[ad_1]

JamesBrey

Introduction

I could also be a kind of who suppose BDC share costs will fall as soon as rates of interest begin to decline. Because the begin of price hikes, many have seen their share costs recognize double-digits, a kind of being the externally-managed BDC, Blackstone Secured Lending (NYSE:BXSL), who’s up almost 24% previously 12 months.

On account of this, the inventory trades at a major premium to its NAV worth. And though I feel that is warranted due to its greater high quality compared to some friends, I feel traders will get a greater entry worth with just a little persistence. I am considered one of them, as I have never added to any of my BDC holdings over the past 12 months or so. On this article, I talk about BXSL’s newest quarter, fundamentals, and why historical past tells traders they need to anticipate a greater entry level.

Recap

Since my final thesis on Blackstone Secured Lending the place I rated the inventory a maintain because of its premium, BXSL’s share worth has trended greater, roughly in-line with the S&P. The BDC together with a lot of its friends have outperformed the market and rewarded shareholders properly in an surroundings with a lot uncertainty.

In my earlier thesis, I mentioned the corporate’s This autumn earnings, which noticed them submit a beat on the web funding and complete funding revenue. However regardless of the stable efficiency in the course of the financial uncertainty, the BDC did see an increase in PIK revenue, one thing, together with rising non-accruals, that has plagued a lot of its friends as nicely. However their dividend protection remained stable with 125% (dividend protection) throughout This autumn.

Newest Quarter

Blackstone Secured Lending reported its Q1 earnings on Could eighth and obtained off to a good begin, though web funding revenue declined from This autumn and on an annualized foundation. Nll of $0.87 declined roughly 9.4% from $0.96 and 6.45% from $0.93 in Q1’23. Whole funding revenue was in-line with This autumn’s $304 million.

Writer creation

Nll in the course of the newest quarter was impacted by $0.02 per share from accrued capital good points incentive charges, in keeping with administration. Regardless of the decline in web funding revenue, nevertheless, web revenue elevated almost double-digits from $0.88 to $0.96, which resulted in a rise in NAV worth to $26.87 from $26.66 within the prior quarter.

Yr-over-year, this grew from $26.10 and $25.93 on the finish of 2022. Other than greater than 9% development in web revenue, the BDC repeatedly out-earned its dividend, one other contributing issue to its NAV development. One more reason for that is their new fundings to develop the portfolio. On the finish of Q1, BXSL had 210 portfolio firms. This grew from 196 firms within the prior quarter to deliver their complete investments to $10.4 billion at truthful worth.

They’d $719 million of fundings, of which 98% have been first lien, senior-secured debt. BXSL continues to be one of the vital defensively-positioned BDCs with 98.5% of their portfolio in first lien, senior-secured debt. The BDC at the moment has the very best publicity to first lien, senior-secured debt compared to a few of its friends. This places the BDC in a cushty place to raised navigate surprising financial downturns like a recession.

FSK Capital

57%

Ares Capital

64.8%

Blackstone Secured Lending

98.5%

Goldman Sachs BDC

97.5%

Click on to enlarge

Low-Leveraged Steadiness Sheet

One other metric that makes BXSL one of many highest-quality BDCs within the sector is their low leverage. At quarter’s finish, their leverage was simply 1.03x. That is compared to common friends Ares Capital and Major Road Capital, whose leverages stood at 0.99x and 0.73x respectively on the finish of Q1.

This did enhance quarter-over-quarter, however was because of the timing of funding fundings. Regardless of this, all three BDCs’ leverage ranges are nonetheless under the sector common of 1.19x. Moreover, this places BXSL ready to proceed making investments, which administration expects there will likely be extra alternatives by 12 months’s finish.

Additionally they had ample liquidity accessible, with $1.4 billion and $5.298 billion in complete debt. Additionally they sport investment-grade credit score rankings from all three main companies, with a latest improve from Fitch to BBB. Moody’s additionally improved their outlook to Baa3 constructive.

Moreover, they haven’t any debt maturing till January 2026 once they have $800 million due. This has a weighted-average rate of interest decrease than present charges at 3.625%, however there’s an opportunity rates of interest may very well be decrease by then. Most of their debt really matures in 2026 with roughly $3 billion complete maturing all year long.

BXSL investor presentation

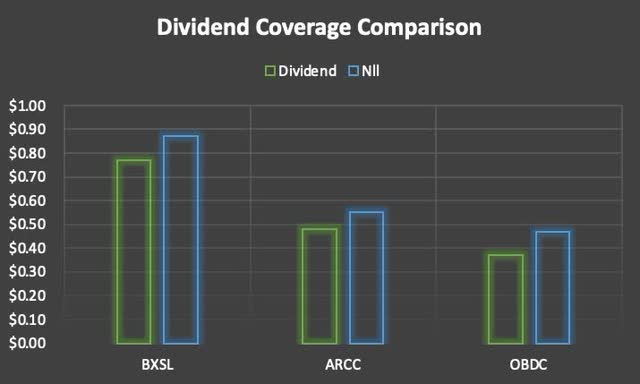

Dividend Protection

Regardless of the decline in web funding revenue on a sequential foundation, BXSL’s present dividend of $0.77 was well-covered with dividend protection of roughly 113%. Ares Capital & Blue Owl Capital’s (OBDC) dividend protection was 114% and 127% respectively throughout their Q1 earnings earlier this month.

So, traders should not fear in regards to the decline in Nll as BXSL’s dividend protection stays stable. And I anticipate this to proceed for the foreseeable future because the BDC continues to make engaging investments because the financial backdrop image turns into extra favorable, seemingly within the second half of the 12 months.

Writer creation

Historical past Says A Pullback Would possibly Occur

One factor the inventory market has taught me is persistence. And though high quality firms often command a premium, I feel traders will get an opportunity for a greater, extra engaging entry worth as soon as rates of interest decline.

I am not predicting BDC costs will return to their costs earlier than the beginning of price hikes, however I do suppose a lot of them will see pullbacks as traders rotate into lower-yielding dividend shares. Moreover, in keeping with CME FedWatch Device, majority suppose rates of interest will likely be 25 bps decrease by September on the time of writing.

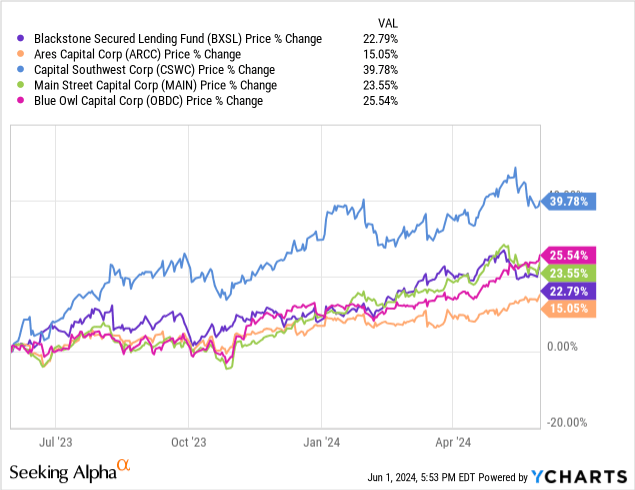

Trying on the chart under, you’ll be able to see a number of high-quality BDCs’ share costs have appreciated over the previous 12 months, with CSWC main the pack at almost 40%. BXSL’s P/NAV ratio at the moment stands at roughly 1.17x. For context, this was 1.16x since my final thesis. Though, their P/NAV ratio sits decrease than MAIN’s 1.7x. Their present premium of 17% can also be greater than the 3-year common low cost of 14.60%.

Within the chart under you’ll be able to see when rates of interest have been hiked from 2004-2006, CSWC’s share worth elevated. Subsequently, when charges declined from September 2007 to December 2009, Capital Southwest’s share worth declined greater than 50%.

Searching for Alpha

The identical goes for ARCC. Their share worth rose then declined from almost $20 a share to $3.29 over the identical interval. And though it was in the course of the GFC and each firms have been a lot smaller then, I feel BDC share costs will retract considerably after rate of interest cuts as beforehand. BXSL wasn’t round throughout that point, because the fund was launched in 2018, so there isn’t a comparability.

Searching for Alpha

Moreover, though Wall Road charges them a purchase at the moment, upside from the present worth is proscribed. And with charges anticipated to say no, I feel traders will get a greater entry worth with just a little persistence. However because of its top quality, BXSL will seemingly proceed to commerce at a small premium above its NAV worth.

Searching for Alpha

Danger Components

Regardless of managing to maintain their non-accruals low with just one firm on the record at the moment, BXSL’s PIK revenue has doubled from $10 to $20 million year-over-year. And though some BDCs construction this with debtors, greater for longer rates of interest can drive extra firms into structuring PIK revenue with their lender BXSL because of monetary stress.

That is one thing some traders fear about with BDCs. And though BXSL’s degree is manageable, that is one thing traders ought to regulate going ahead. Moreover, FED chair, Jerome Powell, lately said he was not as assured in inflation shifting nearer to their goal having seen greater CPI reviews within the first few months of 2024.

Even with the latest Core PCE report in-line with estimates, the FED stays hesitant about inflation reaccelerating, subsequently staying reluctant to chop charges shortly. In that case, price cuts may very well be pushed additional into the long run. And because of this, this might result in fewer or no price cuts in 2024, which might trigger an uptick in non-accruals for BXSL as nicely.

Backside Line

I contemplate Blackstone Secured Lending to be one of many highest-quality BDCs resulting from its defensively-positioned portfolio and robust stability sheet. Moreover, the BDC continues to indicate sturdy NAV development because of a rising portfolio and out-earning its dividend.

Moreover, the corporate appears to make the most of alternatives later within the 12 months with ample dry powder to proceed rising its portfolio. However with rates of interest prone to fall within the close to to midterm, I think investor sentiment will shift from enterprise improvement firms to lower-yielding dividend shares as soon as rates of interest do decline.

And though their share costs could not fall to ranges earlier than the beginning of price hikes, I do suppose many will current higher entry factors within the subsequent 3-6 months. Due to this, I proceed to price Blackstone Secured Lending a maintain.

[ad_2]

Source link