[ad_1]

Klaus Vedfelt/DigitalVision by way of Getty Pictures

Thesis

World X MSCI China Shopper Discretionary ETF (NYSEARCA:CHIQ) is an fairness portfolio specializing in the patron discretionary sector. It has some high-quality and high-growth holdings with earnings development being the principle return driver whereas multiples have been stably depressed since 2022. From this era till now, the disaster of the property market and the uncertainty about secular financial development inside China have been heightened. Because of the extended interval of disappointing efficiency of each the properties and equities market in China, the general sentiment has been in a weak and sticky part the place a significant paradigm shift is probably going wanted to reverse the present lacklustre valuations.

On the flip aspect, the present situation doubtlessly means that the market is at a bottoming part. In the meantime, the earnings development potential for CHIQ’s holdings is mostly sturdy given every of the corporate’s market potential. Though there are many short-term financial challenges, the dangers typically don’t weigh considerably in opposition to the upsides given the pessimistic market expectations as a established order to start with. Because of this, my outlook for CHIQ is impartial for now, with a maintain score.

Introduction

Final week was the week of the Third Plenum in China, the place it should set the tone of long-term coverage agenda in response to China’s present scenario. Within the brief time period, the weak market sentiment continued amid downward strain on housing, disappointing H1 GDP development and retail gross sales performances. That is regarding as a result of a cyclical downturn within the economic system is especially unhealthy for client discretionary shares. Nevertheless, it’s in all probability not as unhealthy as it might appear. I’ll start with a fast overview of CHIQ’s construction after which talk about the broader markets and economic system in China that I believe have extra affect on this scenario.

CHIQ Overview

Web Asset Worth: $213.48 million

Dividend yield: 2.90%

Expense ratio: 0.65%

1-year worth return: -11.36%

Yr-to-date worth return: -4.43%

Shopper-cyclical weight: 94%

In search of Alpha

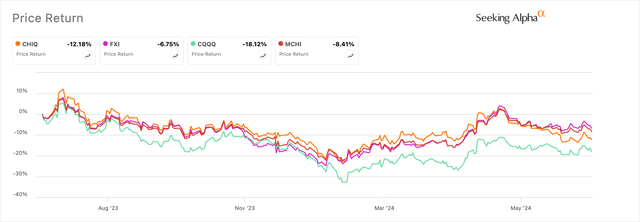

tickers: CHIQ, FXI, CQQQ, MCHI

Within the 1-year interval, efficiency for CHIQ has been in step with a few of the main Chinese language ETFs. Nevertheless, its year-to-date worth return is round -4% vs. +4.3% for MCHI. The distinction is attributed to the sector publicity, the place sentiment is extra destructive for client discretionary shares in China, particularly at first of 2024. In the meantime, MCHI and FXI have extra publicity to Chinese language banks, which currently loved main rallies.

In search of Alpha

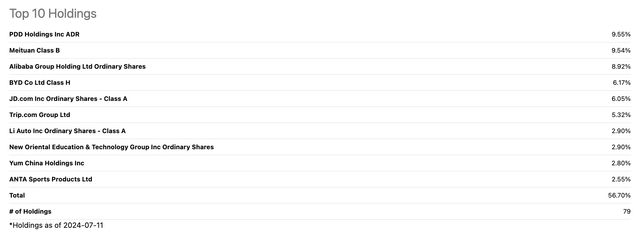

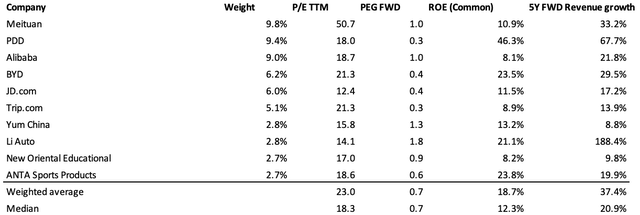

Listed here are the highest 10 holdings for CHIQ. My impression of those shares is that total, their high quality and development are sturdy regardless of broader macro issues. Given their high-growth nature, the fund’s aggregated high 10 holdings weigh round 56% with a weighted P/E ratio of 23, and to stability issues out, a PEG ratio of 0.7.

In search of Alpha, Creator’s calculation

Valuations are pretty enticing if we account for development, which is the principle driver of those shares’ efficiency, as multiples within the China market are staying depressed. Right here is a straightforward abstract of a few of the shares:

Meituan (OTCPK:MPNGY): Consensus annual earnings development is above 50% for FY24 and FY25. Income development is predicted to proceed at a a lot average tempo following the corporate’s aggressive enlargement tempo prior to now few years. Valuation is barely in direction of the costly aspect with earnings development relying on price cuttings, which is difficult.

PDD (PDD): A great funding with sturdy monetary efficiency and a beneficial technical pattern and valuations. A high-growth pattern is predicted given the sturdy price benefit and attraction to its clients. In the meantime, profitability stays sturdy.

BYD (OTCPK:BYDDY) and Li Auto (LI): Each corporations have sturdy potential inside the Chinese language market as a result of pattern of car electrification. BYD’s inventory is performing effectively on a year-to-date foundation, regardless of the Q1 income miss. Li Auto had additionally suffered an earnings and income miss within the latest quarter, with an total downward trajectory of inventory efficiency and earnings revisions. Not like BYD, Li doesn’t have a transparent worth benefit that enables the power for aggressive enlargement inside and past China with much less dependency on client confidence.

JD (JD) and Alibaba (BABA): Progress is pretty modest for the 2 corporations, with no clear catalyst for outperformance. The businesses are direct opponents in a consolidated e-commerce business. Valuations are on the enticing aspect.

Yum China (YUMC): I’ve just lately coated Yum China in one other piece. General, I believe that it is a firm with an amazing moat and a reasonably predictable enterprise. The valuation of YUMC is pretty good, however the present entry level continues to be dangerous. Its enlargement continues to be vital because it expands into China’s lower-tier cities.

These are the few largest holdings that may be necessary earnings development drivers for CHIQ. General, the portfolio continues to be fairly diversified, which makes the broader market and financial expectations to be the extra necessary components for now. Though the outperformance catalyst doesn’t appear clear within the brief time period, the general long-term development potential is robust given the industries during which a few of the corporations function. Financial and macro insurance policies do have a considerable affect on valuations. Nevertheless, they may unlikely affect the businesses’ development potential to the identical extent. A lot growth continues to be wanted within the Chinese language economic system contemplating points reminiscent of electrification, urbanization, unleashing the consumption potential of lower-tier cities, and so forth. The businesses could have a lot room to capitalize on them.

About The Broader Market And Economic system

Now, we might look extra into valuations and their broader context. I’ll first talk about extra concerning the destructive aspect. The year-to-date efficiency has been notably weak for not solely client shares, but in addition throughout segments excluding banking. That is amid the latest decline of the 10-year yield for Chinese language bonds as Chinese language buyers flock in direction of safer belongings and achieve desire for international publicity amid the “asset famine” atmosphere. On a yearly foundation, the marginally bearish pattern of the CSI300 index (extremely correlated with CHIQ) additionally concurs with that.

Outflow from the home markets weakens not solely domestically traded fairness valuations but in addition Chinese language corporations listed within the US, such because the holdings inside CHIQ. Asset costs in China have been on a declining pattern since 2021. This extended interval of disappointment by Chinese language shoppers has a profound impact. I believe, firstly, sentiment is artificially depressed. Secondly, the magnitude of coverage shock and effectiveness must be fairly vital for the entire paradigm to reverse, with the important thing points being the property phase within the short-term and financial development in the long run as China shifts its development mannequin.

Right here is the place we’re by way of insurance policies and broadly talking. Firstly, on the financial aspect, China is pretty clear about its intent to maintain the Yuan sturdy. It’s seemingly that there won’t be vital loosening. On the fiscal aspect, the present housing bundle continues to be seen as inadequate given the big scale of stock. At the moment, the federal government focuses extra of its consideration on deleveraging the LGFVs with a extra fiscally disciplined and long-term oriented stance. The Third Plenum’s outcome displays that, which makes short-term insurance policies nonetheless unclear. A protracted-term outlook is crucial for China on condition that it’s present process a significant transition in its financial mannequin in direction of one with “high-quality development”, much less dependency on the property market, and extra consumption. Other than home affairs, incremental protectionism topic to the potential Trump presidency will weigh closely in opposition to financial efficiency, with roughly 2.5% GDP development draw back per a UBS estimate.

I do know that the above factors would supply fairly a regarding outlook. On the flip aspect, there are causes to be optimistic. They should do with the present low valuation scenario of the Chinese language inventory market (which I consider is the view of quite a few banks), the resilience of CHIQ’s holdings, and likewise the restricted extent of affect from the tariffs levied given the holdings are oblique publicity. The “excessively” destructive motion of long-term yield to me signifies that sentiment is barely getting forward of fundamentals. Additional data shock from markets and the economic system could have a restricted affect on the markets given the present expectations which can be pessimistic to start with. Though property costs have continued to say no for the reason that begin of 2024, equities efficiency has been comparatively sturdy since then, reflecting that expectations on house costs have gotten adaptive in direction of the downward pattern. As for the dearth of coverage readability, I believe the central authorities’s skill to assist its fiscal stimulus is sort of enough contemplating the surplus stock funding wanted by estimate and a few indications of buyers’ optimism on native authorities funds. There may be some extent of “security internet” on that entrance. Trying forward and contemplating consumption shares, key sources of development embrace the present constructive momentum in youth employment, a big financial savings base to be transferred into consumption, new vitality and EVs adoptions, and nonetheless a big urbanization potential that may drive consumption and stuck belongings investments as soon as the native authorities and property builders deleverage sufficiently.

Abstract of Draw back Dangers

Geopolitics: Updates in tariffs in primarily the US and the EU could have a substantial affect on financial development. Tariffs have a powerful affect on China’s financial efficiency. Nevertheless, the extent of the affect it has on the equities market is unclear, together with for shares that aren’t instantly impacted by commerce.

Macro and insurance policies: As talked about, each short-term insurance policies and the long-run development tempo for China are pretty unsure. The extent of fiscal stimulus, which is way longed for by the market, comes off fairly weak as of now. I believe that is notably difficult in China’s scenario the place it’s constrained by the target to shift in direction of the “high-quality development” mannequin which has a lot much less dependency on investing within the housing sector, This challenges the coverage stance of instantly injecting into the housing market. Given the present scenario, house costs are falling with extra stock, and the scenario can turn out to be worse.

Liquidity: The web asset for the fund is round $210 million, which isn’t notably massive. This together with a comparatively low-volume ends in a comparatively dangerous score from In search of Alpha.

Conclusion

I’ve mentioned my view on its portfolio compositions and on China’s equities market as a complete. The portfolio is 94% client cyclical and usually comprised of high-quality shares with no clear outperformance catalyst given their “impartial” valuations. Chinese language shares usually commerce cheaply and CHIQ is on the costlier aspect given their justifiably high-growth and high quality traits with earnings development being a stable return driver.

Draw back dangers from valuation decline are restricted, whereas earnings development can proceed to drive CHIQ’s efficiency strongly. The earnings potential concurs with expectations. Restricted draw back dangers from valuation are primarily based on just a few predictions. Firstly, as a result of pessimistic sentiment from buyers, valuations are at an affordable degree to start with. That is true for China’s total inventory market and nearly all of holdings inside CHIQ. Regardless of the unresolved challenges for the Chinese language economic system and the dearth of transparency, there are nonetheless appreciable causes to be optimistic. They vary from long-term development potentials to a few of the short-term indications of insurance policies’ skill and metrics on financial revival. General, the view is sort of balanced, which provides it a “maintain” score for now. I’ll await extra coverage outcomes within the subsequent few months for revision, on condition that it’s one thing that the market weighs strongly on in my view.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link