[ad_1]

tagphoto/iStock through Getty Photos

Introduction

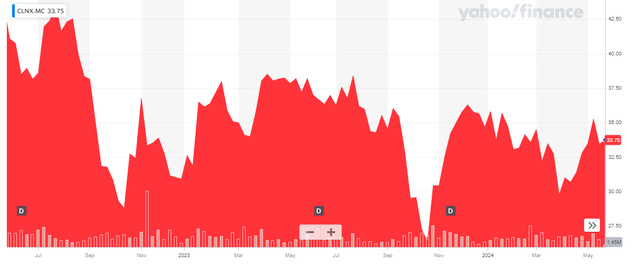

Simply over a 12 months in the past, I wrote an article on Cellnex Telecom (OTCPK:CLNXF) because the European counterpart of American Tower (AMT) and Crown Fort (CCI) was (and nonetheless is) buying and selling at considerably decrease multiples. As Cellnex shouldn’t be structured as a REIT however as a traditional company, its handicap is that it has to pay company taxes whereas the underside line result’s clearly closely impacted by the depreciation and amortization bills, that are a a number of of the sustaining capex to maintain cellphone towers working. I argued this was a possibility to have a better have a look at Cellnex as its debt load – which was one of many important arguments towards an funding – is manageable and consistent with the debt ratios of its North American friends. Happily Cellnex’ administration additionally realized it needed to change the notion of the corporate by specializing in free money move. As an alternative of reinvesting the free money move into constructing further towers, Cellnex has now confirmed on a current capital markets day it’ll concentrate on debt discount and it’ll begin to pay a dividend.

Yahoo Finance

Cellnex Telecom is a Spanish firm and its main itemizing (ticker image CLNX) on the Madrid Inventory Trade for certain is essentially the most liquid itemizing. The common every day quantity is 1.4M shares and the present market capitalization is just below 24B EUR based mostly on the present share depend.

The period of low-cost debt is over

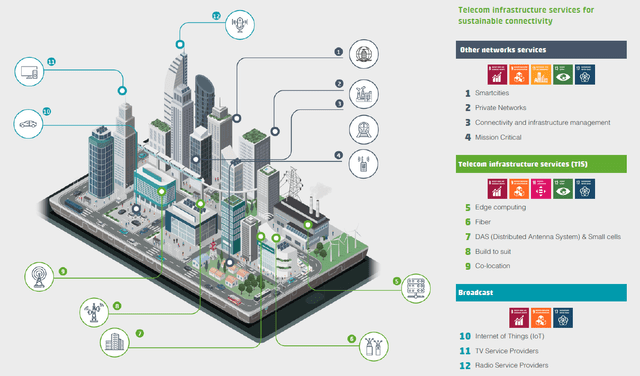

The enterprise mannequin of Cellnex was/may be very easy. It builds, owns and leases cellphone towers to telephone corporations. Very simple. This additionally means there’s a big upfront price to truly construct the towers, however as soon as they’re up, the sustaining capex is fairly minimal.

Cellnex Investor Relations

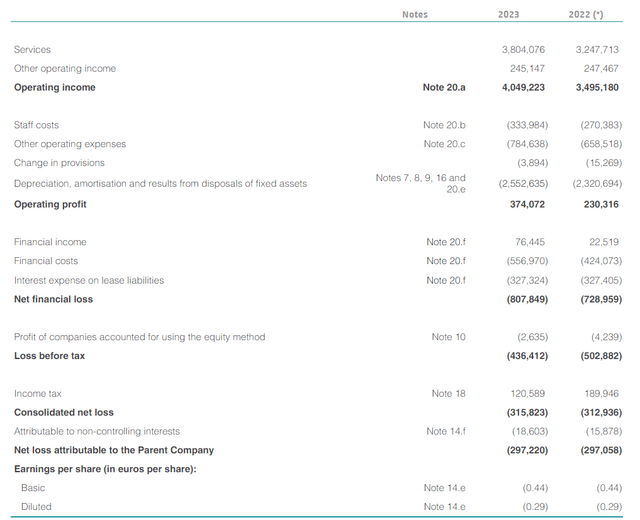

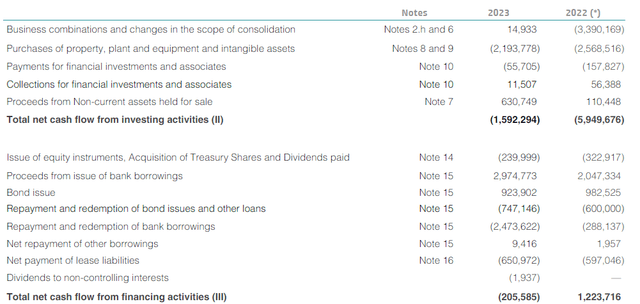

Though the online revenue isn’t actually the perfect metric to guage Cellnex on, it is a crucial start line to derive the underlying free money move results of the corporate.

As you may see under, the telephone tower operator reported a complete income (which it calls “working revenue”) of 4.05B EUR and because the revenue assertion reveals, the working bills to maintain the towers up and working was simply over 1.1B EUR. The depreciation and amortization bills of two.55B EUR really symbolize near 70% of its whole quantity of working bills. Because the sustaining capex is far decrease (I’ll focus on that later on this article), the underlying money move efficiency is far stronger than the reported working revenue of 374M EUR.

Cellnex Investor Relations

As you may see above, the whole quantity of monetary bills exceeded 800M EUR and this represented a rise of in extra of 10% in comparison with the 2022 efficiency. I’ll focus on the corporate’s sensitivity to the rates of interest later on this article. Extra importantly, all these components resulted in a pre-tax lack of 436M EUR and a internet lack of 316M EUR of which 297M EUR was attributable to the shareholders of Cellnex. As there are simply over 700M shares excellent, the online loss was roughly 0.44 EUR per share, which was nearly precisely the identical end result as within the previous 12 months.

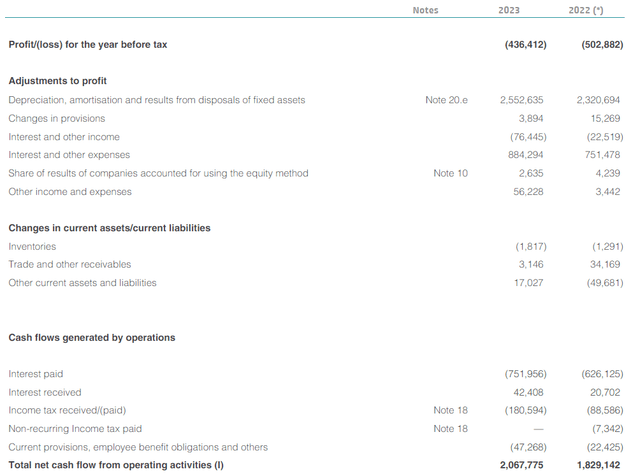

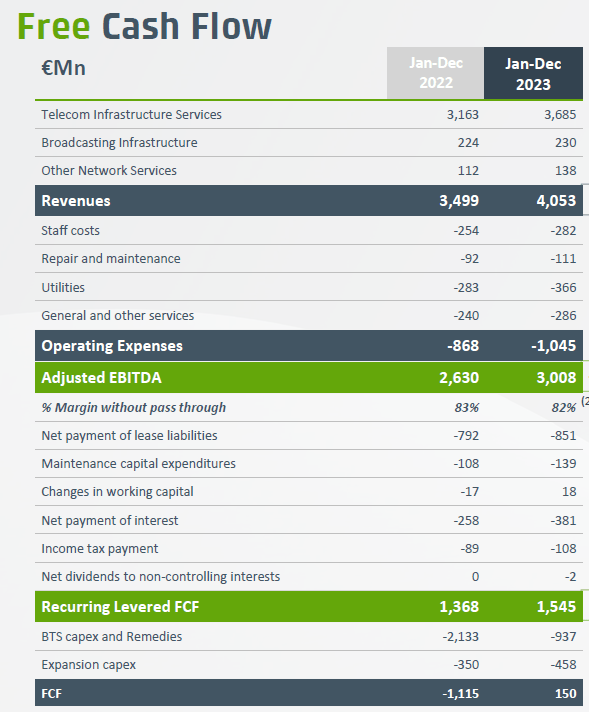

A internet loss definitely isn’t nice to see, however let’s take a look on the money move efficiency of Cellnex as that’s what actually issues. As you may see under, the whole working money move was roughly 2.07B EUR and roughly 2.05B EUR after deducting the modifications within the working capital. Observe: this features a 181M EUR tax cost to settle deferred tax liabilities though no taxes had been owed based mostly on the revenue assertion.

Cellnex Investor Relations

From that end result, we must always nonetheless deduct the 651M EUR in lease funds in addition to the 2M EUR in dividend funds to non-controlling pursuits. This implies the adjusted working money move was roughly 1.4B EUR.

Cellnex Investor Relations

As you may see within the picture above, Cellnex spent about 2.2B EUR on constructing new cellphone towers. This implies the corporate was just about breaking even on the money move degree after additionally taking the 631M EUR in proceeds from asset gross sales into consideration.

It goes with out saying the overwhelming majority of the capex consists of growth capex. The picture under clearly confirms this. As you may see, the upkeep capex was 139M EUR whereas there was roughly 1.4B EUR in growth capex, together with the build-to-suit (‘BTS’) capex.

Cellnex Investor Relations

Which means excluding the asset gross sales and assuming an adjusted working money move of 1.4B EUR, the underlying free money move end result was roughly 1.26B EUR and this contains the 181M EUR in money taxes paid, as per the money move assertion. Excluding that, the underlying free money move would have been 1.44B EUR which represents an FCF of in extra of two EUR per share.

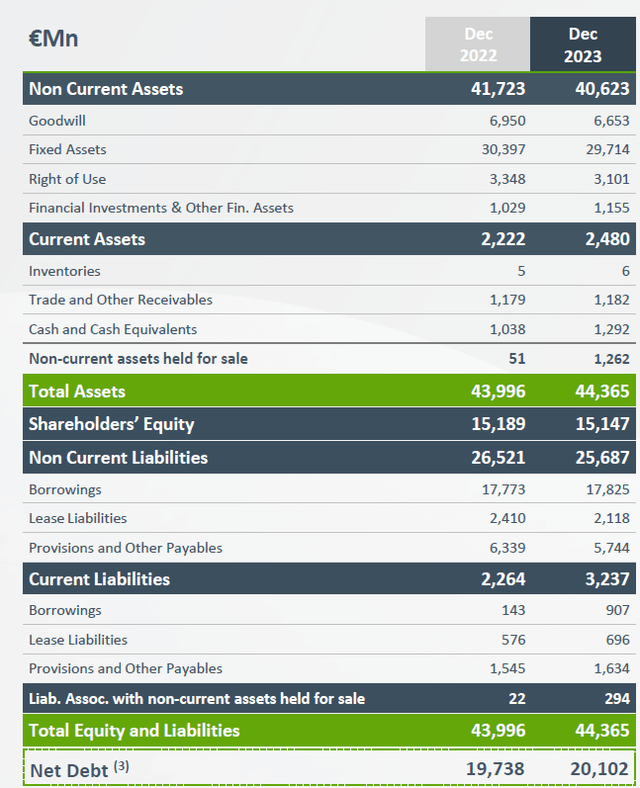

In fact that is “hidden” by the excessive capex. And though these investments will definitely be accretive, the market was getting a bit anxious in regards to the internet debt of 20.1B EUR as of the top of 2023.

Cellnex Investor Relations

Bear in mind the 20.1B EUR additionally contains the lease liabilities. The web monetary debt excluding these lease liabilities was roughly 17.4B EUR. Together with lease liabilities, the online debt vs. EBITDA ratio was getting near 7. Whereas that’s a traditional ratio for REITs and though Cellnex is a “REIT-like” firm, the market signaled it was anxious in regards to the debt pile regardless of Cellnex’s towers being topic to a mean contract size of 31 years (together with assumed renewals).

The long-term plans are encouraging

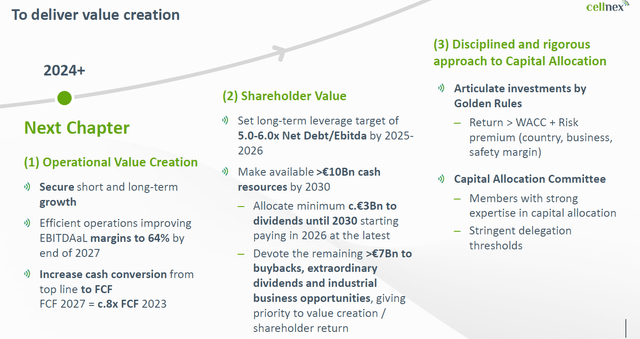

That message was properly understood by Cellnex administration and the corporate revealed an up to date capital allocation plan for the following few years. As you may see under, the corporate is dubbing the present section to be its “subsequent chapter” whereby deleveraging and shareholder rewards would be the important precedence.

Cellnex Investor Relations

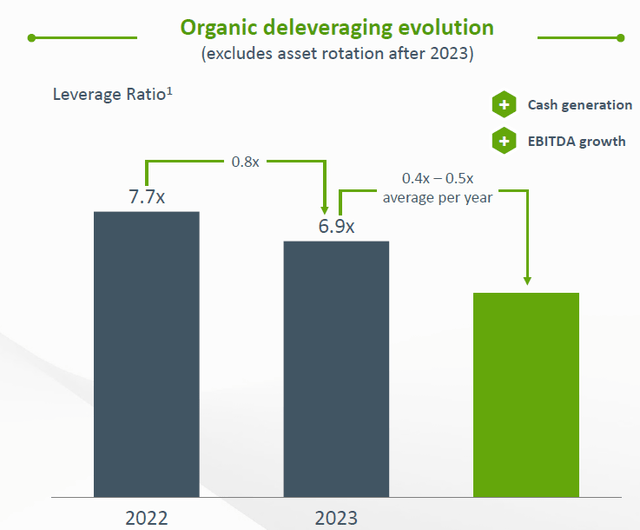

The important thing pillars are the decrease debt ratio which shall be decreased to 5-6 instances EBITDA inside the subsequent three years whereas the corporate will spend 3B EUR on dividends and spend 7B EUR on buybacks, particular dividends and potential (smaller) M&A alternatives. Cellnex is aiming to stroll down its debt ratio by 0.4-0.5 instances EBITDA per 12 months as a result of a mix of debt discount and better EBITDA outcomes.

Cellnex Investor Relations

Assuming the 3B EUR in dividends shall be unfold out over 5 years, the common annual dividend can be 600M EUR per 12 months (beginning at “no less than 500M EUR from 2026” and projecting a mean annual progress charge of seven.5%), which is roughly 85 cents per share. Based mostly on the present share value, that might symbolize a dividend yield of simply over 2.5% (topic to the 19% Spanish dividend withholding tax). Positively not the very best yield, however the 10B EUR in whole money era is vital as that signifies about 14 EUR per share, to be generated by the top of the last decade.

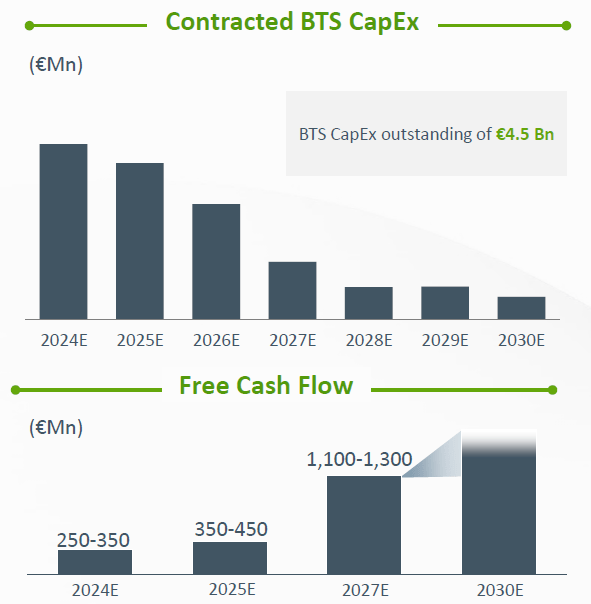

The growing free money move shall be pushed by the top of the construct to go well with capex program which is slowly winding down.

Cellnex Investor Relations

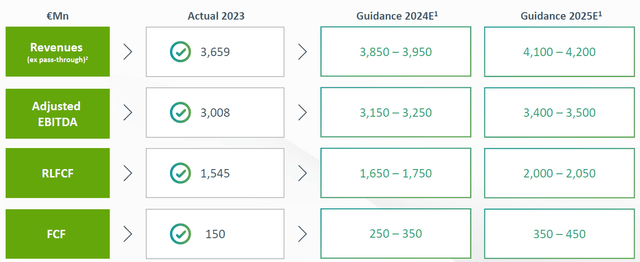

Extra importantly, Cellnex additionally offered near-term targets. It expects a reported free money move of 300M EUR and 400M EUR in 2024 and 2025, respectively, and that also contains the substantial progress investments. The Recurring Leveraged FCF (together with curiosity funds and lease funds however excluding progress capex) shall be 1.7B EUR this 12 months, growing to no less than 2B EUR in 2025.

Cellnex Investor Relations

And that’s what issues to me. The 2025 steerage calls for nearly 3 EUR per share in underlying free money move per share. The overwhelming majority will nonetheless be spent on progress (and the influence is seen within the EBITDA steerage which is able to present a 7% enhance in 2024 adopted by one other 6% enhance in 2025), however the reported free money move, together with progress, will enhance as properly.

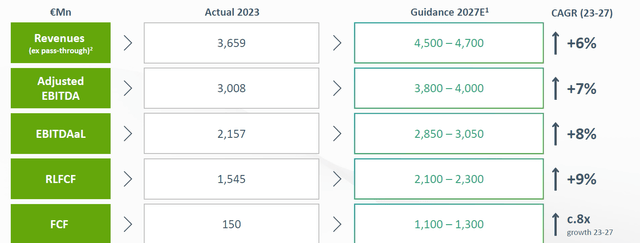

For FY 2027, the corporate is guiding for a 2.2B EUR RLFCF and a reported FCF of 1.2B EUR.

Cellnex Investor Relations

The anticipated greater curiosity bills needs to be included within the 2027 steerage however Cellnex can be fairly fortunate it has locked in mounted rates of interest on nearly 80% of its debt. The corporate anticipates that, based mostly on the present market charges, it is going to be in a position to maintain its common price of debt at or under 2.6% till 2027.

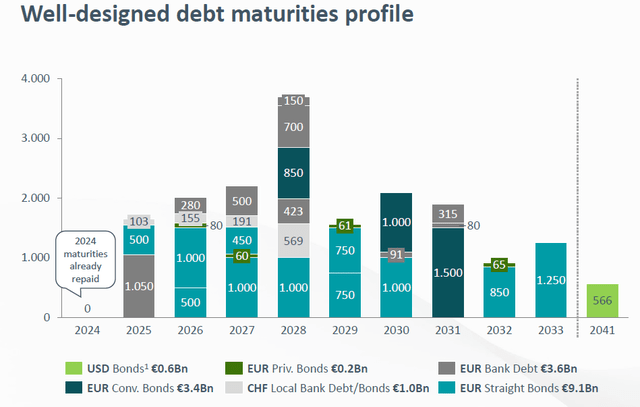

Cellnex Investor Relations

The picture above reveals 2028 shall be an vital 12 months for Cellnex because it must refinance about 3.7B EUR in current debt. That’s about 20% of its whole internet debt place, however I’m not notably anxious. Let’s assume not a single greenback of debt shall be repaid and three.7B EUR shall be refinanced in full. Let’s assume the price of debt will enhance by 250 bp. That will enhance the curiosity bills by 92.5M EUR which is simply 4% of the RLFCF. So, sure, there can be a noticeable influence, however the influence will nonetheless be simply manageable.

And contemplating the corporate will generate tons of of tens of millions in free money move, I wouldn’t be shocked to see it use a few of that money move to cut back the financing wants which might additional scale back the influence on the free money move efficiency.

Funding thesis

Whereas I definitely perceive the market isn’t too eager on seeing a leverage ratio of near 7 instances EBITDA, however we at the moment are at “peak debt” and the corporate’s reported free money move will enhance whereas the EBITDA will proceed to extend as properly. The EV/EBITDA a number of is at the moment roughly 15, but when we might use the 2025 steerage of three.45B EUR in EBITDA and assume the 2024-2025 free money move will scale back the online debt to 20B EUR, the EV/EBITDA ratio drops to round 12.5 and can proceed to lower (topic to Cellnex’s last capital allocation plans).

I’m extra considering seeing Cellnex attain its free money move steerage as that might point out the corporate is buying and selling at a free money move yield of roughly 9% which I believe is a sexy valuation for an European chief in its section.

I at the moment don’t have any place in Cellnex Telecom, however I’ve written put choices which are at the moment barely out of the cash. As the corporate now has a transparent plan for the near-term and mid-term future, I’d prefer to provoke an extended place inside the subsequent few months.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link