[ad_1]

Richard Drury

On this article, we compensate for the BDC Blue Owl Capital Corp III (NYSE:OBDE) and talk about its newest quarterly outcome. We additionally spotlight the introduced merger with its sister BDC Blue Owl Capital Corp (OBDC) and why it’s a good outcome for OBDE. For the quarter, OBDE and OBDC delivered a complete NAV return of two.1% – barely under the typical to date within the sector.

We’ve got coated the earlier earnings launch right here. We fee the inventory a Purchase ranking as the basics have remained secure, however the merger gives a valuation catalyst.

OBDE business focus is in Tech, Insurance coverage and Healthcare – pretty typical non-cyclical sector overweights. OBDE trades at a 11.5% whole dividend yield and a 9% low cost to e book.

OBDE

Merger Catalyst

There are a number of positives for OBDE within the merger proposal. For one, the inventory has been buying and selling at a decrease valuation than OBDC of 5-6% in absolute phrases, presently buying and selling at a 4% decrease valuation. Within the base case state of affairs of the NAV for NAV merger, that is the seemingly uplift for OBDE shares if the ensuing firm continues to commerce on the OBDC valuation – which we anticipate given OBDC’s bigger dimension and stronger market “model”.

The relative valuation uplift for OBDE is lowered the upper the valuation of OBDC goes nonetheless absolutely the return can be very sturdy in that outcome because the small relative discount occurs in mild of a giant absolute rise in worth. The bottom case state of affairs is the straightforward NAV-for-NAV trade (left-most state of affairs under).

OBDE

The second constructive issue for OBDE in mild of the merger is the potential waiving of the final lock-up expiry if the merger is closed earlier than 24-Jan of subsequent yr (the date of the final lock-up expiry). The primary lock-up expiry delivered a pointy drop to the value as proven under. Cancelling the final lock-up expiry ought to assist the value. The October lock-up expiry appears to be on monitor, nonetheless, and will ship one other enticing entry level as properly. Its affect is unlikely to be as giant as the primary one, nonetheless, as a consequence of higher liquidity after the primary lock-up expiry and the merger plan.

Systematic Revenue

One other profit to OBDE is the decrease degree of curiosity expense in OBDC in addition to the next degree of portfolio yield. That is why the web funding revenue yield of OBDC is 2.1% larger than that of OBDE. Internet funding revenue of the merged entity ought to be barely under that of OBDC, however properly above the OBDE degree.

Systematic Revenue BDC Software

Two small downsides are price highlighting. One is the upper degree of non-accruals in OBDC and a decrease first-lien allocation. This, arguably, makes for a much less “protected” portfolio. Nevertheless, there are two mitigants. One is that the loss fee for OBDC is kind of low at 0.14% annualized and two, an fairness allocation additionally gives upside. Aside from some variations in allocation weights, the portfolios of the 2 BDCs are very related. About 90% of investments in OBDE are additionally in OBDC. The illustration under highlights the important thing metrics of the 2 portfolios.

OBDE

Administration estimates there can be round $5m of bills saved by the mixed entity, doubtlessly boosting web funding revenue by roughly 2%. The advisor can even pay as much as $4.25m in merger bills.

Total, this can be a good outcome for OBDE and shareholders ought to assist the merger in our view.

Quarter Replace

Internet funding revenue ticked larger by over 4% to $0.41. This was the most important leap within the sector to date and properly above the typical 0.7% quarterly fall. That mentioned, we anticipated a much bigger rise, because the earlier quarter’s web revenue was laden by the one-off trade itemizing charge.

Systematic Revenue BDC Software

The corporate declared a $0.35 base dividend, unchanged from the earlier quarter, in addition to a $0.06 particular dividend. The particular dividend is a part of a collection of 5 beforehand declared dividends. This works out to a complete dividend yield on NAV of 10.6%. Particular dividends are pretty widespread for BDCs like OBDE with lock-up expires and are supposed to extend demand and assist the inventory worth. If the merger goes forward, OBDE shareholders will seemingly see a pick-up in dividend yield as OBDC encompasses a larger distribution fee on NAV.

The NAV fell 0.6% (OBDC NAV fell 0.7%). This was due primarily to the truth that the corporate’s whole dividend is on par with its web funding revenue (itself as a result of particular dividend highlighted above). Most BDCs keep whole dividend protection properly above 100% and this retained revenue helps the NAV.

OBDE

This was the primary NAV drop since mid-2022.

Systematic Revenue

Internet new investments have been very excessive for each BDCs (OBDE proven under).

Systematic Revenue BDC Software

This pushed leverage as much as 1.2x – now above the 1.1x median degree. That is near the higher a part of the 0.9-1.25x vary, so we do not anticipate a giant enhance above the Q2 degree.

Systematic Revenue BDC Software

Portfolio High quality

Non-accruals have been blended for the 2 corporations. OBDE non-accruals rose barely to 0.5% however stay properly under the 1.8% sector common. The OBDE quantity fell to 1.4% as proven under.

Systematic Revenue BDC Software

Portfolio high quality, as gauged by inner scores, was secure. The allocation to the 2 worst buckets remained flat throughout each BDCs. OBDC figures are proven under.

Systematic Revenue BDC Software

Internet realized losses have been minimal final quarter for each BDCs. OBDC figures are proven under.

Systematic Revenue BDC Software

The PIK quantities in each portfolios have been operating at round 10% – in regards to the sector common. Administration mentioned that round 80% of PIK was structured as such on the time of the funding for performing credit. In different phrases, it isn’t an indication of misery within the portfolio.

Systematic Revenue BDC Software

Stance And Takeaways

We proceed to have a Purchase ranking on OBDE. We are able to summarize this stance with the next three figures.

One, BDCs are way more pretty valued now as a sector after a drop in costs over the previous week or so.

Systematic Revenue

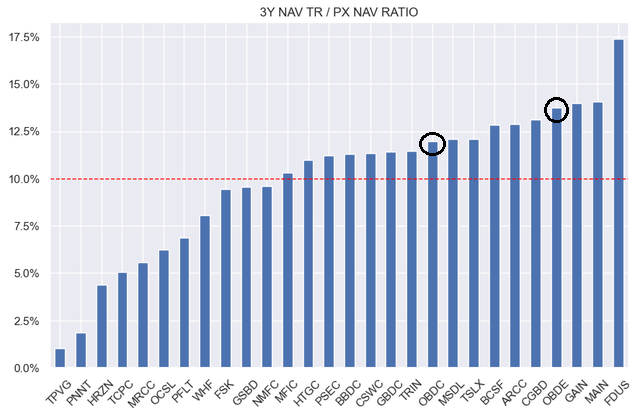

Two, each shares stay enticing holdings not solely due to their stable longer-term whole NAV returns but in addition as a result of they’re attractively valued relative to their whole NAV returns as proven under.

Systematic Revenue

And three, OBDE continues to commerce at a reduction to OBDC. The valuation hole between the 2 corporations ought to shut, giving an uplift to OBDE shares.

Systematic Revenue

[ad_2]

Source link