competitor, FMX, is poised to launch this summer season, threatening CME’s dominant place in charges buying and selling.

CME (CME) inventory dipped 1.1% in Friday premarket buying and selling.

BGC Group’s (NASDAQ:BGC) FMX Futures Trade has recruited a distinguished set of companions, together with what J.P. Morgan expects are a few of CME’s largest clients in charges buying and selling.

“These FMX companions inform us they’re annoyed with CME’s conduct as a monopoly, together with common worth will increase and lack of product innovation,” J.P. Morgan analyst Kenneth B. Worthington wrote in a observe to shoppers. They really feel {the marketplace} would profit from a competitor.

“Whereas all which have tried to compete with CME (CME) have failed, we see FMX having essentially the most compelling providing up to now, supported by state-of-the-art expertise, highly effective companions, and a compelling worth proposition together with decrease fee and aggressive, if not doubtlessly higher, portfolio margining,” he famous.

The analyst expects that the success of the brand new change will likely be decided by how liquidity develops and if FMX can win over asset supervisor contributors, that are doubtless CME’s (CME) most loyal clients.

Worthington’s Underweight ranking contrasts with the SA Quant ranking of Maintain and the typical SA Analyst ranking and common Wall Road ranking, each at Purchase.

Extra on BGC Group, CME, and so forth.

[ad_2]

Source link