[ad_1]

Khosrork/iStock by way of Getty Photographs

We beforehand coated Block (NYSE:SQ) in March 2024, discussing why we had maintained our Purchase ranking because the administration expanded its monetization efforts and revenue margins in FQ4’23, whereas providing a promising FY2024 steerage.

With FQ1’24 more likely to deliver forth glorious numbers, because the administration launched intensified buyer acquisition efforts and the US labor market/shopper spending remained strong, we believed that it continued to supply a compelling funding thesis after a reasonable pullback to its buying and selling ranges of between $62 and $70.

Since then, SQ has misplaced -13.4% of its worth regardless of the double beat FQ1’24 earnings outcomes and raised FY2024 steerage, with the inventory’s FWD valuations additionally persistently moderated in comparison with their 1Y and pre-pandemic means.

It seems that the market is undecided learn how to worth the fintech, because the administration additionally intensified their investments in bitcoins from April 2024 onwards. With the inventory but present indicators of breakout potential, our reiterated Purchase ranking is simply meant for buyers with increased danger tolerance and affected person investing trajectory.

Within the meantime, SQ is more likely to commerce sideways till the market is satisfied concerning the fintech’s prospects together with bitcoins’ appreciation potential.

SQ’s Money App Phase Continues To Outperform Expectations

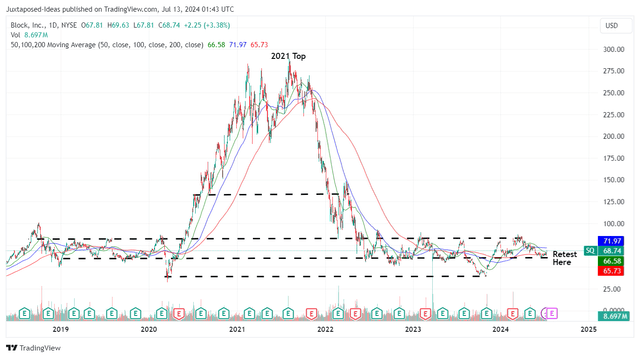

SQ 5Y Inventory Worth

Buying and selling View

For now, SQ has continued to commerce sideways since Might 2022, with the inventory charting strong assist at $61s and resistance ranges of $83s. Even so, we’re disillusioned that the inventory has failed to interrupt out of this buying and selling sample regardless of the double beat FQ1’24 earnings name and raised FY2024 steerage.

A lot of its prime/ backside line tailwinds are attributed to strong monetization noticed in SQ’s Money App phase, with revenues of $4.17B (+6.6% QoQ/ +27.5% YoY) and gross revenue margins of 30.2% (+0.1 factors QoQ/ +1.8 YoY).

With Money App additionally more and more adopted with 57M month-to-month transacting lively customers (+1M QoQ/ +4M YoY) together with increased inflows of $1,255 per consumer (+10.3% QoQ/ +10.4% YoY) and better monetization price of 1.48% (inline QoQ/ +0.07 factors YoY), it’s unsurprising that the phase has been the highest/ bottom-line driver to this point.

Mixed with the rising Money App Card month-to-month lively customers of 24M (+1M QoQ/ +4M YoY), it’s obvious that SQ’s intensified consumer acquisition and cross-selling monetization has labored as meant.

That is by means of the introduction of quite a few banking merchandise which builds upon its current BNPL and digital pockets choices, leading to a particularly sticky fintech platform with minimal churn.

Even so, readers might need to word that SQ might face extra competitors regardless of the strong fintech prospects, as Apple (AAPL) exits from the BNPL scene whereas highlighting Affirm (AFRM) as one of many key companion banks/ lenders within the US shifting ahead.

As mentioned in our AFRM article, we consider that AAPL customers could also be extra more likely to undertake its BNPL platform, with the partnership doubtlessly influencing “buyer choices on which playing cards to spend on, or the place to arrange credit score.”

On account of the potential headwind, readers might need to take note of SQ’s upcoming FQ2’24 earnings name on August 01, 2024, whereas monitoring key metrics, such because the Money App lively customers and monetization price, since these are indicative of its retention price.

The Bitcoin Love Story Continues

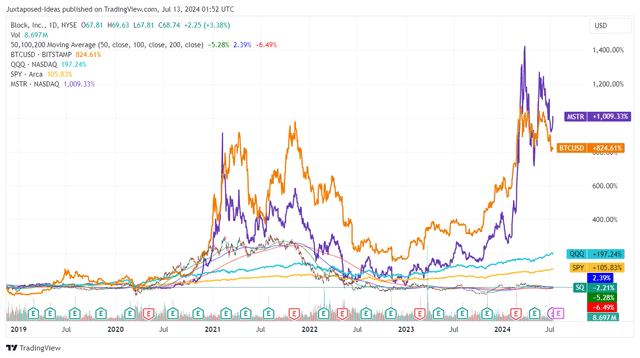

Bitcoin Costs In opposition to MSTR & SQ

Buying and selling View

On the one hand, SQ’s attention-grabbing option to make bitcoins extra accessible has labored out as meant, with over 21M lively Money App customers utilizing the cryptocurrency whereas producing strong bitcoin revenues of $2.73B (+8.3% QoQ/ +26.3% YoY) and bitcoin gross income of $80M in FQ1’24 (+21.2% QoQ/ +60% YoY).

With “solely 0.7% of associated bills,” bitcoin has been a profitable phase for the fintech certainly, with Money App’s vertically built-in capabilities permitting customers to “purchase, maintain, withdraw, or promote bitcoin” inside one platform.

However, maybe a part of the pessimism embedded in its inventory costs could also be attributed to the SQ CEO’s conviction surrounding Bitcoins, the supposed king of different cryptocurrencies.

For now, we consider that SQ has but to emerge as a Bitcoin proxy inventory as how MicroStrategy (NASDAQ:MSTR) has over the previous few years, with the previous solely holding 8,038 bitcoins (inline QoQ/ information not out there) in comparison with the latter at 214,278 bitcoins as of March 2024 (+13.2% QoQ/ +53% YoY).

Even so, it’s plain that each CEOs stay extremely satisfied, with SQ already committing to investing “10% of its month-to-month gross revenue from bitcoin merchandise into purchases of bitcoin itself” from April 2024 onwards.

With the idea of smaller incremental purchases to offset the “challenges of market timing,” readers might need to carefully monitor SQ’s intermediate time period execution.

That is particularly since bitcoins have beforehand retested its all-time prime of $70Ks, after recovering tremendously by over 4x from the November 2022 backside of $15Ks and just lately pulled again to $57Ks.

The inherently unstable Bitcoin spot costs might have additionally contributed to the pessimistic market sentiments surrounding the SQ inventory, since it seems that some swing crypto merchants have unlocked some beneficial properties at current heights.

On account of the speculative nature of bitcoins and the potential affect on its stability sheet, we will perceive why the market stays undecided about SQ, as noticed within the inventory’s sideway buying and selling since Might 2022 regardless of the more and more worthwhile fintech phase.

Transferring ahead, readers might need to take note of SQ’s Bitcoin revenues and bitcoin funding allocation within the upcoming earnings name, for the reason that unsure Fed pivot has put an enormous damper on the current Bitcoin value motion, worsened by the extended normalization in macroeconomy outlook.

So, Is SQ Inventory A Purchase, Promote, or Maintain?

SQ Valuations

Tikr Terminal

The identical uncertainty has additionally been noticed within the constant moderation in SQ’s FWD EV/ EBITDA valuations to 13.86x and FWD P/E valuations to 19.22x.

That is in comparison with its 1Y imply of 18.33x/ 24.07x, 3Y pre-pandemic imply of 67.98x/ 91.24x, and the sector median of 10.10x/ 11.13x, respectively.

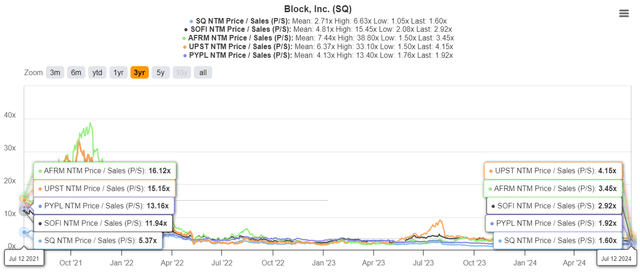

Risky Inventory Valuations

Tikr Terminal

Readers should additionally word that the identical volatility in inventory valuations has been noticed with a number of fintech shares, specifically SoFi (SOFI), Affirm (AFRM), Upstart (UPST), and PayPal (PYPL), with the correction seemingly but to finish.

These developments indicate that fintech buyers might need to mood their near-term expectations, with the unsure macroeconomic outlook and the extended Fed pivot more likely to stay a breakout headwind.

Whereas we proceed to face by our earlier honest worth estimates of $40.20 and the 2Y value goal of $123.80, with the SQ inventory presently effectively supported on the YTD backside of $60s, readers might need to observe its motion for a bit longer and solely add if the train reduces or matches their greenback value averages.

Even then, we consider that SQ is more likely to commerce sideways within the intermediate time period, till the market is satisfied concerning the fintech’s prospects together with bitcoins’ appreciation potential, each of which stands out as the catalyst to the inventory’s eventual breakout.

Till that occurs, it goes with out saying that our Purchase ranking is simply appropriate for buyers with increased danger tolerance and long-term investing trajectory.

[ad_2]

Source link