[ad_1]

Hans Hansen

The Thesis

Since my final impartial article on Boise Cascade Firm (NYSE: NYSE:BCC), the inventory is down in single digits in opposition to a 6% rise within the S&P500. After an honest begin to 2024, the second quarter reported a consolidated topline decline of 1% because the weak demand surroundings continued primarily resulting from elevated mortgage charges. I’m anticipating the corporate’s topline to stay below stress within the the rest of 2024 because of the anticipated quantity decline throughout a lot of the enterprise and value lower in EWP (Engineered Wooden Merchandise) and some components of the enterprise, which ought to additional lead to decrease gross sales within the quarter forward. Long run however stays favorable resulting from tailwinds from demographic traits and the corporate’s market place to profit from this within the coming years. The corporate’s inventory is on the market at an inexpensive valuation, nonetheless, resulting from persisting challenges within the close to time period, I’d keep away from BCC’s inventory for now.

Final Quarter Efficiency and Outlook

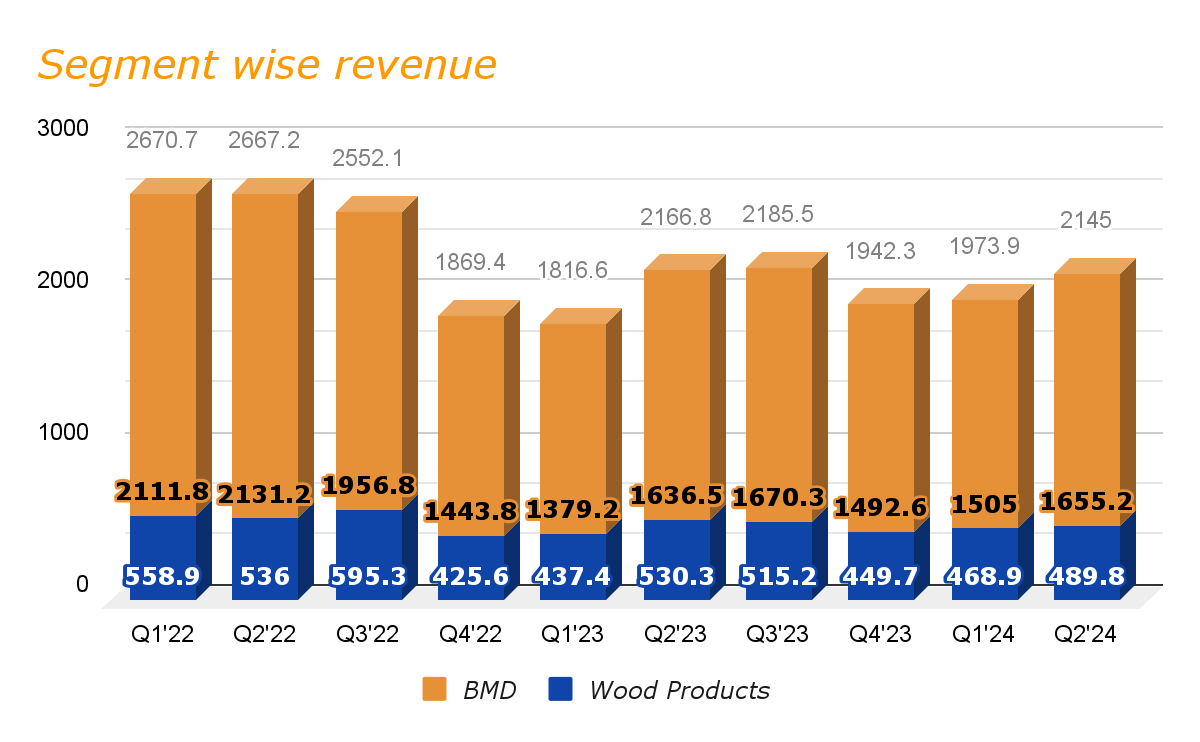

Shifting into the second quarter of 2024, quantity development throughout normal line merchandise within the BMD phase continued to assist the corporate’s high line within the weak pricing surroundings. EWP volumes on this phase had been down 1%, nonetheless, continued to be supported by resilience and single-family begins, resulting in a 1% development within the phase gross sales to $1.7 billion greater than offsetting the impression from value declines over the past quarter. Wooden merchandise phase however was down 7.6% 12 months on 12 months, as continued pricing stress throughout I-joist and LVL greater than offset the profit from quantity development throughout the quarter. General, the corporate’s consolidated gross sales had been virtually flat with a year-on-year decline of 1% throughout the second quarter of 2024.

BCC segment-wise gross sales (Analysis Clever)

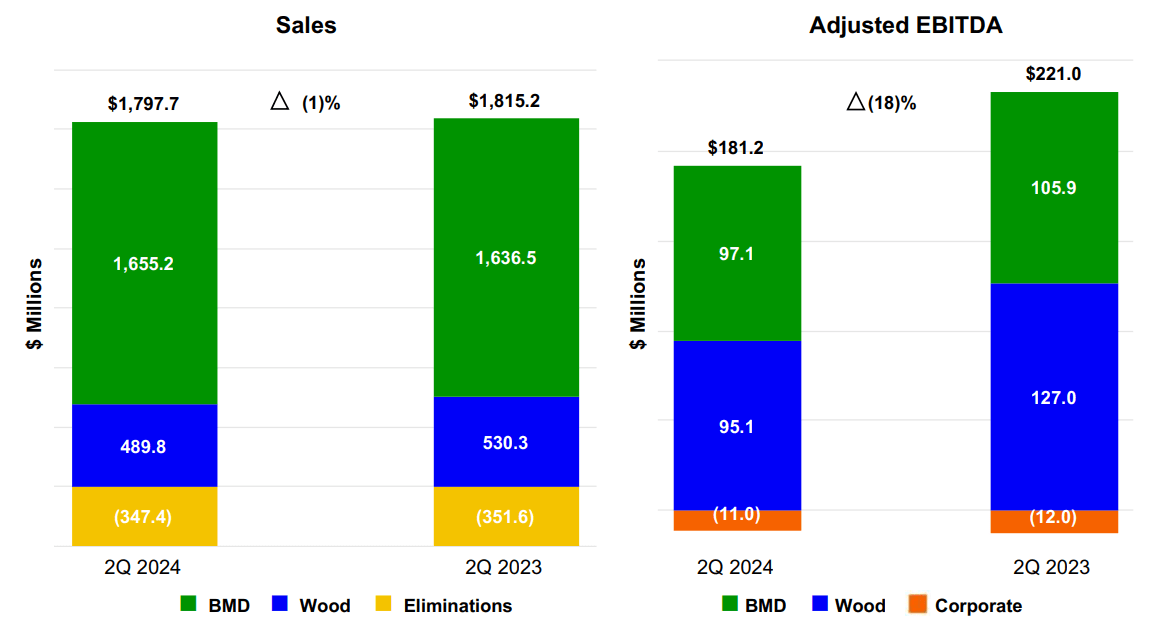

Whereas the corporate noticed quantity development throughout most components of its enterprise, the continued impression of pricing declines and better wooden fiber and conversion prices resulted in a 210 bps year-on-year decline in its consolidated EBITDA margin to 10.1% over the past quarter. Promoting and distribution bills additionally elevated by roughly $11 million within the BMD phase which additionally negatively impacted the corporate’s margin over the past quarter. As anticipated, the decline in EBITDA additionally impacted the corporate’s backside line which dropped to $2.84 throughout Q2 2024 from $3.67 a 12 months in the past, nonetheless, managed to beat the consensus estimates by $0.15.

Q2’24 end result comparability (Firm presentation)

The corporate noticed a big topline and margin contraction in FY 2023 because the demand surroundings throughout each segments stays influenced by the elevated mortgage price and financial uncertainties. I count on these components to proceed to affect the top consumer’s buying determination within the quarters forward till the economic system cools down. In the previous couple of quarters, BCC has seen a big value decline throughout most of its enterprise. Along with this, a decline within the builder sentiment and weakening household begins and allow knowledge resulting from ongoing affordability constraints for homebuyers, has slowed EWP order consumption considerably. Consequently, the corporate is anticipating additional value decline within the mid-single digits within the coming quarters, which ought to additional impression the corporate’s topline in 2024.

The near-term challenges as I additionally talked about in my earlier articles on BCC nonetheless persist as the corporate is coming into into the second half of 2024. Nevertheless, to not neglect, longer-term prospects stay sturdy primarily resulting from favorable housing fundamentals like underbuilt housing inventory and rising home-owner fairness. And, for my part, these tailwinds place the corporate strongly to capitalize sooner or later resulting from its vital native presence and nationwide scale. The corporate additionally continues to boost its income potential by leveraging its intensive wholesale distribution community in addition to specializing in longer-term capability development in the important thing markets together with Kansas Metropolis and South Florida. To boost its market place additional, BCC additionally continues to discover underserved areas together with South Central Texas and Carolina Coast, which ought to additional assist the corporate’s income development within the coming years.

General, the near-term outlook stays difficult for the corporate because of the high-interest price surroundings and unaffordability constraints amongst patrons, which together with additional value decreases ought to proceed to place stress on the corporate’s topline development in 2024. Nevertheless, the long run continues to be favorable for the corporate resulting from tailwinds related to demographic traits and the corporate’s capability to capitalize on that within the coming years.

Valuation

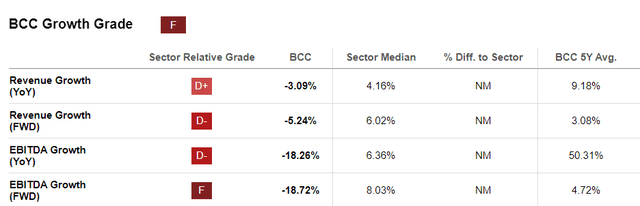

I final wrote a impartial article on BCC in Could’24 and since then, the inventory has been down roughly 2%, whereas the S&P500 grew over 6.4% throughout this time. At present, the corporate’s inventory is buying and selling at a Non-GAAP ahead P/E ratio of 13.95, primarily based on FY24 EPS estimates of $9.60, which symbolize a 12 months on 12 months decline of about 20% as we will see within the chart under. As compared with its sector median common P/E, the inventory seems to be priced at a big low cost.

BCC’s EPS estimates (In search of Alpha)

Whereas the inventory appears attractively priced however remains to be costly contemplating poor development prospects within the close to time period. I count on, the corporate’s topline development to proceed to battle shifting ahead resulting from an unfavorable demand surroundings adopted by elevated mortgage charges and lowered builder confidence. This could result in decrease quantity within the quarters forward, which together with the impression of lowered costs ought to result in margin contraction within the coming quarter. This could end result within the backside line contraction, which ought to deteriorate the corporate’s inventory valuation within the quarters.

BCC Development grade (In search of Alpha)

Conclusion

As mentioned above, the corporate’s inventory is at present buying and selling at an honest low cost versus its friends. In my opinion, the headwinds ought to proceed as the corporate enters the second half of the 12 months because of the weak demand surroundings throughout the enterprise because of the excessive mortgage price. Value additionally stays weak, and because the firm is anticipated to implement additional value decreases, the corporate’s margin must also stay below stress going forward. Whereas the corporate’s inventory is valued attractively, poor development prospects within the close to time period recommend avoiding this inventory regardless of its promising long-term. therefore, I’m staying with the HOLD score on BCC’s inventory.

[ad_2]

Source link