[ad_1]

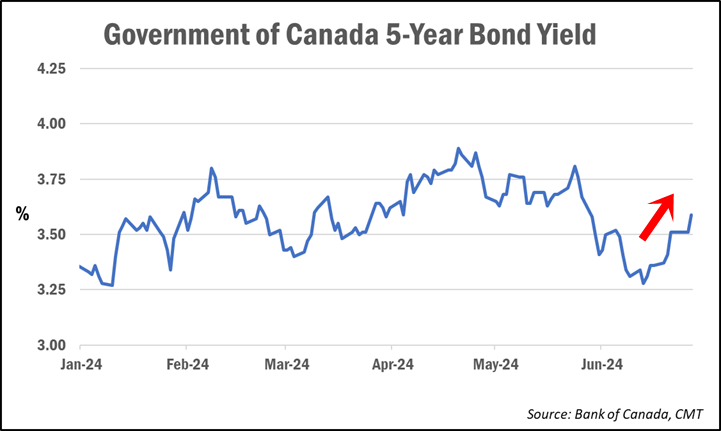

After being on a downward path for the previous two months, Canadian bond yields have reversed course and are as soon as once more on the rise.

After reaching their lowest level of the yr final month, Authorities of Canada bond yields, which affect mounted mortgage charges, have surged greater than 30 foundation factors, or 0.30%.

As of Tuesday, the 5-year GoC bond yield—which strikes inversely to bond costs—broke again above 3.60%, a two-week excessive. And within the U.S., the 10-year Treasury yield equally rose to its highest level since mid-June.

Why are bond yields rising?

Whereas slowing inflation charges in each Canada and the U.S. had helped drive down yields in latest months, a number of components are behind this newest turnaround, consultants say.

For one, U.S. President Joe Biden’s poor efficiency throughout final week’s presidential debate could also be main buyers to anticipate the next likelihood of former President Donald Trump successful the November presidential election, including extra strain on Treasuries.

“For quite a lot of causes having to do with fiscal coverage, tariff coverage, and immigration coverage, we do imagine {that a} potential Trump administration in 2025-2028 might be extra inflationary than a Biden administration,” Thierry Wizman, a worldwide foreign exchange & charges strategist at Macquarie Group, was quoted as saying within the Financial Occasions.

Moreover, feedback by Federal Reserve Chair Jerome Powell on Tuesday appeared to help a doubtlessly “higher-for-longer” rate of interest outlook.

Whereas he expressed satisfaction with the progress on inflation over the previous yr, Powell stated he needs to see extra earlier than being assured sufficient to begin slicing rates of interest. “We wish to be extra assured that inflation is shifting sustainably down towards 2% earlier than we begin the method of decreasing or loosening coverage,” he stated.

As we’ve reported on previously, Canadian bond yields, and in flip mortgage charges to a level, largely take their cue from financial circumstances and developments south of the border.

How may mounted mortgage charges be impacted?

After seeing some substantial reductions in mounted mortgage charges over the previous few weeks, some price watchers say debtors ought to count on these cuts to pause for now.

“Undoubtedly, the [rate] drops will cease, but when we see the bond yield hit 3.60% and maintain, I’d suppose you’d see no less than the uninsurable creep up a bit,” price professional Ryan Sims instructed CMT. “You’ll additionally kiss goodbye to the deep-discounted insured 5-year charges at that time, though I may see the 4.89% mounted cling round for insurable.”

Nevertheless, price buyers may additionally see some charges begin to rise once more as properly, says Ron Butler of Butler Mortgage.

“Charges are going up as I kind this,” he instructed CMT, including that the large banks are being “much less aggressive” of their discretionary pricing.

“The last word development [for fixed mortgage rates] might be down, but it surely received’t be linear,” Butler added.

So, what would it not take to get bond yields—and mortgage charges—again on a downward path?

“We would want to see inflation come manner down with a view to deliver charges down,” Sims says. “Each month we see inflation cling larger than anticipated, we push bond yields up.”

For now, it may take some extra time for inflation to edge again in direction of the Financial institution of Canada’s desired 2% impartial goal. In Could, Canada’s headline inflation price rose again to 2.9% from 2.7% in April.

BMO chief economist Douglas Porter described inflation as being on a “bumpy” path going ahead.

That is additionally more likely to delay price aid for variable-rate mortgage debtors, whose charges are straight correlated to the Financial institution of Canada’s financial coverage selections. Whereas markets had beforehand anticipated a second quarter-point price reduce from the central financial institution at its upcoming July assembly, forecasts at the moment are suggesting a September price reduce is extra doubtless.

The opposite financial indicator consultants are watching might be this week’s launch of employment knowledge in each Canada and the U.S.

“The market consensus is for a continued rise in our unemployment price to six.3%,” Bruno Valko, VP of nationwide gross sales for RMG, wrote in a word to subscribers. “In my view, we desperately want aid within the type of decrease rates of interest.”

[ad_2]

Source link