[ad_1]

Final time, we confirmed the adjustment approach, utilizing a calendar to defend an iron condor.

This time, we use a calendar to defend a non-directional butterfly.

Within the condor case, we positioned the calendar on the quick leg of the threatened unfold.

We’ll place the calendar for the butterfly on the lengthy leg of the threatened decrease wing.

You will notice what I imply by the next instance of an SPX commerce that’s already in progress.

Date: April 2, 2024

Value: SPX @ $5203

One lengthy Might 10 SPX 5275 putTwo quick Might 10 SPX 5225 putOne lengthy Might 10 SPX 5160 put

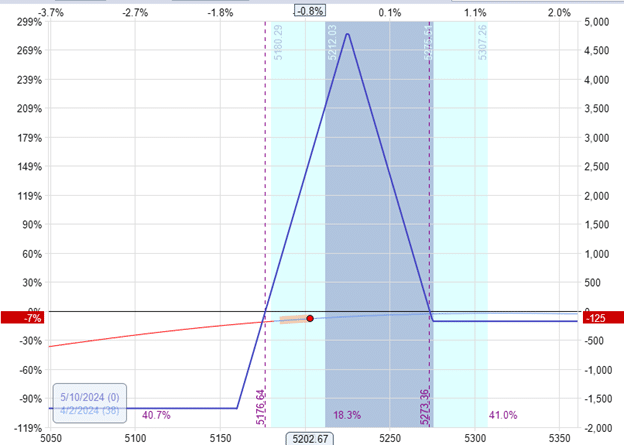

BEFORE:

Supply: OptionNet Explorer

The value of SPX is close to the left fringe of the expiration graph with the next Greeks.

Delta: 1.83Theta: 3.88Vega: -50.76

Theta/Delta ratio: 2.1

The dealer decides to calendarize the decrease leg.

Promote to shut the Might 10 SPX 5160 putBuy to open the Might 17 SPX 5160 put

Debit: -$675

The adjustment is a calendar as a result of we’re promoting a put possibility on the near-term expiration and shopping for one on the identical strike at an extra date.

As a result of the calendar’s quick put possibility coincides with the butterfly’s lengthy put possibility, it successfully closes out the lengthy put of the butterfly and provides one other lengthy put possibility additional out in time on the identical strike.

One can consider it as rolling the lengthy 5160 put possibility additional out in time.

If “calendarizing the decrease leg” sounds an excessive amount of like a medical process, a much less graphical description can be “rolling the decrease lengthy possibility out in time.”

Be a part of the 5 Day Choices Buying and selling Bootcamp

Afterwards, we’re left with a butterfly with one leg at a special expiration:

One lengthy Might 10 SPX 5275 putTwo quick Might 10 SPX 5225 putOne lengthy Might 17 SPX 5160 put

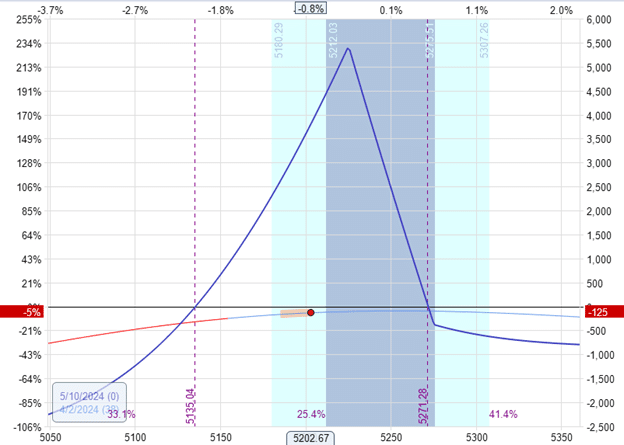

AFTER:

You’ll instantly discover that its expiration graph has widened, and the value is extra centrally positioned beneath the “tent.”

We’ve elevated the gap to the decrease expiration breakeven factors, which was at 5176 to now 5135 (see purple vertical line).

The adjustments within the Greeks have additionally improved.

Delta: 1.65Theta: 11.88Vega: 6.21Theta/Delta ratio: 7.2

Whereas it has solely decreased the delta barely, the calendar has vastly elevated theta, thereby boosting the theta/delta ratio.

Non-directional premium sellers using this butterfly depend on theta for the commerce’s earnings era.

The delta represents the value danger.

A better theta/delta ratio signifies an enchancment within the commerce’s reward-to-risk traits.

This adjustment works nicely when the value is transferring down.

When the market is transferring down, its volatility sometimes will increase.

The unfavorable vega is a legal responsibility.

The adjustment utterly eliminated the butterfly’s unfavorable vega and decreased the commerce’s sensitivity to volatility adjustments.

Nevertheless, the timing of the adjustment is crucial.

If the underlying worth had already dropped beneath the strike of the decrease leg, then the adjustment wouldn’t be as efficient as a result of now the calendar is above the value as an alternative of beneath it.

One other variable is how far out in time you wish to roll the decrease possibility.

In our instance, the expiration of the quick and the lengthy choices are seven days aside.

This appears to be an inexpensive time unfold for when the butterfly is a couple of month away from expiration.

For butterflies nearer to expiration, experiment with time variations which are 4 or 3 days aside.

As with all new changes {that a} dealer would possibly study, you will need to mannequin them in all configurations and totally different market environments.

We hope you loved this text on calendarizing a butterfly unfold.

When you have any questions, please ship an electronic mail or depart a remark beneath.

Commerce secure!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who are usually not aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link